This is an article attempting to explain the tulip market, it's meteoric rise and crash, and what it could mean for cryptocurrency and current financial markets.

A special article to celebrate my first 100 followers! To everyone helping me contribute to this wonderful community: Thank you!

A short history lesson

In the Dutch Golden era, Tulips first got introduced to the market. The Tulips, like the economic model Bitcoin pioneered, was so novel that the market swiftly reached the peak of popularity. There was a state of frenzy and people were eager to buy the tulips at any cost they could maximally provide. This is an interesting topic of debate among economists as to whether to categorize this historical event as ‘bursting of an economic bubble’ or not.

The Introduction of Tulips in Europe

The tulips were first introduced in the Europe by Ogier de Busbecq, who was the ambassador of Roman Emperor to the Sultanate of Turkey. He sent some tulip flowers and seeds to Vienna. Tulips then started earning popularity throughout many regions like Antwerp, Augsburg and in the United Province. A botanist grew tulips in his garden and came to the conclusion that the plant can survive the harsher climatic conditions. In Europe, it was a new species of flower; people were seeing the vibrant colors of Tulips for the first time. The petals were so densely loaded with beautiful colors that the Europeans just couldn’t resist taking a fervent interest in this plant. The multicolored petals had intricate lines and vivid flame-colored streaks. The double shades of the bulbs were due to an introduction of a mosaic virus, which could break down one color into diverse and vivid shades.

Tulip Mania

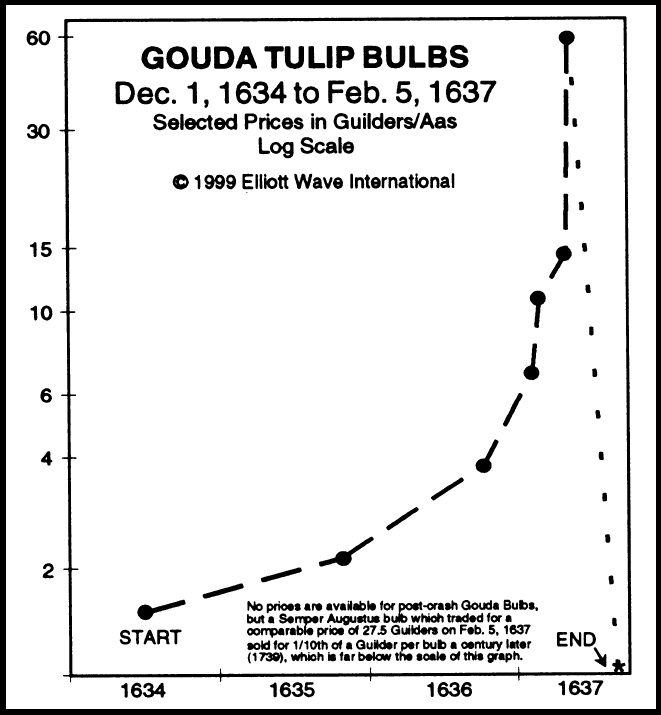

The tulip market hit it's been during 1636- late 1637. The market was rising tremendously and on an ever steeper rate; its valuation reached the peak of business valuations at the time. Professional growers and even the general populace started taking an interest in tulips. Many tulip gardens were grown and tulips brought to the market. The rare varieties of bulbs with dense patterns remained high-priced throughout 1636. But even the common variety prices started escalating too and went sky-high. The Tulip marketers started extending the coverage in many areas. The contractors would buy and then sell at exorbitant prices. In 1636, the tulip became the fourth largest exports business of Netherland. The skyrocketing prices were due to towering amazement, as it was an extraordinary thing for people at that time. There came a time in March 1637, when a single tulip bulb price rose to more than ten times the income of very skilled craftsman. A single day was saw thousands of sales of tulip bulbs. A single tulip bulb was even exchanged for many acres of land.

The Downfall

The Tulip market couldn’t make a sustainable journey upwards. During late 1637, the market started falling. The first incident of this collapse was reported in Harlem, where the bulb auction could not gather enough sellers. The reason wasn’t the stoppage of fascination in this plant species, but the bubonic plague that had recently struck Harlem stopping people from entering the town. The illness couldn’t let the people attend the tulips bulb auction in the numbers expected by the traders. This incidence somehow came as a breaking point in the frothy market, and the the entire industry collapsed within a few short months.

