My last piece on Security Tokens, “The Flippening Is Coming”, outlined the reasons why 2019 will see more issuance of Security Tokens than Utility Tokens. Since then, the Security Token future has come in to greater focus, and it’s bigger than anyone thinks. Below are the 8 reasons why I’m all in.

- The Smartest People In Finance Are Quitting Wall Street & Devoting Their Life To Crypto

CNBC headlines like “Goldman banker waves goodbye to Wall Street in search of crypto riches” and ”Credit Suisse Banker Known for Preaching Crypto Is Leaving”are becoming increasingly commonplace.

The thing that gives me the most confidence that Security Tokens are the next big thing is the quality of people dedicating their lives to Crypto and Security Tokens. Now, many of these rock stars are in it for the money. And that’s ok. We need them too. But many see the Crypto Light, and know that the greatest thing about Crypto is how it’s going to make the world a better place for billions for people. This isn’t just a new financial instrument, it’s a movement, driven by a community of brilliant people, infused with a strong sense of purpose. That’s a combination poised to changes the world.

- People Want Liquidity

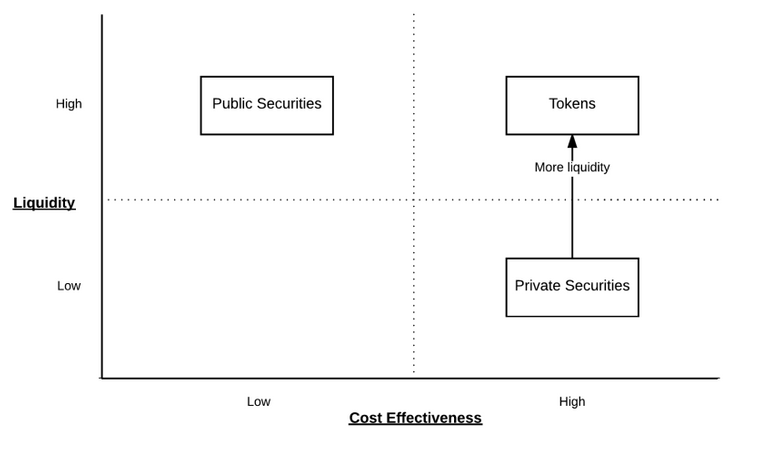

The simplest argument for Security Tokens is from the Harbor Whitepaper:

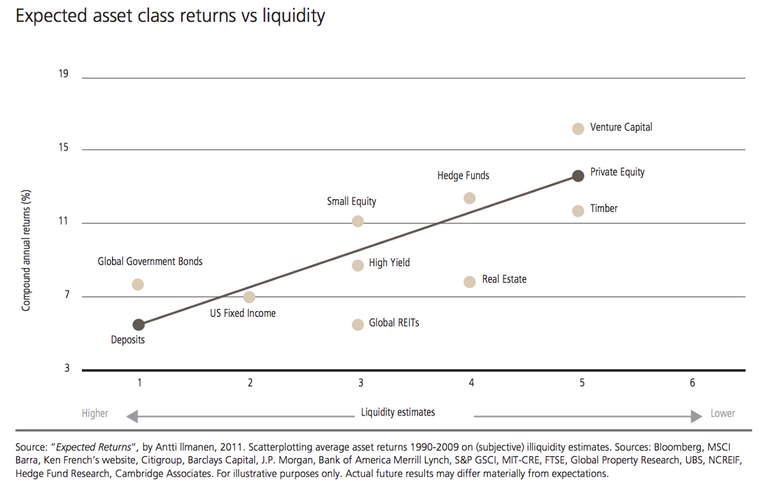

People pay for liquidity. It’s a truism. All else being equal, the more liquidity you give investors, the lower return they require:

With hundreds of trillions of dollars in private assets that could be tokenized, the value that will be unlocked via tokenization over the next decade is in the tens of trillions of dollars.

- The Security Token Rails Are Being Laid

The mechanics of how Security Tokens are made, traded, custodied, & remain security compliant, are more complex than is obvious at first blush. That’s why the few STO’s to date have struggled. But that’s all changing in real time. Rails are being built at a furious pace, and are more functional with every passing day.

Firms like Tokensoft, OpenFinance Network, Teknos, Polymath, Verify Investor, Start Engine, tZERO, Templum, Kingdon, Blackmoon, Securitize, and Harbor, are just a small fraction of the companies building standardized, interoperable, and scalable Security Token solutions.

Good overviews of the Security Token rails include this piece by Tatiana Koffman, and this piece by Christopher King.

