Stock trading already gives some people heart-attacks, but you and I know that the excitement in Crypto is at least a hundred times the thrill. Your stock gained 2.5% today? Wow. Congratulations. How does a +30% $LTC trade sound to you?

In this post I will help you to mentally prepare for what's about to come. Crypto trading is not for the faint-hearted. I will share some must-read advice before you venture into Crypto Trading. Buckle up!

Emotion 1: Excitement

Excitement is great. It keeps you motivated, it keeps you going. One good trade can completely nullify a thousand bad trades, emotionally speaking.

You need excitement to keep going, you need excitement to pull you through many not-so-great moments. It's perfectly normal to feel some emotion while trading. This article is not a pitch for sitting behind your PC with Alexithymia [1].

Nineteen months after bitcoin has reached it's ATH, it's pretty standard for any crypto trader to feel depressed right now. Celebrate your good trades, some positivity and excitement don't hurt right now.

But what if you're getting a tad too excited about something? This brings us to our next emotion: greed.

Emotion 2: Greed

You're starting a trade. You see a good risk-reward ratio. A nice horizontal support level defines the entry. You plan to go out just below the horizontal resistance level you are drawing on the chart right now. Logging into Binance... aaaand. Go!

Immediately the price is taking off! You perfectly called the bottom. Niiice.

You didn't check the trade for a few minutes and suddenly realize it actually broke resistance and is up 15%! There have been more than 5 green candles in a row.

The smell of freshly printed dollar bills enters your mind. Surely, there must have been some kind of big announcement. You're brilliant, and you knew it all along.

What will be your new target? 25%? 30%? Wrong. You should've been out that trade already for a long time.

Trading is for people who want to earn an honest living using consistent gains. Greed causes your trading to be nothing short of gambling.

Emotion 3: Regret

Now imagine that same scenario but you actually did get out of that trade on time. You sold your coins around the resistance level, and you made a nice 3% profit.

But now you look at the chart again. Your pupils are widening. Table flip! A GREEN 15% CANDLE!? How!? Why!? Why didn't you see this coming?

What if!!! What if... You just stayed in the trade a bit longer. You just missed out on so much money!

Sounds Familiar?

It's easy to analyse a situation after it has already played out. In retrospect, everything is easy. Stick to your plan, more often than not the price will just drop again. Don't overanalyse those few moments

Here's a protip. After you leave the trade, don't keep the chart open. Just focus on your next trade and let that coin cool down a little bit.

Move on with your life. You made a profit, congrats!

Emotion 4: Anxiousness

Did I mention already that, unlike stocks, the crypto market never sleeps? Imagine you are in a trade, but it's time to go to bed. Tossing and turning, you can't help but wonder how the trade is going. The thrill. The excitement.

Sooner or later, you will check the trade. And every move, up or down, will create some emotion.

Studies show that there is a relation between stock market volatility and mental disorders [2]. Let's make sure you are not included in their next research.

The only right thing to do here, is to change your positions to 100% USDT during the night. Or, for BTC maximalist, hold $BTC. Trust me, if you're in it for the long run - you need your sleep.

Emotion 5: Boredom.

Having built my own automated trading algorithms, I noticed odd patterns compared to my own trading. Some strategies wouldn't trade for weeks and then one evening would go ab-so-lu-te-ly crazy. This is how a machine would trade.

Humans trade very differently. You planned a few hours this evening to do some trading. So you sit down, poor a good cup of coffee and start looking for entries.

The problem? You are looking at opportunities RELATIVE to everything you see. You made the time available, so you want to start trading right there, right then. This makes you go for the best available trade, relative to that moment. But you don't look at it in an ABSOLUTE way like a computer would do. Maybe there just aren't any good entries at all.

This causes you to enter bad trades, and exposes you to high risk.

Staring at charts an entire evening, while not seeing any good entry? Perfectly normal. Boring? definitely.

The solution is to add some rational, hopefully computer generated, insights to your trading. Use a crypto market scanner to understand which trades are good, and don't go looking for things that really aren't there.

Another solution is to understand that there are plenty of useful things you can do, that are not trading itself.

If there are no good set-ups, don't trade. Watch youtube tutorials about trading instead, go create a sheet where you can organize and analyse all trades you ever made. Do some fundamental research on some coins. Just don't feel that now that you are sitting there, you have to trade.

Learn from others

Many have made the step to becoming a day trader before you. Learn from them. Obviously more often than not people will fail, but there are still many who succeed. Learn from their mistakes, read their stories.

