Well, pretty much all in. And pretty much by default.

With the markets how they are currently, I find myself in the unhappy predicament of having to sweep some paper wallets I have stashed away to pay on them bills! Fuck. Oh well. That's life. What this seemingly negative situation does present, though, is an opportunity to execute a move I have been toying with in my head for awhile now: getting almost completely out of BTC and into BCH.

Most of the cats I met at the Bitcoin meetup down in Tokyo last time I was there were already leaving the BTC game behind. From an economics standpoint, and as far as I can slice up the situation, it certainly would appear that BCH has the more solid plan and approach if actual usage of the currency is one of the goals. And for me, it is. Add to this the recent announcement made by one Roger Ver that BCH will be entering tens of thousands of convenience stores here in Japan as an acceptable means of payment in the near future. In this slump of a time, I think one needs to remain proactive. To me, the Bitcoin Core team seems to be suffering from a lack of market sensitivity, poor economics, and a fundamental failure to understand why Satoshi Nakamoto created the currency in the first place.

Anyway, long story short. I am sweeping a paper wallet and using some of the value held therein to reinvest into BCH, and the rest to "pay on mah gas bill," as Chicago rapper Rhymefest might put it.

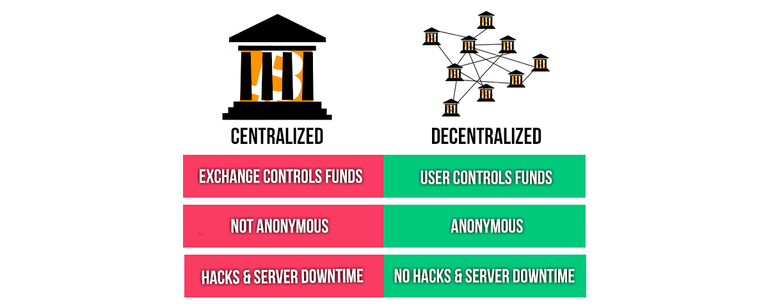

The Need for Truly Decentralized Exchanges.

This is where the rubber meets the road, really. As I see it, there are three basic scenarios which have the potential to play out in the crypto space in the coming months/years:

Folks make their own markets, disobeying laws, ignoring threats of jail time and worse, and drop fiat currency for sound money. Many, including myself, would say that this scenario is highly unlikely to play out anytime soon, as unfortunate as that may be.

A new tech comes along which has the potential to achieve state approval (a coin, say, where the privacy features are not baked into the protocol, but can be switched on, thus appeasing and avoiding the government's fear and restriction of "privacy coins" while still maintaining privacy capabilities) and is adopted by the masses, regardless of philosophy or politics, due to its practicality, convenience, and value. The state is thereby forced to accept this new paradigm or become extinct.

A total state takeover of the crypto space via fear, punishment, regulation, and insidious co-optive practices such as the repackaging of centralized, essentially non-cryptographic blockchains and coins as "cryptocurrencies."

I don't know. Am I missing something?

Basically, it is my conviction that people just need to start using the tech. To get millions and millions to do this, though, it must be super easy, and relatively safe. DEXs (decentralized exchanges) are great, but one typically cannot convert to fiat without supplying extensive identification and sacrificing privacy. Simply viewing crypto as a means to "cash out" to fiat, while sacrificing sound econ and user autonomy, defies the whole original point of currencies like Bitcoin.

As I see it, in reference to the three possible forecasts for the crypto space I listed above, there are 2 possible solutions:

- Better cryptography and more secure, private systems on which individuals can trade freely, regardless of government regulations (this would include channels to privately convert cryptos to gold, silver, or fiat, as well).

OR

- "Flash flood" mass adoption of one or several coins by the market, before the state has a chance to exert dominance, effectively returning economic power to the serfs on whom the elite globalist class is dependent, thus shifting the extant paradigm to a new, decentralized-market-centered paradigm.

Who knows. Again. I'd be interested to hear your thoughts.

In closing, some wisdom from Mr. Satoshi Nakamoto, himself.

"The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts."

~Satoshi Nakamoto

Let's not forget what this is all about. It's nothing less than freedom versus slavery.

Cheers.

~KafkA

Graham Smith is a Voluntaryist activist, creator, and peaceful parent residing in Niigata City, Japan. Graham runs the "Voluntary Japan" online initiative with a presence here on Steem, as well as DLive and Twitter. (Hit me up so I can stop talking about myself in the third person!)

If he can pull that off, it would be a huge game changer. Hmm maybe ought to load up on BCH!

Pretty nice prices right now, market wide! 😜

Nice price? Still heavily overvalued despite the current drop. Do some investigation on the real world use compared to the price, you will get a hard attack when you are really all in:

https://steemit.com/bitcoin/@michiel/the-valuation-of-btc-ltc-and-bch-based-on-transactions-remarkable-outcome

A "hard attack," eh? Look, I don't understand why so much emotion needs to be involved here, bud. Glad to check out the stats. Thanks!

The point is that BCH is a huge mall investment at this point because the value is fully driven on lies and aggressive marketing. When you see the value through use in the real world its really shocking. An informal way of saying that something is shocking is saying that you get a hard attack, its nothing personally. You have to know that you may pull uneducated people into Bcash with your post and I just try to warn them as I did with Bitconnect in the past.

*heart attack

Thank you for your opinion.

haha, your right, thanks

I know!

I feel like DPOS generally, and STEEM specifically is going to eat away at bitcoin's dominance.

