Cryptocurrencies are something so new that there are only very few statistics about this whole business industry.

It's hard to estimate how many cryptocurrency users there are, and so far there were only very few studies to collect data about the user behaviour.

That's why I was happy to find out that today, the Camebridge University released their global cryptocurrency benchmarking study, an extensive study about global cryptocurrency users, wallets, and markets.

The research provides insights about the active cryptocurrency wallets and exchanges, in which regions cryptocurrencies are the most popular, which currencies are being traded the most, cryptocurrency mining behaviour, and much more.

The study is split in different topics: general data about the cryptocurrency industry, wallets, exchange platforms and mining.

Cryptocurrency industry

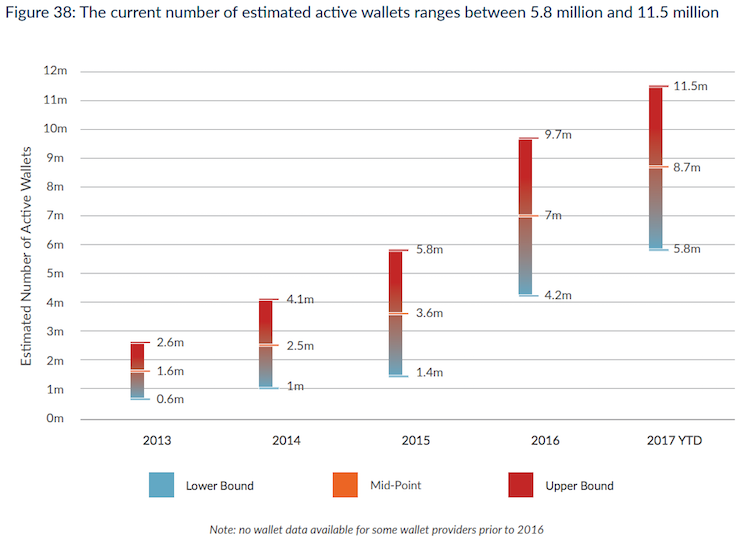

There are currently between 2.9 million and 5.8 million unique active users of cryptocurrency wallets. The exact number is of course quite hard to guess.

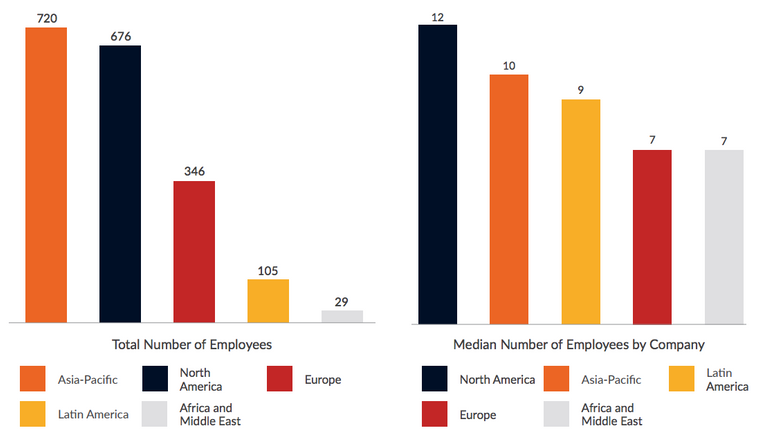

A minimum of 1,876 people are working full-time in the cryptocurrency sector, but the actual total figure would probably much higher since many organizations didn't provide any headcount figures.

Most of these people employed in the cryptocurrency industry are working in Asia (720 people), followed by North America (676 people).

It also seems like the different sectors within the cryptocurrency industry are overlapping: 31% of the cryptocurrency companies surveyed stated that they're operating across 2 or more industry sectors.

And while cryptocurrency-to-cryptocurrency payments account for 27% of currency transfers, national-to-cryptocurrency payments actually take up 60% of total payment company transacton volume.

Wallets

There are anywhere between 5.8 million and 11.5 million cryptocurrency wallets currently active. Of course this number is very vague, but that's because it's hard to determine how many wallets are really "active" if most users are 'just' storing their cryptocurrencies.

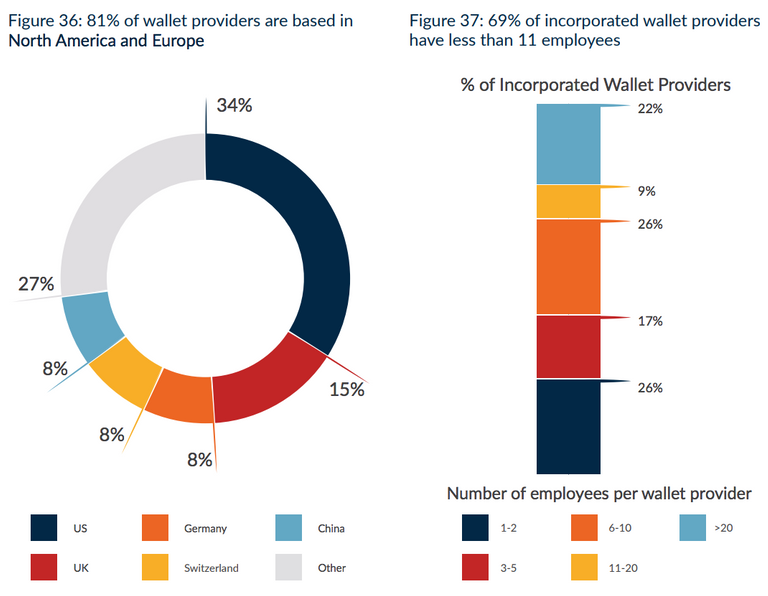

Most users are from North America and Europe (both about 30%), followed by users in the Asia-Pacific Area.

And since most exchanges also offer wallet features and vice versa, the lines are quite blurred here as well.

52% of wallets surveyed had an integrated currency exchange feature, of which 80% enabled the user to a national fiat-to-crypo exchange service.

Exchange platforms

The exchange sector employs the largest number of people within the cryptocurrency industry, and also has the highest number of operating entities.

While only 35% of large exchanges hold formal government licenses, 52% of small exchanges do.

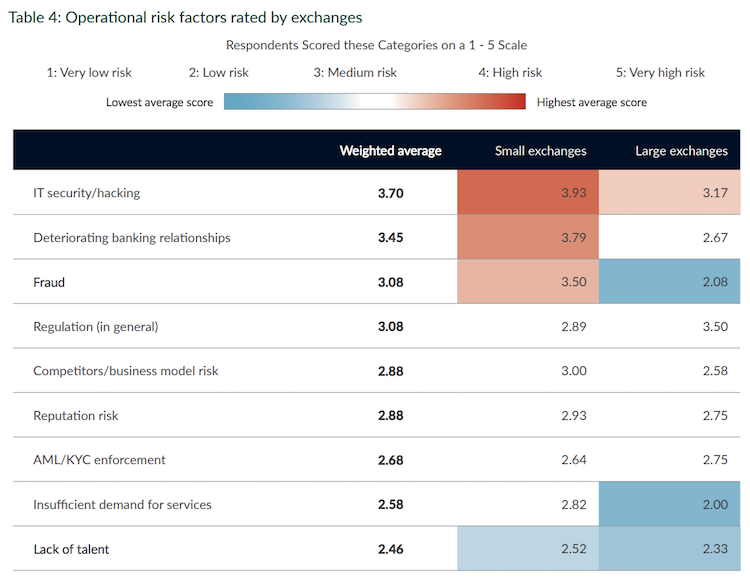

Around 17% of the budget is being spent on security issues, and there are 13% of employees working in the security department.

73% of exchanges operate by holding the user's private keys, therefore partly taking control over the user's funds.

In comparison, Europe and then Asia-Pacific currently have the most amount of Cryptocurrency Exchanges.

The US Dollar was the most widely supported fiat currency and was available at 65% of exchanges surveyed, followed by the Euro with 49% availability.

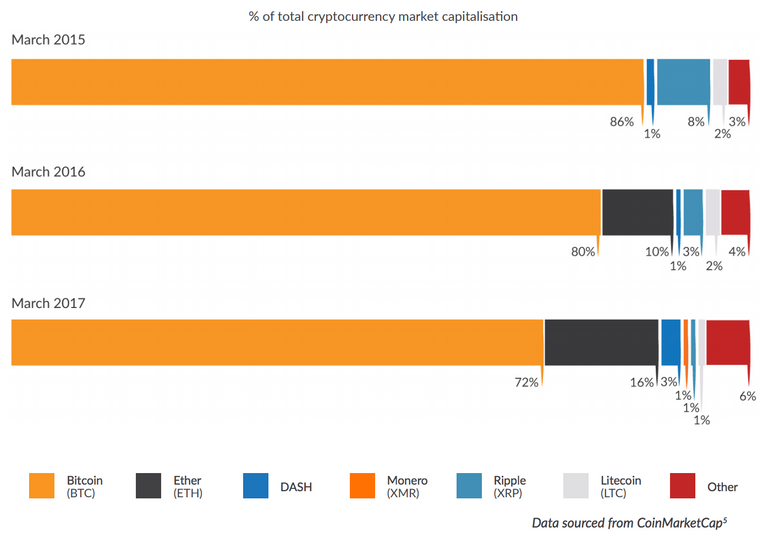

When looking at the cryptocurrencies within the exchange, every single alternative currency was tradeable with Bitcoin - followed by Ethereum and Litecoin. Ripple, Dash, Monero, Ethereum Classic and Dogecoin were also widely represented.

