In order to understand Technical Analysis you must first understand why it works. When we think about Technical Analysis we think about statistics, charts, graphs and numbers but at its heart Technical Analysis is based on human emotion.

The History

Technical Analysis can be dated all the way back to the 1600's in Japan where it was implemented by Homna, 'the god of the markets'. The reason that the same strategies work today, a staggering 400 years later is because of the consistency of human emotion. A skilled technical annalist can recognize a moment of excitement in a market(bullish) or a moment of fear(bearish) and capitalize on that.

So what information do you need in order to analyse a market?

All you need is the naked price action, this is the raw data that tells you the price history of whatever security you are researching, from Facebook Stocks to penny stocks. You can get this information from any online trading site in the form of candlestick graph/chart.

What is a candlestick graph?

It is a style of financial chart used to describe price movements of a security, derivative, or currency. Each "candlestick" typically shows one day, thus a one-month chart may show the 20 trading days as 20 "candlesticks"

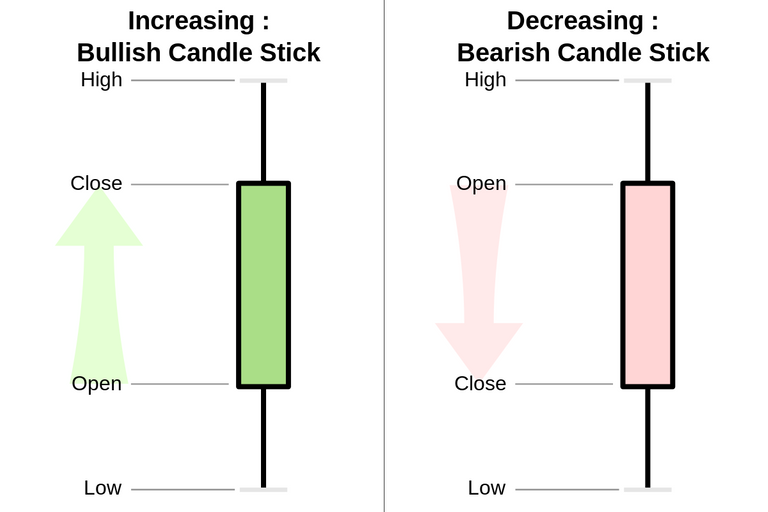

There are two types of candlesticks, bullish and bearish. A bullish candlestick is green and indicates an upward trend and a bearish candlestick indicates a decline within a certain time period.

If you are looking at a day chart, each candlestick represents one day of trading. Similarly if you are looking at a one year chart each candlestick represents one year of trading. So now you know if the value of an asset has risen or fallen, but by how much? This is where the wick comes into play(the straight thin line at the bottom and top of the candle). Imagine that the wick goes right through the main body of the candle. The very top of the wick signifies the highest price within the time frame and the very bottom, the lowest point. For example if you are looking at a 24 hour chart and the top of the wick is at 10 and the bottom is at 3 that means that the highest valuation of the asset was 10 and the lowest was 3 within that time frame.

The main body of the candle stick is a little more complicated. If the candlestick is bullish(green) then the bottom of the main body is the opening price and the top of the body is the closing. If the candlestick is bearish(red) then the bottom signifies the closing price and the top the opening. So basically if the main body of a bullish candlestick starts at 2 dollars and finishes at 4 this means that the price opened at 2 and by the end of the time frame it closed at 4. Whereas in a bearish candlestick this would mean that the price started at 4 and finished at 2.

This is the very basic knowledge you need to begin learning technical analysis, if you would like to see part two please support me with an up-vote and give me a quick follow so you do not miss out!

Congratulations @dylan607! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

Congratulations @dylan607! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!