It was over three years ago, back in May 2014, when we wrote "How Bots Manipulated The Price Of Bitcoin Through "Massive Fraudulent Trading Activity" At MtGox" in which we first demonstrated one of the more striking observed "bot-driven" bitcoin manipulation schemes, in this case related to the infamous collapse of the now defunct Mt.Gox bitcoin exchnage.

As we wrote at the time, a number of traders began noticing suspicious behavior on Mt. Gox. Basically, a random number between 10 and 20 bitcoin would be bought every 5-10 minutes, non-stop, for at least a month on end until the end of January, by what appeared to be two algos, named later as "Willy" and "Markis." Each time, (1) an account was created, (2) the account spent some very exact amount of USD to market-buy coins ($2.5mm was most common), (3) a new account was created very shortly after. Repeat. In total, a staggering ~$112 million was spent to buy close to 270,000 BTC – the bulk of which was bought in November.

"So if you were wondering how Bitcoin suddenly appreciated in value by a factor of 10 within the span of one month, well, this is why. Not Chinese investors, not the Silkroad bust – these events may have contributed, but they certainly were not the main reason.

But who did it? and why?"

Of course, in the end this alleged manipulation did not help Mt.Gox which eventually collapsed in what has been the biggest case of cryptocoin fraud in history.

We bring up this particular blast from the past, because in the latest case of bitcoin market abuse - with Bitcoin trading at all time highs above $3,000 - Cointelegraph reports of rumors swirling about a trader "with nearly unlimited funds who is manipulating the Bitcoin markets." This trader, nicknamed "Spoofy," received his "nom de guerre" because of his efforts to “spoof” the market, primarily on Bitfinex.

Of course, spoofing is what Navinder Sarao pled guilty of last year, when regulators inexplicably changed their story, and instead of blaming a Waddell and Reed sell order for the May 2010 flash crash, decided to scapegoat the young trader who allegedly crashed the market due to his relentless spoofing of E-mini futures (and also making $40 million in the process of spoofing stock futures for over five years).

It now appears that a spoofer has once again emerged, only this time in Bitcoin.

For those unfamiliar, spoofing is simple: it is the illegal practice of placing a large buy order just below other buy orders, or a large sell order just above other sell orders, then cancelling if it appears that the order is about to be hit or lifted. The idea is to make traders think that somebody with deep pockets is getting ready to buy or sell, in hopes of moving the market. If traders see a sell order of 2000 Bitcoin they may rush to panic sell before the whale crashes the price. And vice versa on the bid-side.

As an example of Spoofy's trading pattern, here is a breakdown of a typical "trade" by the mysterious entity as noted by BitCrypto'ed who first spotted the irregular activity: Spoofy is a regular trader (or a group of traders) who engages in the following practices:

- Places large bids ($2 million and up) for Bitcoin, usually just under a smaller bid order, only to remove them once someone starts to sell. These orders usually have a lifetime of minutes, or sometimes as short as 5–10 seconds to manipulate the price up (more common)

- Places large asks ($2 million and up), for Bitcoin when he wants the price to go down, or stop going up (less common)

- Occasionally ‘Spoofy’ will allow orders deep in the orderbooks to remain for a few hours, usually $50–$100 below the current price. For example, during the recovery above $2,000, he had roughly 4,000 BTC of false orders in the $1,900 range that were unlikely to execute, and ultimately were never executed.

As noted above, spoofing is actually illegal - as ultimately the trader has no intention of ever executing the publicized trade - but as Bitcoin markets are largely unregulated, it’s a very common practice.

What is unusual in this case is the nearly unlimited bankroll that Spoofy has at his disposal: He regularly places orders approaching $60 million.

Even more unusual is that, as cointelegraph reports, most of Spoofy’s activity occurs on a single exchange: Bitfinex. This exchange came under fire earlier this spring when Wells Fargo cut off their banking ties. As a result, it’s virtually impossible to deposit fiat on Bitfinex without going through intermediaries.

Yet unlike most Bitfinex traders, Spoofy appears to have special privileges, and has massive sums of both fiat and Bitcoin at his disposal on that exchange, likely one of the only traders who does.

