Just how good is a crypto trader?

It's a fair question, but "good" is one of those words that can mean SOOOOOO many different things, that to people like me, it generally doesn't mean much. It's like "natural." WTF is that?!

The reality is that if we are going to measure how "good" or "skilled" a trader is, we need numerical data; the actual data behind a trader's performance and the metrics associated with it.

Even though we've only been dabbling in cryptos since 2017, some of the guys in our group have been trading other markets for decades: stocks, forex (foreign exchange or "FX"), options, futures...you name it!

In Forex, we have access to some pretty cool tools that I wish we could tap into for cryptos.

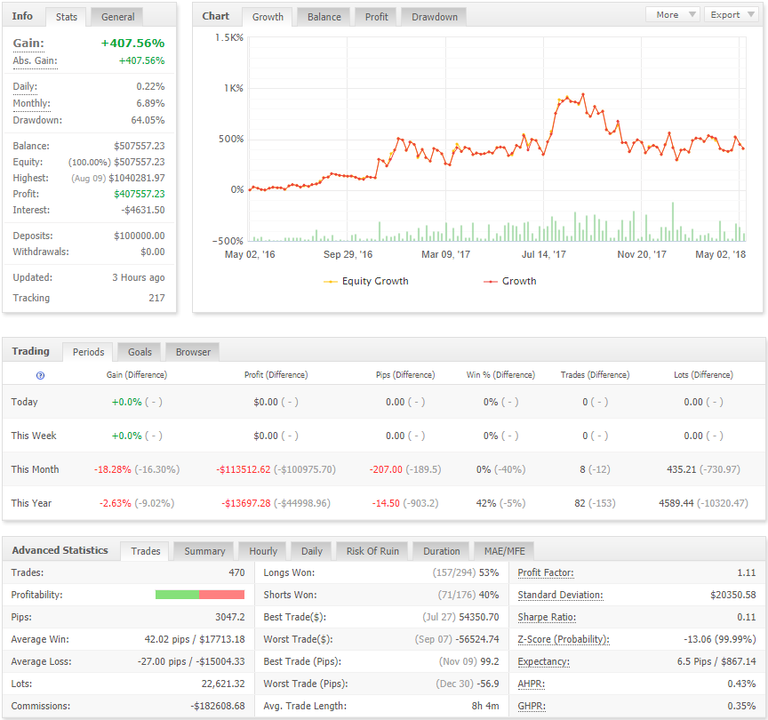

For example, check out this cool tool from MyFXBook. It actually breaks down an FX trader's historical performance and gives you a lot of important information associated with it.

In the example above, you'll notice that the trader is up 407.56% since he started on May 2016, which equates to 6.89% a month compounded.

Sounds like a darn good return, right?

The reality is that looking at return without taking risk into account doesn't really give you the complete picture you need to make an informed decision about a trader's skill or lack thereof. In the world of hedge fund trading, six (6) percent a month is actually pretty high, but when you take into account that the trader above had a drawdown (or maximum downside deviation in equity) of 64.05%, then the return doesn't look as good.

I know that in a market as volatile as crypto, dropping 64% in an account might be the style du jour for many, but the reality is that we don't know many traders that have survived for too long by letting their equity drop by that much!

Don't get me wrong, just looking at a trader's return in proportion to historical drawdowns is not enough. You need to consider many different things. How does his average win compare to his average loss? What percentage of his long/short trades are profitable? All of these things are important, as well as many others.

But my goal here is not to assess a trader's report card. That is a subject for a much more in-depth, future post!

I just wanted to bring up the topic of tools that we think all traders need; tools like the ones above, which would make the lives of both novice and experienced cryptocurrency traders alike a lot easier.

Given that we are planning to eventually launch a crypto fund [hopefully this year], we are craving for tools like these. We've looked and looked, but haven't found anything remotely close.

How about you...do you use anything similar to this to analyze your crypto trading performance?

If you're a dev, do you know of a group or project that's working on something like this for the crypto market?!

Hi, thank you for contributing to Steemit!

I upvoted and followed you; follow back and so can help each other succeed! Thats what this community is all about!

Great work!

How much have you invested in security? Has your tools been turned over to a professional hacker to test the hackability? Is the fund going to be sourced by a pool of traders or investors?

Hey Ralph. Thanks! You bring up good points about security, which is crucial in the crypto world. As I mentioned on the article, we have not formed the fund yet, so we don't have the final security solution in place. The reality is that we prefer not to set everything up from the ground, like a traditional hedge fund. That is why we have been looking at solutions like Iconomi, TokenBox, and Blackmoon for all this.

Great analysis

Asi es @cryptoplayhouse pienso que es un poco desconcertante Te apoyo ya que con tus grandes publicaciones llevara a esto en ser un trabajo mucho mas facil en un futuro

El mercado de criptomonedas necesita muchas herramientas como estas. Haremos todo lo posible para acelerar el desarrollo de las mismas. Gracias por tu comentario y apoyo.

Crypto trading as a whole is still in its embryonic stage. We will hopefully see some advances in the future that will make the job easier.

Oh, no doubt. Its just a bit baffling to me that there haven't been more efforts to convert existing tools to cryptos; theres a practical sea of trading tools out there for the traditional guys!

So it's @cryptoplayhouse I think it's a bit disconcerting I support you because with your big publications it will be a much easier job in the future

Thanks for the support. We will definitely do our best to make the space better.

Great analysis bro.

The post is great.

Thanks for sharing your idea

Thanks man. My pleasure. We want this space to develop as quickly as possible, so that everyone can benefit.

Crypto is a new field and it needs a lot of work and attention but it has a great potential.

You're exactly right