Script(ish):

Today we’re going to talk about the problems Coinbase has been going through recently and why new entrants like Robinhood are healthy for the market. Many customers using debit or credit cards to purchase cryptocurrencies via Coinbase have received additional charges recently.

This was due to a change to the Merchant Category Code by a number of major credit card networks. These changes were made so that future transactions with Coinbase could be classified as “cash advances,” a move made to slow down purchases of cryptocurrencies using credit cards.

Unfortunately, Visa decided to retroactively apply this to many purchases between January 22nd and February 11th, leading to many purchases becoming refunded and reprocessed simultaneously. For many customers, the reprocessed charge occurred prior to the refund for the initial charge, leading to a situation where many individuals were “double charged.”

However, there are numerous reports of some customers being charged more than twice, up to as many as 50 times. These reports are impossible to verify, so it’s hard to tell who is telling the truth vs. who is trying to defame Coinbase, but the overall number of reports suggests that some of them are likely true. As far as I am aware, there is still no explanation for why some are being charged more than twice.

Many customers were charged overdraft fees as a result of the additional charges, leading to a PR disaster for Coinbase. It’s still unclear what will happen with these overdraft fees – if they will be reimbursed by any of the parties involved (AKA the banks, Visa, and Coinbase) or if these costs will be left on the customers. Many customers also had their credit cards maxed, which can affect credit score negatively as this causes their credit utilization ratio to increase. For some it was even worse as they weren’t able to pay other bills on time.

While it seems at this point in time that Visa is responsible for this particular disaster, we still have limited information and so it’s difficult to say definitively where the fault lies. However, there is no question that Coinbase’s reputation took a hit with this event and its outlandishly poor support has led to many frustrated customers.

There have been other concerns with Coinbase recently as well, such as missing wire transfers. While these reports are much rarer than the reports we are seeing for the double charges, there have been people talking about their money being “held hostage” by Coinbase for periods longer than a month.

Many also disagree with the way that Coinbase added Bitcoin Cash to its exchange back in December, with very little forewarning to allow ample liquidity to build up in the market. This led to a situation where Bitcoin Cash spiked up to $9k in a matter of minutes before trading had to be halted.

There have been other controversies as well, such as back in June where Ethereum had a flash crash down to 10 cents before bouncing back up $300 only a few seconds later. Coinbase reimbursed losses associated with this event, but it still left a poor taste for many people.

Enter Robinhood Crypto, a new platform designed to allow for free trading of cryptocurrencies. This was all the rage back when it was announced in January because Robinhood is a well established stock broker which is notably known for commission-free trades. I’ve used Robinhood myself and I can say that despite the very limited options available (you can only open taxable accounts, no DRIPs, no trailing stops, etc.) and barebones mobile platform (no research or even charting), it executes fairly well. It is by no means competitive with other brokers like Td Ameritrade or Interactive Brokers outside of its free commissions, but that’s the whole point.

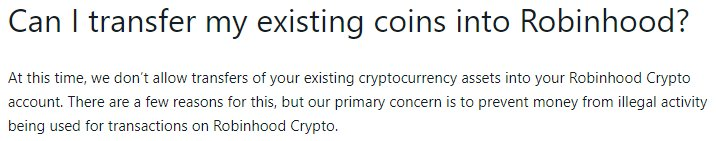

Based on the information they’ve provided in their support center, it seems they’ll be going a similar approach here as well. There are a number of limitations, perhaps most notably that you won’t be able to deposit your cryptocurrencies onto the platform. In other words, if you want to sell the Bitcoin you already have, you’ll have to look elsewhere.

However, one very welcome feature is one that they are bringing over from their stock broker side, which is instant deposits for amounts lower than $1,000. This is excellent for many of you who are investing with smaller amounts, because you won’t have to wait for your deposits to settle in most cases. The only time you will have to wait is if you have more than $1,000 waiting to settle, and even then you only have to wait for the remainder over $1,000 to settle. Your instant deposits reset whenever your transfers settle, meaning if you’re dollar cost averaging over a reasonable frame of time, you’ll never have to wait for settlement again. No more waiting 7+ days like you do at Coinbase. But wait… that only benefits small traders right? What about the big fish?

Turns out Robinhood … sort of? has your back there too with their subscription service known as Robinhood Gold. This is where things get a little tricky because based on what I’ve read, I don’t think that Robinhood is actually going to allow you to trade cryptocurrencies on margin which is what Robinhood Gold is for.

