There are plenty of articles around telling people what they should or should not do if they are interested in getting into cryptocurrencies. How to buy, how to trade, how to learn about the projects. I won't get into all the details here (there's so much!), you can already find a lot of information on the Internet. What I'll try is to get into things that might be a bit harder for you to find elsewhere: an honest and more personal opinion of someone that has gone through this process recently.

I am not affiliated with any company or institution that works with cryptocurrencies, so this is my personal unbiased opinion that I hope can help you make less mistakes and feel more confident as you get into this amazing (and rather overwhelming) world.

TL;DR

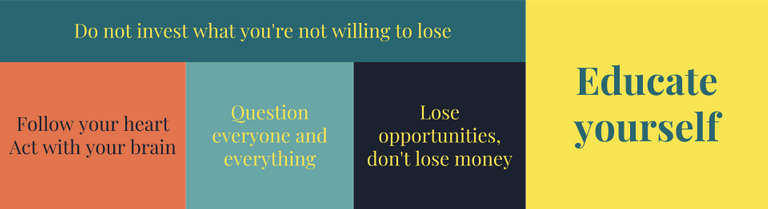

Since this is a bit of an extensive post, let's start with a short summary:

- Do not use money you cannot afford to lose.

- Holding coins? Use a hardware wallet.

- Save your wallet's seed in a safe place. Write it in piece of paper and store in a place you trust. Check it regularly.

- If you don't have the private keys, you don't own the coins. Coins in an exchange are not yours, you have access to them. That doesn't mean you can't use exchanges, but know the risks.

- There are technical challenges of all kinds in crypto. Take your time and educate yourself.

- Learn what is a "coin" and what is a "token". Learn about smart contracts and the different applications of cryptocurrencies and tokens.

- Secure your account with two-factor authentication using Authy and not SMS.

- There are scams everywhere, question everything and everyone.

- Don't attract attention to yourself. If you do, be extra careful.

- Act with your brain, not emotions. Emotions are important in life, but when money is involved they are a hindrance. Follow your heart, but act with your brain.

- Lose opportunities, don't lose money.

- Question everyone and everything, but find those you trust and learn from them.

Rule number one

Do not buy cryptocurrencies with money that you cannot afford to lose.

You will find this rule everywhere, it's like a law among crypto people. Yet, you will feel the urge to break it as you see your profits go up, be sure of that.

I started with a little, around 5% of my savings. Slowly I bought more and more until I reached about 20%. It was early December 2017 and the market was going up and up ("to the moon" -- well, not really). I was seeing my investment go up, and even though I had no idea what I was doing, at some point I got to 140% up in profits. Then the correction came: bitcoin went from 20k to 6k in 4 to 5 weeks and all other coins lost most of their value.

20% of my savings is more than I expected to invest when I got in and that's more than I would recommend. Will I be mad if I lose it all? Hell yeah! But will it affect my life at all? Not really. I didn't sell anything important, I didn't mortgage my house (come on, don't even think about doing this) or take out a loan (also a no no). I used money I already had saved during my life, a percentage I (passionately) decided to put towards a risky investment.

So just keep it in mind: you might lose it all. This is not to make you feel depressed or stop believing in crypto, but to make you know it's real, it can happen. Be humble and be safe. However you decide to "play" with crypto, educate yourself and do it wisely. You can get into it with as little as you want to. Have an extra $50 dollars? Buy some coins and try it out. Start slowly and learn as you do it.

Risks

There are all types of risks involved in investing or trading cryptocurrencies.

Let's start with the technical risks. If you've never made a bitcoin wallet you will probably stumble a bit learning it. What is a private key? Where is it stored? Why can't I just have a password like in any other website? I made a mistake, why can't I cancel this transaction? There are so many aspects you will have to learn that it might seem scary, especially if you're not a technical person.

