Standard ICO Report Structure:

- Part 1: ICO Analysis (What is it about? What is the ICO intending to do? Describes what the platform is.)

- Part 2: CROWDSALE ANALYSIS – DETAILS & TOKEN SUPPLY

- Part 3: Useful Links (Further Research)

Part 1: ICO Analysis

Universa solves the barriers of entry into real world applications that conventional blockchain tech is facing: speed, scalability, and cost. Universa envisions that its architecture will be superior for creating Dapps (Decentralized Apps) due to privacy, low fees, and high network speeds.

No real world solutions

Over 180k bitcoin transactions were held up in November 2017 – after a swath of miners decided that they would rather switch to mining Bitcoin Cash – bringing much of the hash power used to mine bitcoin with them.

Can cryptocurrencies ever be ready for mainstream adoption when nearly 10 years later, networks are still susceptible to ‘strikes’ such as this?

Universa vs Bitcoin: No Unnecessary Storage

Universa does not store anything unnecessary on their blockchain. In Bitcoin, for example, all transactional data and a complete history of the states is stored on the blockchain. Universa’s only focus will be to ensure the validity of such data, as well as security. This substantiates the boast of Universa’s speed.

In the blockchain, token ownership is ‘proved’ by a contract. Say, if Sally has 10 bitcoin and sends 5 to Alex, this data is stored on the blockchain.

In Universa, this contract is split into two. Given that 0x1 is the cryptographic hash of the contract, the contract will in the beginning be:

0x1: Sally has 10 bitcoins.

After which, it is split to:

0x2: Sally has 5 bitcoins.

0x3: Alex has 5 bitcoins.

Only the validity of the contract is stored on the blockchain, instead of:

Sally had 10 bitcoins.

Sally sent 5 bitcoins to Alex.

Sally now has 5 bitcoins.

Alex now has 5 bitcoins.

It will be,

0x2 is valid. 0x3 is valid. 0x1 is no longer valid.

Universa vs Ethereum: Smart Contracts

Universa smart contracts have different ‘abilities’ than Ethereum smart contracts. In Ethereum, a smart contract contains validation logic as well as contract ‘documents’ that constitute what agreement terms are in the contract. Validation logic constitutes code that will execute the conditional terms of the contract.

In Universa, this validation logic is excluded for the most part. Simply put, a smart contract will act very much like a real world contract and contain just ‘terms and conditions’.

This makes it much easier for business to adopt blockchain technologies by having to integrate a lot of coding and validation syntax in addition to the conditions of a contract (what most Dapps around do).

For example, if Alex wants to use an Ethereum smart contract to send 5 ethers to Sally, it will require coding both the ‘details’ for the contract and also the code.

Send 5 ethers to Sally at 3pm on the 20th of November 2200.

Whereas in Universa, Alex will just provide the ‘details’ and the validation logic will be executed by Universa. Alex does not have to know how to ‘operate’ the contract.

Time: 3pm

Month: November

Year: 2200

Amount to send: 5 ethers

Recipient: Sally

Universa’s contract editor does not require the input of a single line of code. It can be found here.

Superior Privacy

Universa's architecture effectively decouples data storage and data validity storage. Now, even the Universa blockchain itself will not have knowledge of what constituted the contract. In the guise of blackbox testing, nodes will only be able to answer ‘yes, hash X is valid’ and not ‘this is what occurred in hash X’. This is certainly beneficial for privacy.

Zero knowledge Proof

Universa is also private. Validation of transactions can be done by only offering partial information to the validator without exposing the full ‘secret’. In fact, the crypto cloud used for storing smart contracts and chat communication (which can be found on the Web Client) is also fully zero-knowledge.

Target markets for usage

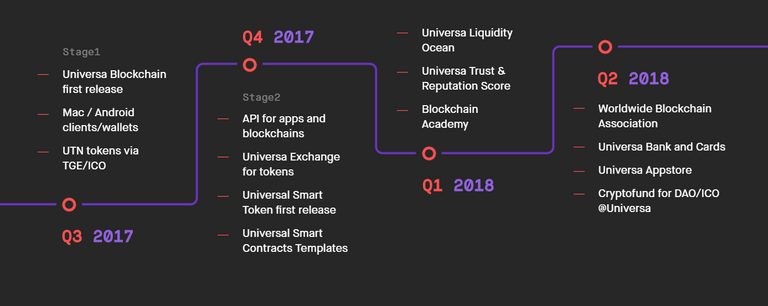

There is a flurry of use cases with Universa, which will be delved into deeper later on in their roadmap. However, they have a few applications on their sights: b2b contracts, IoTs, true micropayments, and multisig contracts. The primary strength of Universa would probably be the ease of releasing new tokens and the luxury of being able to have validation done offline.

Part 2: Crowdsale Analysis – Details & Token Supply

Token Sale Date: 28th October

Total token supply: Undefined

5 Billion theoretical limit with 9.9 Billion on sale. Tokens are generated after they are sold. Whatever that remains unsold will not be created

Hardcap is $ 99 million with softcap being 10 million (although the team could operate with minimally $5 million without any R&D capabilities)

Token type: UTN-P and UTN

UTN-P is a placeholder ERC20 token. When the Universa Blockchain goes live, participants will be able to swap them to UTN tokens at a 1:1 ratio

Token Price: $0.01 = 1 UTN-P/UTN

Token Distribution:

- 66% Public sale

- 20% Foundation

- 10% Team

- 4% Bounties, Advisors, and Partnerships

Crowdfunding Usage:

- 35% Universa Protocol

- 20% Marketing and Business Development

- 20% Foundations

- 10% Reserve

- 8% Operations

- 5% Legal

- 2% Security

Another fresh review of Universa Token Sale. All benefits of the platform, risks and growth potential in strong... https://t.co/WGCqpfwLdC

— Universa Blockchain (@Universa_News) November 2, 2017

Team Overview - Members & Advisors

Alexander Borodich, CEO, Visioner, Business angel, Entrepreneur

- Investor in blockchain economy: Shapeshift, Unocoin, BitAccess

- 95 startups in portfolio (×8 ROI)

- Founder of #1 crowdinvesting platform in Russia

- Blockchain educational program director at Plekhanov Russian University of Economics

Sergey Chernov, Ex-CTO at Cybiko

- 25 yrs of software development & architecture

- 17 yrs in cryptography

- ASM, C++, Ruby, JS

- Ex-CTO at Glomper

Alex Dovnar

- 20 yrs in digital & print design

- 10+ yrs Art-director experience

- ex Marketing Art-director at Mail.Ru Group

Advisors

John McAfee, Cyber security and software pioneer

- Formerly from Lockheed

- Founder of McAfee Associates in 1989, the world’s first antivirus company

- McAfee Associates acquired by Intel Corporation in August 2010 after 2 years of being public

Yale ReiSoleil

- Private equity fund manager and quantitative trader

- Co-manages Sichuan Hongjian Medical Fund, a ¥20 billion acquisition fund, and a cross-border high technology venture capital fund

- Developed several proprietary quantitative trading systems

- Co-founded ReiSoleil McAfee Zhu Ventures LLC (RMZ) with Mr. McAfee and Mr. Zhu in July 2017.

Dmitry Finkelstein

- Expert in quantitative portfolio management and capital markets with 17+ years of experience

- Familiar with running multiple quantitative strategies ranging from low speed global tactical asset allocation and equity long-short to super fast HFT and cutting-edge AI-based strategies

- Co-founded four companies in IT and FinTech. Master degree in Applied Math, EMBA, CQF

- Partner at Bankex and Terreus Capital.

Samson Lee

- Over 20 years of experience in TMET sector

- Co-Founder of Ethereum South China and South Asia communities

- Founder of CoinStreet Asia, Chief Crypto-Economic Advisor for the Gibraltar Stock Exchange

- General Partner of AVO Partners Group and Southern International Capital

- President of Next-TV, and Chairman of STM Digital Holdings Group.

David Drake

- Chairman of LDJ Capital, a family office; Victoria Partners, a 300 family office network based in London; LDJ Real Estate Group and Drake Hospitality Group; and The Soho Loft Media Group with divisions Victoria Global Communications, Times Impact Publications, and The Soho Loft Conferences.

Another fresh review of Universa Token Sale. All benefits of the platform, risks and growth potential in strong... https://t.co/WGCqpfwLdC

— Universa Blockchain (@Universa_News) November 2, 2017

Part 3: Useful Links (Further Research)

- Website

- Whitepaper

- Bitcointalk Forum ANN Thread

- Telegram (Community)

- Telegram (Announcements)

- Github

- Testnet/Web Client

*I would like to thank Alexander Myodov (Universa Blockchain Developer) for being attentive to my queries.

*Reposted from Bitsify.net

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://bitsify.net/ico-list/universa-ushering-in-lean-smart-contracts/

Congratulations @manwe! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP