Greetings everyone

and welcome to the Technical Analysis of Oct 22, while pandemic is - actually - on an outbreak, news that we waited for long, came to the light and the markets to be on an uptrend. In fact, the market capitalization has reached $393 billion, as bitcoin has gained back partly its market share, a bit over 60%. Market daily volume is over $60 billion.

We have some big news around the crypto space and that is about the PayPal announcement. It will let its users buy, sell, and hold crypts in its wallets. This, also, means that purchases, through the platform, can be made while using cryptos.

We will take a look at the two major cryptocurrencies, as the alt-coins have not yet following the trend of the market - at least not clearly. Now, let's see what charts have to say.

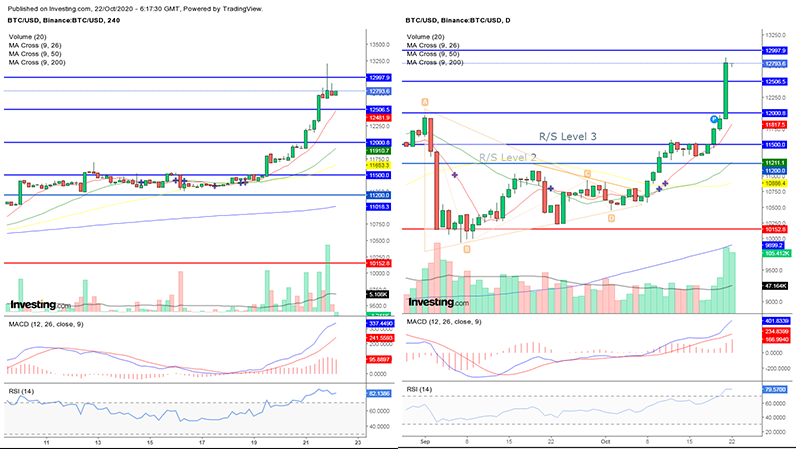

BTC/USD

Bitcoin has broken the resistance level at $11,500 - also the $12,00 and $12,500 - and has tested $13,000 once. The indicators, the momentum, and everything shows an uptrend, but sooner or later we will have a correction, but overall, I think, that this is the moment everyone wanted since the beginning of the year. The exploding of the King.

Maybe it needed something to trigger this, some may say that this is due to the PayPal announcement, maybe not. Either way, keep an eye on the support level at $12,700. I believe that it will hold a possible test. If not, $12,500 is further below as a stronger one. Now, around $12,800, I hope for a consolidation. If this occurs for more than a day, I am positive that we will not have to test the support levels.

ETH/USD

Ethereum, for once, has not following bitcoin - good for bitcoin - but rather has it is on its own smoother uptrend - good for Ethereum. The charts show this controlled rising, while has already tested $400 resistance level, a strong one, which had to hold the pressure - pressure that was more of a fake-out - and it will be tested again, soon, during the day.

Cover Photo by Markus Spiske on Unsplash

Charts from Investing.com

Thank you for reading. Please like/tip/spot/upvote, comment and share!

This is my own content and I will cross-post it at Publish0x, and Hive.

Follow Me Also:

- https://www.publish0x.com/@LeaderIcarus

- https://beta.cent.co/LeaderIcarus

- https://read.cash/@LeaderIcarus

- https://hive.blog/@leadericarus

If you want to join please use these affiliate links

- https://www.publish0x.com?a=zPdy7g7aQr

- https://read.cash/r/LeaderIcarus

- https://minergate.com/a/d8603d585d0bdbc115045ac5

- https://www.binance.com/en/register?ref=RFCDTZ1B

Disclaimer

- The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

- Nothing contained in this article constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

- Nothing in the article constitutes professional and/or financial advice.

- You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content before making any decisions based on such information or other Content.

- You agree not to hold The Author, or the Article liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through this article.

- There are risks associated with investing in securities. Investing in stocks, bonds, exchange-traded funds, mutual funds, and money market funds involve risk of loss.

- Loss of principal is possible

- Some high-risk investments may use leverage, which will accentuate gains & losses.

- Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods.

- A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

- The resource is not included, as I use more than one to verify. For more information, please search online.

- None of these are personal opinions, unless otherwise specifically and very clearly stated

- All product names, logos, and brands are the property of their respective owners.

- All company, product, and service names used in this article are for identification purposes only.

- Use of these names, logos, and brands does not imply endorsement