I consider myself a tech-savvy person; I've been around video games and computers for more than 20 years and it's my main hobby and professional. And still I had doubts and made mistakes, so I can imagine how hard it might be for people that are not that much into technology or that are just starting. But take your time and do it slowly; get a wallet, play around and read about it. Buy some bitcoin and send to it, a very small amount at first. Reduce your risks while you're learning.

If you're interested in other cryptocurrencies be extra careful. Some wallets they provide are just terrible or very, very experimental. If you're in doubt, don't use them.

If you're looking for a Bitcoin wallet, I would recommend Samourai Wallet. Works on your phone (which can actually be considered safer than using your PC, if you're on Windows) and is open source. It's the only software wallet I've used and I had a good experience with it.

The safest option to store coins at the moment are hardware wallets. They are like USB drives that you connect to your computer, but they are highly protected to prevent hacks and any kind of infection when you plug them in. The most known at the moment are the Ledger wallets and the Trezor wallets. I have I Ledger Nano S and I really like it, it's been a good investment. If you're planning on holding coins, use one of these.

Regardless of the wallet you decide to use, you will notice that they have something called a "seed", a set of words that they use to generate your account. Write them in a piece of paper and store it in a safe place in your house. Yes, paper. What do you trust more, a document in your computer, that is connected to a network accessible to anyone, or a piece of paper inside your house, in which you control who can or cannot enter? In any case, store this in a safe place, do not lose it and do not share with anyone. There's no one you can contact to "recover your password" if you lose it.

I strongly believe that storing and dealing with cryptocurrencies will be a lot easier in the future. Anyone will be able to safely use cryptocurrencies the same way we use fiat money right now. But while we're not there yet, play safe.

Be also careful with exchanges. If you're planning on getting alternative cryptocurrencies (altcoins or simply "alts") or if you're planning on trading, you will need to get into exchanges. When you have your coins on an exchange, the exchange is in control of them, not you. In this new and unregulated world of cryptocurrencies, you never know for how long your coins will be there. Again, this is not to scare you, but to make your risks clear.

To get into crypto you have to first buy bitcoin. Some exchanges allow you to pay in fiat for bitcoin, so that's how you get into the game. Other coins can also be bought with fiat, but people usually start with bitcoin. I can't really recommend any exchange for this because I've only used local exchanges and it really depends on where you live. But most people use Coinbase, which seems to be the friendliest one (despite some recent events that tainted their reputation).

I currently have resources in two exchanges, Binance and BitMEX, which are probably the most used exchanges at the moment. Binance allows you to buy alts using bitcoin or Ethereum and it's become the number one exchange for most people, even though it's a company that only started operating in middle 2017 (and is already considered probably the fastest unicorn in history). As for BitMEX, people have been using it mostly to trade bitcoin, and specially because it allows shorting. (If you want to help me, check my referral links to Binance and BitMEX).

I can't say much about how trustworthy BitMEX is, but as for Binance, I started trusting them more and more after seeing the way they dealt with some recent events. They seem very professional, a reliable place in a risky environment. But you should use your own judgment. You can start by checking their twitter and their CEO's steemit account. (Disclaimer: I own BNB, Binance's coin, so I might profit if they succeed. However, this is not why I recommend them, it's because they are actually good.)

Regardless of how much I trust them, I still know it's risky. There have been several cases of exchanges being hacked in the past and this will probably not end so soon. I've been into crypto for only 3 months and I have already been a victim of one of these hacks: I had a few NANO coins on the exchange BitGrail, that has recently been hacked. I have my coins frozen there and have no idea if I will ever be able to have them back. Gladly, it was a small investment. So keep in mind that this can happen to anyone.

Still on the topic of exchanges, always secure them with a strong password and enable two-factor authentication. Favor Authy over SMS authentication (which is very troublesome).

Don't attract undesirable attention

Some people like being successful and making money. Some people like fame more than everything. You can be whatever you want in the crypto world, but you have to know your risks.

If you're willing to put yourself out there on the Internet, to make yourself visible by making videos, making a blog, talking to people in forums, or whatever it is you do, you have to be ten times more careful than the average guy that doesn't call attention to himself.