* * *

In addition to spoofing, "Spoofy" also engages in wash trading, or effectively trading with himself. As BitCrypto’ed points out in a recent blog post:

“Spoofy makes the price go up when he wants it to go up, and Spoofy makes the price go down when he wants it to go down, and he’s got the coin… both USD, and Bitcoin, of course, to pull it off, and with impunity on Bitfinex.”

The BitCrypto’ed blog also describes Spoofy’s wash trades, when he trades with himself by either selling into his own buy orders or vice versa. Wash trading at high volumes can induce a frenzy of buying or selling, as other traders respond to the high trading volume. Spoofy can execute wash trades at very low cost, about $1,000 per million dollars of volume.

A single entity (entity could be a trader, or a group of traders), single handedly wash traded 24,000 Bitcoins in shorts. In order to do this, you would need to have at least 24,000 BTC on Bitfinex and the USD to buy them with.

When Bitfinex announced its plan to distribute Bitcoin Cash, it initially planned to distribute Bitcoin Cash to holders of short positions. Immediately following that announcement, a single trader short sold tens of thousands of Bitcoin all at once. It’s likely this trader was Spoofy himself, hoping to acquire as much Bitcoin Cash as possible.

The large number of shorts on Bitfinex also led many to believe that an epic short squeeze was coming, and many Bitcoin traders purchase coins in expectation of this. Suddenly, he “claimed” all of his own shorts, closing them using his own Bitcoin. The number of shorts dropped drastically, yet without affecting the price at all.

Bifinex itself admitted the manipulation on August 2, one day after the fork:

“After the methodology announcement on July 27th, several accounts began large-scale manipulation tactics in an attempt to obtain BCH tokens at the expense of exchange longs and lenders on the platform, causing the distribution coefficient to artificially plummet.

We have determined that this kind of manipulation?—?including wash trading and self-funding shorts?—?is in violation of Bitfinex’s terms of service. Those who intended to take unfair advantage of the circumstances surrounding the BCH distribution at the expense of other users have been sanctioned accordingly.”

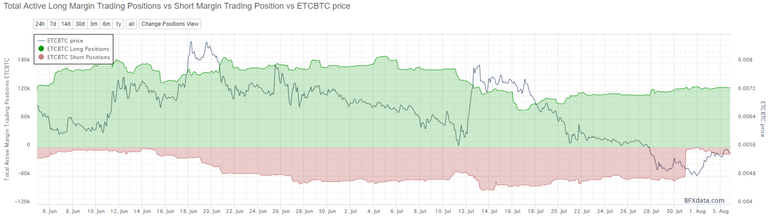

Interestingly, BitCrypto'ed claims that Spoofy isn’t limited to just Bitcoin, and that shortly after this ‘trader’ was ‘sanctioned’ by Bitfinex, another interesting thing happened: ETCBTC shorts immediately disappeared on August 1.

Here we can see how the ETCBTC shorts simply vanished, from 60,000 ETC short, to a low of 93 ETC. But let’s not just look at ETCBTC, what about ETCUSD?

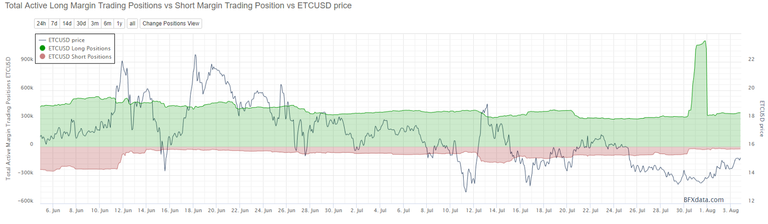

A giant middle finger. Notice the dramatic increase and decrease in longs with no effect on price.

I'm not sure what to make of these, but it calls into question the legitimacy of this data. The point I’m trying to make by showing the ETCBTC/ETCUSD margin pairs also engaging in very funny business at the same exact time, how are we supposed to know that the BTCUSD longs on Bitfinex are not also subject to this manipulation? ETCBTC Shorts = Clear evidence of manipulation.

