This guide will cover how to Stake your TUSC on the BitShares DEX.

Before you begin you should have completed the following:

- Have a BitShares account and wallet | Check out: BTWTY Wallet Set-up Guide

- Deposited BTWTY.TUSC into BitShares | See: How to Deposit and Withdraw your TUSC from the BitShares DEX

- Deposited XBTSX.TUSC into BitShares | Visit: XBTS FAQ

Note: You will use the same BTWTY BitShares wallet for both steps 2-3.

After you're done, you should now have a sense of using BitShares Gateways for TUSC.

You will need both BTWTY.TUSC and XBTSX.TUSC to stake in this particular Liquidity Pool (LP) we are demonstrating (BTWTY.TUSCLP).

That's because pools operate with a 50/50 ratio of an A and B asset so, you will always need both A and B assets of a given pool staged prior to staking.

How to Stake your TUSC

- Open your btwty Wallet

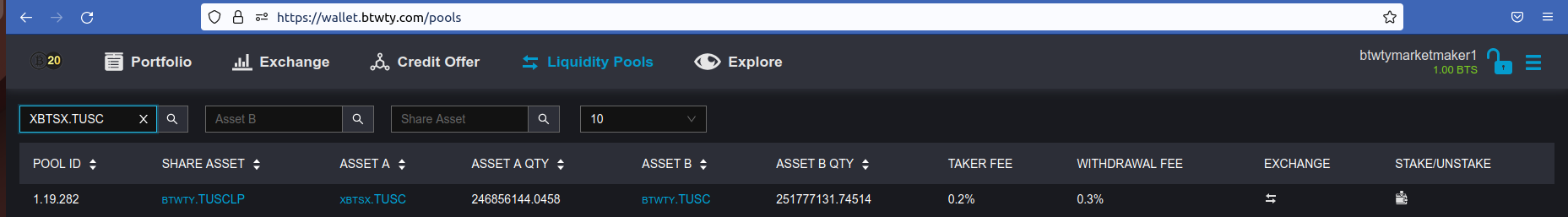

- Click on “Liquidity Pools”

- Type BTWTY.TUSCLP into Shared Asset (3rd box from the left)

- Click the box icon under “Stake/Unstake” on the far right (10th column)

- Under "Stake" click Blue numbers after “Available:” Select the amount of tokens you want to Stake in a Liquidity Pool (The UI with automatically balance your B asset to equal a 50-50 ratio with Asset A)

- Click "Submit" to send your staking contract to the Blockchain

You will receive newly minted BTWTY.TUSCLP tokens which represent a claim to both XBTSX.TUSC and BTWTY.TUSC. (Hence, the 50-50 ratio mentioned earlier.)

Congratulations you are now a pool liquidity provider and partial holder of its shares!

What happens after you Stake?

Depositing TUSC tokens increases the overall market’s liquidity, integrity and strength through deeper volume from staked tokens in the pool.

The pools operate autonomously and are open to facilitate swaps 24/7/365. Users include, bots, BitShares retail traders and the pools themselves.

How do Liquidity Pools and Token holders make money?

Pools make money the same way brokers do, by receiving a pre-programmed, built-in fee for processing the exchange (i.e. a royalty or commission). The Pool also charges a withdrawal fee to redeem your Liquidity Pool (LP) tokens.

This exchange revenue and withdrawal fees dictate the "yield" earned proportionally by Liquidity Pool (LP) holders and is typically shown as an Annual Percentage Yield (APY).

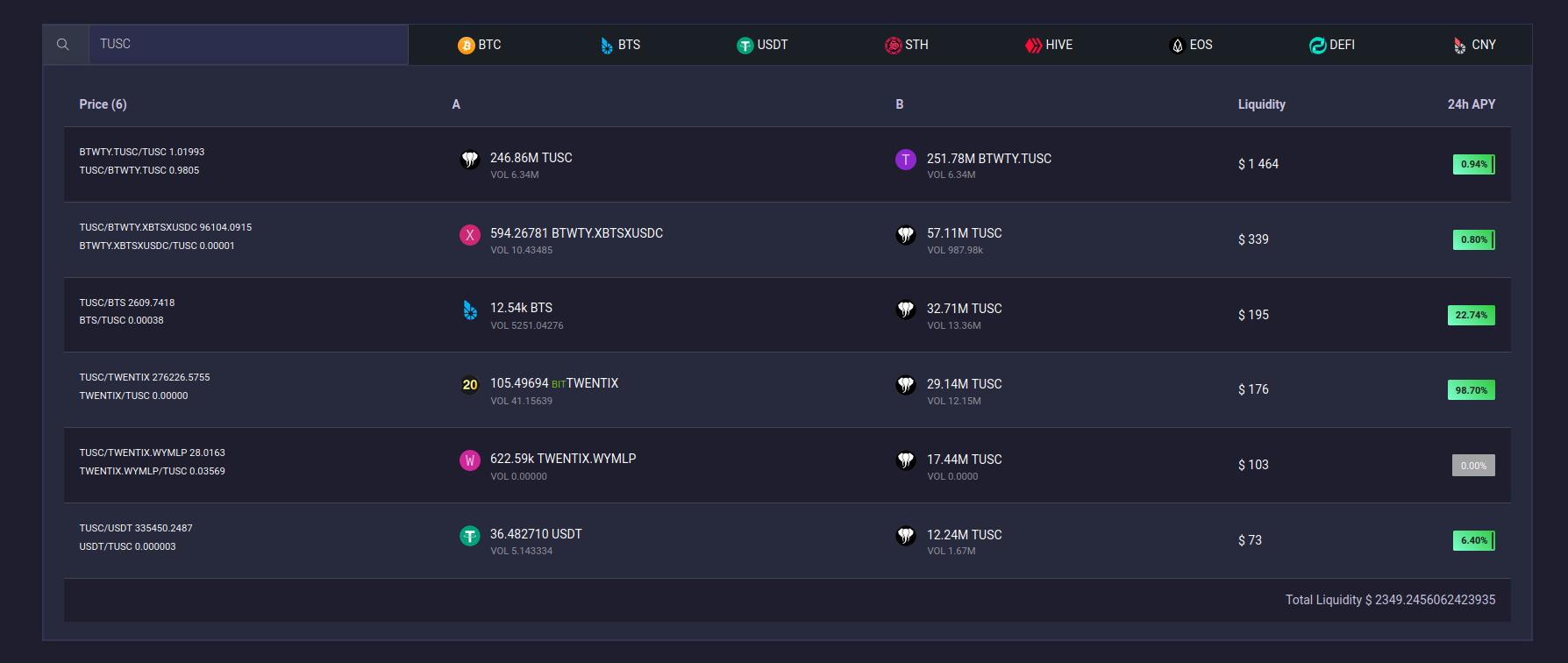

See TUSC pools here: https://app.xbts.io/#/pools?a=TUSC

The APY right hand side is calculated in real-time by XBTS, another TUSC gateway service.

The longer you hold the more opportunity there is to earn yield on your holdings.

Happy TUSC Pool Adventures!