At its highest tier, it’s meant to allow you to borrow up to the cash value of your account when used in stocks. For example… if you have $2,000 then you can borrow up to $4,000 if you go with the highest tier of Robinhood Gold, which will cost you a certain amount a month. The amount you’re charged is a flat fee depending on the amount you’re allowed to borrow up to.

Anyway, the point of this is that you can get instantaneous deposits up to the tier of Robinhood Gold that you have, which is a nice bonus for those who are using the stock side as well. In fact, I see this as a nice positive because it could provide incentive for people to try out stocks. It’s not going to be worth buying Robinhood Gold just to have larger instantaneous deposits in most cases, but it is worth noting nonetheless.

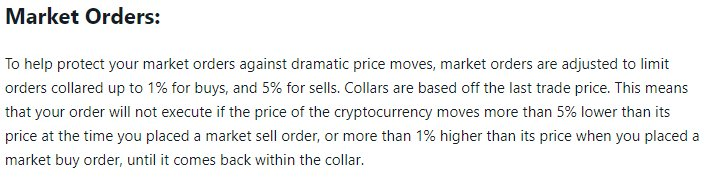

It is also evident they are taking some steps to protect themselves from situations like the flash crash in Ether last June on Coinbase by limiting slippage on market orders. They have decided to limit slippage for market orders to 1% when buying and 5% when selling, which it should be interesting to see how the community reacts to this. Some will call it hand holding, others will welcome it in this absurdly volatile market. P.S: There is an explanation of slippage in the video.

However, Robinhood has had many issues of its own too while trying to take over the stock broker world, namely related to outages and poor execution of orders during peak activity. They’ve also stated in their support center that they will have weekly maintenance for the crypto platform, during which times you will not be allowed to execute orders which I could easily see being a pain point in the future.

So is Robinhood the hero we need in crypto? I think any new entrants into this market are welcome, although I’m sure the pitchforks will be raised at Robinhood in the future too. There is well over a million people on the waiting list and trading is expected to launch this month. However, they will initially only launch in 5 states so it’ll be a while for most of us before we can use Robinhood Crypto unfortunately.

Let me know your thoughts on Robinhood Crypto in the comments below.

As always great post... But as you well know neither Robinhood nor Coinbase will be perfect, we need a thriving decentralized exchange, with seemless tranactions, low or no fees, which is safe and secure because we hold our tokens until moment of sale/exchange.

Ps. I had this happen to me, on three separate purchases my bank, or visa, charged me three times each. I called my bank to seek refunds on the 2nd overcharge but not yet on the 3rd. It took 45 mins on the phone so that sucked, but in the end all fees and overages were reimbursed.

Yes! Competition is strongly encouraged in this space! The only exchange I use now is Coinbase. They’ve been ok for me to this point, but it’s about as basic as it gets. I’m looking forward to more secure and advanced crypto platforms in the future! I also agree that when Robinhood goes live it’s gonna have it’s own list of issues! Thanks for the post!

Gemini is much better than coinbase but Robinhood has 1 million plus people sitting on the sidelines right now waiting to jump in! All the merry!

I like Gemini but Robinhood will allow for many more coins. Also Gemini has a percentage transaction fee. It's really just a matter of time before we get fixed cost rather than fixed percentage fees.

e.g. Interactive Brokers charges 1 cent per share. Lots of places have free to $15 stock trades. Nobody these days would call up their stockbroker who charges a percent commission.

Please make a video about polymath, would highly value your opinion on it.

It all sounds great but I am still skeptical so I am going to wait it out a while. that you for pointing out some very good points.

Nice to see a little more competition among the crypto exchanges, and it sounds like Robinhood is a little more professional, and think about possible problems beforehand (like slippage).

And, by the way, it is terrible how Visa and Coinbase have treated their customers.

Will Robinhood save us from Coinbase alone? No. However, new exchanges such as reputable ones from the traditional market will definitely place new pressures on Coinbase and bring a new set of entrants to the market.

I'm intrigued on how the landscape of the market will change by year's end with the rise of new exchanges (including decentralized ones) and the bolstering of current exchanges like bittrex (e.g., with the addition of fiat trading pairs this year).

As consumers, this will work in our favor and give us the freedom of options. From an crypto ecosystem perspective, this will strengthen the market with having more reliable exchanges and increasing the number of trading pairs, especially fiat pairs, that might be available.

Competition is (almost) always the consumer's friend!

absolutely

Did I hear you say that Bittrex was going to take USD in the future in one of your other videos?

