“Those who refuse to learn from history are condemned to repeat it”

This site was started to bring sound, logical evaluation to Crypto. It seems, however, that we are dealing more with the chaos signaling what many believe portends an imminent adjustment in Crypto. Lately, it’s taxes, trading and ICO scams, fraudulent marketing, etc. If you read any of our previous pieces, you know we are very concerned by these events.

Web gurus say that if you had crawled the internet before 9/11/2001, the terrorism traffic was there for anyone to see. There are bots now that monitor web traffic world-wide and accurately predict political and financial events. This technology is a vital part of the US defense system against terrorism.

Have any of you noticed lately that the traffic on the web is increasingly about doom and gloom and the Government/s taking over? Have you noticed the rise of web traffic related to government intervention, government adoption of blockchain or a US digital currency? China, Japan, and a dozen other countries are exploring digital currencies. There are internal blockchain beta tests running at multiple US agencies as I write this. Many of the huge international banks are talking about their own digital currencies. Over a hundred private blockchains exist that are being used at private corporations.

Have you noticed the increase in new crypto currency listings? New tokens are averaging 20 per day, and with them, the likelihood that more and more of them are scams is very real. This is all seemingly very familiar for some of us. It’s like a melody stuck in your head that you just cannot shake free of.

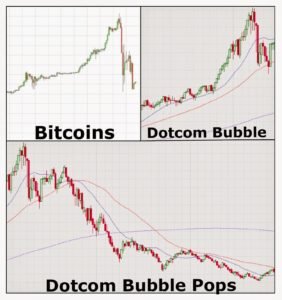

Unless you were born before 1985, it is likely you are only peripherally aware of the dot-com bubble that burst in 2001. You may know it happened, but you many not understand why. The reasons are applicable to Crypto and since history repeats itself, let's investigate the .com model and apply it to cryptocurrency and blockchain tech.

When the internet started it was a novelty. But as I’ve said in other posts, new technology always breeds new and bigger businesses. It was’t long before the fad became the future, as main stream companies found ever more creative ways to utilize the web. Soon their business presence increased and it was not long after that the the smart and not so smart money moved to internet companies. This is when there was a flood of Dot COM IPOs hitting the Stock market daily. Money flooded to these new companies. Existing companies saw this and many changed their names, adding ‘.com’ to their corporate identities. We had companies like “www.buyahammerhere.com”, “www.toiletpaper.com”, “www.wemakenothinganddontplanto.com”, and people gobbled them up.

In the 90s a good stock had a profit to earnings ratio (PE) from 6:1 to as high as 10:1 - 14:1 even in some cases.

From Wikipedia:

Simply put, the p/e ratio is the price an investor is paying for $1 of a company's earnings or profit. In other words, if a company is reporting basic or diluted earnings per share of $2 and the stock is selling for $20 per share, the p/e ratio is 10 ($20 per share divided by $2 earnings per share = 10 p/e).

That’s pretty clear, right? Well the dot-com craze created such a frenzy, that stocks were opening at $10 on the IPO day and closing at $100. Reasoned, logical investment strategies based on company performance were abandoned. Companies without financials became the norm. All it took was a good story. Write some gobblediegook in a prospectus and you had a dot-com business. Company future potential became the new investment religion. What you were going to do became far more important than anything you had done. No experience needed. A 23-year old CEO still living with mom, no problem. People bought a stock on Tuesday for $25 because someone who bought it on Monday for $22 was willing to sell it. Many people who got in and right out early made millions. Value and earnings were no longer part of the equation. Companies with 7 employees and $500,000 in annual sales had market caps of $500,000,000. PEs rose to 100:1, or 500:1, or 3000:1. The main reason for this was that almost no one understood the technology. Companies were making outrageous claims that the technology was years away from supporting. Some knew this and tried to tell but they were drowned out. Why? Because people were making millions. Sound familiar? The money they were making had nothing to do with the utility of the technology. It was coming from other American’s life’s savings.

The dot-com craze was the largest person to person transfer of wealth in history at the time. Stocks weren’t growing from company value. You had it and I wanted it. How much? No one knew what would happen or who the winners would be. But everyone knew big things were on the horizon, and they wanted their piece. And they were right. Amazon, Google, Facebook, Twitter, You Tube, cures and treatments for conditions that had plagued mankind for millennia were on the horizon. People new to the market no longer wanted to buy 50 shares of a solid $100 stock that might grow slowly to $150. No, they wanted to buy the 1000 shares of the $5 stock that might grow to $100 next week. School teachers earning $30,000 a year were making $200,000 annually in the market. Sound familiar? Our own CEO - Jon, made his first million off less than a $2000 input.