- We’re Entering The Golden Age of Securities Innovation

History is rife with great innovations in finance:

Interest was invented in Mesopotamia in 3000BC, and initially set at 20%.

Paper money was invented in China around 800BC.

The first coins containing gold were struck in Asia Minor, around 600BC.

Mutual funds were invented by the Dutch in 1774 in response to the bailout of the British East India Company.

Mortgaged Backed Securities (MBS), were invented in the U.S., in the 1850s.

Leveraged Buy Outs were invented in the U.S. in 1919 with the LBO of Ford.

Junk Bonds were first issued by Bear Stearns in 1977, quickly followed by 7 issuances by Drexel, which went on to invent the Collateralized Debt Obligation (CDO) in 1987.

But we haven’t seen anything yet. For the first time in history, with the digitization of securities, and the use of smart contracts, securities innovation is only limited by our imagination:

A great fintech innovation example is Bancor, an algorithmic market maker, taking friction out of the marketplace, and enabling a breadth of liquidity previously unfathomable.

Early STO’s are simply taking existing securities, and digitizing them, similar to the early days of TV, which we’re simply guys doing radio on television, not taking advantage of the innovation the new medium afforded. The first TV broadcasters could never have imagined:

And we can’t begin to imagine what securities are going to be. As we enter the golden age of security innovation, get ready to have your mind blown and your digital wallet overflowing.

- Security Token Regulations Have Been In Place For 85 Years

Institutional investors have a fiduciary responsibility, including a Duty of Prudence, which includes ensuring what they’re investing in is legal. That’s why there’s been little institutional investment in utility tokens, as U.S. investors are governed by securities regulations, and utility tokens largely claim to not be securities.

But the five seminal securities laws we’re written 1933-1940. They’ve been amended by Congress many times, including in the JOBS Act of 2012. We might not like the laws, but Security Token investors know what the laws are, and are free to invest, knowing they’re within the letter of the law.

- I Want My MTV — Fractional Ownership Will Be Huge

Shares are fractional ownership of a company. NetJets brought us fractional ownership of planes in 1964. While fractional ownership’s not new, tokenized private ownership solves for both the trustless verification of ownership as well as the liquidity of that ownership, ushering in an era of unprecedented growth in fractional ownership. Some areas like art and real estate already have multiple projects underway. But just wait and see what’s next.

The Green Bay Packers first sold stock in 1923 at $5, and last sold shares in 2012 at $250. The shares don’t represent an equity interest, aren’t tradable, and don’t bring season ticket privileges. Shareholders receive voting rights, an invitation to the annual meeting, and a chance to buy exclusive merchandise. They’re Utility Shares! But future sales of sports teams will include ownership rights, because fans want them (over 350,000 fans own Packers shares), and paying for it (Green Bay raised $64 million in 2012). I can’t wait to buy Red Sox shares, sit in Fenway, and watch MY team!

Instead of fractional ownerships of planes, why not fractional ownership of seats on planes? We’re going to see fractional ownership of songs, movies, TV shows, restaurants, bikes, cars, scooters, mining equipment, and cable channels. In the future, if you want your MTV, you can actually own a piece.

- Enhanced Transparency Equals Enhanced Value

Leveraging blockchain and smart contracts, information like sales can be public in real time, eliminating the never ending series of one-off disclosures. As more services become distributed ledger based, reporting will evolve from static disclosures to real-time and web based. By definition, all else being equal, companies that are more transparent, will have higher valuations.

In addition, technologies like Zero Knowledge Proof will enable sophisticated privacy features, eliminating one of the major drivers of private blockchains.

- The Security Token Meetup — It’s All About The Communities

The major difference between Crypto and everything that came before is the importance of community to the success of projects. That’s why, from CryptoMondays to CryptoCommons, CryptoOracle’s focused on communities.

Building on the Security Token community work done by the Security Token Academy and Start Engine, we’re launching the Security Token Meetup NYC on June 18th featuring a Fireside Chat with execs from Templum and Satis. Use discount code CO_VIP for a free ticket (or pay the $20 if you want to contribute to the drinks). Tel Aviv is also rocking a great Security Token Meetup. More cities to follow. Like all other aspects of Crypto, as the Security Token community grows and engages, the Security Token community wins.

Finally, learn more about Security Tokens by reading Stephen McKeon, Howard Marks & Anthony Pompliano. Time spent will have a high ROI. So batten down the hatches. The Security Tokens tsunami is about to hit.

If you liked what you read, PLEASE “Clap” below so others will see it too (up to 50 claps allowed!).