Also Robinhood is a traditional (regulated) broker so they will probably have decent safeguards against crooks or idiots losing your money.

The idea that the market should build itself is also bad . Take an example of health care, let the diseases spread and there will be pharmaceutical laboratories who will invest and eradicate the diseases.

So true. When the big boys like TDAmeritrade, Scott trade and the likes come out to play in this space coinbase can basicly call it finito.

Good to see you commenting on Robinhood helping us breakfree from the hegemon. I was a bit too early when I posted about it being a potential catalyst:

https://steemit.com/crypto/@lordprime/why-robinhood-is-good-for-crypto-potential-catalyst

Yep. I suppose the financial institutions must be getting nervous now about the rise of cryptocurrencies. Which is ironic, considering that the underlining point of cryptocurrencies is to get out of the busy hands of the banks that clog up the flow of your money. On the exchange side, it doesn't take much dirty play to throw a monkey wrench into the gears. I'm pretty much constantly shocked when this kind of stuff happens, but then again, I suppose it's human nature to use whatever tools you have at your disposal to try to win the game. It's crazy though.

Coinbase though understaffed isnt 1/2 as bad as other services ive tried in the past (Gemini/CoinMama)

I wish the bigger services (Fidelity/TD/ETrade) were as ambitious because i think they have a much better chance at kicking open the market for crypto trading over your smartphone/desktop.

Though trading crypto on margin....might be ugly for some based on lack of knowledge/trading on that platform (ive heard some trading platforms are/or about to use this)

Competition is good for this market.

Quality competition...even better.

Though Im surprised noone's tried a Morningstar type review site for all crypto.

(For those who might not know,that site reviews almost all stocks/etfs and rates them according to different categories)

That in itself might be better than Coinmarketcap.com & help the newbies out about certain alt coins instead of relying on shilling on YT.

Makes too much sense.

Excellent video as always @cryptovestor

Good advice telling people to open a separate bank account to link to their crypto. That's the first thing I did, then I froze the account, and I can unfreeze it with just a few taps inside the bank app if I want to.

I was hoping to hear you mention that major US Banks are closing accounts that wire money to Coinbase. My 15 year old Wells Fargo Account was closed by Wells Fargo after joining the Crypto space in 2018 and making two wires of $5000 and $7500 to Coinbase. If you Google is issue (US Banks closing accounts from Crypto customers) you will see I am not alone. I am surprised I have not hear any Crypto YouTubers talk about this matter. Comments anyone?

My two cents worth of advice for forrestal and others who have an account with Wells Fargo, B of A, Chase, etc. You are better off with your account at a credit union, I opened an account and use it to deposit/withdraw money back and forth to Coinbase with no problems. If you are worried about health of the institution of your choice you can check them at www.bauerfinancial.com. Sorry to hear that they are treating customers that way, hope this helps

Small local or regional banks also don't give you problems (yet). The big banks are not here to help people. Leave them, there are better choices out there.

I was initially hyped about this but after reading through their support documentation, which it seems most people have not, I quickly changed my stance and am not really interested in it anymore.

Here is a link to their full support documentation, but here is some of the highlights:

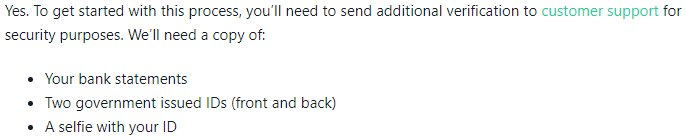

Since they support direct fiat to crypto transactions, they are going to be heavily regulated, so strict KYC is to be expected. Yet this is one of the most ridiculous KYC procedures I've seen thus far. Beyond the typical ID selfie they also require 2 forms of government ID and copies of bank records.

They won't have "true" market orders. Their market orders basically are executed as limit orders within a +1%/-5% collar range. Basically this means when you place a "market" order it actually gets put in as a limit order anywhere between +1% and -5% of the current price. Also their data feed (at least on their stock app) doesn't always match the current real price. This could lead to many issues with order execution.

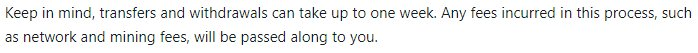

They say that it can take up to one week to withdraw. This may just be a generous estimate to cover any future load on the blockchain. It could also mean they take a week to process it before it even hits the blockchain, at which point you then have to wait for the actual blockchain transfer time on top of that. This makes the whole thing unusable in my opinion.

