TL;DR

- Market making is a huge but inefficient industry in crypto. Exchanges and token issuers pay quantitative hedge funds millions of dollars per year to provide liquidity.

- We introduce liquidity mining, a digital marketplace for liquidity, powered by the Hummingbot open source software that lets anyone run a market making bot (read the whitepaper).

- Simulations show that users can earn 10-50% annually while providing the same level of liquidity as a hedge fund. This results in 5-10x cost savings for exchanges and token issuers.

Market making is broken

The need for liquidity is persistent in crypto. Crypto markets are highly fragmented, caused by regulations that force exchanges to silo order books, competition between stablecoins, and technologies like 0x Launch Kit that allow anyone to create a decentralized exchange. Per CoinMarketCap, there are now 21,000+ unique markets (trading pairs), all of whom compete with one another for a scarce pool of liquidity.

We estimate that exchanges and token issuers spend $1.2 billion per year on market making, in the form of fees, rebates, and cost of lent inventory.

Despite this large sum of money spent, market making in crypto is rife with inefficiency, opacity, and manipulation. Ask any exchange and token issuer about their experience with professional market makers, and the resounding message is: (1) crypto market makers are expensive, (2) they operate as a black box; it's hard to evaluate how effectively they are doing their jobs and actually improving liquidity, and (3) economic incentives are lopsided and unfair.

A typical market maker arrangement is a multi-month contract with high monthly fees and additional fees charged per currency pair and per exchange. Market makers force projects to give them millions of dollars of inventory, charge up to six figures per month in fees, and receive a percentage of any profits generated while taking none of the downside. Exchanges and token issuers are effectively funding market makers to go wild at the casino!

While alternative arrangements do exist for exchanges, such as market maker rebates and agreements based on order book uptime, these too can be gamed. Market makers can engage in rebate arbitrage, in which market makers can opportunistically create and cancel orders at select times in order to qualify for rewards while not actually providing beneficial, meaningful liquidity.

How can these market makers get away with this? The problem is that there are only a limited number of quant hedge funds with the technology to provide this service; scarcity has allowed them to hold exchanges and token issuers hostage.

Until now...

Individuals can be effective market makers

Hummingbot is an open source project that allows anyone to create and build market making bots. Launched in April 2019, we currently support 9 centralized and decentralized exchanges and 4 strategies. With 1,000+ installs per month, we now have a rapidly growing global community of individual and professional market makers.

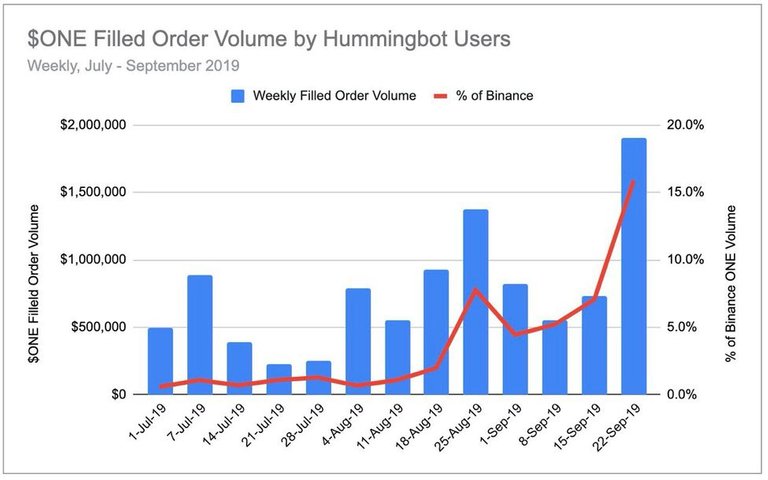

In July, we ran a 3-month pilot with Harmony Protocol to assess whether members of their community could provide the same level of liquidity as a professional market maker. Over the course of 3 months, approximately 70 individuals were responsible for up to 15% of the Harmony $ONE token's overall trading volume on Binance:

Since professional market makers typically generate 10-20% of a token's volume on an exchange, the Harmony pilot proved that a community of individuals could effectively replace a professional market maker.

Now that we have established the basis for decentralized market making, how can we take the next step of expanding and scaling this concept to the broader crypto market?

What is liquidity mining?

Similar to how digital marketplaces such as Google Ads and Uber revolutionized industries such as online advertising and transportation, we believe that a marketplace-based approach can improve matching efficiency, boost transparency, and align incentives in the market for liquidity in crypto.

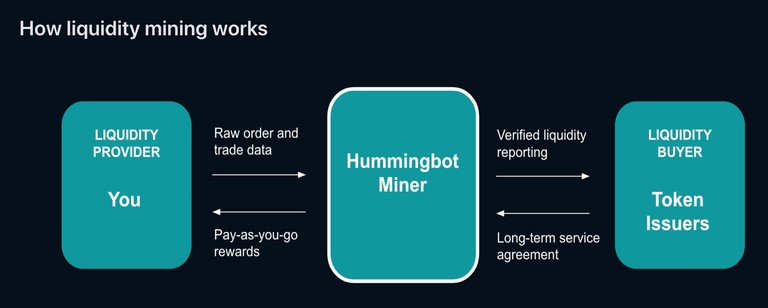

In this marketplace for liquidity, buyers can create campaigns that reward sellers for making markets in designated tokens and exchanges. Reward payments can be mapped to objective, observed actions of liquidity sellers.

We call this Liquidity Mining because the concept is similar to proof-of-work mining. Rather than setting up a mining rig and using electricity, users utilize computational power and token inventory to run the Hummingbot market making client. By competing with other participants to earn economic incentives, their combined efforts can achieve a common goal, providing liquidity for a specific token and exchange. In return, they are compensated proportional to their work, according to an algorithmically defined model. For more details, please see the Liquidity Mining whitepaper.

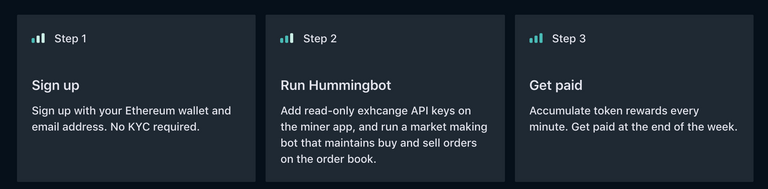

How to get started with liquidity mining?

Liquidity mining enables crypto to realize its potential

Crypto allows anyone to create an asset that can be traded by anyone in the world. But whether it's a liquid global reserve currency like Libra, synthetic Tesla shares powered by UMA Protocol, decentralized sports betting powered by Augur, or digital cats and wizards issued by Dapper Labs, these assets are only valuable if they are liquid.

But until now, the long tail of crypto assets has faced an unfair disadvantage. Due to high costs, traditional market making services have generally been inaccessible to all but the largest, most well-funded projects and exchanges.

Liquidity mining levels the playing field by allowing any project or exchange to get liquidity on a self-serve, pay-as-you-go basis.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://hummingbot.io/blog/2019-11-liquidity-mining/

!cheetah whitelist

They are already whitelisted!

Good cat

Congratulations @hummingbot! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!