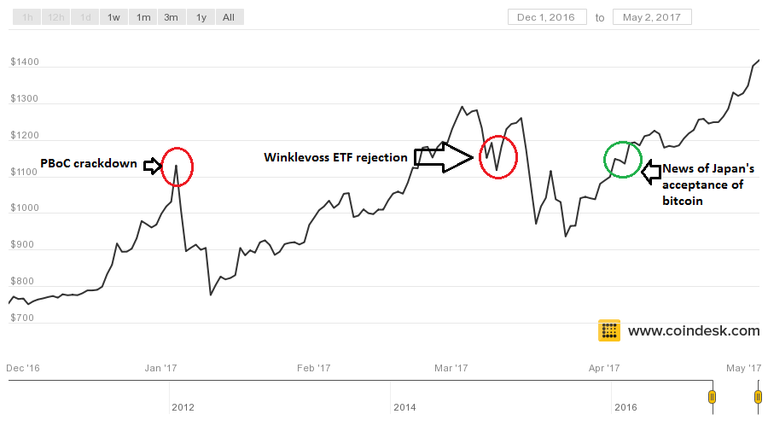

The opportunities of cryptocurrencies are now well known, in fact, if you look at recent Alexa ranking of cryptocurrency related websites such as Coinmarketcap, Poloniex, Blockchain.info, Bitcointalk, and others have all gained significant traction in the last weeks to months. These statistics has gain the attention of major players in the world financial system. It has led to some countries banning cryptocurrency related activities such as ICO's and encourage others to start a dialogue on the matter. The resilience of cryptocurrency like Bitcoin in the face of heavy regulatory pressure and rejection cannot be ignored. Here are some major events that have impacted Bitcoin in the last couple months.

Source: Coindesk

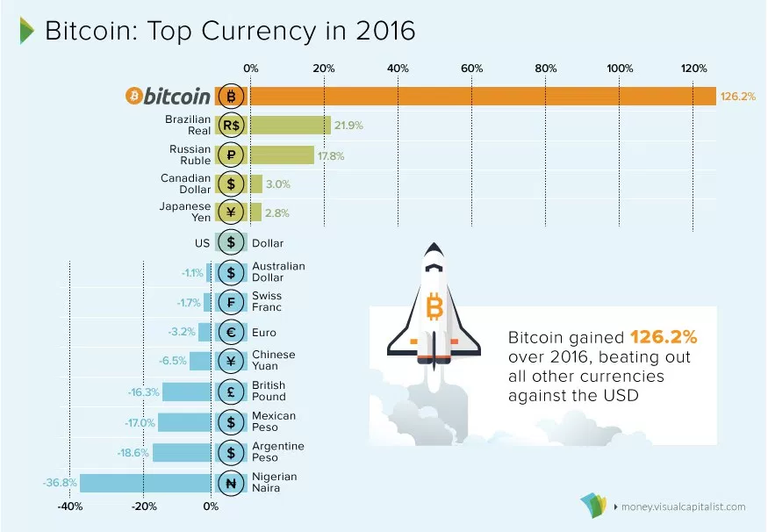

Within the last three weeks, the cryptocurrency market has seen major volatility with measures from China influencing the price in one way or the other. These measures include banning of ICO's and significant regulatory pressures on exchanges resulting in some closing down their operation. Bitcoin also wake up to criticism from the CEO of JPMorgan & Chase Jamie Dimon accusing the cryptocurrency of being a "complete fraud". Nonetheless, Bitcoin and other cryptocurrencies has shaken off these ebbs and continue to trend higher. This chart below shows bitcoin performance in 2016, a performance that mirrors and probably would better at the end of 2017.

Today we saw shares of Goldman Sachs trade higher after it made an announcement that it was "weighing a new trading operation dedicated to bitcoin and other digital currencies". This is a complete contrast to the likes of JPMorgan & Chase after its CEO indicated that it would fire anyone he caught in the firm trading the digital currency. Probably a less known fact of Bitcoin meteoric rise to USD 5000.00 per coin saw its market capitalization within 5 billion USD of surpassing the then 86 billion marketcap of Goldman Sachs and the 83 billion marketcap of Morgan Stanley. Interestingly enough, Bitcoin saw some profit taking measures and relentless assault attack coming in the form of China regulatory pressure to Jamie Dimon claims to general FUD spread by those seeking varying motives.

