ChainLink is an ERC-20 token offering a “Decentralized Oracle Network,” facilitating trustless up-to-date data feeds that can be used to execute smart contracts.

Image from ChainLink’s website: https://link.smartcontract.com/

How can the result of a smart contract be verified without a trusted third party? When you need to verify outside data (inflation rates, the status of a shipment of goods, the arrival time for a flight/taxi, etc etc etc) to ensure the proper fulfillment of a contract, have to rely on something to provide you with that information.

ChainLink offers a system which aggregates data from a variety of Oracles. Each Oracle is rated based on a “reputation score” (sound familiar? :-P) and other metrics based on prior performance.

In this way, any external data can be accessed on-the-fly, whenever it is needed, in a trustless manner that ensures reliable accuracy. It’s a great idea.

There’s a lot of great stuff about this token. The white paper inspires a lot of confidence, but there were some controversies surrounding the ICO. Read on for more information.

The LINK Token

Why does this service need a token?

It’s pretty simple: LINK is used to pay the Oracles who are providing information. The Oracles that provide the best data with the most reliable uptime get the best payments.

Oracles that either offer faulty data (for example, if an oracle says a flight arrived on time when all the others say it did not), or that do not respond to queries fast enough, are penalized with a lower reputation score and receive fewer LINK tokens.

This system is a simple way to incentivize Oracles to provide great data and maintain 100% uptime. For highly in-demand data, like financial information, these fees could add up to a significant income stream.

(As a side note - this is a lot like steem’s witnesses, who are compensated with steem tokens in exchange for generating blocks and providing key information like SBD inflation rates.)

Having a token that solves the problem of maintaining reliable oracles is a great idea. It’s one of those not-so-sexy, but extremely useful, concepts. Exactly the kind of thing that a blockchain is perfect for.

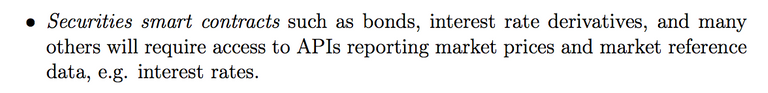

Here are a few examples of use cases for the LINK token, taken from the white paper:

So far, this token looks great. I’m stoked. Are we in the clear?

(imagine a record scratch sound here) — No, we aren’t! There was an ICO Controversy that threatened my confidence in this token. Let’s take a look and see what went down.

The ICO Controversy

Just when I was finishing up reading the white paper and getting all excited about this token, I discovered a controversy. Here’s the reddit thread with the bulk of the accusations: “Potential ChainLink ICO Deception: ChainLink Website: "The Crowdsale is Capped at $32,000,000" "Sept. 19th - Crowdsale Begins.”

Originally, prospective ICO participants were expecting that there would be $16 million worth of LINK tokens up for grabs following a $16 million pre-sale. (A total of $32 million.) However, as the reddit thread’s OP states: ”Apparently, ChainLink failed to disclose that there was $29 Million sold during the 'Pre-Sale'. Chainlink seems to have now decided to deduct this figure from the explicit $32 Million ‘Crowdsale’.”

The crux of the issue is this: ChainLink supposedly said that they sold half of the $32 million worth of tokens in a pre-sale. This would leave $16 million for the public ICO. However, by the time the ICO was opened to the public, only $3,000,000 of tokens were left - far fewer than anticipated.

As such, very few investors were able to buy in. Some people even sent in ETH after the fact, due to the fast and intense nature of the ICO - and they had to wait days for their refunds to be sent back to them.

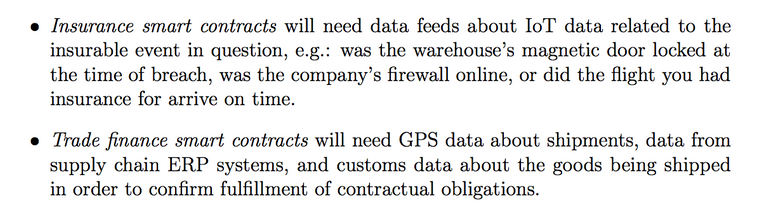

One of the project’s primary technical advisors (not a paid member of the staff) weighed in on the reddit thread right away:

He never ended up “Screaming from the rooftops,” which is a sign that the thread is exaggerated. In fact, as far as I can tell, he never returned to this issue apart from a single edit on that reply.