It's too slow, too expensive, too cumbersome.

Sending value instantly, for free, to a person's actual name, instead of a long string of letters and numbers; that's so much better than anything any of the bitcoin forks can do.

Knowing that he can lock it down for 3 days, or 3 months, in effectively a time delay safe, to protect it from hackers.

It can also earn him a yield on top of any growth.

I've loved bitcoin since 2012, but its going to get eaten alive by its grandchildren.

Yeah man. I agree with much of what you are saying here regarding BTC vs Steem, etc.

When you say “he can lock it down,” are you referencing BCH/Ver? If so, could you elaborate? I hadn’t heard anything like this before.

While it's pretty clear what the global cryptocurrency community thinks of Bitcoin Cash, If he really can pull off having chains of Japanese stores accepting Bitcoin, that will put Bitcoin Cash at an edge compared to Bitcoin.

The market is the market is the market. Right now the majority of Bitcoin holders aren't willing to part with their bitcoins for fears of losing out when the price goes up again. This kind of hodl doesnt make Bitcoin really that utilized. make utilization is the core of value.

Maybe Bitcoin Cash would stand out in bearish markets times.

I’m not so sure about a global consensus regarding opinion on either of the two, but yeah. The market is the market, is the market. And that will ultimately decide.

And yes, if Ver can deliver on this it will be huge not only for Japan, but for the market as a whole. The Japanese use the konbini for everything, from paying rent to buying porno.

It would be a pretty huge shift in the crypto space.

TIL konbini

And yes, it could be a good gamble to shift to BCH ahead of the decisive Japanese BCH implementation since btc has been tanking and likely will tank in the following months.

Well thank goodness I haven't touched my BCH since the fork.

Haha :) Yes. Viva konbini.

Viva konbini!

Going 'all in' on anything is taking on a lot of (unnecessary) risk. I went in heavy on banks in 2007-2008 (they seemed so cheap! They'd be rising 18% year on year for 20 years!). It was a painful lesson. Why not just maintain a balanced portfolio or buy token on bitshares that tracks the top 20 cryptos & rebalances monthly. That way, whoever wins, you still win.

Disclaimer: I own no b-cash. I have btc as part of a portfolio

Yeah, as I say, I’m not dumping a whole portfolio of alt-coins into BCH, just switching over largely from BTC.

If you're looking for decentralized Btrash is not where it's at. Btrash is Roger Ver and Roger Ver is Btrash. In the short term they have the better option, but once lighting network becomes mainstream there is no point for Bcash.

I guess I don’t understand calling something “trash” that has a greater functionality—as per it’s purported usage goal—than what is being argued to be superior.

It has bigger blocks so what? Last i saw bitcoin transaction speeds were quicker and cheaper a few weeks ago.

In sat/byte BTC was cheaper the last week, in USD/transaction it wasn't. ATM Bcash is indeed cheaper in dollars, but when the market price was even Bcash would be more expensive. So it is only cheaper because the network has less value.

When has a BCH transaction cost been more than BTC when a comparable volume is being transacted. Can you give me hard data?

http://fork.lol

The last 4 days ruined it, but there are periods that BTC is cheaper in sat/byte, but mostly is about even. Since this is the selling point of BCH and BTC does every other thing better I think it is fair to say that the marketing campaign of BCH is a fad

Haha. You can say that again. Show me a month where the fees were less than BCH.

It has smaller blocks because nobody is using it, they use not even 0.2% of the capacity, is Roger going to bring it to 0.3 by paying some Japanese merchants to use it? LOL.

@michiel, your tone is kinda ridiculous, bro. Let's have a big boys conversation. I answered and thanked you above for your info. Cheers. I'm talking with @gniksivart now. May the market be the judge and the best coin win. No need to get undies in a wad.

This is not a conversation with @gniksivart, this is a public conversation since it will be read by many and I feel free to mix in. I agree that the best coin should win decided by the market, but for the market to decide facts have to be given.

This is a conversation between @gniksivart and I, and of course you are free to jump in, as you have already several times on this post, which makes your case seem a bit desperate. Regardless, I’m glad to look at the info you’ve presented.

Really? What about transaction costs? Can you source that? I’m open to all facts/stats.

I think ZENcash is switchable between public and private transactions. Not super sure yet, but I'll know more as I start getting into it. It's on the list. I'm gonna set one of my GPUs to mine it I think.

Check out Electroneum. Something like 150k mobile miners running. That's just mobile, not anyone that's using it in a real capacity. They have a long list of businesses adopting it as well. Worth a look.

We're here fam. This is our space. They're just no starting to tax Amazon interstate traffic. We have time before they try shit here.

IDK if it's available in Japan, but check out LibertyX. It's a peer-to-peer exchange (kinda) that let's you buy BTC at participating retail stores. There's a few here within a short distance of my 6000-person town. Everything can be a BTC ATM this way!

I just checked prices this morning for the first time in a week or more. Yikes, I cried lol but I'm not down, I'm gonna buy more. And I just started a mining plan this week. Prolly gonna buy some hashes at pool.bitcoin.com too. I need me more income. This shit is awesome!!! There's so many awesome projects here that are making incredible strides in the direction we want. I'm kinda of the opinion that we shouldn't use a dying coercive system to value our space too. Wonder if we could value things in precious metals.

Bro, I'm pumped as fuck. Just made a comment as long as a small post lol

Coins mentioned in post: