If you’ve paid attention to the Dapp and token listings in Wombat, you might have noticed the terms Equilibrium, EOSDT or NUT since a few weeks ago (or, you might just know what all of that is, then you can safely skip the intro). This guide will explain what all of that is, what’s cool about it and how you can start earning EOS, EOSDT or NUT tokens in no time.

What’s Equilibrium?

Equilibrium (equilibrium.io) calls itself the “All-in-one interoperable DeFi hub”, so to understand what you can do, you would need to know Decentralized Finance (DeFi) generally is. In a nutshell, DeFi subsumes all kinds of applications running on a blockchain which reflect traditional finance products like credit/lending, investment pools, exchanges and many more. There is infinitely more information about DeFi in the Coinbase Blog or dedicated resources like DeFi Pulse. Here, we will rather talk about the example at hand.

One of these applications of DeFi are stablecoins. Stablecoins are tokens with the value determined by a real-world asset (mostly US-Dollars). Therefore, they reflect the value of this underlying asset but can be used in any context of their home blockchain. Less technically: a stablecoin pegged to the US-Dollar is — pretty much — always worth one dollar.

Right now, the main asset of Equilibrium is EOSDT, a dollar-pegged stablecoin that is backed by a certain amount of EOS tokens. These tokens enable the EOSDT to be stable in the price instead of fluctuating just like EOS itself, or most other of your favorite tokens.

How does this work?

This might get a little technical, but we assure you, it’s nothing you can’t handle. Still, if you feel like you may get overwhelmed, we’d recommend reading up stablecoins in general first.

The amount of EOSDT that you can borrow from the smart contract depends on two factors:

- The amount of EOS you’ve locked up

- The current price of EOS in USD

The basic principle is:

Equilibrium users can lock up some EOS, which is then used as a “collateral” to create EOSDT stablecoins. It’s kind of a loan — you ‘offer’ some EOS to Equilibrium as a safety deposit to seal the deal, and in return, you can borrow a proportional amount of EOSDT tokens that you can use for, basically, anything you want. EOSDT can be freely transferred on the EOS blockchain, so if you want to pay your friends or a merchant with some stable currency (pegged to the US-dollar), you can use EOSDT. You can also use EOSDT to buy other tokens, or you can also buy even more EOS with those EOSDT tokens and lock those EOS up to get even more EOSDT.

To ensure the token’s stability, Equilibrium sets a minimal value ratio of the EOS you stake against the EOSDT you get. Currently, the minimum ratio is set at 1.4 to 1 or 140%. That means, in case the EOS price suddenly drops, and the value of the EOS you locked goes below 130%, your EOS in this safety deposit will be used to buy back EOSDT. It’s a pretty complex process, but you can read more about in the EOSDT Knowledge Base if you’re curious about all the details. In any case, these are the base mechanics that make EOSDT stable — anyone using the coin can trust that it’s always backed by enough collateral and therefore is actually worth at least one dollar.

If you want the EOS back that you’ve locked up, you’ll have to return the EOSDT tokens. In case you don’t have them, you’ll have to buy them from somebody else, first.

More specifically, the ratio between the value of your EOS locked and the EOSDT borrowed needs to be at least 1.4 : 1 (the “collateralization ratio”, in this case, 140%) when you initiate the process. This collateralization ratio ensures the stability of EOSDT. In case the EOS price should see a sudden drop and your collateralization should fall below 130%, your position will be liquidated, meaning that your EOS will be taken from your ‘safety deposit’ and used to buy back EOSDT. It’s a pretty complex process, but you can read more about in the EOSDT Knowledge Base if you’re curious about all the details.

NUT tokens

Again without going into too much detail, Equilibrium’s Native Utility Tokens (NUT) are used for the governance of the Equilibrium DeFi hub (e.g. NUT token holders could vote to increase or reduce the minimum collateralization ratio), and they give you a few other perks like staking, Block Producer voting or priority in the liquidation auctions.

