One big thing I've noticed this cycle is that nobody says "buy the dip" anymore. Diamond hands was apparently only good for one cycle. To be fair maybe we were saying this two years ago which certainly falls in line with the current cycle, but the dynamics seem to have completely shifted since that time. This is weird, because buy-the-dip mentality is a key feature of "complacency".

A lot of people on social media that have been worried that the "bull market" is over because it's 2025 and these things tend to last 3 years before they crater. Bull run started January 2023 so logic would dictate that we are perhaps out of runway. The problem with a lot of this panic is that these people are trying to act like they can call the top because price dipped 20% or less from all time highs, but as we all know it can dip as much as 35% ($82k) and be totally fine. Even funnier is the FUD that the bull market's end was calculated down to the day from a random 4chan post. Please stop believing in fairy tales.

It's honestly even baffling that anyone would even believe a prediction of a screenshot without a link. There's an ID number there but searching for it doesn't give the link but rather people just talking about the screen shot. Even when you find the post it could have easily been manipulated and backdated by the owners of the database. Ironic how predictions like this belong on the immutable ledger. Not that it matters because thousands of predictions can get made and people will just ignore all the bad ones and act like the good ones were some kind of miracle. Classic survivorship bias.

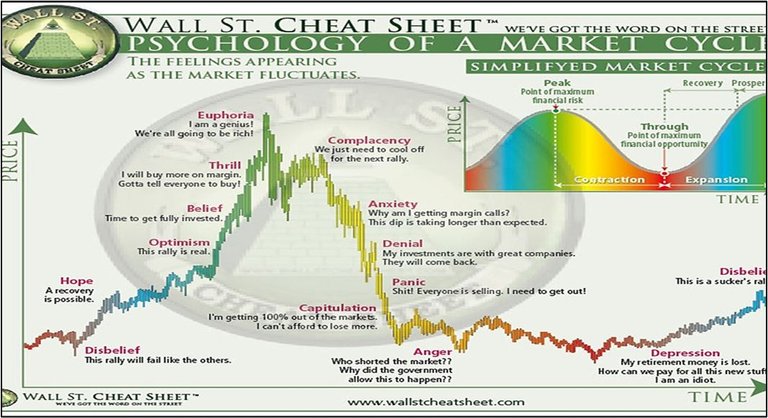

What is "complacency" in the market cycle anyway?

Complacency is an emotion I've experienced several times my crypto career. It's very similar to "optimism" or "belief". This rally is real; time to get fully invested; buy the dip it's going higher. Complacency means you're already up a lot of money and you're being greedy by not taking anything off the table. You're thinking: even if I lose half of what I have it wouldn't be a big deal. In fact you're probably doubling down and about to completely round trip the entire bag. What's interesting about the cycle we find ourselves in is that people in alts can't be complacent because they were never up to begin with. There are no paper gains to realize in the first place. There was never any bubble to speak of.

I mean take Hive for example we are sweeping the absolute lows right now. Hive hasn't shown any signs of life since January. Hive has already been in a bear market for almost an entire year, and the same is true for a lot of other alts as well. Normally this would be the time I'd be rallying and telling everyone 10 cent Hive is an uncrackable support. Unfortunately I can't make this claim because of Bitcoin.

I know Bitcoin could fall back to $58k in the absolute worst-case scenario, so it's safe to say Hive could fall pretty significantly as well. Right now I'm looking around the 5 cent range where HBD starts buckling and de-pegging from the dollar because of the debt ratio. Our network still is printing quite a lot of debt.

💚💚💚❤️

It seems fairly obvious that the reason nobody says buy the dip anymore is because they are completely tapped out already. Certainly this wasn't expected for Q4 2025, but also these sharks have a way of manipulating everything to separate people from their money. No bull market has ever been the same as the previous one. The only similar thing was the 4-year cycle, and perhaps now we don't even have that, but we won't know for a while. A peak in February would still be well within acceptable limits when 4-year cycle theory is concerned.

