Welcome to Risk Management 101

Hey, you gems! In this tutorial, we're going to talk about the three-step risk management process that I use and that you should probably use too. Now if you want to get caught up in the Ride the Waves series, stop being a lazy bum and watch the other tutorials (linked at the bottom of the page).

Don't be a Risky Roger

Before jumping into the process, I wanted to answer the question, "why is risk management important?". Now that may seem obvious, but improper risk management is one of the main reasons why traders tend to fail in the markets.

It's not uncommon for profitable traders to lose multiple trades in a row - sometimes 5 in a row or even 10. Now if you risk 10% of your portfolio per trade, you could completely wipe it in its entirety in 10 trades...don't be a Risky Roger - stick to smaller risk.

What risk is enough risk?

I advise any trader to start off only risking 1-2% of their portfolio per trade. You may be thinking to yourself that you won't get the reward that a 10% risk would give & for the most part that is true. However, let me show you an example of what consistency of this 1-2% risk can do.

Say you start off with a portfolio value of $5000. Every trade you take is only risking 2% or $100 ($5000 x 2% = $100) with minimum risk-to-reward (R/R) is 3:1. We'll get into R/R below, but essentially it means that for every 2% you risk in this case, your reward potential is 6%.

If you made 1.5% per day profit with this strategy, in 365 days of trading, your account will be worth...

$1,145,711

Now don't get me wrong, trading a 1.5% profit every day for 365 days isn't an easy task (especially for noobies). I don't want you to think it is; however, it is doable. Even if you have days that you lose multiple trades in a row, with that 3:1 risk-to-reward ratio, you can lose 3 and win 1 to be breakeven. This is the power of proper risk management

Every battle is won before it is fought

Picture trading like medieval warfare. Would you wake-up, grab your chainmail, and just start screaming as you charged the opposition with no plan? Absolutely not. You and your clan would have a strategy. You'd also prepare all your weaponry and make sure your defense mechanism is set up to ensure your safety.

However, rather than sharpening your sword & checking to see if the catapults function properly, you prepare by identifying your max risk, by laddering entries, and by limiting your losses with a stop-loss.

Step 1: Identify your max risk per trade

Think of your maximum risk as your survival strategy - are you going to risk everything by standing in the middle of the war zone butt naked just waiting to get nailed by an arrow? Hopefully not.

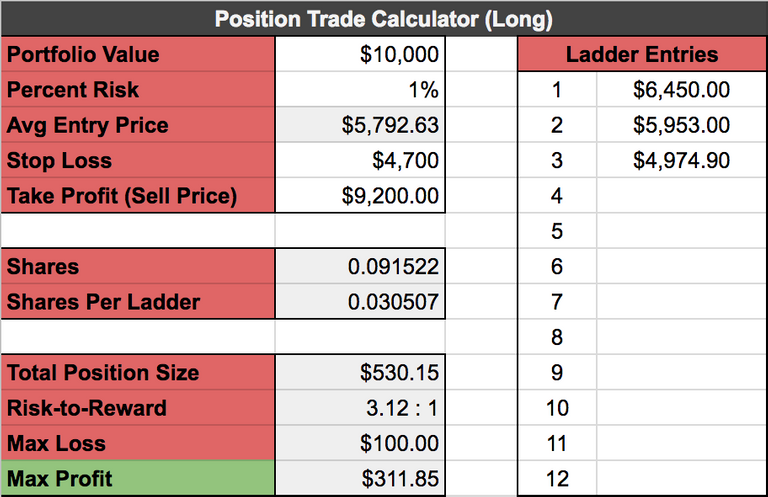

Calculating your max risk is simple - just multiply your portfolio value by the max risk per trade. For example, say you have a $10,000 portfolio and you want to risk 1% per trade.

$10,000 * 0.01 = $100 max risk

Step 2: Ladder your entries

Think of laddering entries like your plan of attack. The general gets all members of a clan in a room together & divides them up into attack groups. Group 1 attacks from the west, group 2 attacks from the north, and so on. What's the purpose of this? To have an effective offensive strategy that mitigates the risk of attacking one heavily-guarded area.

Rather than throwing all your money down in one single entry point, the goal with laddering is to disperse risk with multiple entry points. Take a look at the photo below for an example.

Now let's stick to that example of the $10,000 account value & $100 max risk. How are you going to know how much to buy at each ladder? Well luckily for you, I made an awesome Google Sheets position and profit calculator that will calculate EVERYTHING for you...

You can download it by clicking here!!

Step 3: Set a stop-loss & take profit

In a previous article about trading profitably, I bring up the importance of mitigating risk through a proper risk-to-reward ratio. Take a look at what I said:

Say for instance, in your trade strategy, you set to only risk 2% of your portfolio value on a single trade. If your portfolio is $1000, you're only going to risk losing $20. Ideally, if you're willing to risk $20, you should at the very minimum only take trades that have the potential to bring in $60+. That is a 3:1 risk-to-reward ratio. I would advise you to set a 3:1 as you're minimum.

This 3:1 R/R basically means that you can afford to lose 3 trades, while only winning one to be break even. This tilts the odds in your favor BIGLY. Say you backtested your strategy and it has a 66% win-to-loss. That means if every trade was taken with a 3:1 risk-to-reward, you would win 2 out of every 3 trades equaling a total profit of $100 ($60 win + $60 win - $20 loss).

Think of your stop loss as your armor - it protects you from taking a lethal hit. It's important you have your armor on BEFORE you enter the war, or you just might not make it out alive. I can't really think of a medieval war analogy for the take profit that works for this...uhm....whatever, maybe you can leave one in the comments to help me out!!

Anyways, how do you know where to set your stop loss & take profit? Well, that might just be for another blog (the next one maybe?). However, use the calculator above and only take trades with that minimum 3:1 risk-to-reward ratio & you should be ready to rock & roll.

Now you're ready...

You have your armor on. Your war pig is ready to attack. You have your offensive & defensive strategy set and you are ready to win the war. Go get 'em you beauties - I know you're now ready to kick some ass

Is this the first post in the tutorial you're seeing? Go watch the previous ones you knob!

Tutorial 1: The Fundamentals

Tutorial 2: Wave Structure

Tutorial 3: Using Fibonacci with Elliott Waves

Already rekt!!!

Your post was resteem by Whale ResteemService @booster007

Keep it up!

All the best!

Send 0.100 SBD/steem For resteem over 4400+ followers / send 0.200 SBD/steem resteem over 10,500+ Follwers Send your link in memo ! @boostupvote Attached !

Resteemed to over 16400 followers and 100% upvoted. Thank you for using my service!

Send 0.200 Steem or 0.200 Steem Dollars and the URL in the memo to use the bot.

Read here how the bot from Berlin works.

We are happy to be part of the APPICS bounty program.

APPICS is a new social community based on Steem.

The presale was sold in 26 minutes. The ICO is open now for 4 rounds in 4 weeks.

Read here more: https://steemit.com/steemit/@resteem.bot/what-is-appics

@resteem.bot

People who liked this post also liked:

The Road to 100 000 dollars! Week 5 : How low can you go? by @d0zer

You got a 4.95% upvote from @postpromoter courtesy of @concordiainvest!

Want to promote your posts too? Check out the Steem Bot Tracker website for more info. If you would like to support the development of @postpromoter and the bot tracker please vote for @yabapmatt for witness!

Wonderful post ..thanks for sharing...Best of luck friend ✫

this is the best bot for steembottracker clik here https://steemit.com/bots/@hassanbenali/the-best-bot-for-service-how-to-create-steem-bot-tracker

Transfer 0.200 SBD or 0.250 steem to @mrbean1 and put the link of your post in the public memo you get 5 good UPVOT and resteem by @mrbean1 +followers

Resteem to 1370+ Follower . Send 0.250 SBD or 0,300 STEEM to @music-curation ( URL as memo ) + 16 upvote

Congratulations @concordiainvest, this post is the forth most rewarded post (based on pending payouts) in the last 12 hours written by a User account holder (accounts that hold between 0.1 and 1.0 Mega Vests). The total number of posts by User account holders during this period was 1659 and the total pending payments to posts in this category was $2956.48. To see the full list of highest paid posts across all accounts categories, click here.

If you do not wish to receive these messages in future, please reply stop to this comment.

nice post @concordiainvest

Resteemed by @resteembot! Good Luck!

Curious? Read @resteembot's introduction post

Check out the great posts I already resteemed.

ResteemBot's Maker is Looking for Work