If you've been looking at one token for a long time, you'll eventually get some feel for how it's going to behave during the bull or bear markets. I didn't trade any meme coins because these new tokens have so much volatility and it's not worth losing sleep over. I'm sure many people made their riches trading this stuff but the untold stories include market losers losing their money to these winners.

While it's not readily noticeable in the charts, Hive's greatest activity happens during the Tokyo session and New York Session on regular days. Random news events do happen outside these trading hours but I mostly get an idea of the market direction intraday based on these hours. I wouldn't get this confidence if I wasn't looking at the charts daily even when I'm not actively trading because it's a practice.

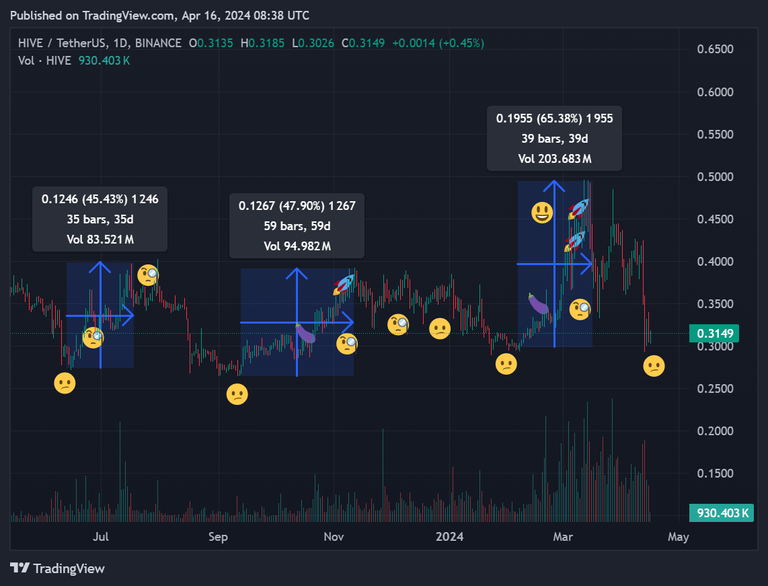

I keep a trading journal and it not only mentions about my best trades, it also records my worst decisions in the market. I check my notes and compared. Even scribble down some emoji's just to see to visually remind myself the emotions when I was thinking about the trade. I know it sounds silly but it serves me some good reminders on what I did and not to do next time I was getting a feel for the market.

Emotions and getting affected by FOMO are the things that every trader or investor has to go get a grip on if they want to earn money from the market.

Let's say I'm done making some scribbles on my chart. The last check I do was is filling the chart with emojis and comparing it to previous notes.

Thinking: Contemplating to enter the trade.

Eggplant: Buying in levels

Rocket: Sell time

Sad and uncertain face: It's exactly as that when the market gives me no clear direction and just goes into consolidation.

There are how I marked my previous actions. If you noticed on the first area to the left most side, there's no rocket or eggplant, that's because I didn't buy or sell. I was indecisive and sucking my thumb while the market was making its move. I was unsure if this was a true breakout from the long term resistance or just another series of rejection. I just document my reaction so that in the future I'd know what to do and it paid off, sometimes.

The word on the street during that time was bulls coming back on BTC. But I don't really jump in the hype and prefer to wait since I was just trying to observe and record what's up on my journal. I consider this silly exercise as a feelings indicator, how well do I trust my gut feel whenever I'm looking at the charts provided that I already identified my potential setups?

Be your own therapist and ask yourself what do you feel when you're being greedy and what do you do with it? what do you feel when you're down in the dumps and what do you do with it in relation to your time spent on the market? On previous occasions, I overtrade when I feel the gamblers high on small winnings, then stop looking at the charts for a while when I feel like shit for losing my profits during forced trades.

Not every success can be attributed to following a strict trade plan. Even Jesse Livermore, one of the greatest traders of all time got lucky selling stocks right before the great earthquake which was totally outside his usual trading strategy. Sometimes gut and luck do play a role in the market but I think it's just developed intuition honed through practice.

The most important thing is having some sense of clarity that what emotions that drive your conviction to buy into a position or sell is in agreement with your logical side. I'm make mistake and most of them include being greedy after my original plan was to sell at 10% gain but it shot past 15% and now I decided to wait. Then the price retraced back and now I ended up selling at a 5% gain. Even if I win, it felt like shit for making the wrong call and this was when emotions took over your logic moment.

A little introspection may have changed my mind about how the lesson felt. What if it ran past 15% and went as high as 20%? would I still regret selling at 10% early? definitely, even if you did the right moves, you still get the pangs of greed and that's the purpose of documenting what you feel when you're trading in the moment.

In hindsight, it really is more sensible to just be contented with the gains, it's better than losing money but while the realization was fresh, some victories just didn't taste right. But that's just emotions and greed talking, it doesn't have to obey the laws of reason. Keeping a journal to understand your trading or investing decisions and emotions may sound silly but what you feel really warps your sense of the market. If you're greedy, you get confidence and gamble more.

Nobody loses money taking profits. So while I would never be able to sell at the tops, I still end up finding some worth for my time and sleep better at night for not requiring any cutting of losses. This was from reviewing the times when I got the bias right, in the right side of the market but didn't sell at take profit points for thinking it could go higher.

So above is where I draw some arrows with visualizing the 3 possibilities of of the market going up, down or sideways. The market will move in one of these directions and your guess has a 1/3 of chance to come true, but another question is when will it happen and how long? just be content with the answer nobody knows. The task here is knowing what you would be doing if scenario A happened instead of B rather than be reactive. If the market pumps, when are you going to buy? If the market dumps, when are you going to buy or sell? One of the 3 movements are bound to happen but the trading plan includes having an answer per scenario than react to FOMO.

You'll have no shortage of YT videos giving you buy or sell signals, sell you a course, hopium and copium because regardless of the market direction, these content creators already made money from your views.

You know the market can go higher or lower and it doesn't care about your take profit or cut loss points. But your psychology in investing on trading will dictate how you perform under pressure. Let's say you lost money, the chances of you losing more money increases as your try to gamble or revenge trade your way to cover those losses.

I don't win all the time but I lose less money by not giving into the moment during FOMO. There's really no need to push yourself to trade when uncertain because the noise from the crowd don't have your best interests. Journaling is the only sure consolation I'll getting from scribbling emojis on the chart.

Thanks for your time.

Yea many people I know has lost a lot of money to online token trading but some are legit anyway

Similarly if you are an experienced person you will trade in crypto in the same way and entry into new tokens at all can be very risky.

The emoji's are genius. It's amazing the amount we trade off emotions of FOMO.

Maybe that's why bots can be profitable, they just need to follow a ruleset and don't have that sense of FOMO.

Congratulations @adamada! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 7000 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP