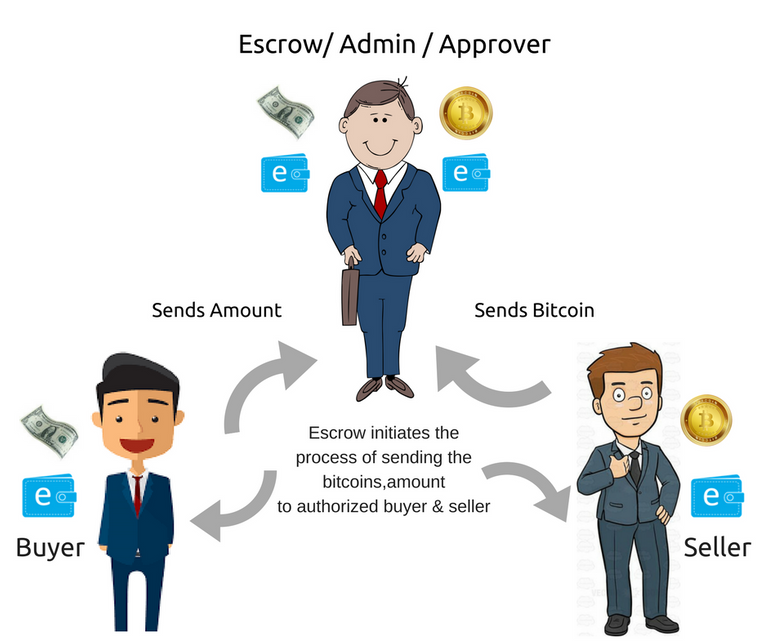

The breakthrough of blockchain technology established the era of the decentralized ecosystem. Now the users can experience the essence of decentralization with blockchain technology. With blockchain technology, the p2p transaction has become a reality. But the on-chain transaction is still expensive particularly if the transaction amount is of small value. So in order to mitigate this, the off-chain solution has evolved. But again, in the off-chain solutions, there is a role of custodian during the point of transfer. So a user having a cryptocurrency which is decentralized, however during a transfer to another user, the same has to pass through a custodian or escrow. That means at the point of transfer it is not trustless and the user is trusting a third party.

The cryptocurrency on the top of blockchain technology was invented by keeping the aspect the decentralization at the forefront. So be it holding a coin or transferring a coin, if the user is not facilitated with a decentralized atmosphere then the primary purpose of blockchain technology is not fulfilled. Therefore the off-chain solution has to be decentralized and secured through blockchain technology. If the fund of a user is secured through blockchain technology at any point of time, then the off-chain solution can leverage the benefits of other forms of services/technology.

With the passage of time the blockchain technology is advancing & evolving, however this advancing & evolving blockchain technology is being challenged with issues like scalability, interoperability, transaction fees, congestion in the network etc.

Scalability

Scalability generally refers to:-

- The time taken to put a transaction into the block.

- The time taken to reach a consensus.

So for a transaction to go through depends upon the size of the block and the miner's verification time. More the number of transactions at a time more will be the overall time period of a transaction. So block size in case of Bitcoin and gas limit in case of Etherum and the subsequent consensus mechanism makes the transaction speed slower and gives rise to the issue of "scalability".

In centralized systems like PayPal and VISA, the number of transactions is really high whereas this is an issue in the decentralized system.

The decentralized network enables trustless network but at the same time, it poses "scalability" issue. This issue should be addressed in order to bring blockchain to the mainstream. Before the various crypto projects & blockchain technology can find the true and wide-scale adaptability, there is a requirement to improve the scaling capacity of blockchain, which can be done by:- * Improving the Tier-1 scaling solution, that is scaling capacity of the blockchain has to improve in order to scale the on-chain transaction at a higher rate. * Improving the Tier-2 scalability which refers to the development of off-chain solutions.Interoperability

In crypto segment, we have major coins like Bitcoin, Etherum, Litecoin etc. But we don't have any such provision till now that one chain can interact with another chain. The interactions between different chains will make the Ecosystem more powerful and this will help to bring the blockchain technology to mainstream and mass adoption will become a ground reality if there will be "interoperability".Transaction cost

It is another bottleneck to the crypto ecosystem. The crypto ecosystem is looking lucrative because of the decentralized blockchain technology. But the transaction cost at times is proving to be the set back for the crypto ecosystem, particularly for those payments which are smaller in value. So this is another problem interface of crypto ecosystem.Congestion in the network

If the network is overloaded, then it may lead to congestion in the network, then the user while dealing with his/her transaction may experience a transaction which is full of hassles & frictions and this could lead to bitter user experience at times. The best example of congestion in the blockchain network may be referred to cryptokitties.

The above problem interface definitely demands a more viable solution. Off-Chain solutions are one of them. But in off-chain solutions which primarily aims to improve scalability, there are requirements like the creation of payment channels between two parties, collateral management etc. Creation of payment channels incurs an additional cost. More the number of payment channels between users means more complex connectivity. So even if we consider off-chain solutions to improve scalability, the challenges like the creation of payment channels, collateral management, complex topography remain.In this context, it is imperative to say that not just do we need an off-chain solution, rather we do need a robust off-chain solution which can offset the challenges of existing off-chain solutions. This segment of a viable off-chain solution introduces Liquidity Network.

