A week for adjusting a few things - profits and new adds in Japan, scaling in uranium and buying the dips on lithium

Portfolio News

In a week where S&P 500 rose 1.87% and Europe rose 3.2%, my pension portfolio rose only 1.15%. Drags were relatively under-invested in Europe, alternate energy stocks taking a breather, and a few Japan stocks. Uranium was mixed on the back of the NexGen (NXE) news.

Big movers of the week were AXP Energy (AXP.AX) (100%), TechGen Metals (TG1.AX) (46.4%), Dutch Bros (BROS) (32%), CoreNickelCo (CNCO.CN) (30%), Beamtree Holdings (BMT.AX) (27.8%), GoviEx Uranium (GXU.V) (23.5%), Lanthanein Resources (LNR.AX) (20%), Bayhorse Silver (BHS.V) (18.7%), Stroud Resources (SDR.V) (18.7%), Honey Badger Silver (TUF.V) (16.7%), DevEx Resources (DEV.AX) (16.7%), Vulcan Energy Resources (VUL.AX (15.3%), St Barbara (SBM.AX) (14.6%), Heavy Minerals (HVY.AX) (14.5%), Glencore plc (GLEN.L) (14.4%), Blue Star Helium (BNL.AX) (14.3%), GoGold Resources (GGD.TO) (12.9%), Delivra Health Brands (DHB.V) (12.5%), Fiverr International (FVRR) (12.1%), Genmin (GEN.AX) (11.5%), Pan American Silver Corp. (PAAS) (11.5%), Latin Resources (LRS.AX) (10.6%), APM Human Services International (APM.AX) (10.5%)

22 stocks in the big movers list - about in line with normal. The big themes are present but with some different weights - leading are gold and silver mining (6 stocks) alternate energy (uranium - 2 stocks, lithium - 4 stocks, battery materials - 2 stocks), marijuana (1 stock). A few have been on this list a few times - time to top up Genmin and Delivra Health Brands.

US markets had a sideways upways week with a few Federal Reserve leaders saying rates need to be higher for longer.

This headline from CNN caught my eye as they are normally the leaders of the doom and gloom game. The article suggests that normally one would expect that sort of Fedspeak to scare markets - even into a slide into recession.

History suggests that higher-for-longer rates don’t translate to painful losses for portfolios, even if there may not be much more upside near term for stocks.

Interesting thought - a shortage of upside does not necesarily mean there has to be a downslide. Maybe CNN are playing their normal game ahead of a US Eelection - the incumbent cannot afford a sliding stock market - keep talking it up and/or do not talk it down.

Uranium Holdings

US Congress finalised the Russian uranium ban document - President Biden has 10 days to veto or sign it. That was priced in the week before. The key market moving news came from NexGen

NexGen bought 2.7 Mlbs of uranium in the spot market and raised the $250 million funds via a convertible debenture.

https://au.finance.yahoo.com/news/nexgen-announces-strategic-purchase-2-103000663.html

This sent waves and rumours through the uranium market. Is it an indication that their Arrow mine in Saskatchewan has hit delays imperilling their 2030 production target? Or perhaps the government permitting process is not going as well as they said? Or is it a medium term view of a rising uranium price?

Markets took different views in the 3 days from the announcement - smackdown - recovery - smackdown.

