By Leon Fu Dot Com, @leon-fu The Oracle of Austin

I read an interesting article on investing in alt coins by Willy Woo:

http://woobull.com/startup-investment-analogies-applied-to-alt-coins/

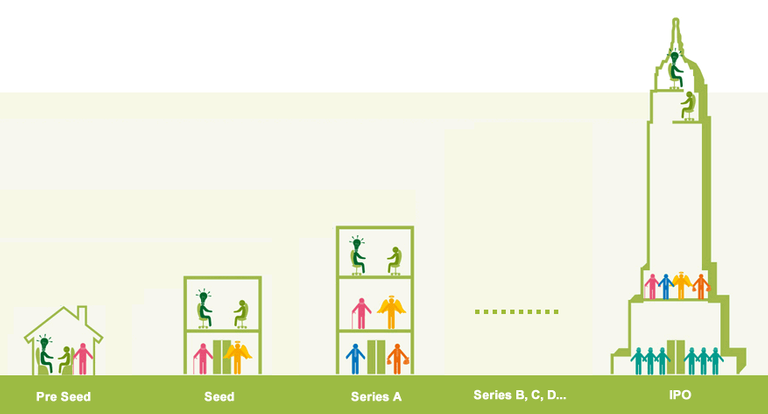

I agree that investing in alt-coins and cryptocurrencies is analogous to investing in tech startups. Common knowledge is less than 2% of ideas pitched to VC's get seed funding. Out of these, 2%-5% of those survive to receive their Series A funding, and finally 10-15% of Series A funded companies survive beyond that. Willy Woo called this "sobering", but should it be? I don't believe it is. Knowing these statistics, what is an investment strategy where we can make big profits?

The first thing to realize is that, no matter how risky, you can't lose more than 100% of your investment. If you put 1 BTC in, there's no way you can lose more than 1 BTC. In fact, I can't think of many alt-coins we considered investing that lost 100%. The maximum loss was 80%-90%, but even Bitcoin has had 90% draw downs over the years.

If the probability of success is so low in tech investing, why is there so much money being invested? The answer is because the returns are absolutely MASSIVE. Investing in Bitcoin returned literally 10,000 times your money or 1 million percent. Ethereum is currently trading at 40 times its ICO price in just two years. These returns are not unusual. They're inline with other successful well known tech startups that went on to IPO such as Google, Apple, Facebook, Dell, Microsoft, etc.

For this exercise, let's say just 3% of seed funded startups make it to their Series A round. Let's say you did no research or vetting and invested in a random sample of them to get close to this 3% success rate. If we use Ethereum as an example of the returns of successful seed round that makes it to Series A, that was ~40X return. If there is a 3% chance investments such as Ethereum succeeded, the expected value of a $100 investment is:

$100 * 40 * 3% = $120

Let's say the other 97%, we suffer at 50% loss on average:

$100 * .5 * 97% = $48.50

Summing the two gives us our expected value (EV) $168.50. In other words, if there is a 3% chance we earn 40 times our money and a 97% chance we lose 50%, our EV is $168.50. Let's say that it takes 2 years on average to go from seed stage to Series A, as Ethereum did. That's a ~30% return by randomly investing in seed stage projects.

But it doesn't end there. There's a 10%-20% that a Series A investment goes on to a Series B, C, D, and finally IPO. If we assume there's a 15% chance that Ethereum goes from $1 billion to $10+ billion where Bitcoin is, that is >10X our investment:

$120 (EV from our seed investment) * 10 * 15% = $180

Assume we still have the $48.50 from our other losing investments gives us a total of $228. If it takes 5 years for this to play out, that's an annualized return of 18%.

These statistics are without considering, research, performing due diligence, or trading strategies. These are the returns we might expect if we did a passive buy and hold strategy, which doesn't occur in real life.

Even so called passive investors who buy and hold index funds such as S&P500 are not really passive buy and hold investors. The fund managers are constantly rebalancing the fund to keep them in line with the index. The publishers of the index (i.e. S&P) are doing research to decide which companies get added and removed from the index. Their low cost come from the fund not doing any of its own research and relying instead on the research of index's publishers.

The most important factor is your trading/ investing strategy.

Most people suffer unnecessary losses when prices go up by chasing greater gains when they should be hedging/ taking profits.

Just because a crypto does not succeed (in the long run) does not necessarily mean an investor cannot make a profit during the ride.

Absolutely. We'd certainly would like all our investments to survive in the long run, but most of them won't. Hedging, and rebalancing our investments is crucial to success.

A great article. Thanks for sharing. Happy to upvote and share this on Twitter✔ for my followers to read. Now following and looking forward to reading more of your posts. Cheers. Stephen

Disclaimer: I am just a bot trying to be helpful.

Hi Stephan please could you help upvote my posts on my blog please. Cheers Andrew.

Hi Stephen will you please check out my post related to Cryptonews in India. Upvote will be appreciated. Love from India. Cheers