In this video I go over an introduction to mortgages and the concept of amortization as well discuss a bit about our new online Mortgage Calculator where you can view at http://mc.mes.fm.

A mortgage is simply a loan given where the house or property is used as collateral which simply mean that you lose your house if you can’t pay the lender back. The concept of amortization is a method of paying back the loan gradually while compounding interest. This concept benefits both the lender and the homeowner since the lender will receive interest payments and the homeowner can pay a bit of the loan back at a time.

I also go over the proof of the formula for a basic amortization method where the interest rate is fixed and the monthly payments are constant. I further extend the proof to include a final balloon payment which is a way to save on interest by paying a big chunk of the mortgage at the end.

If you are looking to buy or sell your home it is very important to have a good understanding of mortgages and thus this is a very important video to watch!

Watch Video On:

- DTube: https://d.tube/#!/v/mes/hk4o4vuufv4

- BitChute: https://www.bitchute.com/video/xuJM3z7U4aYL/

- YouTube: http://youtu.be/jM-0NyIbPt4

Download Video Notes: http://1drv.ms/1e3rEXK

View Video Notes Below!

Download These Notes: Link is in Video Description.

View These Notes as an Article: https://steemit.com/@mes

Subscribe via Email: http://mes.fm/subscribe

Donate! :) https://mes.fm/donateReuse of My Videos:

- Feel free to make use of / re-upload / monetize my videos as long as you provide a link to the original video.

Fight Back Against Censorship:

- Bookmark sites/channels/accounts and check periodically

- Remember to always archive website pages in case they get deleted/changed.

Join my private Discord Chat Room: https://mes.fm/chatroom

Check out my Reddit and Voat Math Forums:

Buy "Where Did The Towers Go?" by Dr. Judy Wood: https://mes.fm/judywoodbook

Follow My #FreeEnergy Video Series: https://mes.fm/freeenergy-playlist

Watch my #AntiGravity Video Series: https://steemit.com/antigravity/@mes/series

- See Part 6 for my Self Appointed PhD and #MESDuality Breakthrough Concept!

Follow My #MESExperiments Video Series: https://steemit.com/mesexperiments/@mes/list

NOTE #1: If you don't have time to watch this whole video:

- Skip to the end for Summary and Conclusions (If Available)

- Play this video at a faster speed.

-- TOP SECRET LIFE HACK: Your brain gets used to faster speed. (#Try2xSpeed)

-- Try 4X+ Speed by Browser Extensions or Modifying Source Code.

-- Browser Extension Recommendation: https://mes.fm/videospeed-extension

-- See my tutorial to learn more: https://steemit.com/video/@mes/play-videos-at-faster-or-slower-speeds-on-any-website- Download and Read Notes.

- Read notes on Steemit #GetOnSteem

- Watch the video in parts.

NOTE #2: If video volume is too low at any part of the video:

- Download this Browser Extension Recommendation: https://mes.fm/volume-extension

Mortgage Amortization Formula: Proof + Mortgage Calculator

We just created our newest online calculator:

Mortgage Calculator

- mortgagecalculator.mes.fm

- Short URL: mc.mes.fm

Mortgage

- It is a loan given where the house or property is used as collateral incase the borrower can't pay off the mortgage loan

- Payments are determined based on an agreed upon fixed or variable interest rates (and property taxes, insurance fees, etc.)

- Payments are usually determined such that they are constant and thus simplifies the finances of the borrower

Amortization

- This the process of decreasing or paying off an amount or loan over a period of time

- Comes from Middle English "amortisen" meaning "to kill"

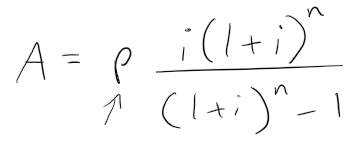

Mortgage Amortization Formula (Basic):

where:

- A = periodic payment amount

- P = Amount of principle or loan owing (subtracting any down-payments)

- i = period interest rate

- NOTE: if installments are monthly and interest rate is annual, need to divide by 12

- n = total number of payments

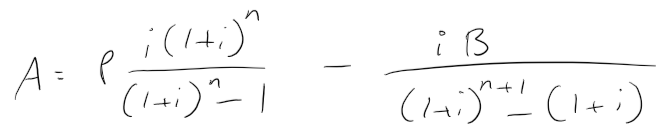

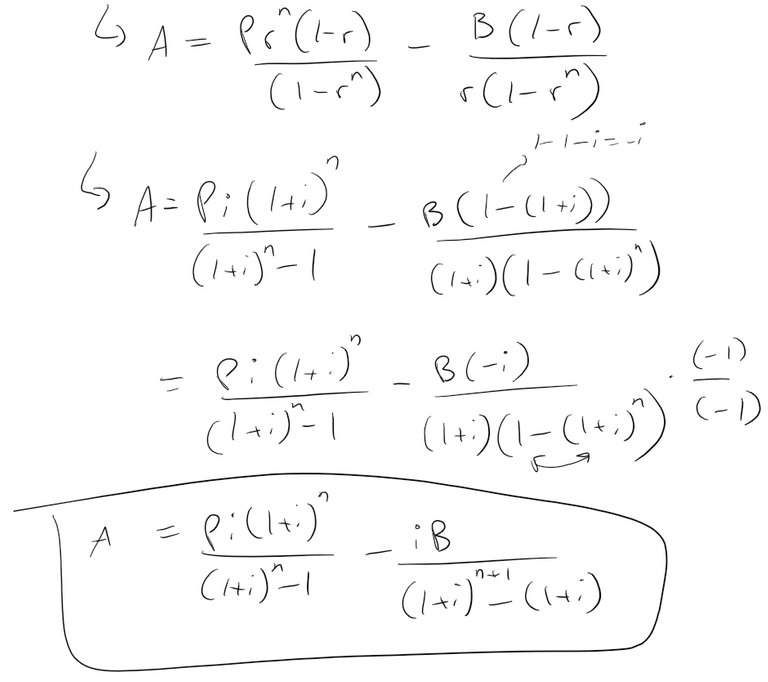

Mortgage Amortization Formula (with final balloon payment):

where:

- B = Final Balloon Payment

- If the borrower wants to only amortize part of the loan or mortgage, they can decide to make constant payments, A, until a specific time and then payoff the remaining loan with one large payment, B.

- If B = 0, then the amortization formula is the same as the basic one.

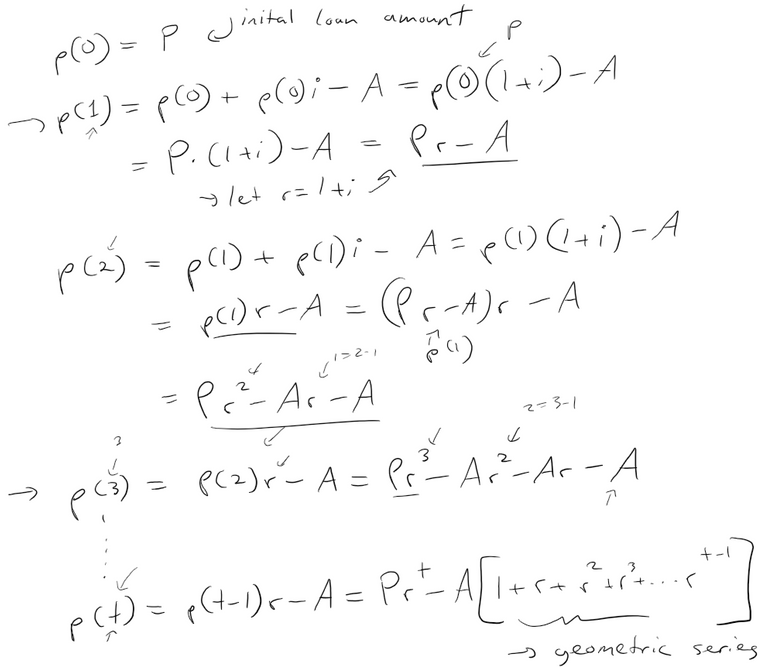

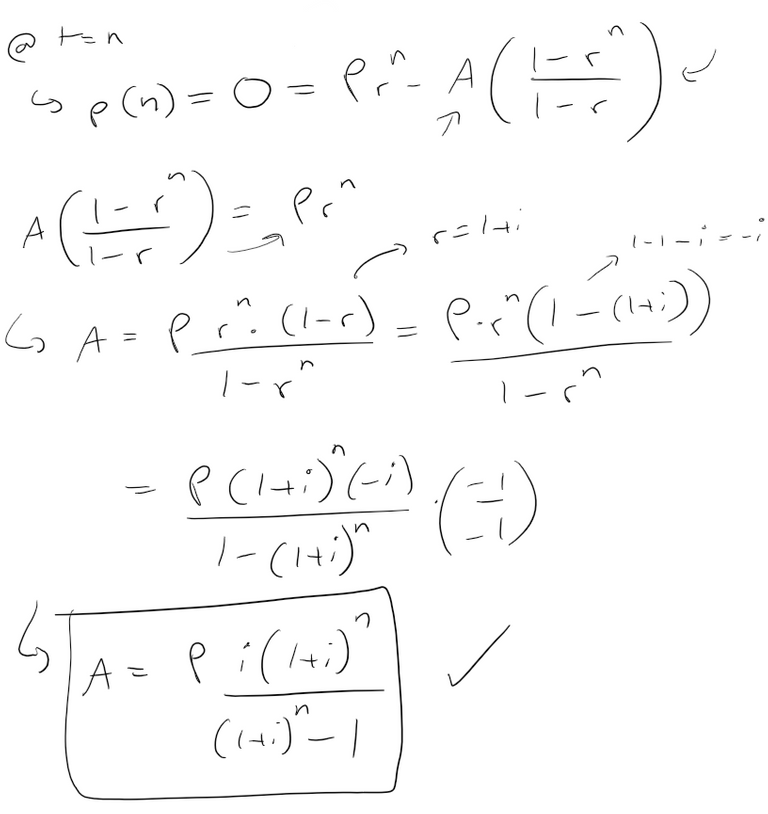

Derivation of the Basic Formula:

The derivation is based on the following requirements:

- Payments are constant (i.e. always the same)

- Interest rate is constant

- The interest is compounded during the installment

- This is basically adding interest to each installment based on the amount owing at that installment period.

- The interest is compounded during the installment

Let p(t) represent the principle amount owing at time t:

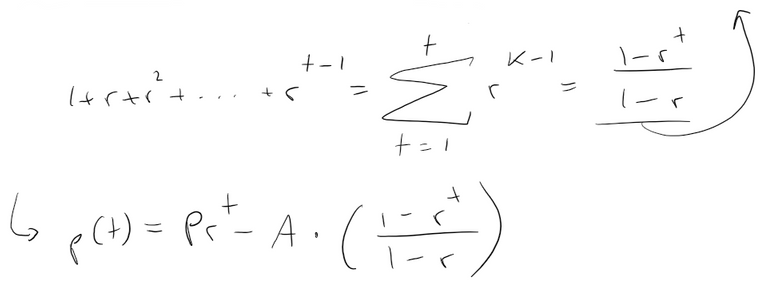

Recall the geometric series (I will proof this in a later video!):

At t = n, we expect the principle to be fully paid off:

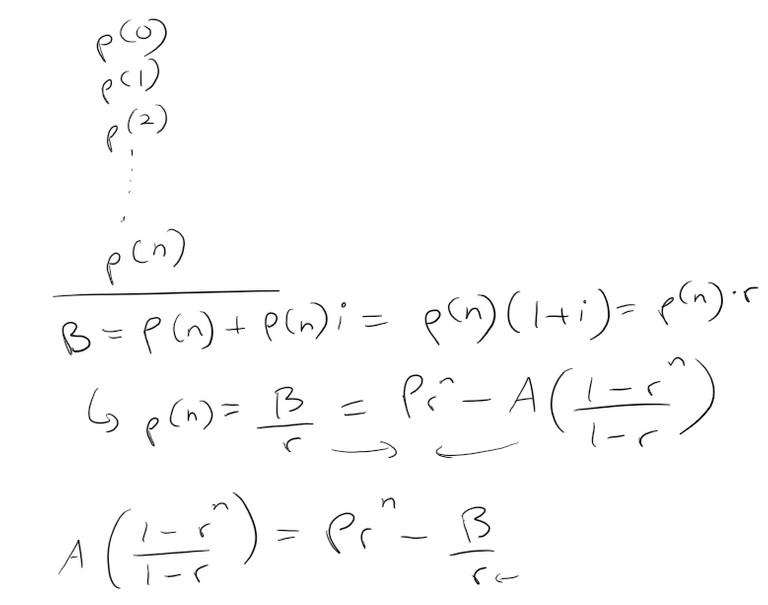

If we include the balloon payment then the final balloon payment will equate to the final remaining balance plus interest:

Notes:

- If B = 0, then we are left with the basic formula

- While often used for mortgage related purposes, this same formula can be used for other debt such as short term loans, student loans and credit cards since they all follow the same concept of compounded interest.

- It is possible to re-arrange the formula to solve for B, P, and n but solving for i are done through numerical methods and are not as straight forward.