In the last week Bitcoin and cryptocurrencies in general got a fair (better put 'FEAR') endorsement, and I say this with a pinch of salt because her timing seem to calm the FUD growing among those countries where Bitcoin and Blockchain technology education isn't well established. That endorsement came in the form of IMF chief Lagarde stating "Ignore Bitcoin at your peril". She further went on to say that digital currencies, such as Bitcoin, don’t currently pose a major threat to the status quo, as they are “too volatile, too risky, too energy-intensive.” However, she highlighted that virtual currencies “might just give existing currencies and monetary policy a run for their money.” As I said earlier I take these statement with a pinch of salt because history has shown that their stands and policy often reflect a double-edge sword.

Today I see opportunities, I see some hope, as the Bitcoin and other cryptocurrency can bring relief to the fiscal misfortune that many countries currently suffer. I see Bitcoin and other cryptocurrencies raising capital markets to countries and business like never before. I see opportunities for innovation like Smart Media tokens from Steemit Inc adding a layer of potential funding for budding entrepreneurs from all over the world that are cut off from their financial system. I see cryptocurrencies like Bitcoin, Dash, Litecoin, Bitcoin Cash adding fiscal stability to people living in countries like Venezuela and Zimbabwe. I see blockchain technology being used to raise funds for disaster relief measures by cutting off the corruption that currently exist as the transaction can be made public ally available getting funds to those who need it the most.

Today I see opportunities, there is room for everyone, no one should be left behind. We just have to build on the technology that currently exist, make the codes better and focus on making planet Earth a better place we all can enjoy.

Tell me what opportunities you see???

Great post buddy. Hopefully Bitcoin should touch the moon one day. With more and more people adopting and understanding cryptos its just matter of time before it explodes to new highs. Upvoted and following u as always. Regards Nainaz

Thank you dear, appreciate it

Great post daudimitch! I believe the bitcoin as a protocol gonna be the brick and mortar to several new technologies we dont even grasp! think about all old movies that talked about the future. There are flying cars, droids and pill-food everywhere but not once you see a concept of the INTERNET on them!

Sometimes the disruption is so deep we can't even imagine.

You just killed it with that analysis...

well said @daudimitch. crypto currencies is a game changer in this world being a decentralized platform, and is making governments and central bankers worried. that is why people like Jamie Dimon, spreading fake news about it where in fact, his company is hoarding bitcoins to their advantage.

Banking is not for the weak, JPMorgan built quite a reputation, they have to do whats necessary to stay on top...I believe Blankflein smell that coffee and is positioning his exposure, kind of make sense why they were one of the few profitable banks during 2008 and still manage to get a share of that bailout...the IMF is also positioning themselves, its left up us to realize the trends and position ourselves accordingly...having exposure to cryptocurrencies is imperative and you should never get tied up in the debate of death to the fiat, they gonna be around for awhile but cryptocurrency would probably pave the way for better fiscal policy and probably override certain fiat currencies if their Central bankers can't enact balancing policies

With so much talk of crypto currency being banned, yet you see it continue to climb higher only shows the confidence if a free market, if they would stop manipulating gold and silver , it too would take off.

But right now it's hard not to own some crypto, and have the confidence knowing you have that money available offline and secure, no matter what happens

I can probably share some of my Gold charts with you, I enjoy charting and doing a little technical analysis, Gold trades in predictable patterns reflected economic certainties/ uncertainties, I am more seeing Gold as a traded asset rather than an appreciating asset...Gold put in quite a performance from 1126 all the way up to 1356, with "V" all the way and holding trend-line as support and resistance, it break to the downside, it break down and vice versa. After the recent Fed decision, it break the diagonal lower trendline before the speech, so traders had a good idea where its heading, now you have to look at the weekly and monthly trendline, to see where it may find possible support but for now its heading down.... you can probably hope for a rumors of war between US and North Korea to get some buying pressure even then I would wait until it breaks the upper trend-line to place any long position, after that I just monitor trades to take profits, you can't have no love for anything in the market, Gold movement is just profit taking....

I'll check out the charts as you post them, thanks!

No problem man, my pleasure