Based on the current borrow/spend levels being undertaken by the US government (and I presume most governments), it is not far-fetched to assume some level of hyperinflation is on the near horizon. Especially when the rampant, out of control borrowing is being coupled with a severe breakdown in supply chains (food). It’s to soon to adequately predict what the job market will look like as restrictions begin lifting.

For those who feel economics is beyond their ability to understand, here is a short video that explains in very simple terms the way monetary creation controls the vast majority of inflation, as it is an instrument of debt creation which by its nature demands there be inflation.

Once you understand how the money cartel creates this money from nothing, then loans it against sweat and goods not yet realized, it allows for a better understanding on how these debt instruments called currency create inflation.

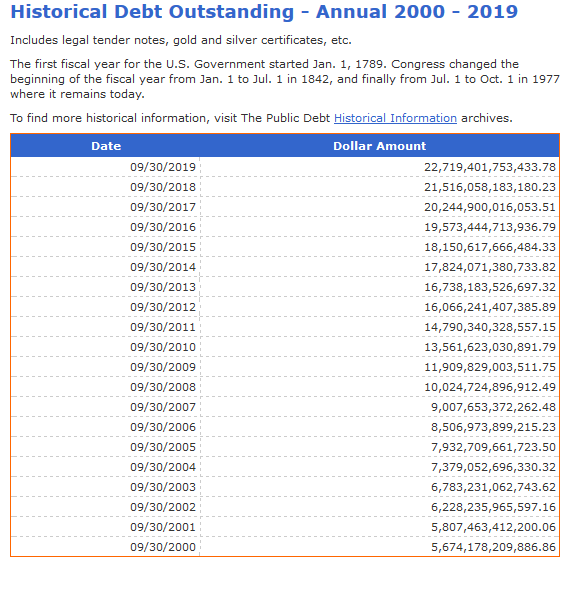

Think of it as an economy being a pie. The currency used being slices of that pie. Whether you have 5 Trillion slices, or 22 Trillion slices, that pie is still the same size. Here is a graph showing the slices from years 2000-2019.

Without arguing technicalities over growing GDP and as such what is real or illusion, it’s safe to assume that the slices being created far outstrip the growing of the pie. This in turn causes inflation, or what is probably on the horizon, hyperinflation.

We saw a small flavor of this in the US back in the seventies, when to fight the manufactured oil crises the Federal Reserve was printing money faster than they historically did, much faster. Keep in mind that it was during this same period that imports began impacting our manufacturing base, our jobs fleeing to other nations. I’ve always suspected this was one of the measures they took to hide the inflationary affects their accelerated currency creation were having.

In the seventies, folks began borrowing money for all sorts of endeavors, speculation running rampant as most every investment looked great as the cost of inflation almost guaranteed a profit after the loan interest.

Then, the Federal Reserve reversed course abruptly, whereby they not only halted creation but began destroying the money supply. Shifting us an inflationary to deflationary pie. The subsequent results being many farmers lost their farms, bankruptcies became epidemic. Speculators such as the Hunt brothers (trying to corner the silver market) were a drastic example of this practice. Despite the pain, this detraction created a massive consolidation of wealth among the upper echelon.

Enough with the history lessons, as there are many. Post WW1 Germany is a great study on hyper inflation for those curious on learning more.

From the chart I used above, one can see the rapid acceleration in borrowing taking place over the last 19 years. Based on current projection on borrowing to fight the pandemic ramifications forced upon us, they will easily be adding 4 Trillion dollars to that. Add another 1Trillion for the normal spending on credit they are using in recent years, that's an addition of 5 Trillion dollars this year. Which will jump our debt from 22.7 Trillion to 27.7 Trillion approximately.

I’ve watched over the decades as prices have shot through the roof. That .25 loaf of bread years ago now costing 3-5.00 is one of many examples. I remember buying Kraft mac and cheese 4/1.00 as well.