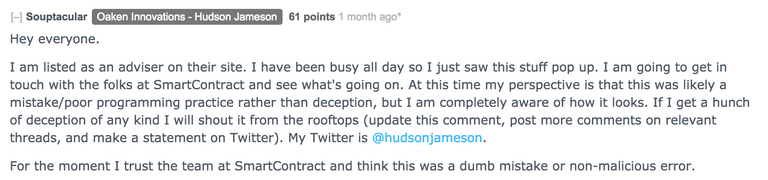

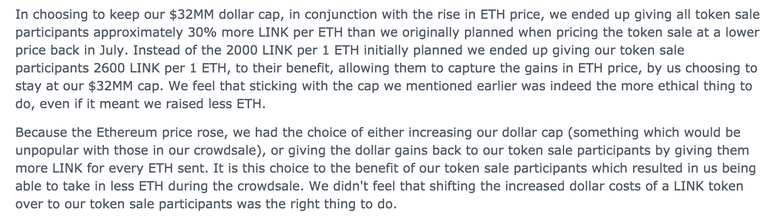

A bit later, the CEO of ChainLink’s parent company chimed in:

He’s claiming that the price difference is the result of ETH’s price shifting upwards between the initial pre-sale and the ICO date. He says the ChainLink team chose to maintain the 32MM token amount for the ICO, rather than inflate that number. His reasoning is that other ICOs have been criticized for changing the total number of tokens in an ICO.

The reddit thread has a lot of angry people, but it’s mostly isolated to this one spot. I don’t see any “controversy” elsewhere on the internet. We all know how reddit can be - it’s not always the most reliable source of info.

My gut says that communication can and should have been better, but that no malicious actions occurred during the ICO. The problem here isn’t so much with ChainLink themselves, as much as it is that the crypto space has appallingly low standards for ICOs in general.

The Token Distribution of LINK

This chart explains how the 100 million LINK tokens are being distributed:

I’m not sure how the “35% going to Node Operators and to Incentivize the Ecosystem” will be distributed… Based on the vague wording, it seems like the company behind ChainLink will distribute those somehow. That’s not great, but I could be wrong about it.

The Team

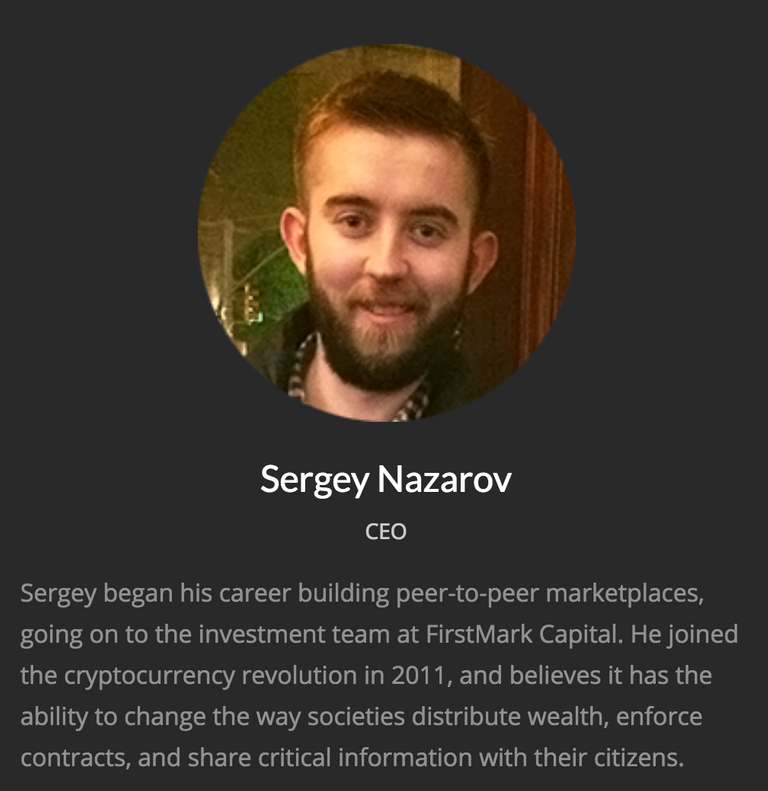

The SmartLink white paper is impressive, as is the proposed technology. To be honest though the team is quite small compared to what I would expect. There are only two people listed as actual team members on the website:

CEO: Sergey Dnazarov

Sergey has a good amount of experience - this is from his LinkedIn:

Note: That last one is the company behind ChainLink

Looks pretty good to me, a lot of experience in relevant roles and companies.

