Watching the BTC making all time highs is witnessing history in the making. You know what else is making history on the charts? daily price swings that go in rhythm. The time, tech and players in the market may have changed but it's still the same market we're playing. I'm making notes so as not to let the maximum experience go to waste.

I'll just be inserting some notes on my trade journal here in quotes and some ideas were influenced by Jesse Livermore. I'm no financial expert, I just shitpost about stuff I'm interested in so there's no part in this post that should be meant as financial advice.

Back to Jesse Livermore, he's one of the few people I'm learning about while raising some investing / trading smarts. Beyond just figuring out how to make more money, I find the idea of examining the past through the lens of those that accomplished something remarkable fascinating on its own. Just trying to learn for the sake of learning if nothing else.

Anyw

Take notes. No matter how trivial some passing ideas may seem, you can still cut them out later.

Some ideas are just outdated until you find some of the concepts still applicable in certain situations. An average person doesn't need to rely on their broker's recommendation to pick a stock but it's encouraging to get some expert opinion from someone experienced in the market right? maybe, that's how I feel about getting those weekly market updates on PH local stock exchange where my broker sends an automated market updates on the hot stocks.

There's no need to heed their advice. But I figured some people with deep pockets really listen to their advice. Going back to how the times, tech and people may have changed but the game is still the game. Brokers have been giving advices on the hot stocks, and it's in their best interest to keep the orders flowing because they earn commissions from both the buying and selling parties. It's not necessarily in their best interest to make everyone profit.

Even when it's not about stocks, you'll see crypto exchanges sponsor articles to keep the platform hooking more players. They'll pay influencers for it. The market makes suckers and winners at the same time.

Until there's is some sense of accountability in your buying and selling decisions, you have no business staying in the market.

Recalling from the days when I started out buying on someone's recommendation without doing my own research, you think I'd know better even with all the damn books that prep me for the moment. Even when I made the right or wrong decisions as evidenced by the end result of profit or loss, it didn't feel like I had some active agency since these were decisions made on someone else's hunch.

My unpopular opinion about getting scammed is "if you get scammed, some part of the process had your fault in it". From start to finish, there's a step missed or overlooked when trying to validate authenticity in a deal. I got scammed a few times, these were from people that used friendship as a collateral and I'll just have to take their word for it. I process the experience and think, maybe I didn't do enough diligence to see through the lies, or the loss was great because I shelled out cash more than I was comfortable losing, or maybe I was too trusting in this scenario.

Those pitfalls can be blessings in helping you avoid bigger falls. The point is having some sense of accountability that while the scammer was at fault, you also made your call on the matter and therefore should be ready to accept the consequences mentally. When the market swings against you, do you blame the market for being the market? do you blame it when it made a price action that favors you? It's two sides of the same coin, someone's loss is your gain and vice versa.

You don't need to feel bad about missing out on profits that could have been if you never even thought they were possible.

Everyday there's a token out there that pumps and dumps you knew nothing about. The same way for stocks, commodities and currencies but you're doing fine with the ignorance. It's probably bittersweet that some of your coins are riding in the BTC trend but you wished you could've bought more BTC when you had more than a year to accumulate.

Like, how conceited do you have to be to be to be able to predict the market or catch all opportunities when it presents? the inconvenient truth is that it's everyone's game and you don't really need to come out on top to be profitable. Let's say you invested 100$ on Hive and 100$ on BTC, if both tokens went up 10%, how much would you have earned if you picked had only one of them in the bag? 10$. But it so happens that the BTC got more love so your Hive may just rallied to a 4-5%,it's hypothetical and let's just leave it at that.

How could you even know how much would a token be valued the next day or the day after? If the inverse happened, you probably sung a different tune but this is why psychology place a bigger role in investing or trading, it's really controlling your expectations and managing your risk.

Before this happens, answer what to do with the ifs.

I thought I was being creative when I made that entry but I had to backtrack what I was smoking when I wrote it. Ah, something to do with being prepared for possible market scenarios. The market could go up, down, or sideways and there has to be a premediated move and a ready answer from your part. This goes back to lessons like cutting your losses early, taking hold a position or letting go, but generally doing stuff where you don't find yourself sucking your thumb while the market rushes you to make a decision.

In live trading, there isn't any time to react because bots trigger orders faster than you can react. So most decisions I've made were premediated stop loss orders expecting the market would react in this and that manner. That's not to say I've made the right calls, I paid the tuitions for those lessons and learned to be less emotional when things don't go in my way.

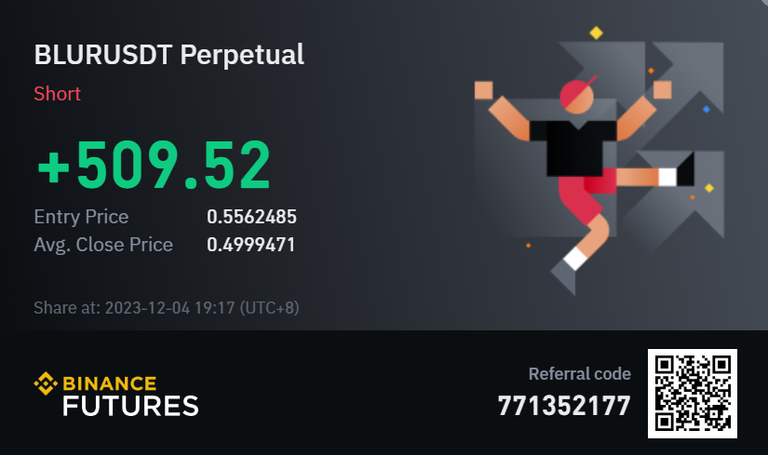

One of my fluke moments when I anticipated a dump but didn't expect the market to down this bad that it ended up being a 500$ profit, (700$ if I didn't get greedy and took the prize early). While it's a win, it wasn't because I followed my damn rules so it was a fluke and I couldn't really replicate the moment. I ended up taking losses afterwards chasing the dopamine kick which costed me more. The thing is, I should've answered the question on what if I won, got greedy and overtrade?

It's unlikely that I'll be able to avoid all the same pitfalls 100% even if I took notes but at least I don't get to be the market's bitch as I used to. I'm still learning the process and it's been a fun journey despite the losses and occasional wins.

Thanks for your time.

This time things are very different and Bitcoin is looking strong at the moment, we will see that within the next few months it may see us go to $150,000 this time.

Up for now, quit while you still can Adadadaddad.

Pls don't become broke

Damn it. That was really quite massive $500 profit is huge

Hmm

So you mean that some of the articles we see were written or paid for by some crypto exchanges so that we can maybe buy their token or so?

That’s surprising

How could it not be surprising? you get youtube influencers shilling specific tokens or making guides about how to trade on platforms like Binance where they made it sounds so easy.

Wow

No wonder

I get the drill now

Congratulations @adamada! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 77000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP