How viable is it that petroleum, Venezuela's cryptomoney, can be used to alleviate the crisis in the country?

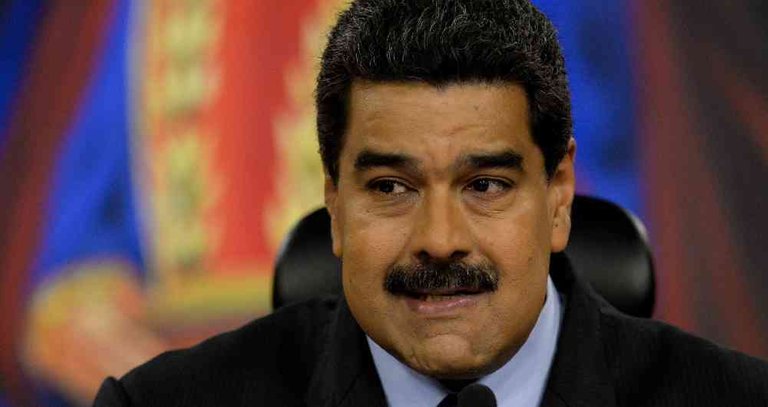

The cryptomoney issued in Venezuela is, according to the government of Nicolás Maduro, the first one launched by a state, although countries such as Estonia and Dubai have already stated that they also have similar plans.

In the midst of a severe economic crisis, President Nicolas Maduro's socialist government made a new and risky decision in the midst of a severe economic crisis, which officially began to function on Tuesday with the presale phase.

The government relies on it as a source of financing at a time when its revenues have fallen due to low production and falling oil prices, the country's main and almost sole source of foreign exchange inflows.

Added to this are the financial sanctions imposed by the United States that prevent it from issuing new debt or refinancing itself through the institutions of that country.

Supported by Venezuelan crude oil, petroleum represents a "change of era in the financial world,"according to Hugbel Roa, Minister of Science and Technology, said Tuesday.

Recommended: Venezuela announces "intention to buy" Petro for US$735 million amid skepticism

Although the analysis of its technical data still leaves many unknowns, these are 6 keys that serve to explain what is known at the moment about petroleum.

- Who can buy it, how much is it worth and how much can I change it for?

Anyone who wants it can from this Tuesday express their intention to buy petals. In this pre-sales phase the idea is to check the appetite of the market.

Venezuela's currency superintendent Carlos Vargas said last week that the government hopes to attract investors from Qatar, Turkey, as well as Middle Eastern countries, Europe and the United States in the presale of its digital currency.

Each petroleum has as its reference value the price of one barrel of oil, of which Venezuela is considered the country with the largest proven reserves in the world.

This does not mean that each petroleum is equivalent to one barrel, but that the value of the petroleum is linked to that of Venezuelan crude oil.

With this in mind it should now be around US$60, but the selling price of the petroleum will still depend on an agreement between pre-sale stakeholders and the government.

As announced, 100 million petros will be issued, so the total value of the issue is estimated at US$6 billion. According to the White Paper on the functioning of the currency, 38.4 million cryptoactives were sold this Tuesday.

You may be interested: Venezuelan immigrants looking for the Colombian dream?

This White Paper initially states that the supply is fixed, but it is also said that petroleum will be mined if users agree.

The document also indicates that when someone wants to change their petroleum, the price of the barrel will be paid but in bolivars, the Venezuelan national currency, very devalued by the hyperinflation that crosses the country.

The largest denomination banknote, the 100,000 bolivars, is barely less than US$0.50 in the parallel exchange market.

The changeover to Bolivars will take place on exchange platforms authorized by the government, of which few details are known at this time.

Its value will lie, above all, according to Laura Rojas, an expert in digital finance, in the promise that a market will be created in Venezuela and "can be used later to pay taxes and public services,"he tells BBC Mundo.

This, together with the government's promise that it will make an effort to promote its international use through, for example, the state-owned PDVSA, which will have to pay part of its transactions in petros.

- Is it really a cryptomoneda and how is it different from bitcoin, the most popular?

Yes, petroleum is one of the hundreds of cryptomonths that exist and of which bitcoin is the best known.

Read also: 600 Colombian companies sanctioned for irregularly hiring Venezuelans

The main difference with bitcoin lies in the fact that petroleum will be centralized by an intermediary, in this case the Venezuelan government, while bitcoin is completely decentralized. It belongs to no one, it is not regulated by governments, banks or investment funds.

Another difference is mining. Bitcoin can be generated by anyone with the right equipment. Petroleum, according to the White Paper, will depend on whether users agree to it because the initial supply is 100 million.

Petroleum is not the first digital currency issued by a centralized entity, such as a company.

"From this point onwards, we follow established and predetermined rules that make sure that neither the value nor the offer is managed in a discretionary way,"Rojas points out.

- What does the government want?

The Venezuelan government, with income problems, in the midst of a serious crisis and under pressure from the financial sanctions of the United States, launched the petroleum and promoted it as a solution to finance itself and solve the most difficult problems.