Bitcoin was developed with the intention of providing an alternative to the banking industry. Many, today, question whether Bitcoin will replace the US Dollar. This was not the original intention. Bitcoin served as an option to keeping one's money within the banking system.

Essentially, a digital wallet serves the majority of use cases for most people. A bank serves as a place to store, send and receive money. Over the last couple decades, the services most banks provided to individuals has dwindled. This was reflected in the state of the industry.

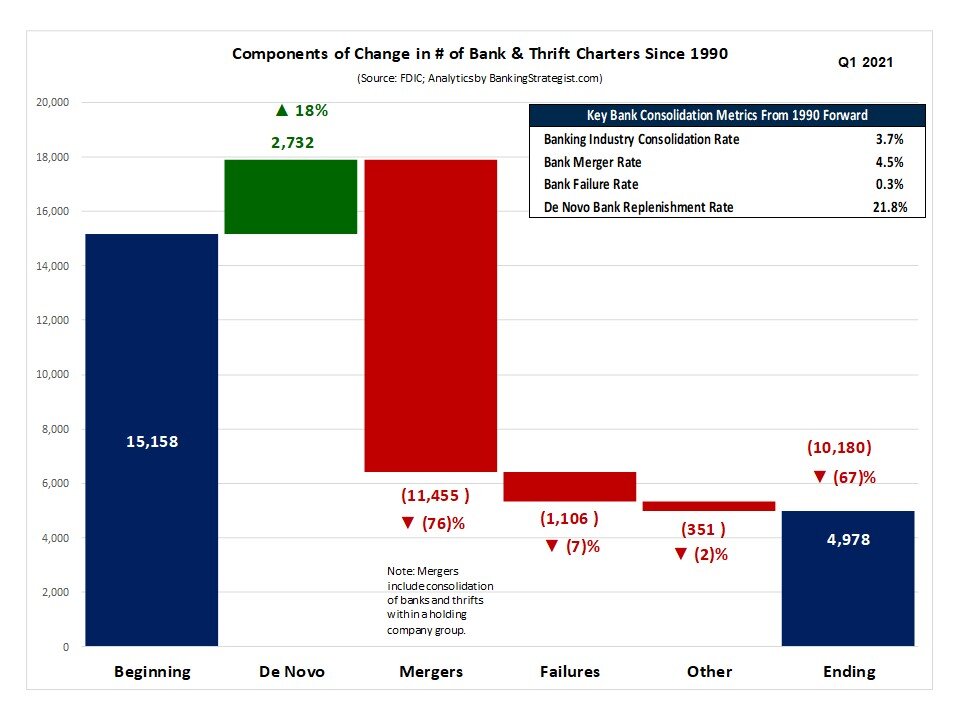

Since 1990, bank charters in the United States consolidated at a rate of over 3% annually. This means that, over 30 years, the impact is great.

Source

As we can see, the number of charters went from over 15,000 to just under 5,000. Thus, we saw a net loss of more than 10,000 bank charters over 30 years. There were some new ones created, naturally, but this was more than offset by mergers and failures. Who can forget 2009 when a couple banks were closed every week?

This is not a sign of an expansive industry. Consolidation to this degree usually is a sign of maturity, meaning it is either primed for disruption or it is already taking place.

FinTech

About 20 years ago, the banking industry started to get hit by Financial Technology (FinTech). Here is where starts up began to penetrate some of the traditional banking sectors. This caused competition from newer sources, a state that the banks were ill-prepared to handle.

One of the best examples of how this played out is in the mortgage industry. Most today are familiar with the names Quicken Loans™ and Rocket Mortgage™. These are leading mortgage originators that operate without branches. Unlike the banking system, they are completely Internet based. Their entire platform runs on an application.

Hence, people can try to get loans simply by downloading an app on their phone. This allows them to get an answer at any hour of the day as well as it being instant. This is something the banks were not offering.