At Crypto Criterion we are not preaching common sense or that sound analytics be applied to cryptocurrencies because we invented the concept. We’ve seen what happens when frenzy rules. Tech does not create the bubble. Greed and ignorance create the bubble. One saving grace for many intelligent investors in 2001 was the controls and rules the government applied to the market through the SEC. The really smart money was short in 2001. They saw it coming and made billions overnight. But with Crypto, there is no SEC. There are no shorts. There is no safety net. And when thousands of these penny cryptos with no actual business or sales crash, there will be nothing to stop the fall.

For those of you opening wallets and getting ready to sell your crypto, STOP. There is more bad news, but there is GOOD news too.

So what happened in 2001? At the time, Human Genome tech was riding or driving much of the bubble. The bubble was real, just like the housing bubble of 2008. In 2001 the signs were all there. In March 2000, Tony Blair and Bill Clinton announced that Genome research belonged to the human race and should not be protected. The one area of the market that actually represented a real future gain was destroyed in a moment. The Med Tech sector was largely driving the market and it bombed on the release. It fell far and should have been a warning that the rest of the FAKE dot-com market could follow. In 2001 fear finally happened, trading bots happened. Auto Trading happened and before it was removed; computers and panic had crashed the market. One day everyone woke up and asked, “What exactly is the PE”?

Today the market shuts down at a fixed % loss. It takes ‘too much’ panic out of the equation. Why is that important to the government? People in panic run to cash. Crashes create runs on banks. Banks are holding trillions in deposits but it’s just book keeping. Banks use the Bankchain. Your money is a entry in a ledger. It’s all plusses and minuses. And here’s why the gov will get involved in crypto. Remember what I said in another post, technology is just a way of doing something better and faster that's already happening. Crypto is merely a digital/virtual representation of an analog financial system that we all use daily. This is what makes Crypto inevitable.

If there was a run on the banks today, every bank in America would close it’s door within minutes. Most banks don’t keep even 5% of their deposits on hand in cash. The government has about 1.3 trillion in cash circulating in America. There is another 10-trillion outside America. But the cash in banks and investments is about 11-trillion. So if everyone wanted to convert everything into dollars, even if the banks wanted to they could not return/exchange your money. The government could just begin printing hundred-dollar bills right? Sure; it would take years to do in hundreds. Then, ok you have 2000 hundreds. How do you buy milk? The government would need to print 8-trillion 1s, 5s,10s and 20s. It would take 10-years just to make the paper to do so. Good luck. Do you think the people will wait? What do you think happens to the value of the dollar in the mean time? By the time you got your $100,000 life’s savings back you couldn’t buy groceries with it. So the US government needs to create stops to protect us all. We each lose a bit of personal freedom, but we are largely safer. We are not safe.

I told you what happened in 2000, the market fell 24%, but what caused it was inexperienced people entering the stock market by the millions for a decade and buying junk assets. Reckless speculation caused it. 24% you say. so what; right? Crypto does that all the time. Correct, it does, but 24% is only a small part of the story. The DOW represents the average value of the 30 Industrials. (Just 30 companies) So when you read the DOW dropped 24%, that was the very best companies in America, the creme of the crop, the gold. The junk that lost 90% or fell to zero is not reported in that number. If you just lost 24%, no big deal, but millions didn’t have their money on the "Blue Chips" like Bitcoin and Ethereum. They had their money in the 2001 version of "Poor Peoples Cash Coin" (PPCC), or "Save the World Coin" (SWC), and that all evaporated over night.

The housing bubble didn’t happen in 2008 because the US government and Banks made it too easy to buy a house you could not afford. The loan requirements turned houses into the next 90s dot-com stocks. Prices rose until homes were 60% overvalued. POP! It happened because people bought houses they knew they should not have bought.

So what does this all mean? Everything that happened with the Savings and loan, dot com and housing in '08 is happening again, and the SEC is coming. We have done a poor job of managing our own tech. The US dollar is the biggest bubble, not crypto. As the government engages in crypto and begins to regulate it, weeding out the scammers and junk companies will become manifestly inevitable. Millions of people who have invested in those junk Cryptos are going to lose everything. A loss limit order won't help you. There will be no buyers at any price. The US government needed an alternative to the dollar ten years ago and it's likely that Crypto will pave that road. The dollar is 70% overvalued and that’s a sound enough reason to replace it. Here's a little secret that you may not have considered, but will recognize as truth, cryptos are not rising. Fiats are falling and being de/re-valued against what the people have decided is real currency, Crypto. Governments cannot allow 10% of their populations to create a monetary system that causes runaway inflation for the other 90% holding fiat. The realty is it’s time that all currencies are digital. If the US has 1.3 Trillion in currency and 1/3 of its net worth is in non-collectable student loans notes, and you weigh that against it's real debt of 20-trillion and its unfunded debt of 100 to 200 trillion, then the US's debt equity ratio is upside down 100:1. So how much is the dollar really worth? Less than nothing. This is why you see Crypto running away. The lack of faith in fiat is coming home to roost. The question is whether we the people or the governments will control crypto. The US government is beta testing blockchain in numerous agencies today.

