If you don't think inflation is coming, even more than it already has, look at this:

(Source: ~~~ embed:1014141782437842944) twitter metadata:Y2hhcmxpZWJpbGVsbG98fGh0dHBzOi8vdHdpdHRlci5jb20vY2hhcmxpZWJpbGVsbG8vc3RhdHVzLzEwMTQxNDE3ODI0Mzc4NDI5NDQpfA== ~~~

Almost a 2% yield on a 3 month treasury.

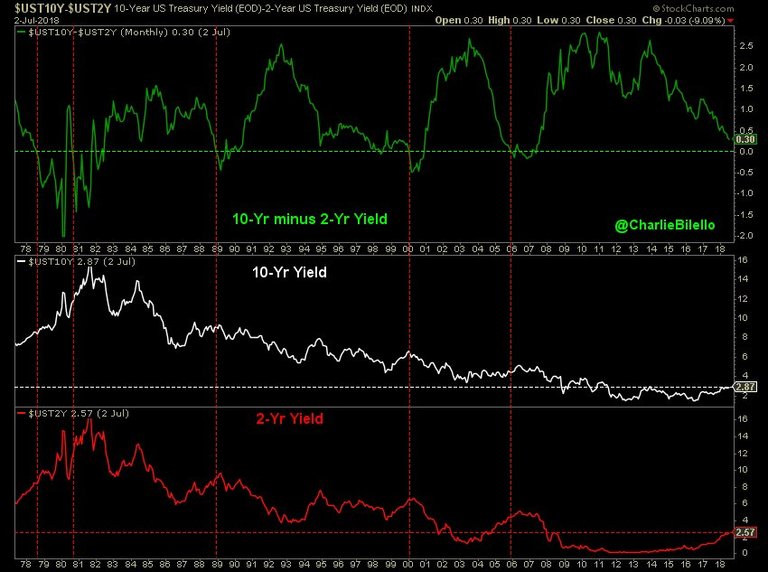

Also take a look at the spreads:

(Source: ~~~ embed:1014145085024370688) twitter metadata:Y2hhcmxpZWJpbGVsbG98fGh0dHBzOi8vdHdpdHRlci5jb20vY2hhcmxpZWJpbGVsbG8vc3RhdHVzLzEwMTQxNDUwODUwMjQzNzA2ODgpfA== ~~~

The difference between the 10-year and the 2-year is the smallest it has been in over 10 years.

Last time we had this small of spread, we were a couple months away from a recession.

Dun dun dun...

Hummm! Very interesting 🧐

Get your water, food, gold, guns, and bitcoin and hunker down!

well, after such a long run a recession wouldn't be very surprising. Most probably it is only a matter of time.

My thoughts exactly. They average one every 5 years, it has been 9 years since the last one ended.

I don't think there will be a recession based simply on technicals however if there is a fundamental shift during this time then the markets will react with more volatility than before. This might create a correction which is desperately needed, but I doubt we will enter a recession unless Trump massively fucks everything up.

Bitcoin's next catalyst will be adoption, not speculation. Once an FDIC insured index or mutual fund gets listed on NASDAQ we can guarantee moon lol

Adoption may be spurred by crashing prices of everything else. :)

Yes and no. I think the tech itself will create adoption. If a company has an unsolvable problem that needs to be fixed and crypto tech has the ability to fix it then we will see big players bring adoption.

I was at NY consensus and I saw more than my fill of companies starting up knowing damn well they aren't going to last. They got theirs, but nobody else gets theirs.

Right now bitcoin is still not as preferable to gold or bonds which replace dividends with yields.

Yes I agree, the technology will spur adoption. I was mostly making a joke that crashing prices may speed up that adoption as people scramble for a store of value. Though it isn't really clear how bitcoin will hold up during a recession, it hasn't existed during one yet here in the US.

Great post. The yield curve will invert in Dec, the Markets will peak a year later, followed by a recession in April 2020.

Interesting, though I think we are closer to the market peaking, and a recession, than this model indicates.

Total agree, the Markets are topping out now.

I am thinking so as well. Though I think this will be more of a "typical recession" in terms of magnitude. Not like the great recession, and also not "the big one" people are talking about.

I think it will be worst than 08. Consumer / government debt higher than before, interest rates are not as high as before, so government doesn't have a lot of a lot of fire power, China and Japan don't want to buy our bonds/debt any longer.

They have been saying that for years, yet the buying continues. As long as the dollar remains a reserve currency the debt literally does not matter. However, perhaps bitcoin is the beginning of the US losing that world's reserve currency advantage...

I think the dollar will lose is dominance as the #1 world currency in the future.