Bitfinex currently has the highest market share of all exchanges with 16%, but you also need to take into consideration that 25% of the overall market share came from a number of small exchanges.

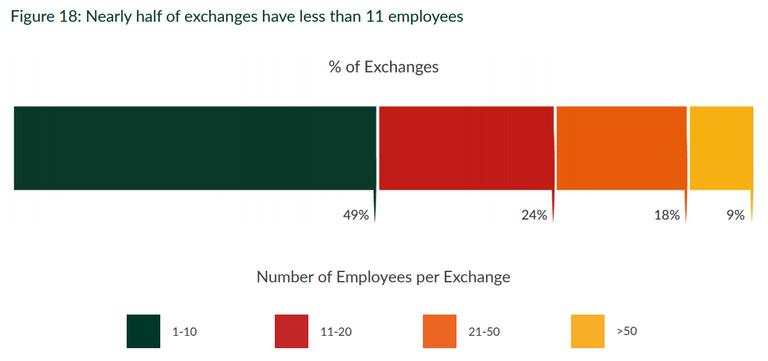

Almost half of the exchange platforms surveyed only employed less than 11 people - despite having millions of dollars coming in on the exchange.

Mining

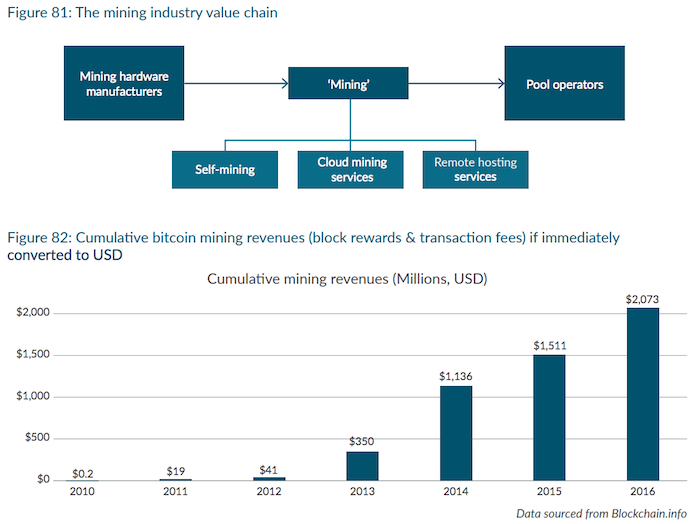

The mining revenue has fluctuated quite a bit despite the recent boom of cryptocurrencies.

In 2014 for example, the total Bitcoin mining revenues per year (block reward + transaction fees) was far higher than in 2016 when revenues were immediately converted to USD.

In 2014, the total Bitcoin mining revenue was at $786 mln dollars compared to only $563 in 2016.

This significant difference can be accounted to the increase of Bitcoin mining difficulty.

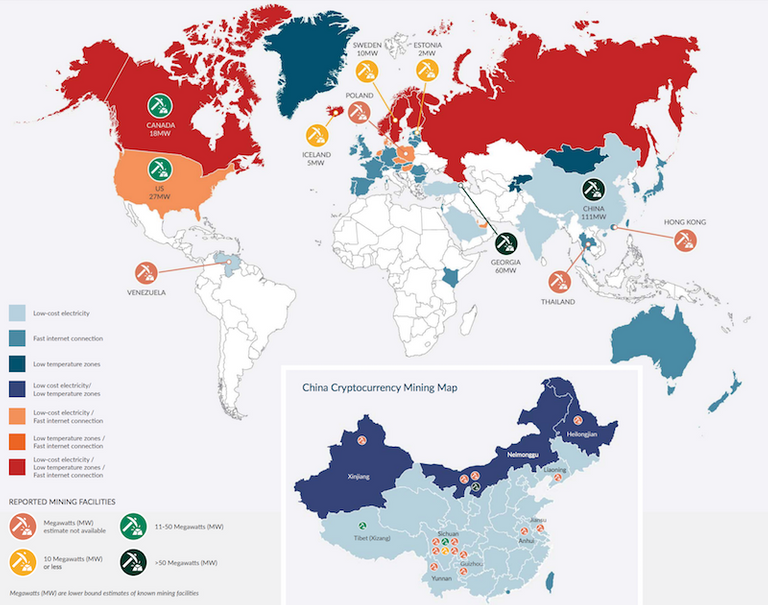

The cryptocurrency mining map shows that well-known mining facilities can be found all over the world, but China holds a notably large amount of mining facilities.

58% of large mining pools are based in China, followed by the US with 16%.

While 70% of large miners would classify their influence on protocol development as high or very high, only 51% of small miners say the same.

Which of these statistics was the most interesting or even shocking to you and why?

© Sirwinchester

Thanks for sharing

Configuration ! Top comment ...

Industry and its potential is fantastic! Waiting for China changing its mind.

All I know is that we are so early in the crypto game, tons of growth ahead! :)

For. Real.

I really hope that regulation doesn't slow it down!

As always, some great information that is also very interesting! Thank you for bringing this for your readers.

While the source of the figures is undoubtedly authentic I feel that there are many more who are not included in the figures simply because they may not be using cryptocurrency as yet. However they may be the most interested people as of now because although they might be playing safe they will have lots of capital to invest. These would be risk takers on a lower scale who may be watching the currencies ready to jump in when they think the time is right.

It is ironical that there is so much of mining in China but it also happens to be the country that is clamping down hard on cryptocurrency. I see a thriving black market there in the coming days.

Very valuable information! Thanks for sharing I will resteem it!

This type of study is very hard to get data for as many people over the years bought into crypto's and either never did anything with them or put them in unrecoverable wallets. It's like watching the volume movements on the exchanges when more volume moves in a day than there are coins. This is the wild wild west with bot gunslingers. What an age to live in.

Yeah, when the blockchain becomes widely accepted by the public, things are going to change drastically. Who knows what the ripple effects will be?

True. Blockchain and cryptocurrencies will influence our lives more than we can probably guess.

Exactly! That's why this study is so interesting and the data so insightful.

Thanks for your comment!

Fascinating article. I'm guessing the landscape will change drastically over the next few years. Bitcoin, while becoming more widely used, is also decreasing in utility as new more innovative coins come out. I'm curious to see if it will bounce back and take a bigger lead again.

Interesting thought. You're right, Bitcoin can't always stay at the top just because it was the first one.

Yeah, if you're interested, I actually wrote an article on that very topic: https://steemit.com/cryptocurrency/@spacecadet1/bitcoin-vs-ethereum-who-will-be-the-victor

Thank you for this

Resteemed

Hard to analyse the data in Nepal there were not aware Ness about crypto so ...

Nice post friend. thanks for sharing

thx for sharing this data!

Nice cotent shared..thanks for sharing your views to us. <3

Thanks for sharing this content. Looking forward to the future.

av a geez @monkeymind

Great summary and article. Sometimes when you're involved in something it's good to step back and take a look. I find it surprising to see how few users of crypto there actually are.

Hey @sirwinchester :) can you please help me spread this.

https://steemit.com/contest/@marianmiller/contest-3-or-guess-where-in-the-world-win-sbd

5.8 million active users???in the world? if this is correct ( but it has to be higher) and that number even goes up by 10x = 50,800,000 / 3 billion people in the world.... thats 1.7% of the worlds population.... It that math even right???

HODL

The entire crypto industry today reminds me of the early days of the internet when every new idea seems possible and profitable. BTC and ETH will be here to stay while many other coins will cease to exist as the industry becomes more mature.

glad to be in it early

Thanks for the great information

Excellent! Important information. Very few people working in this industry was kind of surprising. Upvote and resteemit.

Nice! Would love to be mining full time in Singapore but the electricity here is really expensive.

This post has been ranked within the top 50 most undervalued posts in the first half of Sep 19. We estimate that this post is undervalued by $24.56 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: Sep 19 - Part I. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.

I thank you for your very informative and timely posts. You are a welcome source of truly important information and insights...Bravo!!!

Cool! Thank you for posting this info. It's very clearly presented and very valuable!

Going to resteem this for my friends...tha ks again!

Cheers! from @thedamsu

Hi @sirwinchester, I want to personally invite you to join my free Airdrop/Giveaway of my new own Crypto-Payment Token called "Future24Coin"! :) You only have to send me your Waves wallet address in the comments of my article here to participate: https://steemit.com/cryptocurrency/@future24/cryptocurrency-news-future24coin-pre-token-sale-starts-now-steemit-giveaway-and-bounty-program-ideas

Oh....now they don't want to mine in Africa...They want to mine Africa for everything else though. LoL Thanks for sharing. I found that particular info to be ironic.

Great news! At this point, people will be educated in a better way which open lots of opportunities and innovations at this field.

Thanks for sharing this @sirwinchester ! I am an advertising student and it is a welcome sight to see all of this analytical data visualized in your post! Sharing with my homies!

Amazing post! I fiend on Steemit told be that there where only 300 000 accounts with over $5000 worth of BTC:) I do not know his source though...