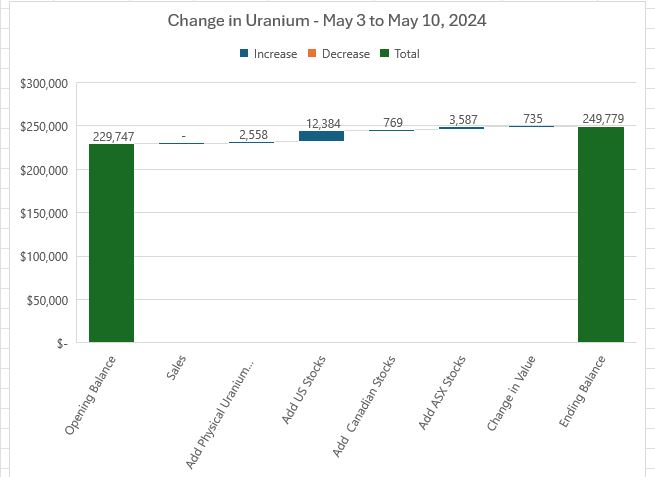

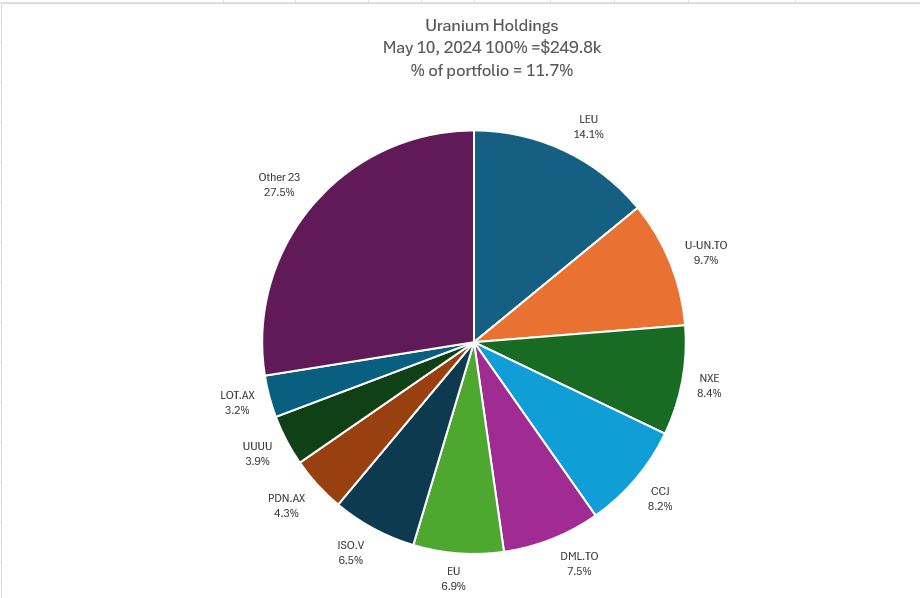

Back to portfolio uranium holdings - despite all the volatility - portfolio value did go up a little (0.3%). There were additions in physical uranium, and a few adds in US, Canada and ASX listed stocks. Uranium is now 11.7% of portfolio holdings - above the target 10% - no more additions for a while.

The mix of holdings changed with the additions made to Centrus Energy (LEU) going up a spot. NexGen adds took it up two places despite the price drops after the news. The other holdings stayed in the same places. Should really add the 1% holding in YellowCake (YCA.L) to the Physical Uranium as it is essentially the same - might do that next week.

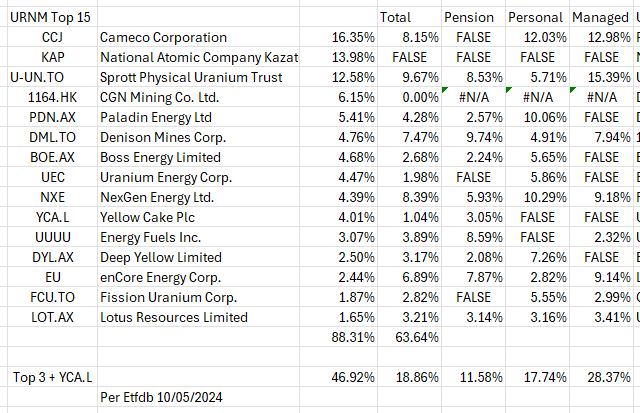

With no more additions planned, timing is right to start refining the structure of the holdings. First step is to compare the holdings relative to the Sprott Uranium Miners ETF (URNM). The notable part is the overlap with the URNM Top 15 is only 63% vs 88%. The key gap is the holdings in URNM of the two big miners plus the physical trusts (Top 3 plus YCA.L) is nearly 30 percentage points lower. This is not out of line with what Uranium Insiders are doing.

Crypto Drifts

Bitcoin price drifted lower all week ending 3.7% lower with a peak to trough range of 8.1%.

Ethereum chart did almost exactly the same closing 6.8% lower with a peak to trough range of 9.7%. It seems that there is more correlation emerging between crypto and stocks markets - when the nerves show buyers desert and head for cash.

Largest holding in my portfolios (HIVE) got a pump and dump over the weekend with a 27% pop ending back where it came from

Chiliz (CHZBTC) made a move up of 11% and chart is looking like the uptrend is formed ahead of the hard fork on May 21 which will widen the accessibility of the token

The Graph (GRTETH) complete 3rd cycle higher with a pop of 20% - could well be scope for a trade on the next cycle. All AI-related tokens moved up.

Litecoin (LTCETH) chart shows 20 day moving average rise above 50 day - trade looks sideways still despite the 11% rise

Arweave followed the moves for the last 3 weeks with another 28% rise

Bought

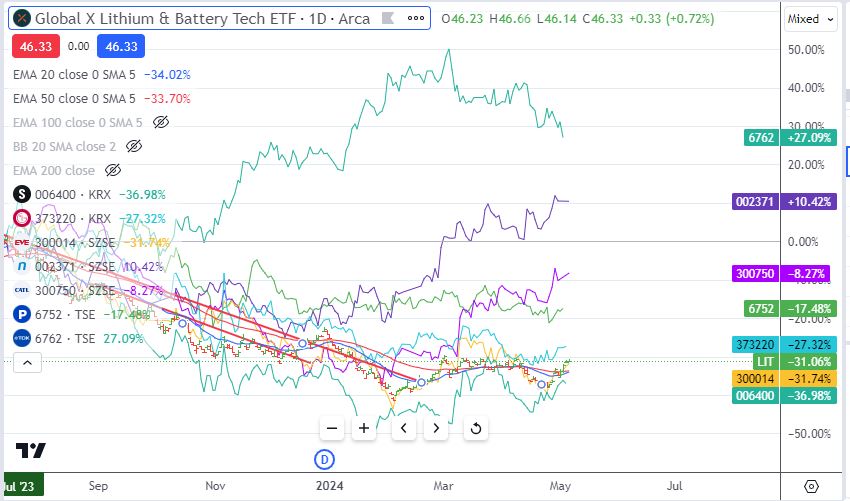

Global X Lithium ETF (LIT): Lithium. With price opening at $46.23, covered call could go to assignment and will trigger a massive capital loss in the managed portfolio. Lithium stocks have been on the big movers list a few times in recent weeks. Rather than buy the call back bought a replacement parcel of shares and scaled in. Also sold a May expiry 45 strike put option - that will recover a fair amount of the loss should this new tranche go to assignment.

Chart tells a clear story of a stock that has broken the downtrend and is consolidating - the W at the bottom of the run suggests the next move could be upwards as the 2nd low is higher than the 1st.

Did do some digging as to what the relative compontents of the ETF are - the leaders are the added value players - battery makers

Yellow Cake plc (YCA.L): Uranium. Yellow Cake holds uranium oxide inventory. Discount to net asset value is higher than the Sprott Phsical Urnaium Trust (U-UN.TO) and relative value is lagging.

Added a small parcel to pension portfolio to bring uranium holdings up to 10% and to add physical uranium price coverage. The outluer is CGN Mining (1164.HK) - nobody mentions that - it is the leading/only listed Chinese uranium entitiy

Sun Silver Limited (SS1.AX): Silver Mining. Got an opportunity to subscribe in IPO of this new listing. Sun Silver aims to develop a globally significant tier 1 jurisdiction silver gold asset with an Inferred Mineral Resource of 292,000,000oz AgEq at 72.4gt Ag, in Nevada, USA.

Ran stocks screens in Japan to find stock to deploy proceeds from sale below. Chose two stocks alreay held to average down entry prices.

Mandom Corporation (4917.T): Japan Consumer Products. Average down entry price. Dividend yield 2.97%

Chart shows price on a rising trend having a third go at making a higher high after breaking he downtrend.

Maruka Furusato Corp (7128.T): Japan Industrials. Average down entry price. Dividend yield 3.16% Ex date Jun 27

Chart shows prece fell over after first entry (the blue ray)and now making a reversal after breaking the downtrend

Toshiba Tec Corporation (6588.T): Computer Hardware. Dividend yield 1.55%

Chart shows price has squeezed into something of a flag formation - higher lows and lower highs. When these break out they tend to break hard.

Centrus Energy Corp (LEU): Uranium Enrichment. Centrus results came out below market expectations and price was smacked down 10% instantly. Added parcels in each portfolio to average down entry prices when the buyers stepped in. With NexGen (NXE) buying 2.7 Mlbs in the spot markets, the demand for enrichment just went up. While Centrus is principally a HALEU enricher they do have LEU capacity. Wrote covered call for 1.6% premium with 21.2% price coverage.

Norwegian Cruise Line Holdings (NCLH): Cruising. Assigned early on a 19 strike sold put. After all income trades and covering some capital losses breakeven is $12.68, 22.5% below $15.53 opening price (May 8). Wrote covered call for 1.7% premium with 15.9% price coverage.

NexGen Energy Ltd (NXG.AX): Uranium. On the NexGen announcement, price was pummeled 10% taking price below the capital raise being done on Australian listed CDI. Bought a parcel of shares below the placement price on ASX. Those buyers are less than likely to be selling shares below the raise price ($12.29)

In Friday trade, price was pummeled again - added a parcel in the pension portfolio. Late night trading mistake and bought the Canadian listing (NXE.TO) and not US - higher trading costs and harder options market. Will exit at breakeven and buy in US.

Sold

Mizuho Financial Group (8411.T): Japan Financial Services. Closed out at profit target for 46.8% blended profit since February 2017/July 2018 which makes for 5.3% compound annual gorwth rate - well ahead of Japan inflation (and also the Yen exposure is fully hedged)

ENCE Energía y Celulosa, S.A. (ENC.MC): Europe Pulp Products. Assigned on a covered call - somehow the broker missed this in April - 2.4% profit since December 2023. Stock screen idea. What this late assignment did was create an uncovered call situation for May expiry. Bought stock to cover that at a 14% premium - my cost for covering a broker mistake.

iShares Europe ETF (IMEU.L): Europe Index. Sold in managed portfolio to raise capital for 75% profit since April 2011. This would have been one of the first postions when this portfolio started - buy indexes across the world. Captial return is 4.39% annually compund not counting dividends - better than the rate of inflation but well below long run stock market returns.

Unilever Plc (ULVR.L): Household & Personal Products. Unilver has been a lacklustre performer and ticker price is too high to get a lot size for writing covered calls. Made a plan to exit at breakeven with averaging down trade in December 2023. Achieved that exit for 0.5% profit on price terms but a small loss after the high stamp duties charged by UK government. Holdings from June 2019/February 2022/December 2023. First tranche was a loser.

Britvic plc (BVIC.L): UK Beverages. Closed at 52 week high for 10.4% profit since February 2023. Stock screen idea.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

New Buys

Amcor PLC (AMC.AX): Packaging. Dividend yield 4.80%. ex date May 21

Chart shows price has broken the downtrend and is on a rising short term trend - the earnings and dividend has created the spike. Tough part is there is not 35% to recent highs - needs to break that to make target.

Auto Invest

Vanguard MSCI Index International Shares ETF (VGS.AX): International Index. Dividend yield 1.6%

Vanguard Australian Shares Index ETF (VAS.AX): Australian Index. Dividend yield 3.8%

Top Ups

Incitec Pivot Ltd (IPL.AX): Fertilizer. Dividend yield 4.70%

Normally I ignore these signals when the previous purchase is in the last month - the chart shows a solid base of support (the red line) and this entry does average down entry a little

APA Group (APA.AX): Gas Utility. Dividend yield 6.30%

Perenti Ltd (PRN.AX): Mining Services. Dividend yield 2.05%

Holding in Perenti came about as a result of the merger with DDH Holdings in October 2023 (clearly was not good for DDH shareholders). This entry gives a chance to average down entry price and find an exit near breakeven - merger rumours are swirling.