You will only be able to deposit in fiat. Due to AML regulations they cannot risk taking "tainted" incoming crypto. They claim to be working on a solution to verify the "legitimacy" of the incoming funds, but don't hold your breath.

Glad to see your posting more often! You have slowed down quite a lot

'I recommended to students' You are a teacher of?

Good analysis on recent news stories. This is a bit of a different direction from your regular video, but still a valuable deeper analysis than initial stories gave.

Either way, I think Robinhood will be valuable in the crypto space. Whenever it comes out, I'm sure I'll probably try it out. I'm not in one of the 5 states either.

The Visa/Coinbase thing is sketchy though. Something like that is too devastating for most people, and I hope it's a problem that gets fixed soon otherwise it might start looking too purposeful.

Honestly if they just have an easy way to move some crypto profits into index funds I'll be happy. Would love the option to take profit into something other than cash.

Is this a paid advertisement of Robinhood Crypro? Almost sounded like it.

Of course not, but I can see how it sounded that way. I like what they have done for stocks, so I am hopeful they will do decent in crypto as well. I'd never do a paid promotion without disclosure, and haven't done any promotions (paid or otherwise) to this point on the channel.

I thought not. Anyway, it does sound like an interesting option.

In my opinion if you are new to bitcoin world and you don't want to take any kind of risk you are likely to land at coinbase. Especially when you have a considerable amount of money you want to invest. For example don't see a hollywood actor who discovers Bitcoin going to Binance. So this exchange has a specific category of investors imo.

Coming to Robinhood i think the simplicity of the app makes it more handy for long term traders or swing traders. That kind of trading when you buy low and sell high once in a month. Despite the fact that it does not have advanced trading features the release of their API (coming soon) is going to be a great opportunity for many day traders as you can plug it to Desktop interface or even delegate the trading decisions to a bot so you can make high frequency trading at zero fees. I don't know if the API will be tweaked to avoid high frequency trading or even will it be a free service .

I am Canadian and I'm not sure if my bank accounts will work in Robinhood, do you have any info on that?

Hey CI,

While I enjoy utilizing tools that aren't available on Robinhood when trading cryptocurrencies, I do like to trade using their platform for traditional markets as those are mainly all long-term investments. I believe Robinhood will be a great on-ramp for those already using their platform who haven't yet ventured into the cryptocurrency space. The competition aspect is great, no doubt about that! However, IMO, the more significant aspect is the liquidity it will add to the market.

As you mentioned, increased competition almost always benefits the consumer. The bigger threat to Coinbase, and soon to be Robinhood, is decentralized exchanges. I would love to get a quick comment on your thoughts in regards to that, or perhaps an entire video if I'm not alone in your audience to that query.

Personally, I don't see centralized exchanges completely going away. I just don't see them being able to compete with a fully functional decentralized exchange, even though that is a long ways out from coming to fruition...

As always, keep up the great content. I appreciate your oftentimes contrarian viewpoints vis-à-vis other content creators in the space.

Is Robinhood coming to Asia to save Asia market?

I have read that you cannot withdraw the cryptos you buy on robinhood

Check out their FAQ. You can withdraw cryptos but you do need to go through a KYC process. Also it takes a couple of days once you initiate the transfer

There are some real use cases for purchasing crypto with a credit card vice linking to your debit card ... most commenters $h#t all over the idea, but the Visa/Coinbase issues highlight the risks. The benefits include avoiding the risk of overdrawn bank accounts, and loss of greater amount of funds.

Nice video (script in this case), and great post as usual. But I have MAJOR concerns over Robinhood coming into the crypto market.

Let me say that personally, my opinion is to avoid Robinhood at all costs.

What is my reasoning behind this? For the past 7 months or so, I have gotten into the world of day trading and swing trading. This comes into play because I have had to weigh the pros and cons of all the different brokers out there to see which ones tailor to my specific needs. There are those few though that make the 'no one in their right mind should use these brokers' list. Robinhood happens to be on that list for me.

When it comes to brokers I have adopted the philosophy of 'you pay for what you get'. This applies to Robinhood because while they advertise no commissions, you heavily pay for it on the other end. So if they don't have commisions, where then, are they getting their money? They obviously are getting it from somewhere because otherwise they wouldn't be around. The answer is you. The customer. They get it through poor executions and other factors you have mentioned so that 9/10 times you end up losing money which they pick up. These reasons are why Robinhood is on my avoid at all costs list.

