Bakkt continues to gain traction

After a slow start, Bakkt is finally starting to do close to the volumes that many had expected initially.

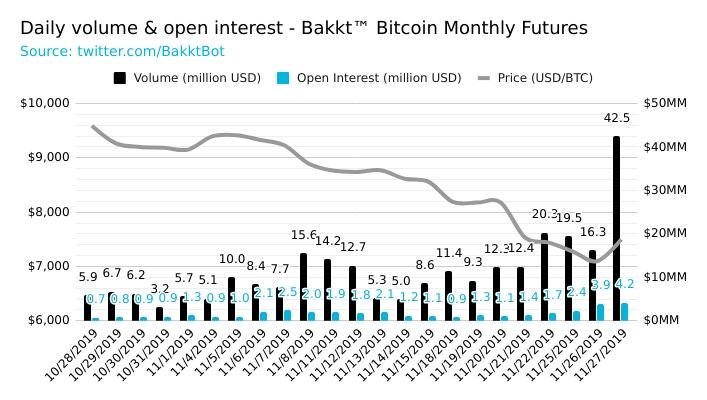

Yesterday, Bakkt saw close to $43 million in dollar volume traded.

That still isn't a ton compared to what the CME bitcoin futures do on a daily basis, but that more than doubled the previous high.

Check it out:

(Source: ~~~ embed:1199951594701434880) twitter metadata:QmFra3RCb3R8fGh0dHBzOi8vdHdpdHRlci5jb20vQmFra3RCb3Qvc3RhdHVzLzExOTk5NTE1OTQ3MDE0MzQ4ODApfA== ~~~

It finally happened on an "up-day"!

Traditionally, the highest volume days on the Bakkt bitcoin futures products had occurred on days when the price of bitcoin was headed lower.

This sort of trend lead some to believe that perhaps these new institutions that were using Bakkt for bitcoin exposure were perhaps doing more harm than good.

Using the Bakkt product as a way to bet against bitcoin.

This latest volume figure though, of more than 2x the previous highs, helps put those fears to rest as it occurred on a day when bitcoin was up a significant amount.

Bitcoin futures are really catching on...

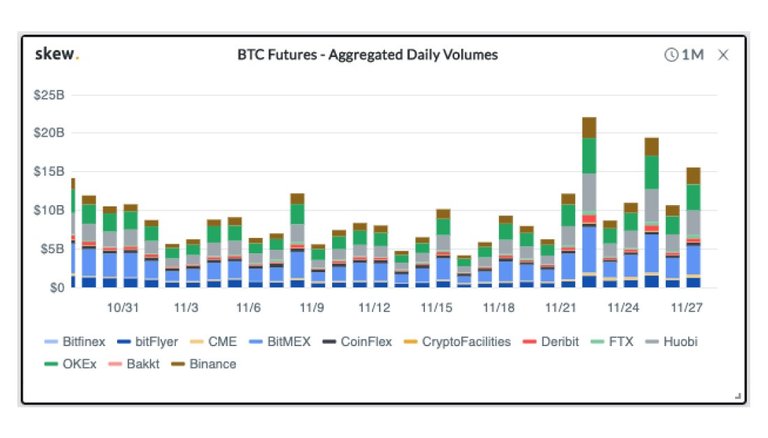

The total bitcoin futures volumes are averaging close to $10 billion in daily volume over the past month.

With 3 of the largest days ever occurring in just the past week or so:

(Source: ~~~ embed:1200018870410629123) twitter metadata:c2tld2RvdGNvbXx8aHR0cHM6Ly90d2l0dGVyLmNvbS9za2V3ZG90Y29tL3N0YXR1cy8xMjAwMDE4ODcwNDEwNjI5MTIzKXw= ~~~

This is starting to mirror other more traditional assets classes where derivative trading eventually becomes larger than spot market trading.

This is a very interesting development and something to keep an eye on.

Stay informed my friends.

-Doc

Snowball effect?

It certainly looks to be building. A year from now we may look back at $43 million and laugh as they are doing hundreds of millions or even billions in dollar volume per day.

A year from now, there will be no USD, so we can't even measure trade in dollars... Economy of United States will collapse as progressively the administration will isolate dollar from all the prerequisites... If trades with Chinese encompass 20% of theoretically value of USD, and USA will further restrict trade between China and other countries (including themselves), they are essentially plugging the safety pin out of the metaphorical hand grenade.

More institutions are moving into crypto, overall good news for the market. It's great to see Bakkt finally catching onto some real action, but it's exciting to wait for Bakkt's launch into Singapore, and what effects that'll have.

My concern for crypto prices are still on China, as we've no idea the extent of the recent crackdowns. Also, with institutions swallowing up more crypto for themselves, and the prospect of potential miner capitulation, how would this effect market illiquidity @jrcornel?

It could be a problem, though not something I am currently worrying about. When markets are illiquid, yes that prevents some from participating, but it also helps prices go to places they probably shouldn't have gone, including to the upside. A nice irrational pump is always welcome in my book. :)

I'm not sure what to make of the China news. There isn't much reported volume being done on the exchanges I have seen from there, at least not like there used to be, though it is also unclear how much OTC volume they are responsible for... or perhaps some of the volume coming out of China being done on other exchanges... Overall, it would be nice if they would just embrace bitcoin and crypto again.

China is the primary concern for the time being concerning crypto prices. They're already starting some crackdowns on crypto exchanges, with some being shut down. For now, it appears as though the victims are smaller/unknown crypto exchanges.

Hopefully BTC can soon reap the rewards from this

Good news

Posted using Partiko iOS