How you can earn with Equilibrium

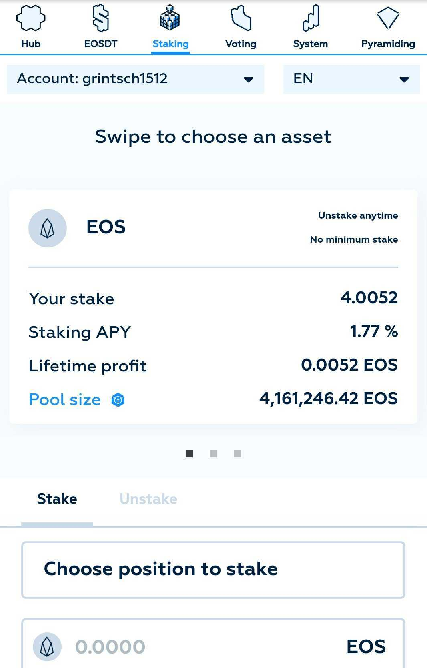

Next to the EOSDT stablecoin product, Equilibrium offers a staking pool product in which you can stake EOS, EOSDT or NUT to receive interest.

The EOS pool

You can stake EOS to receive interest paid in...drumroll...EOS! This is probably the simplest possible product out there to receive interest in EOS on your EOS holdings: no technicalities, no minimum amounts, no voting, no risk, unstake anytime and comparably high interest rates (currently about 2% annually).

In order to stake into the EOS pool, open the Equilibrium app in your Wombat wallet, tap the Staking icon in the top navbar (on mobile devices), choose the amount of EOS you want to stake, and off you go - you’re now earning about 2% annually on your staked EOS!

NB: If you’ve locked up EOS to borrow EOSDT, these EOS will be staked automatically to the EOS pool.

The EOSDT pool

If you’ve borrowed EOSDT by locking EOS, or bought some EOSDT, you can also stake your EOSDT tokens in the EOSDT pool. There’s a minimum of 1 EOSDT to be staked here. The interest rates, however, are currently much higher, about 12% APY (Annual Percentage Yield) at the time of writing. The interest rates depend on the overall amount of staked EOSDT compared to all other assets locked and staked within the Equilibrium ecosystem, so they might fluctuate. For that reason, make sure you check your positions regularly to see whether you’re still getting a good deal.

The NUT pool

Next to the benefits mentioned above, you can stake NUT tokens to receive interest. Staking NUT tokens is much more rigid (minimum staking duration of 10 days, minimum staking amount of 2 NUT), so it’s for the more advanced (or adventurous) people.

As opposed to EOSDT, the supply of NUT tokens is strictly limited to 10 million which makes the token pretty scarce and therefore pretty expensive. One NUT is currently traded at around 22-24 USD.

However, the interest rate you’re getting on your staked NUT tokens currently is above 9%, so you can accrue even more of an already scarce token. Again, the interest rates might fluctuate, so holding and staking NUT is for people with an interest in the future of finance and a bit of a long-term vision.

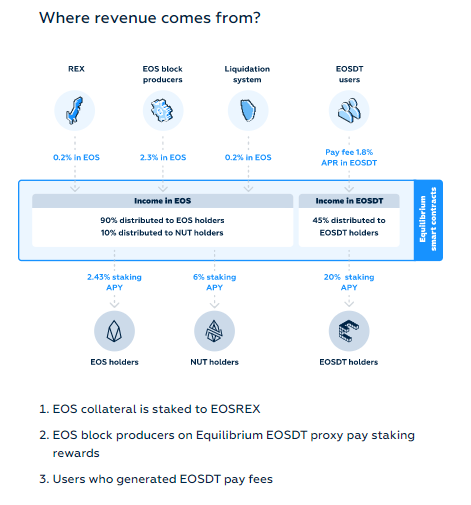

Where does the profit come from?

You might ask: where are all these interest payments coming from? Who’s paying them? The answer can be easily found on the Equilibrium website (scroll down on the Staking site) and it also explains why these rates can fluctuate:

Conclusion

Equilibrium is a great project if you want to get acquainted with Decentralized Finance in general, and it’s pioneering DeFi on the EOS blockchain - a sector that’s already huge on the Ethereum blockchain, but hasn’t spread as far on other blockchains. The currently existing Equilibrium products are only the beginning of a vibrant DeFi ecosystem on the EOS blockchain, but already offer two of the most coveted DeFi function there are: staking for interest and stablecoins.

In addition, Equilibrium is the simplest way of earning interest on your EOS holdings, so grab your Wombat wallet, and start earning right now!

Congratulations @wombatapp! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!