A good day to everyone reading this article.

The new big discussion around the Steem blockchain revolves around the "problem" of SBD not being valued close to US$ 1,00 as it was expected and projected on the white paper.

Before anything else, i would like to state that i am no an economist, but an civil engineer that work mostly with management, and economics is one of the topics that i really find fascinating, and can be very useful on our daily lives. Do you have doubts about that? Read the book Freakonomics, by Steven Levitt and Stephen Dubner. I promisse, you will be amazed with the power of a good economic theory and method.

But now, i want to show you two pictures:

They look pretty similar right? Now, try to guess to wich assets they are related to. I will talk more about the later.

The arguments and positions so far

From what i have read on this discussion, there is basically two positions between the witness:

- Let the SBD "printing" system work as intended, increasing the SBD supply on the market via the already implemented system, wich will drop the price on the long term

- Implement a new "feature" that would allow Steem be converted to SBD at a 1:1 rate (US$ 1,00 worth of STEEM converted to 1 SBD

A good outline of the new proposal being discussed was posted by @reggaemuffin on this post

A big part of the discussion between the users revolves around how would this implementation affect the market (if the price would drop), and the Steemit ecosystem (Authors, curators, investors, etc)

But lets take something of the way first:

It is not possible to create a "hard" peg on the SBD

A hard peg would mean that for every 1 SBD to exist, there would need to be a US$ 1,00 deposited somewhere. The closest thing we have to this on the cryptocurrency enviroment is the USDT, and big part of the commmunity thinks that this is not going to end well. And i agree with them.

The functions of the Steem coins

Based on the knowledge that i have acquired so far on the Steem blockchain (including what is written on the whitepaper), i see the 2 coins used on the Steem ecosystem to be destined to have two separate function:

STEEM

This is our "utility token". It does have a pre-defined function, that is to empower an account with SP. We can relate its function to a company share.

The more STEEM you have on your account, the bigger is the power you have to influence on the in what happens the "Steem blockchain company" (Not Steem Inc.) should go.

And, just as a company share, its price is related to how many money people are willing to put on the "Steem blockchain company", and how much return they will have with theeir invesment.

Big possible of returns, more money enter the system, and the price goes up.

While a stock market is limited in quantity, the company may always issue more shares on the market, or multiply the shares on the market (By stating that 1 share will become 2 shares. Now, instead of having 1 share that values US$ 10,00 each you will have 2 shares that is worth US$ 5,00 each)

SBD (Steem Backed Dollars)

Let's not mind about the fact that the name of the currency is misleading, since there is no actual dollars backing it.

The main objective of SBD is to act as a liquid currency, and to work as our fiat currency works.

The amount of SBD you have allows you to buy something. Today we can use it to buy STEEM or other cryptocurrencies, and the main idea behind it is that i may be used as an actualy mean of payment on the "real world".

But guess what? You can already use SBD as a functioning currency. You can pay for services and goods, be it a vote using a bot, or a service from another steem user. Did you knew that @steemfreelancers is one of the projects around Steemit that is trying to bring together people that offer goods and services evaluated by SBD?

But what about those graphs?

They look very similar right? And it is because they are both related to a currency pair.

This first graph is the price of the US Dollars vs Brazilian Rean (USD/BRL), and the second one is the SBD/USD pair.

And both are volatile. The diference is that in 30 days, while the SBD/USD pair had a price variation of 23,00%, the USD/BRL pair only changed 4,4%.

And that is because of the volume being traded and market captalization. The forces "fighting" over the USD/BRL price are way bigger than the ones driving SBD/USD prices.

SBD as a currency

So, as we can see, price volatility doesn't invalidate a coin as a currency, since every fiat currency pairs circulating on the world have some degree of volatility. But high volatility might be a problem, since it discourages the currency being spent.

My conclusion is that we should look at this problem not as how to peg SBD to USD but as how to reduce SBD volatility.

If we look at Steem blockchain as an independet economic system (kind of like an independent country) that have relations to other independent economic system (currency trades), this makes more sense than to have a currency that is equivalent to another.

Brazil currency case: how Brazilian Real became an stable currency

Before 1994, Brazil had some crazy currencies and stupidly high inflation rates, like 42,12% inflation in one month (january 1994). Even higher ones on the past. Crazy times.

On february of 1994, the government started the "Plano Real", as a series of measures to make the Brazilian currency a stable one. It were actions related to many of the economic gears, but for this article i want to point only one of them:

On the first days of the "Plano Real" the government controled the USD/BRL price

The day after the implementation of the conversion (2750,00 Cruzeiros Reais = 1,00 Real = 1 US Dollar) Here is a picture of USD/BRL price between 1995-2001. Notice what happened until 1999?

And here is the interesting part of this history: the Brazilian Central Bank dind't created a forced peg that kept 1 BRL = 1 USD. It only imposed a daily band (max/min) conversion rate that changed everyday based on the day before. This measure (along with others) made possible an inflation control, and allowed the economy to adjust itself to the new economic policy.

The true "peg" was related to the National Dollar Reserves (how much dollars the government had stored related to the Real), and high interest rates to make it attractive for international players to keep their dollars inside the country.

Here is a closer view of this movement:

then, in 1999 the plan changed, due to some international movements, and the Brazilian government removed the main mechanism (the daily band), and the price were free to float again.

And what happened right after that was a crazy prize movement, as seen above, but, on the long run, 9 years later, the Brazilian Real is a currecy that is mostly stable, and mostly affected by the buy and sell market. There is still some government actions to keep it stable, but all indirectly measures.

The case of the Argentine Peso: The forced USD peg

Now, lets take a look at this graph. The USD/ARS Price:

As you can see, between 1998-2001 the Argentine Peso were directly and forcedly pegged to the dollar. 1 ARS were always valued at 1 USD.

For sometime, this peg helped the Argentine economy, wich were as bad as Brazilian economy before 1994. But in 1999, a crisis related to agricultural commodities prices started, making the Argentine exports prices go way up (To the moon!), wich culminated on one of the biggest economic crisis of the country.

The Argentine government refused to pay its public debt, and that caused a massive movement of dollars offf the country, wich made impossible for the Argentine government to keep the peg. And Argentine economy just wen downhill after that.

There is a lot more factors in this crisis, but the dollar peg had a big influence in it.

BRL and ARS value comparison

Both currencies are devaluated when paired with the US Dollar, but here is its latest prices:

- USD/BRL: 3.1594

- USD/ARS: 19.580

But what this have to do with SBD? (My conclusion)

The idea of creating a direct conversion of STEEM to SBD might at first look interesting as a way to bring SBD value close to US$ 1,00 but it could work in a similiar way as the Argentinian Peso / Dollar peg. Not direct peg, but its a direct conversion that might have the same effects on the value. It might work at first, but the future economic consequences might be worst, even leading to an eternal devaluation of the SBD (less than US$ 1,00), even with the interest mechanism that exist to raise the SBD value when it is below US$ 1,00.

A direct market control (like the Brazilian Government did on the first phase of the Plano Real) is not doable, since as a descentralized economy, it is not possible to set limit prices on the exchanges.

The direct intervention (creating a conversion mechanism) won't be a good thing for the Steem economy in the long run, unless its removed on a determined point in the future, wich may also cause undesired consequences.

The only actual way i see to control the market price is the long run SBD print adjustment, and the other economic indicators that are already in place. It may take longer, but it is also healthier.

Besides that, Steem economy is the first one that uses inflationary coins (just like "real world" countries) that have a working economy, not only monetary exchanges.

And 2 years of lifetime is a really small one for an economic system.

So this is my conclusion: Don't implement the conversion. The long term economic implications will probably be worst than the short term objectives. Adjust the indicators and the economy will adjust in an organic way.

Please, if there is any economist ready this, let me know if i am missing something.

Can you read this post and tell me your opinion? https://steemit.com/steem/@buggedout/steem-dollar-will-fall-to-usd1-usd-here-s-why

That shows how SBD is currently in hyperinflation because of the high price. Would be interesting if that changes your opinion or enforces it even more :)

I won't speak for him, but this is exactly what I've been sharing with others already. It will go down by itself long run.

This is what has been supporting my view point of wait and see. The market clearly has not adjusted to this new state of printing.

The steem market cap supports this issuance too, so it's not a bad thing, it is working pretty much as intended.

I read it, and i think he make some wrong assumptions... Here is my comment there:

High SBD value is not a good thing, definetly, but i think forcing an extra increase of supply/demand on the system might do more damage on the long run.

No one converts anymore, but more is created. So no destruction, much creating implies price goes down. Not sure what you read...

Let me try to pinpoint what i understood from that post:

While somewhat true, we dont have a hyperinflation now, because the SBD is more valuable. The more SBD being printed os indeed devaluation its price, and that is working as intended.

When SBD price reach below 1 usd, less SBD is printed and the valuation mechanism kicks in (interest and burning SBD through conversion) wich takes a while, but Will Bring the price up again. And then the cicle restart.

Wich is exactly the opposite. I would only increase the price, since It would reduce the supply.

My other arguments:

The SBD price we have now is related to the increase of more people joining the platform, increasing demand on both STEEM and SBD. With the mechanism we have, the price will Go down, If we dont have an increase of more people joining steemit.

Implementing another mechanism to drive price down could work, but also could generate a sell so big, followed by a mass panic sell, that the SBD price could Go way below 1 usd, and i think i would take a lot more time to Go up again, since a lot of the demand would go to other places because of the price.

So refreshing. The vast majority of the crypto space can not separate monetary inflation from price inflation. They are not the same thing.

You have this back to front sorry mate. The proposition is to implement a new mechanism that allows STEEM to be converted to SBD at a rate of SBDUSD $1.00. The mechanism you are talking about has existed from the beginning, but is currently hidden from the Steemit UI.

Actually the majority of the crypto space doens't know anything about basic economics. They only go with the hype, and the promisse that they will buy lambos.

Cryptos is a damn interesting economy ecosystem, with lots of different models being applied, but most of the people don't want to know that. And that is where they loose, when "investing" in things that don't have fundaments that make it have a long term value increase (like SBD)

STEEM to SBD is the proposal of some witness (wich i think will probably have a catastrophic consequence), but @buggedout wrote about that the conversion SBD to STEEM should be avaiable now to avoid hyperinflation. At least that is what i understood.

(SBD to STEEM possibility is made avaiable as soon as SBD is below 1 USD, as a mean to burn SBD.

We came to the same conclusion but sounds like we were reading something different. I responded to your comment.

Agree.

Hi @dragosroua - can I add you to my list of pro-SBD/anti-intervention witnesses?

Thanks for sharing! A link to your post was included in the Steem.center wiki page Steem Dollar (SBD) : Links. Thanks and good luck again!

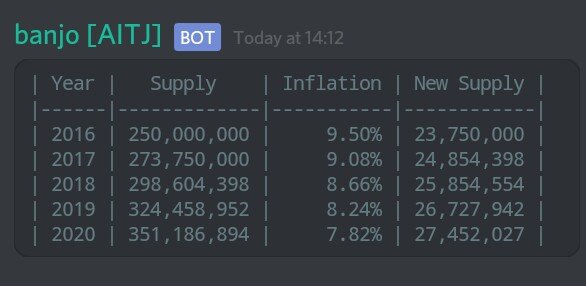

@phgnomo you nailed it. It's best for everyone to keep an fixed inflation level on sbd as on the first solution, I just wanted to see where are this metrics !

Is there a command to see sbd rate?

Also come to the our new @brazilians Discord group

Quick comment, will edit as I analyze the rest.

In fact it is backed by STEEM. Here's how: the reward pool is set and in terms of STEEM. However, for some of the amount it gets converted to SBD instead at price feed rates. When/if that ever gets redeemed back, it gives out STEEM at the price feed rates at redemption time. So it is a deferred STEEM issuance.

It is backed by a set amount of steem at market prices at payout time.

Makes Sense. Would be called Dollar Backed Steem If It were the opposite.

Maybe this is one of the things that create some confusion.

I'm not an economist either, but I don't think the reverse conversion as a way to do direct peg, because it is not. It uses market forces to balance... But I don't think we truly understand how it would play out if implemented.

Besides, even the SBD is not a traditional token in a sense that the one way conversion mechanism already is not something that other currencies do.(to my knowledge anyway). It really is more like a debt issuance that has comparisons to start up funding (which I don't know anything about and am just citing the white paper for)

It is not a direct peg, but It is a mechanism that Will increase the downward force.

If implemented, the downward pressure Will be a lot bigger than the upward, wich Will drive the price down at a fast rate.

What may happen then is that the upward mechanism below 1 dollar (interest and SBD destruction) might not have a fast effect, and we may end with a Very devaluated currency.

Hard to say, really. I do think that the peg will work because the incentives are there. It is much easier to support from below in any case.

It might cause instability in steem price though, which is what I'm concerned about.

As a follower of @followforupvotes this post has been randomly selected and upvoted! Enjoy your upvote and have a great day!

This is a very interesting point, I doubt anyone would go for it, but it makes a whole lot of sense. I wonder how you could reduce SBD volatility? A futures market?

Another very interesting analogy that I have been working from - thinking about it like this, an effort to lower SBD would be akin to an effort to lower GDP. It is self defeating at both the individual and aggregate level.

How to reduce volatility is something that i have no idea. Probably more Economy knowledge is needed to come up with a solution.

I am not really sure if the price of a currency is directly related to the GDP...

On the "real world" the increase of GDP is related to the increase of money being generated inside the economic system (production, exports, consumers)

The relation i see is that the inflation increase (in this case, SBD inflation), is that it stimulate people to use the SBD, and not to HODL. The problem here is the question of how is the value created (GDP increase) inside the ecosystem.

Atm, i only see a few things that create value (SBD being spent to generate more money):

The only way that i see to actually SBD gaining a true money value, and i consequence, increase Steemit GDP, is to push its use as a currency outside Steemit.

STEEM on the other hand is working fine, each of it corresponding to a "share" of the ecosystem, and working as an investment. I just don't have a final conclusion if it should also be created Indefinetly.

Another model would be at some point in the future (maybe when inflation rate reach the minimum established on the code), no more STEEM were created, only SBD. That way we would definetly have a economic model with an "investment" asset and a "cash" asset.

Damn... its so fun think about all the repercussions that cryptos and blockchains are creating at this moment...

You got a 9.57% upvote from @mercurybot courtesy of @phgnomo!

Great insights. Another real world comparison could be the CUC (Cuban Convertible Peso) :-) But I think the SBD dare to be a stable cryptocurrency after the success of BitUSD and BitShares, created by the same inventor of Steem blockchain. Thanks and good luck again!