Again, these are things you have mentioned. What concerns me the most though, is the gravity at which new traders and investors aren't going to take these red flags seriously enough. I personally don't want to see anyone lose money because it sucks. The feeling you get is dreadful but most of the time avoidable. Robinhood can now poise themselves as 'Hey look at us, we specialize in trading and now we're getting into crypto! Open an account today with no fees!' all the while getting more money through shady practices brought over from their trading expertise. This is a game and they want you to lose. Just remember that.

I would like to conclude by saying that these are all my own opinions based on my personal experiences and you should not use them as fact. I personally recommend coinbase still to anyone trying to wire in money for their first time trading BTC or any of the other coins and currencies. I have no experience with Gemini but have heard they have a good reputation as well. However since I have never used them I cannot recommend them. I also highly recommend using wallets (desktop or cold are my preferred) for long term storage to avoid hackers and the risk of losing your coins. What anything really boils down to is research. Do your homework so that you won't bleed like chum in a tank of sharks.

Robinhood states on their site how they make money " Additionally, Robinhood earns revenue by collecting interest on the cash and securities in Robinhood accounts, much like a bank collects interest on cash deposits". I think the point is that we should be happy to see free exchanges emerging as it creates competition which is healthy.

Love your work cryptovestor. I am one of those who has completely lost faith in Coinbase. I sent a bank transfer from Europe some considerable time ago and it has never shown up on my Coinbase account. But, this is not the worst thing.

The worst thing is that it is impossible to communicate with Coinbase about this specific issue. Why? Because the drop down menus in their "customer support" section do not have an item for lost money and as a result queries about missing money are not prioritized above more trivial issues.

As for the "bot" that one has to deal with before getting to the drop down menus, suffice to say that it is to IBM's Watson as a cooked pea is to Einstein's brain.

As for phoning their customer support advisors (and I use the words loosely), this is an exercise in futility and frustration. For me it has now gone way past the issue of the money (and the amount was significant for me). I am now beginning to have those same feelings of hopelessness experienced by the protagonist of Franz Kafka's novel The Trial.

Coinbase def has really high fees despite it's userfriendliness-beginner friendliness. It acted like a monopol and it was the right time for someone else to take a shot.

💥

💥

There we are, we got robinhood, I bet there are a lot more to come in the near future. Although, most of non-us people should use their own country exchanges mostly as you can pay with your country's fiat directly and fees are pretty low.

Interesting article

@smartbot tip @cryptovestor 5

Σ$$$ Tipped @cryptovestor

Σ5 SMART! Comment@smartbot helpto claim. Currently the price of SmartCash in the market is$0.274 USDperSMART. Current value of the tip is$1.37 USD. To find out more about SmartCash, please visit https://smartcash.cc.Finally!! Thank you for posting about Robinhood. I'm a big fan of the app and have been using it for some time. Excited for the future state with crypto trading. FYI, feel free to register via the link to get a free randomized stock as well: https://share.robinhood.com/tunaida

Robinhood will not overtake Coinbase until they support withdrawals to other wallets and friendly forks. As long as they push adoption I’m all for it!

excellent content!

The more "bare bones" it is, the better, because it's usually new inexperienced investors coming into the crypto market.

still waiting for robinhood to come to aussie , hopefully they'll be here soon enough.

I like that you are active on steemit. I've had the account for months and don't really use it because I don't have enough people to enteract with.

nevertheless, it's a good news. More players is always a good thing for this market. Monopoly is bad. thanks for your vid.

I agree that yes any exchanges that make it easier for investors to get involved is welcomed, however do you not think we need to head in the direction of decentralized exchanges? Imagine an exchange as fast as Binance, easy to use as Coinbase (plus having fiat involved) and not having to worry about a hack. How come decentralized exchanges are not more idealized in this space? What am i missing? I think this makes a lot of sense.

The competition will be healthy for the space. Coinbase has too much of a monopoly and we need other "reliable" source to get our money into play in the cryto market. Also we need a exchange like coinbase with more listed coins. To have such a monopoly on the game and only offer 4 coins is almost criminal.

Coins mentioned in post:

I hope Robin Hood will be available in Germany as well at some point!

I know they are only starting in 5 US states right now, so this will be a long way...!

However, we do have some great forests here!

Visa doublecharged three of my recent crypto purchases and then reimbursed me right away. Looks funny on my statement now, three times 100 Euros in red, then three times 100 Euros in green. Just for the hell of it :)