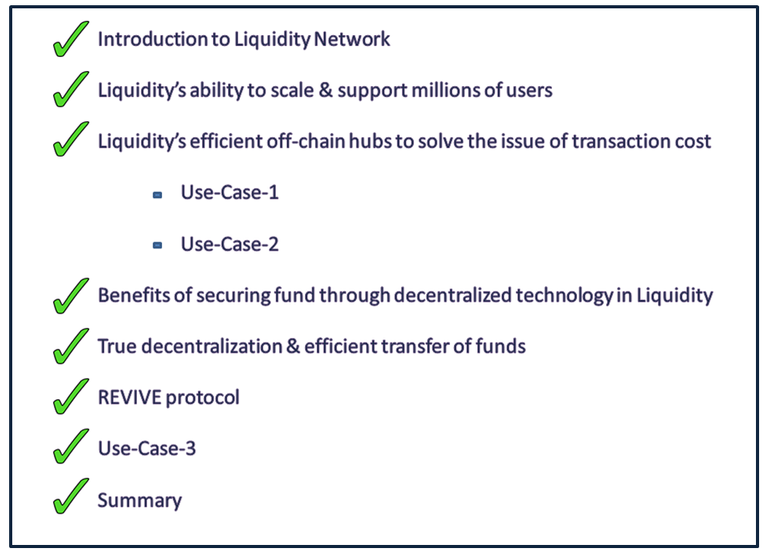

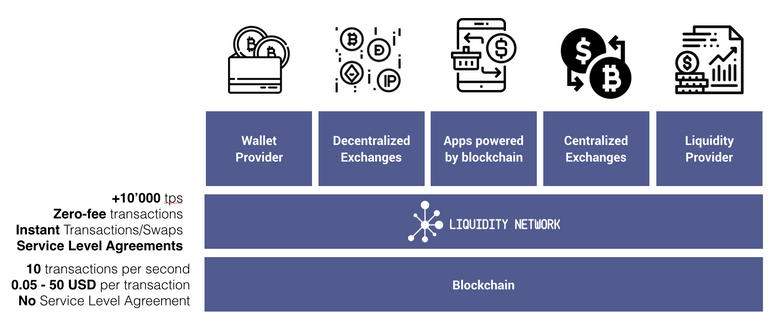

Liquidity Network is built on Etherum blockchain which aims to offer a network to allow blockchains to scale higher by leveraging on off-chain solutions.

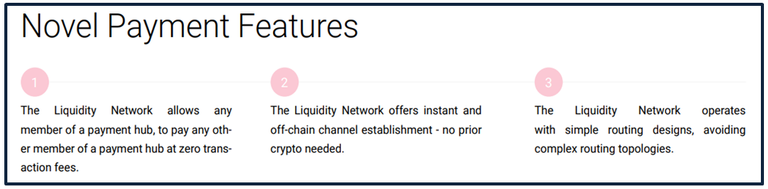

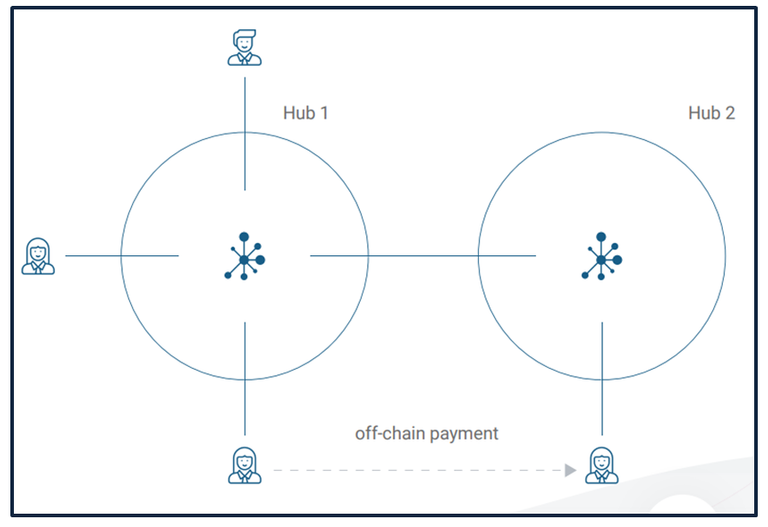

It consists of novel payment hubs and the payment hubs are further connected with each other within the network. The technological innovation in Liquidity Network is cost effective, transparent, scalable so that millions of users can be able to connect to the payment hubs of their choice and can be able to transfer funds with no to minimal transaction cost. This certainly has the potential to break the barrier of entry & make the mass adoption a reality.

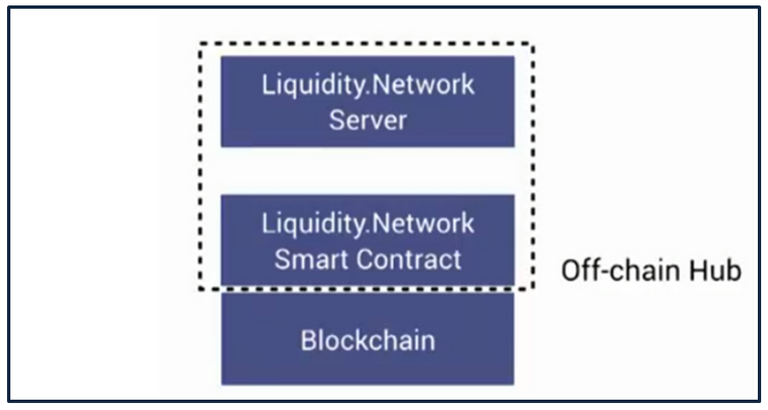

Liquidity being an off-chain solution can work with any smart contract enabled blockchain. In Liquidity Network, it enables n-party payment channels in addition to conventional 2-party payment channels, means more than 2 users can also be able to connect to the payment hub. The payment hubs in the Liquidity Network are trust-less , whose operation can be audited by anybody to ensure integrity & decentralization in the Liquidity Network.Liquidity Network is basically a composition of a blockchain, smart contract, payment hub, connected topology & communication.

Liquidity Network leverages on the advantageous aspects of both centralized as well as decentralized technology. With centralized services, the computation of a transaction happens through centralized server so as to make the transaction instant with low latency and with decentralized blockchain technology, it ensures security of the user's fund, that means at any point of time the private key of the user remains with the user itself.

Image source

The two key components of Liquidity Network are:-

The Liquidity Hub NO-CUST-

The NO-CUST hubs are non-custodian hubs that enable off-chain transaction between users without being the custodian of the fund. The number of transactions per second significantly improves with this facility.

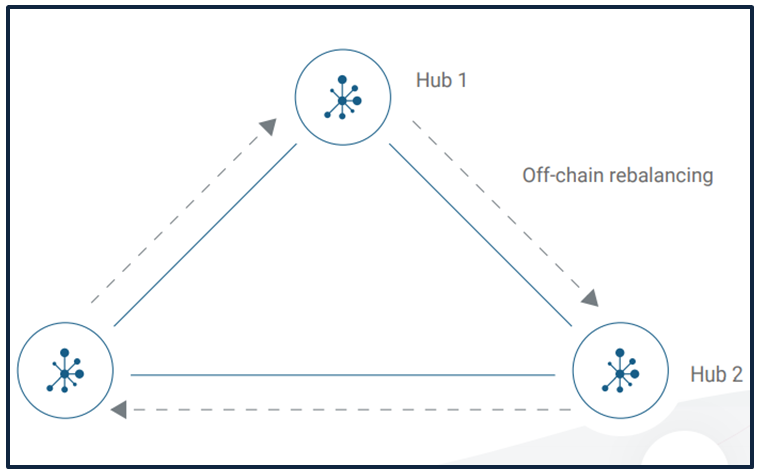

The REVIVE-

It is basically a collateral management technique which enables the different payment hubs within the Liquidity Network to re-balance the collaterals off-chain in between them. With this technique, the congestion in the network can be avoided.

There is no doubt that blockchain technology is the next generation technology and this stage is all set to make this era of blockchain technology implemented in various domain of real physical world in wide varieties of use cases from personal to commercial purposes. But scalability has been an issue since its invention. There has been a lot of debate over scalability issues and several developments are being made to improve the scalability of blockchain.

The widespread adoption of blockchain technology is hindered with the scalability issue. The major cryptocurrency including Bitcoin or Etherum handles less than 100 transactions per second whereas the traditional centralized services handle more than 2000 transaction per second on an average with their capacity being even more than 50000 transactions per second. So it is apparent that along with the blockchain technology, we need better scalability to remain at par with the centralized services so that when the widespread application including commercial adoption will happen, they can easily choose blockchain technology(decentralized technology) over a centralized technology.

This issue of scalability can be solved by off-chain technologies. Or in other words, off-chain settlements are one of the solutions of scalability. The various off-chain technologies are lightning network for Bitcoin, Raiden for Etherum. Fundamentally off-chain solutions are not only faster but also cheaper in cost. In off-chain solutions transaction can be recorded immediately without waiting for any confirmations as happen in on-chain transaction. In existing off-chain solutions, the payment channels are developed between nodes to nodes and the peer to peer transaction is facilitated through these payment channels. There is also a need of collateral for the nodes and one can make a transaction off-chain which is less than or equal to the collateral deposit of the node.

The generic benefits of off-chain solutions are:-

- Improves scalability.

- Lowers the transaction cost

- Tiny payments can also be possible.

- Transaction is almost instant.

- Does not burden the main chain.

The demerits of existing off-chain solutions are:-

- Does not support large payment & only suited for the small to medium sized transaction.

- Could also lead to centralization of payment hubs.

- Most of the existing off-chain solutions are only 2-party payment channels which are either unidirectional, bidirectional or linked payments etc.

Liquidity Network aims to offer a better solution than the existing off-chain solutions where it mainly focuses on creating n-party payment channels in addition to 2-party payment channels so that re-balancing of the collateral can be made between different payment hubs which can accommodate more number of users along with other benefits like faster & cheaper transactions. The routing topology is more simplified with Liquidity Network.

The users participating in the Liquidity Network can set the preference of channel owners. With the solution like REVIVE (re-balancing of payment channels off-chain), users in the network can re-balance their channels. The payment hubs in Liquidity Network are not the custodian of the fund of users and the private key at any point of time always remain with the user itself, therefore keeping the spirit of decentralization intact in the entire process. Because of the facility like re-balancing & n-party payment channels, different payments hubs can be made interconnected to each other efficiently, ensuring liquidity in the entire network.

The private keys remain with the users and payment hubs ensure the transfer of funds between users, however, the computation of transaction is done with the help of a centralized server so that the scalability can be matched to that of a centralized service with low latency. So Liquidity Network takes the benefit of both decentralized technology and centralized services. With decentralized technology, it ensures the private key always remains with the users in the network, without any custodian, so keeping the true spirit of decentralization intact. When it comes to scalability it matches with centralized services by computing the transactions through a centralized server.

So now it clear that with n-party payment channels, by re-balancing of the collateral between payment hubs, by computing the transaction with a centralized server & by keeping the spirit of decentralization intact while dealing with the funds of the user, Liquidity Network enhances the scalability & liquidity in the entire network. This model definitely is a better off-chain solution than the existing off-chain solution in regard to scalability.

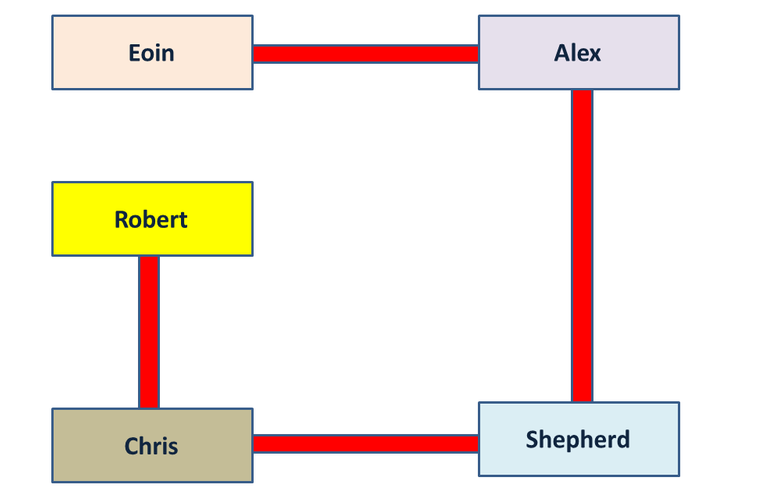

In existing off-chain solutions, the essential requirement is payment channels. Say for example in Lightning Network, if a user does not find a direct payment channel with another user to send a transaction, then the user has to route the transaction through 1 or 2 or 3 or n number of users, that means there have to be that many numbers of payment channels to make this transaction happen. This is really complex as an excessive number of payment channels means excessive transaction cost too. How much excessive transaction cost with excessive payment channels, let's understand from this use-case of a transaction through Lightning Network.

Eoin, Alex, Shepherd, Chris, Robert are five users in a Lightning Network. Eoin wants to send 1 BTC to Robert, but he does not have a direct payment channel with Robert. However, he is indirectly connected to Robert via users Alex, Shepherd & Chris. He does not want to create a new payment channel as that is a costly affair for Eoin, so he wants to route the payment of 1 BTC through intermediaries. Explain how the process of routing through intermediaries will happen in Lightning Network. What is the transaction cost implication in this use-case on account of routing the payment through intermediaries?

The 5 users in this use-case are- Eoin, Alex, Shepherd, Chris, Robert. There are different channels that connect Eoin to Alex, Alex to Shepherd, Shepherd to Chris, Chris to Robert.

Eoin wants to send 1 BTC to Robert, but he is not connected to Robert directly and he does not want to open a direct channel either, as they may cost more money to open an LN channel. Eoin’s lightning node is connected with Alex’s node and Alex’s node is connected with Shepherd’s node and similarly, Shepherd is connected to Chris and Chris is connected to Robert.

So Robert will generate a secret R which only he knows and he hashes it and sends the hash H to Eoin’s node.

Now Eoin will create an HTLC payable to the person who can solve the hash H with a 10 block refund timeout and for an amount 1.003 BTC. The extra amount 0.003 BTC will be used to pay the intermediaries in the LN channel for routing the payment from Eoin to Robert.

So Eoin sends the HTLC to Alex, So if Alex knows the secret to solve the hash H within a timeout of 10 blocks then it will consume 1.003 BTC of Eoin. Alex does not know the secret, so what he will do is that he will create another HTLC on his payment channel to Shepherd with a commitment of 1.002 BTC who can solve the hash H for 9 blocks. Similarly Shepherd will create another HTLC on his payment channel to Chris with a commitment of 1.001 BTC who can solve the hash for 8 blocks and this process continues and similarly, Chris creates another HTLC on his payment channel to Robert with a commitment of 1 BTC who can solve it for 7 blocks.

Now Robert knows the secret value R to solve the hash H, so he can claim the HTLC from Chris. So he sends the secret R to Chris and gets 1 BTC. So now Chris can claim the HTLC committed by Shepherd and earn 0.001 BTC and in similar fashion Shepherd and Alex both can get 0.001 BTC. So in this example, the intermediaries put their lightning channel at stake for routing the payment from Eoin to Robert and for that they earned incentives of 0.001 BTC each. This is how the lightning channel works. So if the secret is known the intermediate nodes can claim back their channel balance along with a fee and if it is known then after the timeout, then they get their channel balance. So the nodes have nothing to lose and if they successfully rout a payment through their nodes they can earn an incentive.

So in this use-case, you see how the transaction fee gets increased to 0.003 BTC because of the more number of intermediary payment channels and with a direct payment channel this transaction fee could have been kept 0.001 BTC only.

