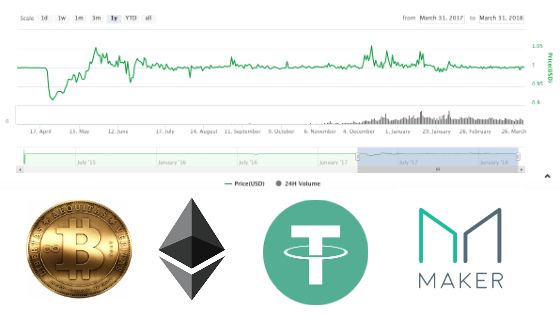

Stablecoins will aid in the adoption and liquidity of crypto assets. Retailers can transact without volatility, and investors can have a stable asset that is pegged to fiat for trading purposes.

Tether has long been criticized as a centralized method of addressing the stablecoin utility. It is vulnerable to central bank confiscation and scrutiny. It also is controlled by a third party and therefore vulnerable to corruption. Tether is not a transparent blockchain where all assets can be accounted for. It's arguably not even a cryptocurrency per se.

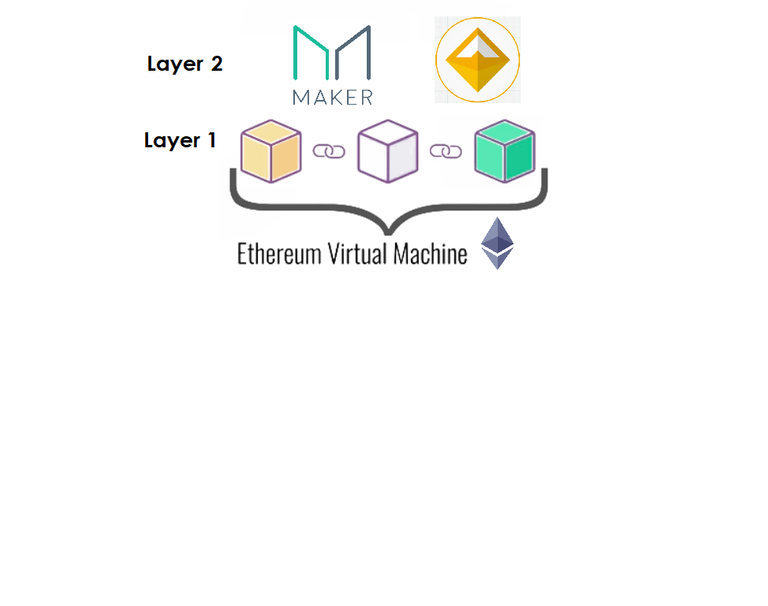

The next generation of Stablecoins such as Maker and Terracoin will incorporate Decentralized Autonomous Organizations to ensure the trust machine of blockchain governs the system.

SPREAD the WORD about DTUBE!!

Happy Investing C# HODLCREW

http://connorkenny.com

https://youtube.com/c/ConnorKenny

https://twitter.com/ConnorLKenny

Find me on steem platforms, @investing

https://steemit.com/@investing

My Favorite Exchange is:

Binance- https://www.binance.com/?ref=10117792

5 steem giveaways! Sub and comment on YouTube video to win with your steem handle/name.

▶️ DTube

▶️ IPFS

HAPPY BITCOIN PIZZA DAY!

I do completely understand that it’s not financial advice. I’m accumulating when we drop to 350 bil.lol They basically want to make new decentralized non speculated unregulated stablecoin. Sounds like a good plan. This appreciation value sounds to me like they will actually invest the funds. It sounds to me like hedge fund in cryptocurency, but I could be as well wrong. Anyway, whether I’m wrong or right this is definitely a great concept once he mentioned “you can create stablecoin of any coins”, and that’s what definitely got me. Nice bonus at the end. 10k bitcoins for pizza. I wish I was that pizza guy that day.

lol I bet whoever got those 10,000.00 bitcoins at that time has already sold it, if not lost it or threw it away. There is word that thousands and thousands of bitcoins are actualy lost and will never be recovered. Forget about 21mil bitcoins in circulation.