Do you go around the streets telling people how much money you have in the bank or how profitable your investments are? So don't do it on the Internet. No one needs to know how much you own. You might have to hold yourself, you might have a desire to brag about your earnings and successes, which is OK, really. But understand that you might be risking yourself and your funds by doing so.

A big difference between crypto and the regular financial world is that banks are harder to break and have contingency plans. Now if your bitcoin wallet's key is leaked somehow and your coins are transferred, there's just nothing you can do.

There's plenty of people that have been hacked because they put themselves out there, made themselves visible. Recently, a guy called Philakone got into serious trouble after hackers got hold of his accounts. He's a cool person that produces content for people to learn how to read charts and other stuff. But if you get on the wrong side with the wrong people and there's money involved, no matter how good his intentions are there will be someone going after you.

So if you're looking for the spotlight, well, go for it! But tread carefully. Don't get out there and say everything you want to say, don't do things you're not absolutely sure of. Minimize your chances of making mistakes and have always a plan B.

Focus on learning

.png)

This is an extremely seducing world. I've seen so many people (including myself!) fall in love with crypto in different ways in the past months that now I know that sometimes I need to take a step back and reflect on things.

Don't do anything in a hurry, take your time to think about it first. Sleep on it. Bitcoin will not go away, you will not lose the "opportunity of your life" by waiting a few days. Follow your heart but act with your brain.

Balance your time between the things you like doing. If you work a full time job, like I do, and have little free time, you will feel the anguish and desire do to more and more, and feel like you're always behind. In average I probably slept less in the past three months than any time since… since forever, I think. There's just so much to learn and to do that I'm always feeling like I'm missing on something.

But this is not the way I want it to be and I'm trying to change it. You should just take your time and focus on the aspects you like. You like trading? Go learn technical analysis. Like the technology? Go read the whitepapers. You're here just for the money? Then learn everything. It doesn't matter what you'll focus on, be sure that it will take time. And that's alright.

As you're starting, focus on learning. Read as much as you can and listen to more experienced people. Learn what is a coin and what is a token and the differences between them. Learn what are the possible applications of cryptocurrencies and related technologies (blockchain and smart contracts, for example). You don't need to know everything, you don't need to be an expert. But you need to have a grasp of what you're investing in. Time put on education is never wasted time, it's an investment.

You will probably feel like you're constantly missing out on something. That's why you'll hear the term FOMO a lot. Get used to it, there's absolutely no way that you can ride on all the waves, take all the opportunities out there. And that makes it even harder for you to slow down and focus on learning. But remember: losing an opportunity is much, much better than losing money. Miss as many opportunities as you need to; take the ones that are presented to you.

Trading, HODLing, investing

If you've been around crypto for a while (like, an hour or two is already enough :P) you've seen the term HODL. This term is used mostly for those that are believers in bitcoin and other cryptocurrencies as a way to show their support. They don't sell, they hold through the good and the bad. And that's what newcomers first do when they get in. I like the fact that there are people that believe so much in some coins that they are willing to hold through major corrections (crashes?) and still believe in them. It's a matter of principles, most likely. Now, are they right or wrong? Who knows… I was like this before, but as I learn more about how the markets work, the less of a HODLer I am. And that doesn't mean I don't believe in the technology behind it, not at all. (The plan is actually make more and more of it, more in future posts.)

Other than holding for dear life onto your coins, you can treat them as an investment or trade them. Investments are usually long term, while trading can be short, medium or longer terms.

Whatever you decide to do, I just want to leave one thought here: you don't make any profits until you cash out. HODLing will not make you money. Trading and getting more coins will not make you money. What makes you money is converting your coins into fiat. Yes, you might argue that bitcoin can buy things, and that's true. If you believe in that and want to hold to your bitcoins, great! But keep that in mind, you need to have money that can be converted into useful things to call that a profit.

This is why I believe everyone should learn how to read charts, even if the most basic concepts and even if you're planning to hold for the long run. It's important to know when things are over or under priced so you can take advantage and protect your funds.

(This is bitcoin in the past 6 months. Where would you buy? Where would you sell? Would you just hold?)

The normal progression is usually from HODLer to investor to trader. You buy and expect it to go up forever so that you will be rich. Then you realize that's not how it works, so you become an investor, someone that will hold for a while to sell at some point. Then you figure out that if you trade you can actually increase the amount of coins you have, so you start doing it.

So should you hold until bitcoin hits 1 million dollars? Should you trade frantically to make more and more coins and accommodate possible declines in prices? Who knows, whatever fits your style. I believe there is a balance for everything. I plan on securing my initial investments, cashing out little by little if I'm ever profitable, but also holding onto those that I believe the most. Don't be too greedy nor too conservative, try to find your own balance.

Question everyone and everything

Everyone has their own interests. Everything is done with a purpose. Think about this when you see that cool YouTuber guy telling you to buy a coin. What are his interests? Is he really trying to help you?

Yes, there are good and trustworthy people that put lots of good content out there, but you need to learn how to pick them from the roten. And honestly, they are the minority.

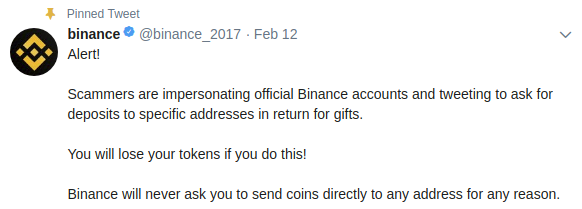

An easy way to check how many scams are out there is to see the Twitter of anyone that is know in the crypto space. Check Binance's posts, for example. The first or second comment is always a scam. Always a fake Twitter account asking you to throw money at them to get more for yourself. Yes, "free money"! Binance even pinned a post warning people about it:

Do not fall for it. NO ONE IS GIVING YOU FREE MONEY.

Just to give you a heads up, I made a list of a few scams that happened recently and that you should be aware of:

- People buying Ledger wallets on Ebay got their funds stolen. The wallet was setup by the seller, so they knew the private keys and proceeded to steal the coins.

- Binance recently froze its platform because hackers got hold of API keys of some users (keys are like passwords) and planned a massive attack to pump coins and make money from it. Users got tricked by accessing a website that looked exactly like Binance but wasn't the real one.

- Bitconnect, the most recent (as far as I'm aware) ponzi scheme.

- Don't buy Bitcoin Cash! Just Google for "bcash scam" and judge it for yourself.

Find the ones you trust

A good way to filter through the garbage is to find people you trust and go after their opinions and recommendations. You'll have to be highly critical of course, to actually find these people. But you can find them, there's plenty of people with good intentions out there.

I started by reading articles on Medium, then Twitter, then Steemit. Being an avid Twitch.tv viewer, I one day stumble onto a channel that became my favorite source of information called Crypto World News. It's a good source because there's a lot of people in that community, and they have different opinions, different trading styles, different focuses. From these sources I slowly got hold of more and more resources and started learning by myself how to identify good information and good intentioned people. I still have a lo(oooo)ng way to go, but this is a great way to start.

Even when you find them, do not trust them blindly. Do not trust me blindly. Unless your mother is a crypto expert, there's no one you can trust blindly. And even the people you trust the most can be wrong, can't they? Crypto is a wild world and people are wrong most of the time. Use your best judgement and learn from others as much as you can.

Resources

I already left quite a few links in the post for you to check, but there are a few other important ones that you should know about:

- Trading View: The website most people are using to view and analyze charts. It's not the only one! If you don't like it, Google for others and you will find a few more.

- coinmarketcap: Best place to check the current market capitalization and the information about all coins out there.

- Coindar: A cryptocurrency calendar. Interesting to check important events of your favorite projects and also events that might affect the price of coins (happens a lot).

@resteemator is a new bot casting votes for its followers. Follow @resteemator and vote this comment to increase your chance to be voted in the future!