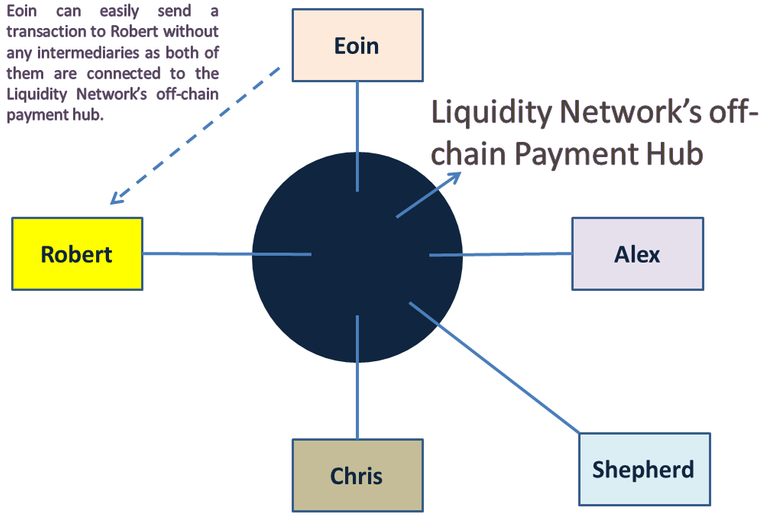

So it is apparent that we need a "one-many" system of payment network in which "one" being the payment hub and "many" being the number of users connected to the payment hub. That is what Liquidity Network aims to offer.

With Liquidity Network there are individual payment hubs where so many numbers of users are connected and there are several such individual payment hubs which are again interconnected to each other. That implies that a user connected to the particular hub can be able to transact with another user of that hub without the requirement of creating a payment channel in between the two, as both are already connected to the payment hub.

So as compared to the use-case(1) in the lightning network above, if the same scenario will be brought to Liquidity Network then it will look like the following illustration. In this illustration, the cryptocurrency is taken as ETH as currently, Liquidity Network supports ETH & ERC 20 tokens.

There are 5 users: Eoin, Alex, Shepherd, Chris, Robert who are connected to the payment hub of Liquidity Network. Eoin wants to send 1 ETH to Robert. Explain how Eoin can send 1 ETH to Robert. Is there any transaction cost involved in this transfer? Does it require any intermediaries? How about the registration fees if these 5 users will be registered in a payment hub of Liquidity Network? Derive a conclusion by comparing it with the use-case(1)?

The same 5 users- Eoin, Alex, Shepherd, Chris, Robert are connected to the Liquidity Network's payment hub. Eoin wants to send 1 ETH to Robert. As both are connected to the payment hub of the Liquidity Network, Eoin can easily send 1 ETH to Robert and that too without any transaction cost.

So in this use-case:-

- There is no registration fee for the 5 users to register to the payment hub of the Liquidity network. The hub generally supports "n" number of users to connect to the hub.

- There is no transaction cost for the transfer operation from Eoin to Robert.

- There is no need to route the payment through intermediaries in this use-case as all are connected to the same payment hub.

- This use-case has simplified connectivity.

So there are two important conclusions we must derive from both the use-cases:-

(1) The off-chain solutions are way cheaper than on-chain transactions. That is true and generic to the off-chain solutions as a whole. But again if the different off-chain solutions will be compared, then Liquidity Network's off-chain payment solution is much cheaper in transaction cost as compared to other.

(2) If "n" number of users are connected to a particular hub, then there is no requirement of creating "n" number of payment channels between the users. So with Liquidity Network, the topology is much more simplified and congestion free than any other available off-chain solutions.

In this way, the efficient payment hub of Liquidity Network can solve the issue of the transaction cost.

It is true that blockchain technology is that technology which can provide a business solution of different needs within a wide array of personal to commercial purposes as the blockchain technology is fair, transparent, immutable, secured, decentralized & distributed. This technology is way better than the centralized services if the parameter is decentralization, if the parameter is the security of the fund of a user, if the parameter is transparency etc.

A business solution has many facets in reality and not every time the security of the fund or the decentralization is the predominant criteria to choose a solution and it varies from cases to cases. For example, a blockahin technology may be decentralized and secured but not scalable, where as a centralized service may not be that secured but that is scalable. So if in a business solution the scalability is predominant criteria then it may go with the centralized services and may not choose blockchain technology despite being the fact that blockchain technology is decentralized & secured.

Therefore a business solution by large may require the service of centralized technology which has low latency, better scalability as well as the service of decentralized technology which ensures absolute ownership of user's fund. Liquidity Network has worked on the advantageous aspects of both the technology to provide a solution where the computation of a transaction is done with the help of a centralized server with low latency and ownership of the fund is secured through blockchain technology, that means at any point of time in the entire process the private key of the asset remains with the user. So Liquidity Network offers a non-custodian off-chain solution of payments.

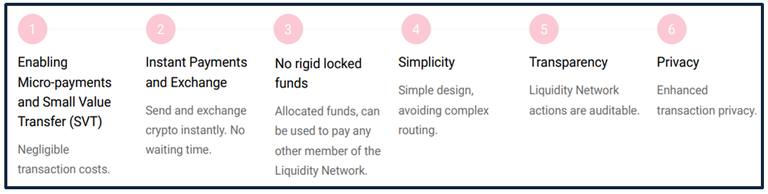

The benefits of Liquidity Network are:-

- It offers an off-chain solution with high scalability. The transfer of fund is almost instant.

- The novel payment hubs ensure no rigid locking of funds between two users. The allocated fund can be used to pay any other member of the Liquidity Network.

- The micro payments can be done with no transaction cost.

- The ownership of the fund is always secured with blockchain technology, that means the private keys of the user remain with the user at any point of time.

- It does not play a custodian role at any point of time, maintaining the true spirit of decentralization.

- Simple routing of payments.

In the centralized services, a user during the transfer of the fund to another user risks his/her fund to the good standing with a third party. Means as long as the third party is good and not corrupt, your transaction is also in good standing. But as it is a third party, it is always going to be the subject of vulnerability. So a user might be holding a cryptocurrency but during transfer to another user, if the user is dependent upon a third party, then that transfer could be the point of vulnerability.

In the decentralized services, there is no such risk of vulnerability, but the user is subjected to a time lock and if the time lock is not in tune with the scalability of the blockchain, then it could be an affair of hassles and frictions. In case the blockchain is congested and it is taking a much longer time than usual, then the user may stand to face timed out transactions. So a solution is needed in order to ensure efficient transfer of funds.

The Liquidity Network is designed in such a way that it consists of universal payment hubs which facilitate the transaction to happen. The transaction is no longer locked between only two users, rather "n"-number of users, as it allows "n" number of users to connect to the payment hub. But the most important point is that the fund is secured by the blockchain. That means the fund of a user will contribute to the liquidity in the system but in the entire process at any point of time, the ownership of the fund solely remain with the user only and neither the hub operator nor any other user can have access to the allocated fund of a user.Therefore Liquidity Network portrays a model of a payment system in which the true spirit of decentralization is always secured by the blockchain technology.

The liquidity in the network is not only enhanced by the "n"-number of users connected to the payment hub but also the liquidity gets enhanced further through interconnected payment hubs. So it aims to provide a redundant and decentralized network for the users.The transfer of fund is solely at the discretion of a user. In case the user chooses to transfer the fund the same has to be done through payment hub's smart contract. Conversely, if the user decides to remove the fund from the payment hub's smart contract, nobody can stop the user to do so. The user is free to choose any payment hub as per his/her suitability. Therefore the absolute decentralization prevails in Liquidity Network in regard to the efficient transfer of funds.

In conventional payment networks in off-chain solutions, the two parties are either directly connected or are connected by intermediary payment channels. So in case two users intend to perform a transaction between them, but are not connected directly can take the route of intermediaries to perform a transaction off-chain, without having to open a new payment channel in between them.

In real practice the actual trend of payment direction is arbitrary. You can not say whether the payment is going to be skewed to left or right or will be dead after 1 or 2 payments. So there will be cases of depleted payment channels. Normally when a payment channel is depleted, the channels need to be closed & refunded, this process requires at least two expensive on-chain transactions. This problem can be solved by REVIVE protocol of Liquidity Network.

So REVIVE protocol is basically a re-balancing technique for off-chain solutions. With this protocol, a group of members within the network can be able to shift their balances safely.

It must be noted that the actual deposits within the payment channel are not going to be shifted. However, with REVIVE protocol, a credit will be assigned to the payment channel where a deposit is actually made and that credit can be shifted to revive another payment channel so that the expensive process of closing & re-opening a payment channel can be avoided within the network.

REVIVE protocol is going to be tricky within the network.

The best possible yield of REVIVE will happen when all the participants are honest. In such a case the cost to revive a payment channel will be free. The scalability will improve. Further, the routing of payments through costly payment channels can be avoided, because with REVIVE protocol, one can re-balance a low priced channel and make the route possible with a much lower cost.

The worst possible yield of REVIVE protocol will happen when some of the participants within the network are malicious. The consequence in such a case will be the trigger of dispute penalty. But the interesting point is that the penalty fee is still lower than the fees that are associated with withdrawing & refunding the payment channel using two on-chain transactions.

Therefore the conclusion about REVIVE protocol is that, be it a best possible yield or worst possible yield, there is saving through REVIVE protocol. In addition to that, it improves scalability & significantly lowers the transaction cost. Further REVIVE can be applied to different payment networks, means REVIVE can be applied to the payment channels which can operate through a smart contract.

LQD token is an ERC-20 token and it is an integral part of Liquidity Network's off-chain ecosystem. The idea behind LQD token is to attract end users & merchants and enable an open market for payment processing within the network where they will compete against each other.

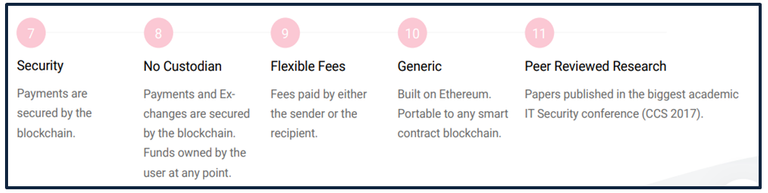

It must be noted that in order to avail a normal service within the network for personal purpose (for example sending a transaction to another user), there is no such requirement to buy LQD token. So for normal users, it is absolutely free. However, that also means that a user can freely do 10 transactions within 36 hrs. If the user intends to do more than 10 transactions within 36 hours, there is a requirement to purchase a service level agreement (SLA) of value 1 LQD. The SLA is purchased within an off-chain LQD transfer.

For commercial purposes & other high-end services, buying of LQD token is an essential requirement to gain access.

The LQD is mostly intended for value added services. The payment hub operators can offer various value added services to their clients such as SLA(Service Level Agreement), API services etc. Liquidity Network also subsidizes those payment hubs who offer free user to user off-chain payment processing for personal non-commercial use.

With the passage of time when the Liquidity Network will evolve & grow with more number of participants then the demand for LQD token will definitely rise. In order to incentivise auxillary services within the Liquidity Network, LQD token can be utilized in the best possible way.

Eoin runs a website and publishes blog on a regular basis on various airdrops. Every day his blog is updated with new & good airdrop offers and also publishes the detailed insight of the airdrop offers. Most of the airdrops he deals with are ERC-20 tokens. He also publishes his referral link & he personally offers additional ERC-20 tokens for those users/followers who register to those airdrop offers through his referral link. He generally offers 50% of what he gets from the respective airdrops to his followers & referrals. Eoin has a good number of followers and many users also join those airdrops by registering through his referral link.

He gets a lot of referral commission in the form of airdrops and as a commitment, he also distributes 50% of those to his followers and referrals. So it is almost a daily business for Eoin to send ERC-20 tokens to hundreds of his followers.

Eoin is looking for a solution where he can distribute those ERC-20 tokens to his followers and referrals without any transaction cost, without any custodian/escrow, with good scalability as he has to deal with 100s of followers & in a transparent, secure and hassle-free manner.

Explain how Liquidity Network can be an effective solution for Eoin in this use-case? Make a comparative chart of Liquidity Network with other existing solution.

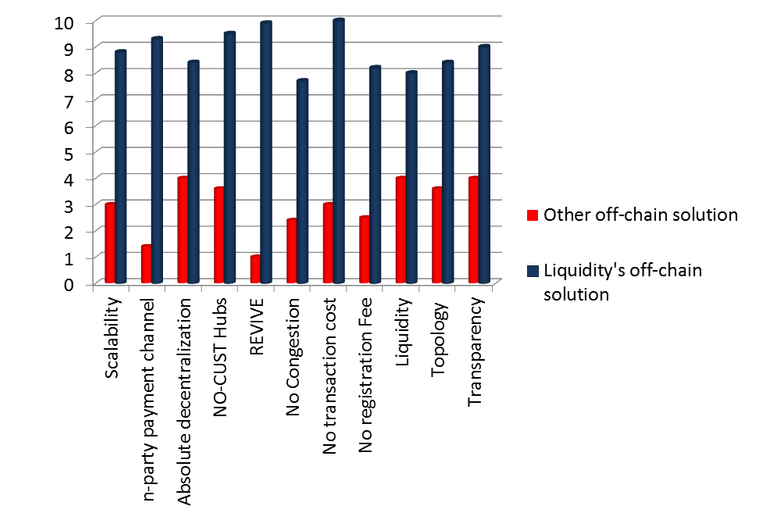

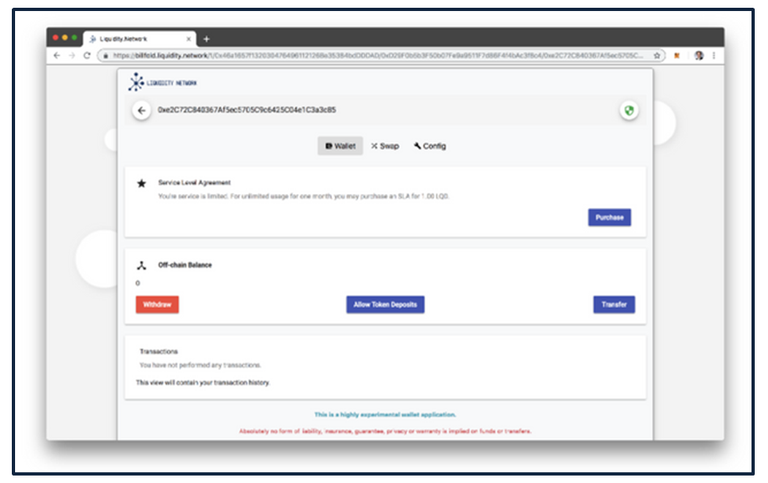

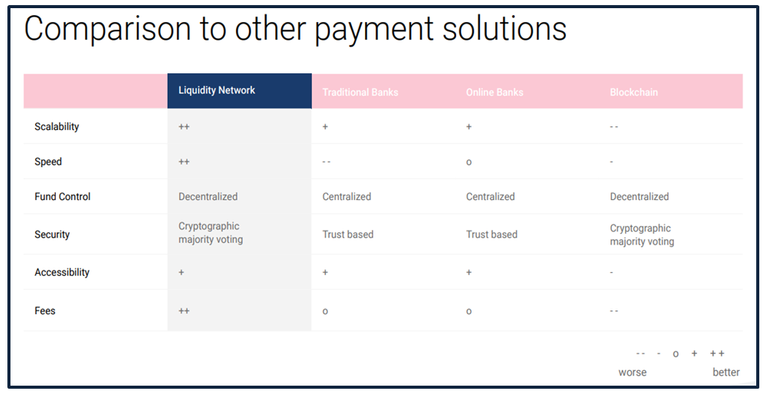

In this user case, Eoin is dealing with hundreds of his followers/referrals and lets us understand this use-case in regard to the requirement of Eoin:- (1) Eoin is to deal with hundreds of followers and distribute ERC-20 tokens to those followers and he wants the transfer with no transaction cost. Eoin is definitely not looking for the costly on-chain transaction as it will cost him a lot for this distribution of ERC-20 tokens. So off-chain solution is a viable option for Eoin in this use-case. With Liquidity Network's payment hub, it will not cost anything for Eoin to distribute his ERC-20 tokens to his follower/referrals. So he can simply register in the payment hub of Liquidity Network and also tell his follower/referral to register in the payment hub of Liquidity Network so that he can easily distribute those ERC-20 tokens at free of transaction cost to his follower/referrals. Interestingly the registration to Liquidity Network's payment hub is absolutely free of cost. So there will not be any issue for anyone to get registered in the payment hub of Liquidity Network. (2) Eoin does not want any custodian during the distribution of fund to his follower/referrals. Liquidity Network has an essential component called NO-CUST payment hub which is designed in such a way that it does not require custody of the fund during a transfer/distribution. In the entire process, the private key of the funds remains with the owner. So NO-CUST payment hub is definitely a solution for Eoin and here Eoin can experience the true spirit of decentralization. (3) Eoin will deal with hundreds of his follower/referrals when he will make the distribution of ERC-20 tokens. So it is apparent that Eoin needs better scalability so that the transfer can happen almost instantly. Liquidity Network leverages on the benefit of the centralized server when it comes to computation of transactions. So it offers very low latency, that means transfer will happen almost instantly. That is what Eoin needs in this use-case. (4) As Eoin deals with hundreds of follower/referrals, the solution should also support a number of users. Liquidity Network has n-party payment channel system. Any number of users can join a payment hub, that is why it is called n-party payment channel. So this n-party payment channel option of Liquidity Network is a viable option for this use-case. (5) Eoin also wants it to be transparent, secured and hassle-free. Liquidity network is completely transparent and can be audited by anybody. It is congestion free as it is an off-chain solution. Fund of the user is always secured through