"Tether is a stablecoin with a 1-to-1 peg against the USD, whereas the conversion rate is 1 Tether USDT equals $1 USD. For every Tether USDT in circulation, $1 USD is added to a centrally managed savings account as a collateral. However, some people doubt that Tether is actually fully collateralized."

Stable coin” is a term used in cryptocurrency to describe cryptocurrencies meant to hold stable values. For example, Tether (USDT) is a blockchain based asset meant to trade for $1 USD. It is a “price-stable cryptocurrency.”

There are a number of stable coins in circulation today, and a number more have been attempted in the past (with varying degrees of success).

Each stable coin has a unique mechanism, but they all generally work the same way. They hold collateral of some type and manage the supply to help incentivize the market to trade the coin for no more or less than $1. For some, like Tether or TrueUSD, the concept is to hold actual dollars in reserve that are redeemable for the token. For others, like Dai, they hold crypto assets in reserve and have a lending system.

copy paste from here

https://medium.com/@argongroup/stablecoins-explained-206466da5e61

Hence the quotation marks.

A useful currency should be a medium of exchange, a unit of account, and a store of value. Cryptocurrencies excel at the first, but as a store of value or unit of account, they’re pretty bad. You cannot be an effective store of value if your price fluctuates by 20% on a normal day.

This is where stablecoins come in. Stablecoins are price-stable cryptocurrencies, meaning the market price of a stablecoin is pegged to another stable asset, like the US dollar.

It might not be obvious why we’d want this.

Why I believe stable coins is really important for the future of crypto currency is because of it's "Stability"

You would agree with me that It’s precisely the volatility and day-to-day price fluctuation that is keeping the masses away and scared of cryptocurrencies.

Imagine if we can assure reluctant people that the value of their money will be stable and safe within the crypto space, so they can enjoy all the benefits from a decentralized and innovative financial system, without all the risks and fears they’ve been hearing about in the media. Everyone can agree stability is important to encourage a wider adoption of cryptocurrencies.

My own thoughts.

Beautiful explanation you also gave @investing

Yeah. Thanks for this explanation my friend.

Did my own little research too and somehow, I've come to realize that The price of most cryptocurrencies is determined by supply and demand in the marketplace.

It fluctuates quite often and sometimes very drastically.

But then, A stablecoin on the other hand, is a cryptocurrency that has a relatively stable price.

Like one of the commentaries i saw, “A stablecoin will relatively have the same buying power tomorrow than it has today”

And I'm hoping that the buying power "increases" rather than remaining stable. Lol

Thanks for this beautiful explanation @investing

My friend would say Stable coins is the "holy grail" in digital currency.

Generally, Cryptocurrencies are well known for their extreme volatility, as it’s not uncommon to see coins like Bitcoin and Ethereum rise or fall by 10-20% in a 24 hour time frame.

Although this level of volatility is beneficial to traders and investors, it also hampers cryptocurrency’s real-world adoption.

I wanna say from a practical perspective, businesses do not want to transact in a currency marked by volatility and risk. It would be really difficult, for example, to pay an employee’s salary in Bitcoin if the purchasing power of his paycheck is constantly in flux.

Volatility would also make it difficult for consumers to make daily transactions using cryptocurrencies.

But then, I believe this stable coins have come to bridge that gap. At least from what I've read and a little investigation too.

I'm hoping it stays that way or improves.

Thank you for your teachings my friend

#TeamHodl

Maker is an amazing project :)

Was not aware off Terracoin will ceck it out.

Just looked into Terracoin ... seems complerly dead :S I now only see Maker as any good

Connor, what do you think, are we going to see another small dump of BTC before the bullrun can finally break the 10k?

I have a feeling that for more healthy growth it kinda has to fall a little bit one more time :(

Traits that will assist the wider adoption of any stable coin are simplicity all along with chic of concept, comfortable integration points for partners, and power for exchange of work with. However, stability is key. Short-term stability is important for transactions and long-term stability is crucial for holding.

The Tether Platform is painstaking to be quite backed if each and every one tethers in spread is fewer than or equate to all of the fiat that is held in the bank account.

I am pretty sure it is going to add value to the life of investors.

Very well explained Tutorial @investing sir.

You always is a source of learning for us and you always teach us something new.

yes you are right it is the best time to buy.

Thank you so much :)

liked your video and commented on it :)

Tether, the best known stablecoin, is often the second most traded crypto asset after bitcoin. Traders routinely trade in and out of it as they attempt to outmaneuver bitcoin’s price swings. When the markets are down, some will remain in the safety of tether for weeks, venturing back into “proper” crypto only when there are signs of recovery.

Trust in stability is a key factor for investors, so is transact without volatility, the stablecoin has done the magic of combining them both. This is excellent.

Resteemed

Price changes are shocking for a consumer. Stability is key. Stable coins will be a game changer for cryptos to go mainstream

The Tether Platform is fully backed if all tethers in circulation is less than or equal to all fiat that is held in the bank account.

Stablecoins are a very useful tool that provides trust for investors. Big money investors would definitley appreciate such tools, therefore even though Tether utilizes a centralized model, it can still help induce mass adoption. Can't wait for Maker and Terracoin.

Yeah, Tether might be good for now, but you can never know when it might just snap, because it's centralized and it's not secure. Since Tether is widely used, when it goes down, the whole market will go down with it. I mean not to 0 or anything like that, but it will take a huge hit I think.

Anyway, there's definitely demand for stable coins. SBD should've been that stable coin since the beginning, but it's not yet there. I think there's something like Bitshares USD, which is basically a stable coin as well and it's on a decentralized exchange, which is even better.

Are you very sure bitshare is stable? Would do my research on that.

Hi @investing i think Stablecoins could help to open the door to new investors and could help to return confidence to the general public because a more stable market may be safer to operate by anyone. Regards

OK. I was listening to an analysis earlier today and I asked myself a question "who really needs this stable coins?"

Lol. Somehow, I was able to answer myself

Would list a few though

The crypto market is very volatile and there is a high correlation between the price of all major cryptocurrencies.

Even though today this market is mainly filled with traders who profit from this process. there is also a large number of users who could actually profit from value stability and if you take a closer look,

Anyone who wants to save some money as they would do in USD, for example, but away from the traditional banking system and away from the negative characteristics of their nation's economy.

Secondly, Investors who want to “play it safe” for a period of time while a new investment opportunity comes up or during an unfavorable volatility crisis that would occur in the market.

Some Exchanges who want to transfer or store money within the crypto space to escape the costs associated to fiat currencies.

An ICO or those who sponsor an ICO who actually needs to keep a stable value for the money they raised.

So for me, its a good buy.

And thanks too for your explanation my friend

This comment has received a 1.04 % upvote from @speedvoter thanks to: @sadiks.

Talking about stable coins aiding investment in crypto, I was speaking with a friend today and he said exactly the same thing when I said I preferred a constant rise in steem than its seemingly stable state right now and he said that in as much as volatility is good, stability of these coins would attract investors because investorels would love to project their ROI which would be impossible with a volatile crypto.

U might be the only one having this thought but somehow , I dint see tether as a threat. If indeed they are centralised, they only create a competition which would make other decentralised tokens function better. What do you think?

Stablecoins have recently become the intellectual and now well funded darling of the cryptocurrency world. Recent startups such as Makerdao, Circle, Basis and Fragments show how hot this space is. Hundreds of millions of dollars have flowed into projects (some little more than white papers) from established venture capital companies. But the question that remains is “i really need stablecoins”

There is proof that basket goods, are dynamic in markets, which inherently set median prices for other goods, due to resource, or shear value as complimentary/supplementary

Thanks for this post. i have a question though: stablecoins seem to matter now because crypto assets are currently highly volatile, but as the distribution and adoption of main coins happens to a much larger scale, don t you believe the volatility factor will significantly decrease (by way to leaner supply/demand gap for eg?). If crypto assets (or some of them) because way less volatile, as i do anticipate it will happen at some point, why would stablecoins still matter?

Trading altcoins against the most commonly used pairs Bitcoin (BTC) and Ethereum (ETH) is getting less and less popular as the prices of both coins keeps falling lower and lower.

If I would have a large stake in a stable coin and I would want to redeem back to fiat currency and suddenly realize that the money jar is empty, I would be very unhappy. A lack of transparency and audit trails will increase this risk. Counterparty risk does not exist for coins like bitcoin and Ethereum, where market prices are determined without a middle man by supply and demand for the coin on an exchange.

It's fun to enjoy. In addition to it, you write with the ability incredible. Thanks my friend!

Dia will also going to do good, because it is DE-centralize.

Very nice explained by the founder of Tether.

Upvoting and resteeming your post sir :)

For cryptocurrencies to go mainstream, we are going to need price stability. That will give users the confidence in making daily transactions. The full adoption of stable coins will alleviate the worry of having to time your purchase with the volatility of coins like Ethereum and Bitcoin.

A stablecoin is a digital money that is regularly pegged to another steady resource, similar to gold or the U.S. dollar. It's a cash that is worldwide, however isn't attached to a national bank and has low unpredictability. This takes into consideration commonsense utilization of utilizing digital currency like paying for things each and every day.

TrueUSD is building a USD-backed stablecoin that is 100 percent collateralized. Much like USD Tether but legally protected and transparently audited. TrueCoin has developed a legal framework for collateralized cryptocurrencies in collaboration with Cooley and Arnold & Porter, and has a growing network of fiduciary, compliance and banking partners.

Maker is a decentralized autonomous organization that is pegged against the U.S. dollar, but is completely backed by ETH. Their stable coin is Dai and each one is worth $1 USD. Stability is maintained through an autonomous system of smart contracts. To receive Dai, you send your tokens to the Maker platform to lock those tokens up.

Advantages: One of the first in the space (First Mover Advantage), backed by ETH (which is on the blockchain and therefore transparent, unlike Tether)

TheMerkle Stablecoin

Stable coins – otherwise called the "blessed vessel of digital money" – are value stable cryptographic forms of money, with a market value that is pegged to another steady resource, similar to the U.S. dollar. Stable coins share huge numbers of the highlights of Bitcoin, yet are far less unpredictable. In principle, this makes stable coins perfect and usable as a store of significant worth and an essential medium of trade. "Stable coins are one of the keys to bringing the advantages of cryptographic forms of money to regular individuals, both as far as value solidness and decentralization of capital," said Rafael Cosman, the originator and CEO of TrustToken, a startup that has quite recently propelled exchanging for TrueUSD, an autonomously confirmed fiat-sponsored stablecoin that is redeemable for U.S. dollars. However debate encompassing the authenticity of stable coins has turned into an issue. A standout amongst the most surely understood stable coins available is Tether (USDT). The makers of Tether guarantee it is pegged to the U.S. dollar, which means a man would pay $1 for one Tether coin. In any case, various concerns have emerged.

In general, seignorage works as follows by following a rules based system. In the case that the price trades above $1 per unit, the smart contract central bank will issue additional units to increase supply until the price reaches $1, collecting profits (known as seignorage) in the process. If the price drops below $1, the central bank will use seignorage profits to buy up units, thereby decreasing supply and increasing price. If the price is still below $1/unit after the central bank has spent all of its seignorage, the central bank will issue “seignorage shares” that promise future seignorage to buyers to raise funds. This system is predicated on the future growth of demand for the stablecoin. If the central bank reaches a point where the currency is below $1/unit, it is out of seignorage, and unable to sell seignorage shares to raise funds, then traders will further lose faith in the future prospects of the stablecoin pushing its price down into a death spiral. Seignorage shares based stablecoins can sustain some downward pressure, but it is difficult evaluate just how much pressure they can sustain because resiliency is tied to the expectations of seignorage share buyers.