ETCUSD Longs =Clear evidence of manipulation

BTCUSD Shorts = Clear evidence of manipulation (and admitted by Bitfinex)

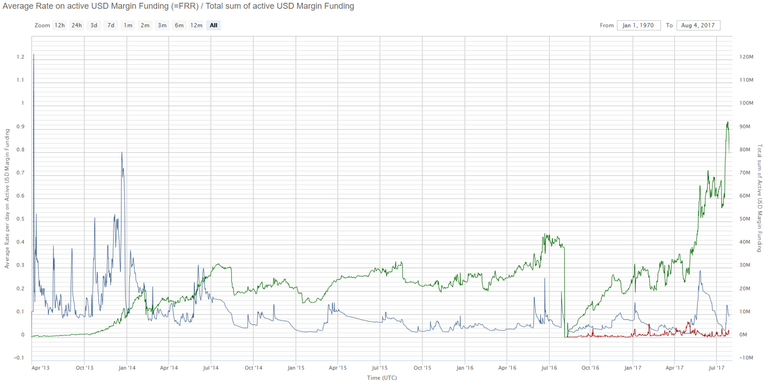

BTCUSD Longs = BTCUSD Longs in terms of USD, has never been higher in Bitfinex's history. See the green line.

It's not just Bitfinex: Spoofy’s activity also drives crypto prices on other exchanges, as arbitrage takes place. Because BItcoin is so thinly traded, a single large “whale” can potentially move the entire market.

Just like in US stock markets where HFTs find instant price arbitrage opportunities, with the help of extensive spoofing, the same takes place in bitcoin exchange.

People underestimate how much exchanges follow each other. Manipulation on one exchange will affect prices on other exchanges. You have traders that watch all of the exchanges and if one exchange starts to pull ahead, they too buy on cheaper exchanges.

You don’t just have people, but you also have bots that will do the same thing, so price reactions can be immediate.

Just like equities. And while Spoofy is certainly exercising outsized control over the Bitcoin price, it is uncertain how much of an affect this is having across all the markets. The price is currently rising, having finally surmounted the $3,000 barrier. The only problem? Nobody knows how much of this increase is organic and sustainable, and how much is due to the market manipulation of Spoofy and others.

Finally, nobody knows who he is: The identity of Spoofy remains a mystery. He may be i) a single trader, ii) a large OTC trading firm or group of colluding traders, iii) or even the Bitfinex management themselves. He sometimes seeks to drop Bitcoin price, and sometimes acts to increase it. One thing is certain: one single trader seems to have a "central bank"-like impact on the entire crypto market.

Source : http://www.zerohedge.com/news/2017-08-06/mysterious-trader-nearly-unlimited-bankroll-said-be-manipulating-bitcoin-price

Disclaimer : This is not the real Tyler Durden! I read ZeroHedge every day to find the one or two best articles and reformat them for Steemit. I appreciate the upvotes but consider following the account and resteeming the articles that you think deserve attention instead. Thank you! Head over to ZeroHedge.com for more news about cryptocurrency, politics and the economy.

Really good article. This type of manipulation is going on in every market in the world today. It's all smoke and mirrors. The smaller the market, the easier it is to manipulate. Whenever central banks and sovereigns started buying securities the free market was essentially dead. How the hell are you going to compete with an entity that can print as much money as they want out of thin air?

Followed and upvoted, resteem coming on 3rd day of the post, bookmarked for now!

This is exactly why i'm being hater on the network. Your complete post is pointing only one thing clearly...

CryptoCurrency has been manipulated and on a world scale - scam...

Since it's very own beginning. Now it's just multiplied with faces, brands and coins. OpenLedger/BitShares is also having some algorithm i'm sure for extra cash and manipulation on the market.

There is still a lot more stories (smaller scales) but exactly same concept like this happening all the time... Through history until today and so on.

Cheers,

Great stuff!

Luci

Yes effectively there are algorithms being employed through API's etc on the exchanges for all the major cryptos and they are acting in a HFT fashion as virtual market-makers - so large and bids / asks will appear and reappear all day automatically and nearly instantly as trades occur

@sky77 - I know, im doing it myself sometime to catch greater bid on OpenLedger/BX for BTC. I come and offer sell/buy one value over another making it higher bid, and buying it myself from another wallet. Once transaction is made, market starts doing higher bids and transactions, allowing me to earn on my own transfers. But we are talking here on much larger scale fraud, not being broker/stock agent.

Yes I did it earlier too on a coin - I won't say which one or where :) it failed by the way. I'm not a real crypto trader. I know it is large described above -- but there isn't much that can be done about it yet and you can call it "fraud" but other than boycotting that exchange what can be done.