An economic bubble?

Tulip Mania | An economic bubble

A British Journalist ‘Mackay’ published a book in 1841, naming it as ‘madness of crowds’. He narrated the incidence as a paradigm of the economic bubble. In his book, it’s written that a time came when forty bulbs were sold for 100,000 Dutch gliders (roughly $1.5-2 million USD). A few tulips were exchanged for huge plots of land in cities and towns. In order to start the business of Tulips, owners would sell two acres of their land to buy just two tulip bulbs. Another incident is quoted in the book when a sailor mistook the tulip bulb as an onion and ate at breakfast. The spectators got furious at his reckless attitude; and such an expensive breakfast, which was more of the cost of the whole ship. He was jailed for his mindless behavior. The hysteria and mania among people are clearly uncovered in his book.

Modern Economist | Tulip Mania, not an Economic Bubble

There is no doubt about that fact that the tulips prices dramatically rose and then fell. But the data is not very evident about claiming it as an economic bubble, and relation to the bursting of speculative economic growth. Many modern economists believe that the tulip mania can’t be correctly put into the definition of ‘bursting of a financial bulb’. Contemporary economists have contradicted Mackay’s theory regarding the Tulip mania. Anna Goldgar stated in 2007 that the story is incomplete and rather inaccurate, saying it was all was limited to a small group of people. She stated that the trade was limited to the merchants and skilled craftsmen, so the collapse of the bubble wasn’t something extraordinary but a simple anticipated event. There were no great losses to the marketers due to a sudden drop in prices, only a half dozen of marketers faced some setbacks but that couldn’t be blamed solely on tulips. The critiques and many rational explanations continue to bring to question the economic impact of tulip mania.

Modern Day

Cryptocurrency

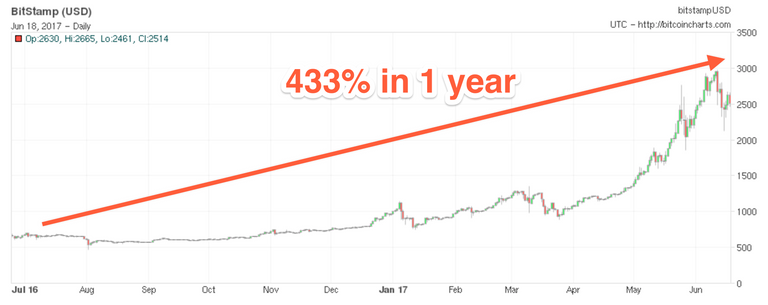

Cryptocurrency, like tulips, are a recent novelty in the financial world. Speculators often don't fully understand the assets they are investing in, and may sell other, more traditional assets to acquire more. Prices can often be driven by fear and greed, rather than any fundamental function or utility. In this way, it can sound very similar to the digital age's tulip mania.

On the other hand, cryptocurrencies as a whole arguably have enormous utility, or at least potential for utility, unlike (often diseased) tulip bulbs. Cryptocurrency can be used to move value quickly and efficiently, act as a store of value, and recently, even drive entire applications (such as Steemit!) While many investors don't understand the underlying mechanics, many others do, and they along with countless open source developers help preserve and drive value. It's not easy to see the similarities to the tulip market when seen in this light.

Excitement and exuberance to the novel is a part of human history and will remain so for as long as we can discover novel concepts. That is to say, forever (that is until humanity fundamentally changes, San Junipero anyone?) Saying each is a bubble is a fallacy, just as much as saying we've moved beyond fooling ourselves into creating one ever again. In the end, the technologies that further human development will survive, and those that don't will fall away. Will people make and lose fortunes along the way? Certainly. If we all focus and move towards what we believe will improve our own lives, everyone will do just fine.

---------------------

Good history lesson.

Thanks for reading! I think it's important to keep a level head during the inevitable volatility that come with novel markets.

I totally agree. I wrote an article about bitcoin's decline, if you'd like to read it it's on my blog.

Definitely, thanks for sharing