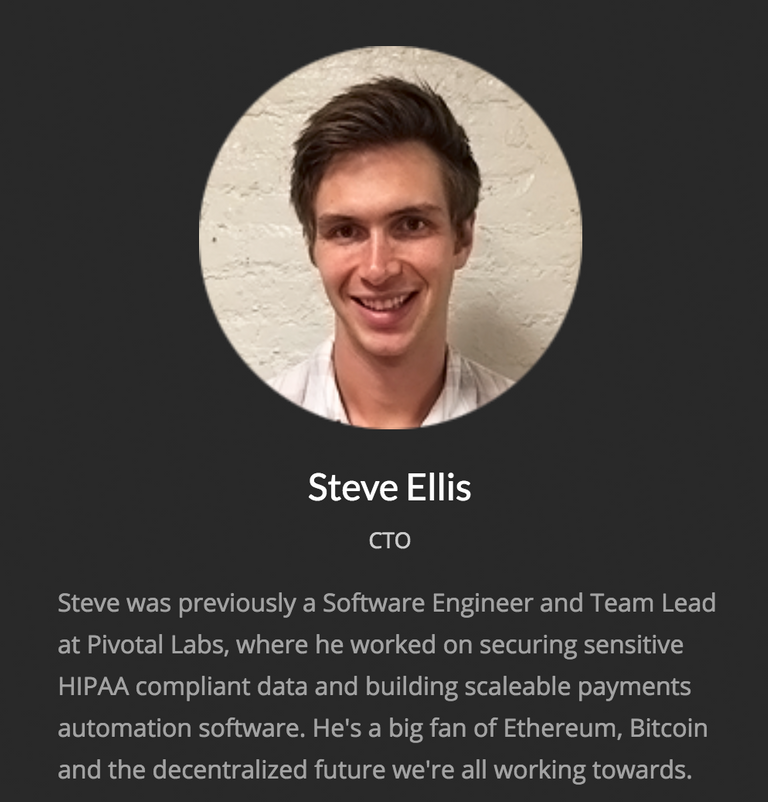

CTO: Steve Ellis

Steve’s experience is less impressive… He goes from Team Lead at a silicon valley startup to the CTO of a company that raises $32,000,000 in a few months. Only in the blockchain world would this happen… Kinda silly to me, but not unusual in this space.

No offense to Steve - he could be awesome. I’m just stating the obvious here.

Market History

Not enough history to say much here. Give it a few more months and maybe we’ll have more of an idea on where this valuation is headed.

Final Thoughts

I’m excited about the future of the ChainLink technology, but worried about the haphazard ICO. It wasn’t managed well and communication seems pretty weak overall.

If the team can ramp up the communication, bring on more members, and show clear signs of progress, I’ll be excited. Having a reliable system for trustless data APIs would be amazing for the blockchain world. Here’s hoping that ChainLink can pull it off.

What do you think? Do you have any experience or thoughts regarding ChainLink? I’d love to hear from you in the comments.

What do you mean by that, exactly?

About the coin itself, its usefulness relies upon adaptation more heavily, it might mean a bottleneck, even if the idea is good. High-quality Oracles like banks are necessary here IMHO

I mean that reddit is not a reliable source of information and many of the subforums succumb to groupthink.

You are right that adoption is key - there need to be enough different oracles for any source of data to be reliable. Hopefully they can do that, I feel like they really need a full-time person to facilitate that recruitment.

Oh yes, you're right about Reddit, sadly.

This collection is a great idea! I'm glad I found it early on, I'm looking forward to keeping up with the rest of the top 50.

Cheers!