blockchain technology. So liquidity Network's off-chain solution matches the expectation of Eoin in this use-case. After the above analysis, Eoin gets convinced to use Liquidity Network's off-chain solution for the distribution of his ERC-20 token to his followers/referrals. Liquidity Network's off-chain solution is much better than the other existing off-chain solutions as it leverages on the benefits of both centralized services for computation & decentralized blockchain technology for security of the fund. The unique features are NO-CUST hubs & REVIVE protocol, that further improves the liquidity as well as scalability. The provision of n-party payment channels allows millions of users to connect to the payment hubs, which makes it different & unique as compared to other forms of off-chain solutions. The following chart depicts the brief comparison of Liquidity Network's off-chain solution & other existing off-chain solutions. The active team behind the Liquidity Network and by focusing on to mitigate the challenges of existing off-chain solutions by offering new solutions like NO-CUST hubs and REVIVE protocol, Liquidity Networks have really provided that platform where free, instant & secure off-chain transactions of crypto assets can be made possible without the involvement of a third party. The most important point to note about Liquidity is that it leverages on the advantages of both centralized services through which computation of a transaction is done & decentralized technology where the funds of a user are secured with blockchain technology at any point of time. The network is transparent too as it can be audited by anyone. Scalability is greatly improved and the transaction cost is free and the transaction happens instantly in off-chain. This model of Liquidity Network can break the barrier of entry to personal as well as commercial purposes and that can certainly improve the liquidity as more number of participants will make the ecosystem, even more, cost-effective. With the scalable off-chain solution and no to minimal transaction cost, mass adoption can become a reality. The team is also deeply focused on the project objective of Liquidity Network & updating the mile stones from time to time. The crypto segment can definitely evolve further with Liquidity Network.

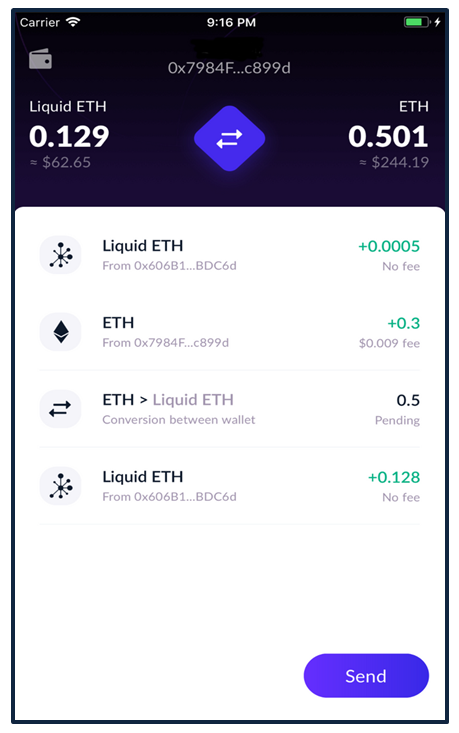

Liquidity Network's desktop & mobile applications

Hello, @crypto-wisdom!

Thank you for your contribution. This is a promising project, and you did an amazing job of promoting it with an extensive and well-illustrated blog post. Well done!

On the content side, you did a great job. The post is comprehensive and very informative, and the content is unique and editorial. Once again, I was amazed by the vast amounts of information included in your review, and I certainly enjoyed reading your work.

That said, the post did have issues of style and proofreading, but not to the level where it hurt the reading experience. Regardless, this is an amazing review, and I appreciate all the information you have provided us with.

I look forward to your next contribution.

Your contribution has been evaluated according to Utopian policies and guidelines, as well as a predefined set of questions pertaining to the category.

To view those questions and the relevant answers related to your post, click here.

Need help? Chat with us on Discord.

[utopian-moderator]

Thank you for your review, @lordneroo! Keep up the good work!

Hi @crypto-wisdom!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your post is eligible for our upvote, thanks to our collaboration with @utopian-io!

Feel free to join our @steem-ua Discord server

Hey, @crypto-wisdom!

Thanks for contributing on Utopian.

We’re already looking forward to your next contribution!

Get higher incentives and support Utopian.io!

Simply set @utopian.pay as a 5% (or higher) payout beneficiary on your contribution post (via SteemPlus or Steeditor).

Want to chat? Join us on Discord https://discord.gg/h52nFrV.

Vote for Utopian Witness!