Income Trades

Covered Calls

Queit week for covered call writing with on four writenn - all US.

Pfizer Inc (PFE): US Pharmaceuticals. With price opening at $27.70, covered call is at risk of being assigned early to grab the $0.42 dividend. Bought the call back to retain the dividend - price was breakeven but there were trading costs loss = 26 shares worth of dividend. Wrote covered call for 0.93% premium with 4.7% price coverage far enough out-the-moeny as to be unlikely price will move that much in the two days to ex date (May 9)

Gannett Co (GCI): US Media. With price opening at $3.28 (Apr 10), the mess in the small managed portfolio on uncovered calls from last week keeps going on. Planned to sell 3 strike put options to grab some premium back to fund buying back the sold calls. Put the trade on and late night trading sold calls and not puts. So now the portfolio is short 4 calls and not 2 and no stock. Tried to buy back in live trade with increasing offer size. Gave that up and went back to the price they sold at and left the order pending. That order was taken up for a 520% loss on the older tranche and a small profit on the mistaken tranche. Why a profit? Broker paid me commision for the trades. That ends the Gannet saga - the losing trade wiped out most of the income trades profit which had covered the capital losses on the stock.

Naked Puts

Global X Lithium & Battery Tech ETF (LIT): Lithium. Return 0.71% Coverage 2.7%

Qualcomm Incorporated (QCOM): US Semiconductors. 1.1% 9.4%

Silver is moving taking a few covered calls into assignement territory. Sold naked puts mostly below the astrikes likely to be assigned at

- ABN AMRO Bank N.V. (ABN.AS): Dutch Bank. Return 1.94% Coverage 4.7%

- Cameco Corporation (CCJ): Uranium. Return 2.21% Coverage 6.1%

- Coeur Mining, Inc. (CDE): Silver Mining. Return 4.6% Coverage 5.8%

- Pan American Silver Corp. (PAAS): Silver Mining. Return 2.75% Coverage 1.8%

- iShares Silver Trust (SLV): Silver. Return 6.96% Coverage -0.1% - May expiry - written too tight.

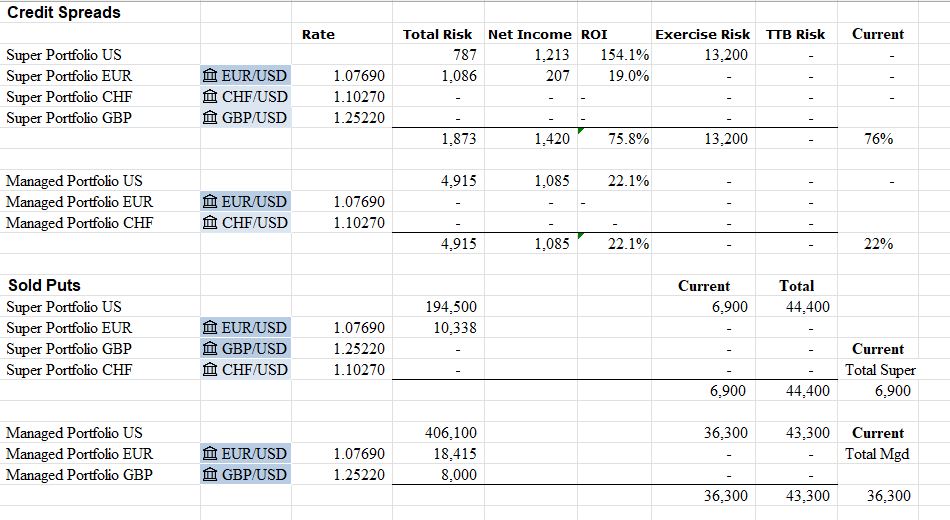

Credit Spreads

Exercise risk on spreads and naked puts is well withing parameters.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

May 6-10, 2024

Informative Post