Exactly what i'm doing at the moment. I never was a crypto trader myself, but i do have certain gift for analyzing patterns :)

This happens everyday, all day, on almost every major stock on the U.S. markets. Legal or not , spoofing is hard to prosecute and almost never is. Day traders often place large orders and wisely have to cancel them as the market moves against them. In any case with bitcoin this much ado about nothing and is really par for the course for trading on any major asset. In a robust market for cryptocurrencies, if bitcoin with a $60 B market cap can survive this "spoofing" , it will only get stronger in stability. Also, this is largely why Level II quotes became largely useless years ago in the markets, and clearly seeing the order book in cryptos has to be discounted in making trading decisions as well.

This is still a great post to raise awareness of the issue.

I upvoted because the article is a good find.

Where there's wealth involved, there will always be somebody out there to cheat, or work the system to their advantage.

My thinking with this and any other investments, Is let the wales do what they will. They are only playing the players. Eventually the Mass rules the Market. If you believe in your investments - Your in it for the long haul. Short term profits are dangerous to chase and hard earned.

Diversity is key in Investing.

When one things up, another is down and vice versa.

Have some good ole cash on hand for everyday.

Hold some real estate if you can. It crashed here in the USA, but is clawing it's way back now.

Hold some Stocks - They crashed in 2000, and 2007 and both times climbed right back out.

Hold some Precious Metals - Not the Certificates, but the real thing.

I'm personally not a bond Holder, but sometimes those are good to have also.

The Trick is not to have to liquidate a holding when it's down.

If a Whale drives a commodity your holding way up, and there's something you want to buy to make life easier, that's the time to do it.

What if our hidden trader is actually a central bank??

If a large powerful entity were targeting any crypto they could drive it up or down with ease - and the larger banks could do this even on bitcoin which even as the largest crypto is still thinly traded at any given time. It may require a quiet period of accumulation of coins which may drive the price up and then the entity could act as an operator to short it into oblivion

There's no doubt there are lots of corruption in the crypto space....also few months ago an Ethereum trader turned $50M Ether to $200M+ worth of Ether...How can someone buy this much Ether??

As long as Crypto being evaluated in fiat currency it also gets corrupted, until we price foods and services directly in BTC etc we see same BS.

Then you will get applied tax everywhere, and again you just exchanged paper currency for something you cant "stash for rainy days" and got more tracing coverage on money flow worldwide.

Basically, if we take Steem for example:

To move Steem to real money in Thailand, i need to pay 14% from my earnings, losing additionally on currency value oscialations. If you add tax on it, how much i earn really ?

Conclusion:

In few years everything will be the same, Europe will ended up working for BTC exchanged from EUR/GBP and over tax on it plus fees, we will be paying 40% or more all the fees and taxes to get our BTC earnings.

If you get caught in exchange with wallet full of money gets rigged or dropped, you can forget your future.

So, who to trust ? Cash in the safe. Until BTC/Crypto wallet can be implemented under the skin with life-time warranty and SSL that cover 1M USD damage :)

I would trust my coins in physical wallets! :)

Who cares?

Markets present opportunities for this. If someone wants to risk their assets and try to send signals about demand/supply to drive others behavior, so what? All parties involved are freely choosing to take the actions they take, and all parties know the risks.

Attempts to regulate this kind of stuff only puts a corrupt, inefficient structure in place of what might emerge as self-regulating adjustments by all parties.

Thanks for Info @sky77

Congratulations, good article hits

I read about this today. Very interesting stuff. I expect someone is making lots of money from this

Amazing

Upvoted! Wow....this is news to me. There's still money to be made in crypto tho.

I want to invite you to a challenge my friend. it makes me happy if you like to find answer of my puzzle.

https://steemit.com/game/@beautypics/play-game-201787t20314584z

Interesting..but nothing new.Whales are controlling the market.Look at Polo for example,last few months every coin was pumped high,now almost all are dumped.All pumping bots are "offline".It's easy to see that something is going on here..How can every coin on Polo be pumped high??who is buying all that??Im not sure,but i think that someone or more people are playing their games there...

I wonder who it is :o maybe someone amongst the global elites or a corporate entity???