For example, in this fantastic article [3] you can read the story of the mental effects of becoming a trader. This includes being perceived as “cold”, “aggressive” and “rude” by your friends, and eating disorders with weight loss. And how he overcame it of course.

By learning how people behaved, and how they've overcome their problems, you can accelerate your own learning curve.

Take the emotion out

Now that we understand the different emotions, let's discuss the best technique to take the emotion out of crypto trading.

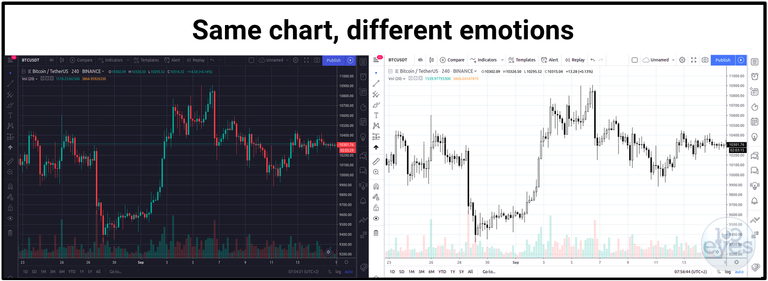

Ever noticed that pro traders never use red/green candles? But instead resort to black and white? No? Look at the following image.

On the left, you see the standard beginner color scheme. The huge red bars going down SCREAM panic at you.

On the right, you see an example of a pro trader color scheme. Feels much more zen, right? Now I can finally maintain my Bonsai tree while keeping my charts open.

Light at the end of the tunnel

You need to go through all of these emotions. Without having experienced this, you would never learn to be a great trader. That's why paper trading is useless, you don't get to experience any of the emotions that you will experience when you are trading with real money.

Especially now that Binance has lowered the minimum order value [4], you can just easily trade with a few dollars. You don't need to use a lot of money, as long as you make sure to use some money.

Conclusion

Now that you've finally made it to the end. Let me share with you the ultimate secret.

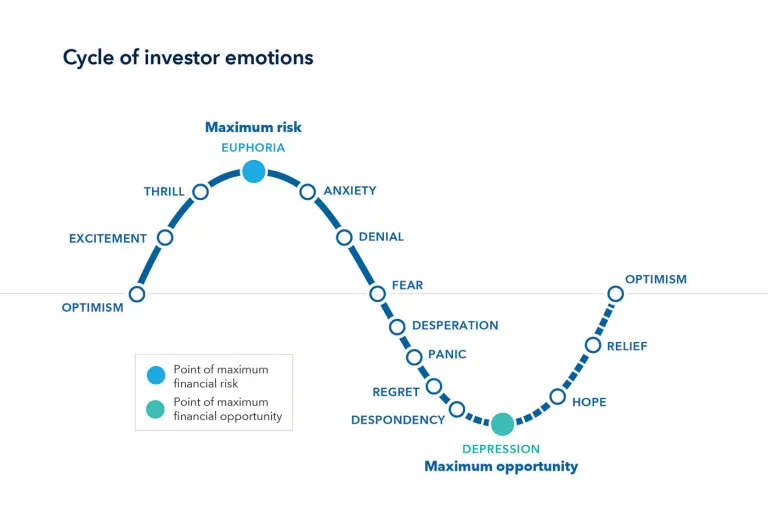

The beautiful part is that for advanced traders, they do not only master their own emotions. No. They also understand the emotions of others. It's precisely these emotions that make them understand which direction an asset is going.

It is the thorough understanding of emotions that give experienced traders the edge on knowing when something is truly overbought, oversold, suffering from panic, or greed.

For example, seen a crypto that just went up 30%? You, who now controls their emotions like a Shaolin Monk, immediately SELLS. Because you are not filled with greed, that is. This means you just found someone willing to BUY it from you after such a surge. Congrats, you are now using the trading emotions in your favour.

Written by David

Sources:

[1] https://en.wikipedia.org/wiki/Alexithymia

[2] Do stock prices drive people crazy? By Chung-Liang Lin, Chin-Shyan Chen and Tsai-Ching Li. https://watermark.silverchair.com/czu007.pdf

[3] Things You Learn After 1 Year of Day Trading for a Living

https://blog.usejournal.com/things-you-learn-after-1-year-of-day-trading-for-a-living-a97bbc8d19fa

[4] https://www.binance.com/en/support/articles/360030848451

the time has changed completely

What do you mean Starboye? That trading used to be less emotional?

Congratulations @wickcrypto! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!