I'm still convinced November is going to give us some serious clues as to how this will all play out. Big moves always come in November, up and down. Currently we are flirting with down but it also hasn't even been a week.

I saw the death cross coming a mile away,

But I didn't trade it... oops!

We can consider this the second bearish signal the market has flashed since I commented on the first one 19 days ago. The bearish pennant has completed and the MA(25) has death-crossed below the MA(200). Support around $100k has been tested and unbroken as predicted. Currently expecting a bounce back to MA(25).

Remember remember the 5th of November

It's also a full moon and a supermoon today, which means the moon will be closer to Earth than usual and pull with a little more gravity. If the market moves with the moon cycle, as it often does, we should get a pretty decent recovery from here... at least for a week or two.

The other three moving averages are on a collision course that should occur mid to late month. These would all be death crosses between MA(50) and MA(100) with the 200 DMA. Unclear if this would actually be bearish or just noise because we already completed the pennant. I'm personally still under the opinion that these averages are too tight and the overall trend is too stable to flip bearish at this time, but we'll see.

Macro economics

A lot of the bullish chatter I see out there revolves around the market cycle and funny-money liquidity injections into the economy. The FED has already started cutting rates. They've declared and end to quantitative tightening come Dec 1. They are also funding the overnight repo market at noteworthy levels.

Now a lot of people look at something like this and would immediately think it looks pretty bearish and not good. But we need to remember that the entire system is rigged. Banks are "too big to fail". When problems are seen in advance they just throw money at the problem. Only when a problem goes unnoticed does it actually wreck everything like the 2008 housing crisis. When fake money gets pumped into the system number tends to go up. By all accounts the wheels of this economy are about to be greased once again.

Conclusion

November has always been a key month of both bear market years and bull market years. Remember November 2022? FTX collapsed and that marked the end of the bear (but the fear remained for over a year straight). Remember November 2018? Bitcoin crashed from a solid $6000+ baseline down to $3000 max-pain. Meanwhile in 2017 we were about to peak while 2021 we were peaked. November has always been a key month so we need to wait and see what it tells us. Somehow I still feel like we recover from this even though it seems bleak. Then again looking bleak is once again the complete opposite of complacency. So many mixed signals.

Just riding the waves here. All DOGE mining rewards go into BTC after every 100 DOGE mined, as well as I am stacking LTC and XMR. Been focusing on metals more too. I am looking hard at the dollar debasement trade basically. Don't care what the dollar figure is, I am collecting what I can.

The debasement of the dollar is obvious. The Fed just cut rates, which is going to cause masses of $'s to be printed, which will make commodities rise in price. Solid reasoning.

I just have to mention this. I do so out of both respect for you and concern for your benefit.

You say this in reference to an alleged post on a Mongolian basket-weaving forum, because it's possible that post isn't able to be provably located in an archive of that forum. Personally I found the content of that post more fantastic than the lack of verfiability, but either way, I agree it's not useful as investment criteria. You later say the following.

Additionally you refer to MA lines crossing as investment criteria, and other things.

Now, it is obvious that investing isn't science. The strongest balance sheet, best management team in history, and superior product line to all competition doesn't guarantee success. The best quantification of the influence of such things on a stock price is statistical, a range of probability, and that could certainly go awry because investors didn't hold their tongues right. But, the phases of the moon aren't any less fairy tales in terms of quantifying risk than 4chan larps.

Educated guessing is the best we can hope to do, but unquantified factors aren't able to educate. Seriously. Phases of the moon? I'll point out that both phases of the moon and BTC price are quantities that can be tracked back in time. You can quantify their association, or the lack of it. I don't think you did that, so what is the basis for considering phases of the moon investment signals? I think you're fully capable of holding yourself to that standard, of quantifying risk and reward regarding factors like that, rather than developing a mewing habit so you're holding your tongue right when you invest.

It's unclear because you haven't looked back at pricing history when these events occur to see if there's statistical relevance to them or not. Same with pennants, heads and shoulders, and etc. Not long ago there was a 'death cross' that didn't produce a sharp decline, which the very name 'death cross' suggests should be all but guaranteed. Your above discussion reveals death crosses aren't actually reliable investment signals.

You can take your money seriously, or hope you're lucky and hunches pay out. Which is more likely to be able to retire on? Quantify as best you can the information you're basing your investments on, because educated guesses require education, and that isn't just hunches.

I encourage you to do so, rather than to increasingly develop superstition on which you base financial and investment decisions. Quantify your data. Make educated guesses, or you're just believing in fairy tales. 'Somehow I still feel...' isn't an educated guess. It's a hunch, and given the depth and breadth of psychological manipulation we suffer, could be engineered to make you vulnerable to being taken to the cleaners. When you can say 'I still feel...because supermoons correlate to increased price 72% of the time...', then you can properly estimate risk and reward, and invest accordingly. But you have to actually quantify the signal to be educated about it.

Thanks!

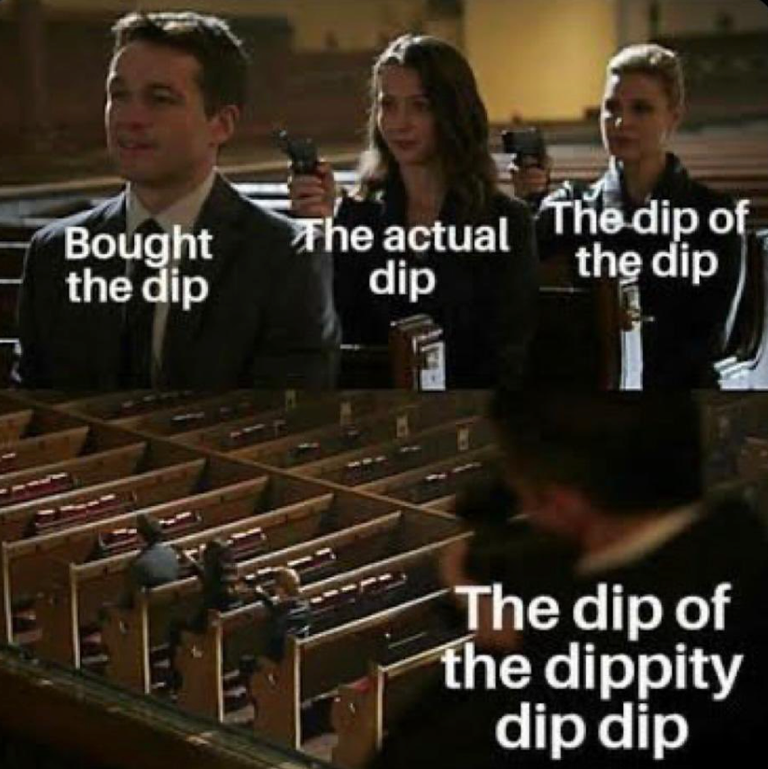

The first meme of this post says it all (at least to me), haha!

I've heard some saying that things are going to extend into 2026, but I feel like it is a lot of wishful thinking at this point. I'm just along for the ride either way and I keep picking up HIVE here and there when I can.

yes normally I would assume flat out that this is all cope but all of 2025 was either a crab or a bear market for the vast majority of the industry

it's very difficult to pop a bubble that never inflated

hell we might crab for all of 2026 as well

that would be wild

Ugh, I don't think I can stomach that! I was hoping for some fireworks. This is more like a demolition!

Yep, that would be me. I am thinking things could extend into 2026 and we could actually have the current bull market end right after the mid term elections next year. There I said it :)

I think btc will be up before November end, about 1 week before November ends, so about 15-20 days.

Then i could buy the dip, always when i could buy the dip the dip was just over :(

This time we will have a five year cycle...

I've had to resort to trading to come up with money for buying dip.

I'm tired boss...

Your memory of events is incredible, I have hard time keeping track with so many 'historical' events happening almost every other week.

Just keep plugging along!