As the out of control borrowing/spending continues, prices will accelerate upwards at a speed to catch up. There is no signal the fools holding the national ~~ checkbook ~~ credit card WE HAVE TO PAY BACK can get a grip on their spending addictions. Even if they were to stop right now, the ramifications from all this spending are going to be painful, especially to upcoming generations behind us.

There are some steps you can take to minimize some of the fast approaching pain.

Stock up on necessities.

Look for ways to become more self sufficient. This could be gardening, learning to cook, etc.

Learn new skills. As money begins collapsing in usefulness for the lower spectrum of society, barter will increase as people look for ways to survive now that the government is no longer playing daddy. Skills can range from mechanical, hunting, etc. The focus should be on practical skills that address needs and not desires.

Diversify your savings. I know many have no savings, but it’s crucial you start one asap. Chances are (if you are in the US) the government is handing you money right now. Probably more than you normally receive. After paying your bills (do pay those bills), don’t just spend the rest frivolously. As you stock up on food to make it through the upcoming shortages, put the rest to good use. Invest in practical goods that can be bartered. Invest in precious metals. Lastly, put some into crypto. Just remember, at the end of the day one can’t eat a metal or a crypto.

Co-ops are a great idea, and now might be a great time to talk with those close to you. Begin planning on worst case scenarios and how you could team up to be stronger as a group. This can be especially beneficial if some in your circle has land they aren’t using to grow crops. Depending on the size of your circle, mini economies can be created. A book from 1970 called Future Shock foresaw many of the implications of people distancing from the neighbors and families. Any way we can mitigate this and grow closer to those close to us will greatly aid in transitioning to self sufficiency as local/small groups.

Here are some examples of what I’m talking about.

This below website specializes in using an in-house currency for businesses to trade services without using fiat currency directly.

https://www.bizx.com/how-it-works

Suppose you are a barber/hairdresser. You participate in such a network, and accrue credits in their in-house money for providing your services to members. Next year, you need dental work, or want a deck built onto your house. You trade in your credits to a skilled member to do just that for you. This concept allows bypassing restrictions placed under the current debt currency model, allowing an exchange of services, not fiat.

A quick note that crypto, such as Hive, would have a use case in such an in-house system.

Want to grow crops but don’t have land of your own. You can use a site like Shared earth to connect with others willing to rent you the land. Reviews I have read say some of the landowners will accept payment in the form of a percentage of the crops you grow.

As the monetary policies loom on the horizon, now is the time to plan ahead. Planning that will involve thinking outside of the box. The money masters created this box of what we consider normal, and the sooner we create our own normal the less severe the upcoming punishment will be. Everyone of us can be a leader if we choose. Those we love deserve this from us.

In closing, I will leave a quote from G. Michael Hopf.

“Hard times create strong men. Strong men create good times. Good times create weak men. And, weak men create hard times.”

Good stuff, thank you!

Stay safe

Nice tips around mitigating hyperinflation which so many are predicting. Also, nice closing quote. I'm glad I stopped by for a read. Thanks for posting.

Thank you.

Always been a favorite of mine.

Love the quote in the end because it is so true.

It's very hard for many people who have remained with no salary at all. It looks like everything is going to shit and governments all around the world don't care about simple workers who can't feed their children.

How long until we can't stand this anymore?

Hey, @practicalthought.

If we weren't still the primary reserve currency for the rest of the world, we would have hit hyperinflation before now. The Weimar Republic never really stood a chance. But since we've been spreading out debt out over 60-70% of the world (or whatever it is), we've somehow kept this smoke and mirrors house of cards we call an economy going, along with a lot of innovation and hard work from the rest of us. I certainly don't want to discount the GDP, which I hope doesn't significantly count the stock market, or we're double ginormous trouble.

All very good advice. I might check into the land share deal. I'd be surprised if there wasn't somewhere in the valley here doing that, especially since farming has become so corporate, you can't make a decent living on smaller acreage like you might have before.

Kind of like bitcoin mining. Funny how that comparison just popped into my head.

Yeah man, self-sufficiency is OP. If you got assets, diversify for sure. Coops are good networking and social self-sufficiency. Good luck to us all in the coming devaluation of fiat currency.