I was initially hyped about this but after reading through their support documentation, which it seems most people have not, I quickly changed my stance and am not really interested in it anymore.

Here is a link to their full support documentation, but here is some of the highlights:

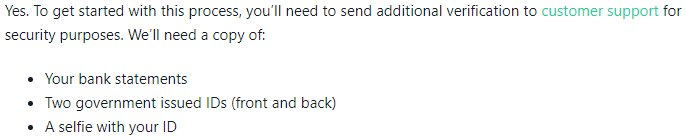

Since they support direct fiat to crypto transactions, they are going to be heavily regulated, so strict KYC is to be expected. Yet this is one of the most ridiculous KYC procedures I've seen thus far. Beyond the typical ID selfie they also require 2 forms of government ID and copies of bank records.

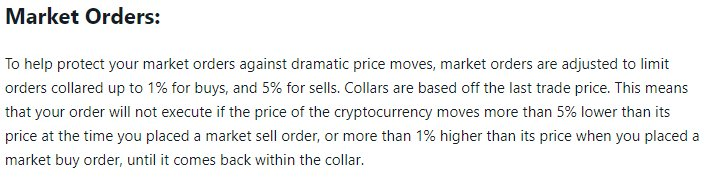

They won't have "true" market orders. Their market orders basically are executed as limit orders within a +1%/-5% collar range. Basically this means when you place a "market" order it actually gets put in as a limit order anywhere between +1% and -5% of the current price. Also their data feed (at least on their stock app) doesn't always match the current real price. This could lead to many issues with order execution.

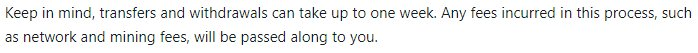

They say that it can take up to one week to withdraw. This may just be a generous estimate to cover any future load on the blockchain. It could also mean they take a week to process it before it even hits the blockchain, at which point you then have to wait for the actual blockchain transfer time on top of that. This makes the whole thing unusable in my opinion.

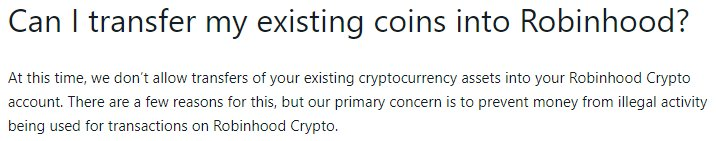

You will only be able to deposit in fiat. Due to AML regulations they cannot risk taking "tainted" incoming crypto. They claim to be working on a solution to verify the "legitimacy" of the incoming funds, but don't hold your breath.