It should come as no surprise that Quicken Loans™ is the largest loan originator in the country. The shift progressed to the point where more mortgages are originated outside the banking system as compared to inside. This is a radical change from a few decades before when banks had a near monopoly on this sector.

We saw the same thing happen with car loans. There was a time, before going car shopping, one went to his or her local bank and got a letter of approval. This was then taken to the car dealership when looking at cars.

Today, we know most dealers have arrangements for financing. This, too, ate into the bank's business.

Adding all this together, it is no secret as to why the banking system experienced the decline in charters that it did.

Cryptocurrency

The next wave of competition appears to be cryptocurrency. This is a major problem for the banking industry since the industry is evolving at such a rapid pace.

As stated, in its simplest form, a digital wallet can operate like a bank. People can send, receive, and store money. This poses a major problem for the banks who, in the US, depend upon fractional reserve lending. The challenge is that if deposits decrease by a significant amount, the bank has to raise more capital to remain in compliance.

Cryptocurrency is a major threat if trillions of dollars in bank deposits start exiting. As more money is contained in the crypto industry, it is not in the traditional banking system. For anyone who understands how depositor banks operate, this is a shot to a major artery.

If this is not bad enough, we then see the development of Decentralized Finance (DeFi). Here is where the shift away from traditional banking could be aided.

The present financial system is mired in a low interest rate environment. This is awful for those who are saving. DeFi entered the scene offering much better interest rates, even on stablecoins. Basically, people are starting to realize they have a much better option.

It will not be surprising to witness the evolution of other lending services. Presently, one is not getting a mortgage or car loan via DeFi. That could be possible in the future. The idea of pools of lenders is one that is going to generate great experimentation. We truly could see some revolutionary ideas emerging from this space.

Of course, all of this eats a bit more into what is left in the banks realm.

Central Bank Digital Currencies (CBDCs)

This will be the death blow to banking as we know it. If CBDCs are implemented, we will see the number of bank charters drop like a rock. The entire industry will mirror the newspaper, where only a few are still left standing.

CBDCs will force a lot of money out of the banking system simply because it is a digital wallet. Hence, like was mentioned above, we see the same result. Deposits will not be held in the bank but, rather, in people's digital wallets. This really creates an issue for the fractional reserve lending.

The other issue is that the government can force people to adopt this. Whereas cryptocurrency is voluntary, a CBDC will change the currency of a nation. Thus, through the use of law, banks will be obliterated. The population simply will be commanded to use the new currency. While it might start of slowly, over time, more will convert to it.

This is fatal to the banking system. Without the deposits, much of the industry is insolvent. There is little that they can do other than to close up shop. Sure, some of the institutional banks will carry on since they are involved in so many other things. The likes of Goldman Sachs could get stronger as they eat into the market share as others get less powerful.

Nevertheless, the overall industry is likely to take another hit. This is almost guaranteed as technology advances. The Internet came to money and this creates an entirely new paradigm. We saw it in many other industries and what happened.

For now, we can sit back and watch it play out in the banking industry.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

A decade from now we will should be seeing a complete difference impact on banks, I actually doubt if most banks we know today will still exist as a lot can happen in a decade considering the rate of development.

DeFi is still at it's infancy, a revolutionary way of savings account that pays more interest than legacy system, DeFi could be more disruptive than Bitcoin.

Time will tell how it all pans out.

Posted Using LeoFinance Beta

Some banks will be around but many will alter what they do. They already have evolved to a degree.

The sign will be where thing move in the next 12-18 months. If there is a massive explosion in DeFi services, put a timer on the demise of most of the banks.

Posted Using LeoFinance Beta

Crypto could could work, co-exist with the banking system if the banks starts of course doing better than it is currently doing, in Nigerian banks for example, you're not even given a reason to save unless you're a multibillionare with a lot of money to save, its why people are seeking other options in this side.

Posted Using LeoFinance Beta

Banks ultimately might only be front ends for what is taking place. They will provide customer service and leverage their names.

It is like with mortgages, they dont hold them. Banks only service the loans for a fee.

We will likely see more of this.

Posted Using LeoFinance Beta

I guess you're right, we will likely see more of this.

Posted Using LeoFinance Beta

Well the problem is that the banks don't really want people's deposits into their saving accounts. Otherwise the interest rates wouldn't be crap. From their stand point, I think they prefer the fees they get from managing money and I feel like storing people's money has gone to the wayside.

Posted Using LeoFinance Beta

Agreed. They'd have us paying them to for the privilege of letting them lend our money for their profit if they had their way.

I've seen the term negative interest rate come up on and off over the years and it wasn't a threat while everyone could just refuse to deposit cash, but now that almost everyone gets paid via electronic transfer it seems to be coming up more often.

Simply put, most of the institutions humanity built to make civilization possible have turned on us and are dedicated to our enslavement in one way or another.

Blockchain tech is the answer to this, but it, too, is neutral and can be turned against us. I feel like it's imperative we have a foundation of liberty baked into everything we use it for and Cubdefi is a great example of how to do it. It's only financial now, but someday soon we'll use smart contracts and DAOs for things like loans and insurance and who even knows what else. Whatever the use case, the ability to engage or pass is crucial.

CBDCs will make it possible for negative interest rated to be used in places where they currently don't exist. As @taskmaster4450 said, the switch to CBDC will not be voluntary as it will beimposed on us by our governments.

Posted Using LeoFinance Beta

Yes it will be imposed on us if we still need the government but I’m hoping to be independent of that financial system by then. 🤞

Wait until you get CBDCs. That will put the control of interest rates effectively in the hands of politicians. At that point, they will go negative almost immediately. If they can put money into your digital wallet, they can take it out (or make it evaporate).

Posted Using LeoFinance Beta

Exactly! In fact, I wouldn't be surprised if the tax to incorporate negative interest rates is built into the initial roll out. Not long ago you discussed the likelihood that CBDCs will be used to roll out a Universal Basic Income. The law put into place to kick that off will undoubtedly include language that is just ambiguous enough to allude to the possibility of a processing fee, or something of the like, that will be glossed over in the beginning but gradually move forward until simply checking your balance drops a few dollars into government coffers.

They need a certain amount of deposits to meet their reserve requirements. After that, they end up either loaning or buying securities with the excess. So the banks do not mind a lot of deposits except when Treasury securities are scarce which is the case right now with the Fed easing.

Posted Using LeoFinance Beta

Yea but securities are scarce and the deposits right now are essentially liabilities since people can pull out money at any point in time.

Posted Using LeoFinance Beta

I doubt many will cry over banking industry collapse. We already see cryptos eating banks lunch like in El Salvador for example and it's just getting started. Hence the continous defensive attitude of the banks. CBDCs are a whole different breed, one that I'm not excited about, nonetheless disruptive for banks. Although the decoupling of financial services and money implicitly is not entirely unfolding in a decentralized manner it takes away a lot of centralization power from the banks. Somehow, individuals and they're wallets become the banks.

Posted Using LeoFinance Beta

There probably will be a few left standing!

It's terrifying to think what Financial Corporations larger governments are going to team up with to implement digital currrencies.

It's a dystopia just waiting to happen!

Posted Using LeoFinance Beta

Only if people buy into them. If people opt not to use them, then the power is diminished.

One thing working in crypto's favor is the USD will be hard to convert to a CBDC. More than half the physical dollars are outside the United States with a few other countries using it as their currency.

This could slow the entire process down.

Posted Using LeoFinance Beta

Ah yes, the international factor is an interesting point!

The truth is no one can really control economies, especially not now!

Posted Using LeoFinance Beta

It's true, and yet that never occurred to me. The longer these CBDCs take to go online the better. Let's see what crypto does in the meantime.

Posted Using LeoFinance Beta

This is why I think Nigeria will not move forward with the CBDC plan and if they do, chances are that they didn’t factor the possibility of this happening. So they will most likely revert it again lol....but sadly at that point a larger portion of the population will have become crypto aware

It will be interesting to see who does and who does not. The US is still standoffish about it. It looks like Europe might jump in after the Chinese.

Posted Using LeoFinance Beta

Europe-- most especially the EU-- went into negative interest rates big-time, so it's no surpise that Europe would go into CBDCs sooner than the US.

However, I'm still surprised that Switzerland went negative. Given their sound money tradition and steadfastness in maintaining banking privacy, I thought the Swiss knew better. It looks as if Switzerland is now just another country as far as banking is concerned.

Posted Using LeoFinance Beta

Still curious to see if there's going to be a bail in when it all comes crashing down.

Posted Using LeoFinance Beta

Worst case for conventional bank, they would still exist for sometimes for offchain usages. Unless all people including elite ditch their nation currency and use crypto.. But that would be creating a rogue nation.

Good content .

Interesting. I've known the banks were at their death knell right now but I didn't know it was this bad. Also, even more interestingly is how generally unprepared the unsuspecting public will be when this takes place, regardless of how long I've been telling them to switch.

Posted Using LeoFinance Beta

It is pretty difficult to say that the Banking system will collapse entirely. The reason for this is banks are pretty active when it comes to money. Right now, They are watching the outflow from the banks which is not being returned to the banks. In the previous days when people used to invest in stocks and forex, it used to come back but now the thing has changed because of the crypto.

And those banks that have realized this have already started to give the custodial services and may adopt the Blockchain sooner. So, They will go with the trend and may remain in side with the all Blockchain based Financial Products.

Posted Using LeoFinance Beta

I have a feeling that if there appears to be a risk of a bank run in the form of crypto deposits, the US government at least, will put a quick stop to it and slap a ton of regs on electronic banking transactions. The problem will then become how to get your fiat into crypto form since the federal reserve system controls all electronic banking transactions. Seems a horrible scenario and would destroy confidence in the banking system. You're exactly right that the only path forward for central banks seems to be government-backed cryptocurrencies.

Great post. !PIZZA

@taskmaster4450! I sent you a slice of $PIZZA on behalf of @shauner.

Learn more about $PIZZA Token at hive.pizza (2/20)

I have been underweight banking sector for years now and even if it bounces back from time to time, this is the best decision I took (as well as being underweight oil and gas).

Technology is literally killing the banks monopoly on money 💰. Also these dinosaurs are not able to adapt compared to new tech and light competitors (online bank…) as they have a heavy structure with millions of physical branches with never ending back offices and so on.

Their size is now a competitive disadvantage and a lot of people will continue to get fire from this industry.

Finally, where does the profit comes from in a bank?

Mostly from fees and credit loans.

Fees are getting eaten up by the Revolut of this world.

Credit loans are very competitive and I did mine entirely online.

If you work in a bank… start looking for a plan B

Posted Using LeoFinance Beta

In Venezuela we see that, banking institutions closed because now everything is solved digitally, even a claim is handled by a bot and solved.

In my city 5 banks closed, the biggest and most important ones are still open, but the emas closed due to lack of use, and as more financial apps come out, the more banks are reduced, we will reach a point where banks will be to store things like metals or will be buyers of real estate and sellers.

Posted Using LeoFinance Beta

What's up with all these downvotes? Seems like solid research and a pertinent topic in my opinion. I've written about CBDC's in the past as well, I think it is almost inevitable as banks and governments seek to keep up with the new wave of self banking and financial freedom.

Posted Using LeoFinance Beta

Oh yes, we can definitely sit back and watch the party !popcorn I wonder whether there already is (or was) a CBDC, because if, how could it be custodial? I can not see how it not fail, but I probably just don't know what's it about. !invest_vote !ENGAGE 15