With blockchain, the government never has to print money again, the worry about runs on banks is gone forever. The GOVCOIN will simply be a worthless digital form of paper fiat currency with all the same problems except one, the government can now create new coin in seconds and deliver it. It brings a lot of positives with the change, but it will cede many of your freedoms to the government. Right now the government says you cannot use food stamps to gamble. With a Federal digital currency it can set restrictions on currency's use thru smart contracts. It can stop you from buying drugs because it will know where the money goes. It can restrict GOVCOIN from being used in Venezuela, or for products from Cuba, or for guns or ammo for your home, and hopefully brussel sprouts.

With crypto as it is now, we the people determine its value and we have as much anonymity as we wish. If the government installs it’s own crypto it will know everything you buy, everything you earn and everywhere you go. Taxes won't be consensual. To accomplish this requires the chaos in crypto to continue. The government wants the scammers and a"bubble" or crash because the same people who caused it will demand the governments do something.

Here’s the good. It’s all in our hands. We cash fix crypto, or we can watch all it could have been become a memory. We need to stop buying junk. We need to self regulate. Be responsible for the Crypto you buy. We need to stop blowing air into the Bubble. Buy the Blue Chips. Here’s what the gov may be missing. Unlike the stock market with shorts and options, the facts of crypto are different. You can leave the stock market or invest in a new sector. With crypto there is no other sector. You are in or out. The fear of a looming crash in crypto may just be what fixes it. We all know it’s the future. We wont leave it. An adjustment would just force people to put their money into the 5-10 real currencies that MUST win. The faster we see this happen the sooner you will see those coins run away. Imagine if all the speculative money going into get rich quick coins was going into the finite amount of the legit coins. The demand would drive the prices to the moon. The volatility would stop and any government that decided to issue a coin would have to be paired to our currencies, not the reverse.

If you think this is all BS, consider this: There are currently 195 countries in the world; and give or take, 195 currencies that serve 7.5 billion people. "But with Crypto we can have coinage for different sectors." True. There are only 11 or so recognized business/industrial sectors in the world. Even if the Crypto world needed 4 different currencies for every sector and one for each country do you think it more likely the world will need 5000 cryptos or perhaps 200? The world really needs 10 to 20 max that will represent commerce. Which makes more common sense to you, 5000 or 20? Many of the Blockchain companies you are investing in may actually be real bona fide businesses. Please tell me what part of that truth requires a currency? It does not. You want to invest in blockchain companies, buy the stock. You will find most do not have stock to buy.After these "core" coins/tokens are narrowed down, there is nothing stopping decentralized apps from improving upon those blockchains. To paint a house you buy paint, you don't knock it down or build another floor just because.

Try this simple strategy: hedge. Put 75%-90% of your crypto portfolio into the "Blue Chips" and leave it there (HODL). Don't panic when they go up and down. If you want to buy ICO's go ahead, just don't buy a coin because you want it to go up. Buy the ones that you know should go up and have a clear, present, real time utility. Make sure they have a limited suply, make sure they are immutable, and can be stored safely. Ask yourself: even if the company has utility how does that tie to its Crypto value?

Posted from my blog with SteemPress : https://www.cryptocriterion.com/com-bubble-crypto-eyes-wide-open/

This is a great post in many ways but I disagree with you on many fronts.

I believe comparing the dot com bubble to cryptocurrency is a very slippery slope. It's much easier for a business to go under than it is for a blockchain to. The overhead for a business is gigantic compared to a cryptocurrency. A lot of these crypto projects have been funded so completely that their respective teams could afford to work on them for the rest of their lives.

I find your graphs at the top to be very misleading. Bitcoin (and crypto in general) has had that shape time and time again while Bitcoin has been declared dead hundreds of times. Yet, it just keeps going up in value every year.

To me, it makes more sense that there would be thousands of valid cryptocurrencies. That is the nature of decentralization and a cooperative economy. The true power of crypto hasn't even been 1% unleashed. Every community (and perhaps every person) will have their own blockchain as a representation of trust, reputation, and value to society.

The dot com bubble existed within an ecosystem of competition. Crypto does not. Think about how different everything would be if every dot com company was open source. This fundamental difference is throwing people off and causing a Halo Effect of incorrect extrapolations.

Once again, great post I enjoyed reading it. It's always good to absorb as many perspectives as possible. There are tons of scams out there and there are tons of projects that obviously bit off way more than they can chew. Buyer beware, and all that.

Still, I can't help but notice your post comes right at a time where the market crashes, not from a bubble, but from multiple fronts of bad news like the CFTC subpoena on exchanges and CoinRail getting hacked. The market cap support line has proven itself three times now I'm not too worried about price action.

Thanks for your input! The original post on our site www.CryptoCriterion.com was posted in February during the last "crash" of importance. I am simply comparing the situation, not the outcome - if that makes sense. This was not something I wrote today, and/or think applies because of recent happenings. I definitely enjoyed the comment and agree with a lot you have to say!