This piece is really informative not just any kind of info but the one that is important to the evolvement of crypto currency, making it more decentralized rather then being liable to corruption like you said. I don't have much details to Stablecoins but thanks to you, I can be boast of saying meaning things concerning it now.

Increased global access to a stable currency: The relative stability of the US Dollar can be underestimated. While expansion gradually disintegrates the estimation of the dollar, this continuous disintegration is exceptionally slight contrasted with the hyperinflation that happens in nations like Argentina, Egypt, and Nigeria, where yearly swelling rates can surpass 15% a year. Individuals in these nations try to hold physical US Dollars to save their riches, despite the fact that capital controls regularly keep nationals from utilizing non-local monetary forms to execute outside of the nation. An advanced, decentralized cash that is generally available and value stable would offer a genuinely necessary option for individuals living in nations with shaky money related frameworks and prohibitive capital controls.

Maker is well positioned to add new exchanges looking for a verifiable, stable, and pegged crypto-currency for trading. While USDt has much wider utilization, Maker may start to take market share for exchanges looking to move away from USDt.

A stablecoin is a cryptocurrency with a fixed price. The price of most cryptocurrencies is determined by the marketplace, where buyers and sellers exchange coins and a price is discovered by supply and demand. In contrast, stablecoins seek to achieve a fixed price, which happens through a variety of means that will be explored in this piece.

Personally, I've come to the realization that In the crypto world, its a bit difficult to circulate dollars due to some restrictions and policies.

So for exchanges that don’t or can’t deal in dollars, having a dollar substitute would greatly help because a dollar substitute would allow you to get out of a cryptocurrency like Bitcoin on an exchange that doesn’t deal in dollars, and to go into a cryptocurrency with a more stable price which would then be mimicking the act of selling Bitcoin to raw cash.

Beyond the use-value for traders and people who also invests, dollar substitutes also allow exchanges access to so much needed liquidity.

Therefore, stable coins would be very important for exchange users, exchange operators, and for the cryptocurrency market as a whole.

So I support it 100%

And thanks for bringing this to many

#Hodl

Awsome video sir

Until now I had the impression that Tether is used as "fridge" (isn't that the case)?

were you could convert values into Tether were its value will always be 1$ and then buy cheaper.Actually i didn't know it is centralized and as a matter of fact nor that it isn't even a cryptocurrency

Oh this makes a lot of sense to me

Stable coins is then an intermediary between a crypto and fiat if I’m not getting this wrong

Tether has advantages as coming close to a like-for-like swap fiat to crypto, well integrated and established

It has disadvantages also; it is Centralized, not trustless, audit refusing

First things first.I have said this before (twice I think) but I am going to say this again. Absolutely love that handle - Luke Steemwalker :-)

Now onto the video and what I took from it - Market is in the 'dippining' stage and this is a reasonable time to Buy back in. Although I think we might only go to around 350 mark before targeting 490 again (short term).

I personally have never been able to trust tether fully. But again I will use your words 'they hold on 20% reserve, which is still better then conventional fiat'. My point is that I might have been able to trust tether fully but I don't trust fiat at all. So given I choice I would rather buy Bullion and if that doesn't happen then I'll choose USDT to temporarily park my money. Still the point that founder if Terra made in video that 'the backup USD for Tether is not on the blockchain and thus susceptible' rings true to my ears.

Now where Terra is transacted and Luna is given a boost. Thus the people are not just owning coins, they are actually getting a stake in the ecosystem and that is great analogy.

I want to be a part of this system. A system where I have stake and thus my actions can directly contribute to the direction of it's growth.

You got a 33.33% upvote from @stef courtesy of @sadiks!