[XBT] [BRR] [BTC futures] [XBT binary options] [SouthKorea] [#ICOban]

The U.S. Commodity Futures Trading Commission just agreed to bitcoin futures. CFE will launch their bitcoin future XBT on December 10, 2017. CME announced their rollout for December 18, 2017. Cantor Exchange is already in the gam(bl)e with bitcoin binary options/swaps.

It makes security engineers talk like monetary scientists

The subject of cryptocurrencies is not just security engineering but more likely monetary theory. A secure payment gateway is, in fact, a desirable technology. But the real advantage of the blockchain is the distributed ledger. Today’s real challenge is to prevent central entities from bypassing and intervention. Bitcoin and many other token systems are meant to be organized as nonprofit corporations. The community requests and changes the source code in a way that follows democratic participation. Everyone who commits to the protocols and algorithm will be part of a consensus. As cryptographic tokens cannot just be interpreted as money or currency, it first needs to be described and regulated by governmental institutions so that every entity and corporation can apply the same rules. It is not wise to ban such technology because as it operates globally. The emerging industry will just move to another blockchain-friendly economic zone. The lack of blockchain industries in Europe is basically caused by too much financial regulation.

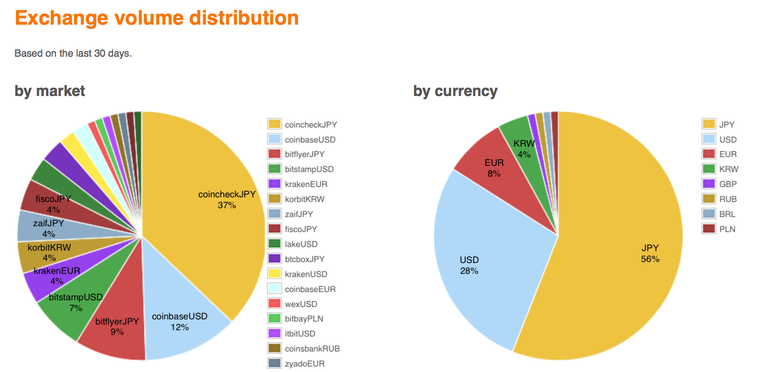

The largest bitcoin exchange platforms of 2017 are Coinbase (US), Bitfinex(US), Bitpay(US) and bitFlyer(Japan/US). The biggest EUR/BTC volume is traded through Coinbase(US), Kraken(US) and bitstamp(LU/SI).

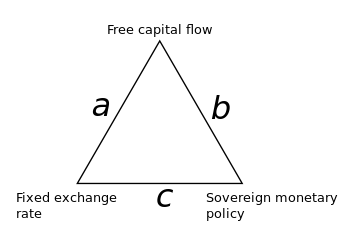

The impossible trinity

Not every government will agree to certain blockchain related investments and services. South Korea already banned bitcoin futures and ICOs. It appears that South Korea's financial regulator is leading in issuing the statements for Asian markets as China followed with their #ICOBan soon. Especially in countries where we can sight a strong sovereign monetary policy and a free capital flow, there is a high chance of inflation. After the Asian financial crisis (1997) financial regulators begun to build large foreign currency reserves. Therefore a lot of Asian countries are about to boycott cryptocurrencies as it causes a lack of power on hedging Asian currencies.

Sources:

https://bitcoincharts.com/charts/volumepie/

https://data.bitcoinity.org/markets/volume/30d/EUR?c=e&t=b

https://www.cryptocoinsnews.com/breaking-south-korea-preissues-ban-bitcoin-futures-trading/

http://www.cftc.gov/PressRoom/PressReleases/pr7654-17#PrRoWMBL