What is the difference between a "1099-Miscellaneous" and a "1099-K" form for taxes in the United States of America as overseen by the Internal Revenue Service or IRS?

Specifically for this, what happens when our income gets double reported both on a "1099-Misc" and a "1099-K?"

How do we handle that? Now, I'm no CPA. I've had my own business online for seven years. I do my own taxes and I research for myself.

What I'm presenting here is based on my research from several different conflicting points of view from Certified Public Accountants based on what I see makes the most sense.

This may or may not be the most appropriate for you, but I hope it's helpful because I've just spent a lot of time researching and learning these things myself. I hope I can just present that for you and make it a little easier.

1099-MISC & 1099-K Explained + Help with Double Reporting, PayPal, and Coinbase!

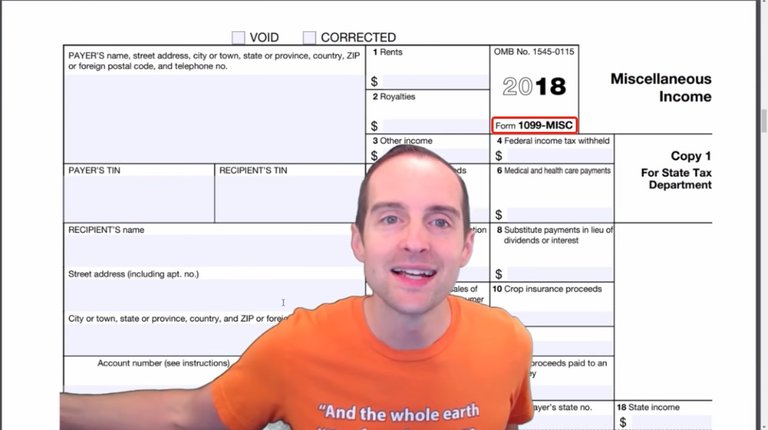

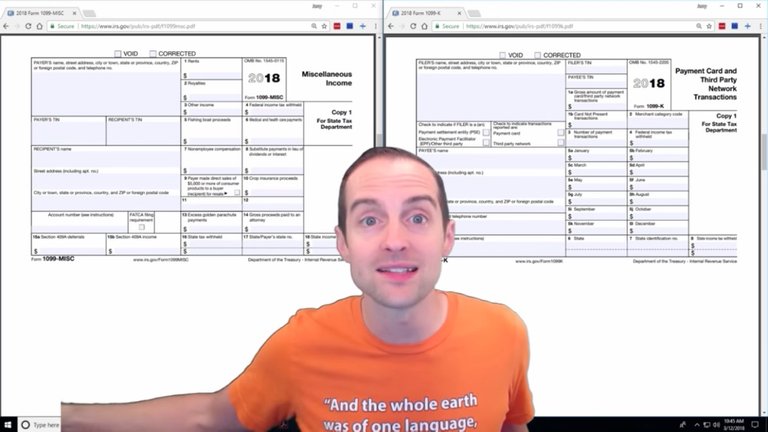

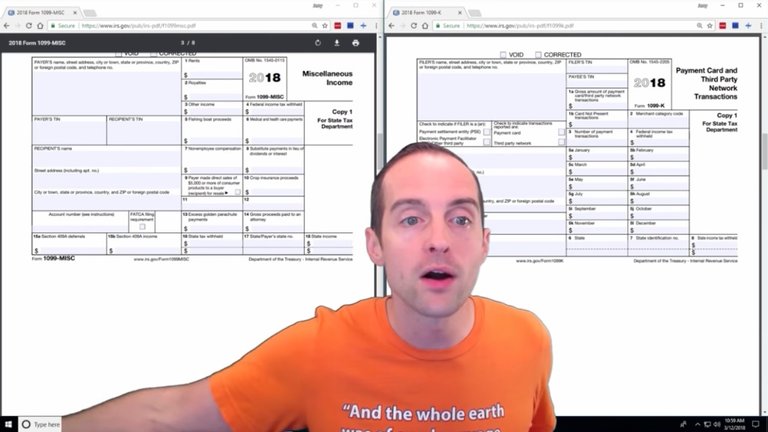

First, what is the difference between a "1099-Miscellaneous" and a "1099-K"?

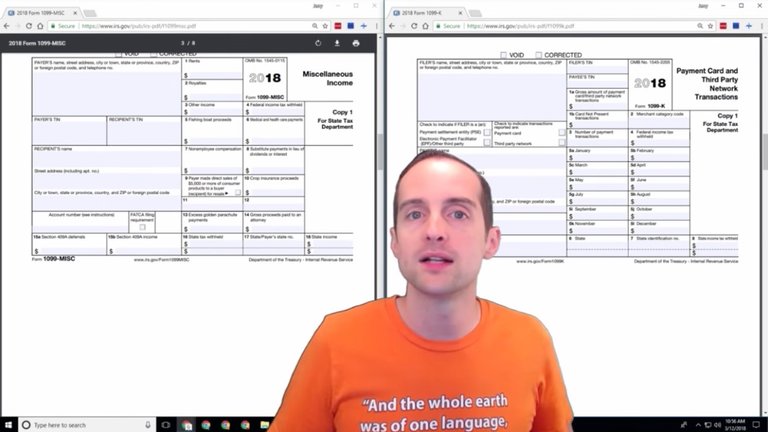

A "1099-Miscellaneous," the form you see below, is intended for payments that are made essentially like cash or direct deposits into a bank account, not using a third party, and this is for independent contractors in the United States of America.

It is used if I pay you for something for my business directly with cash, a check, an ACH transfer straight to the bank, a wire transfer or using PayPal specifically sending money to friends and family, and let's say I paid you for a service or I paid you for advertising, and you are reporting directly to the IRS as an individual and not a company.

There may be differences for companies there, but if I'm paying just one individual to another and I did not use a third-party payment method or I sent a cash equivalent on PayPal or another method, then it is appropriate for me if I've sent at least $600 in one tax year to use a "1099-Miscellaneous" form to report that income.

It depends on what it's for, but it could be box 2, box 3 or box 7.

For example, Amazon reports it to me in royalties and most others report it in 7, non-employee compensation.

This is not appropriate for someone who's actually hired as an employee. This is for independent contractors.

Now, this form is for, again, not using a third-party network.

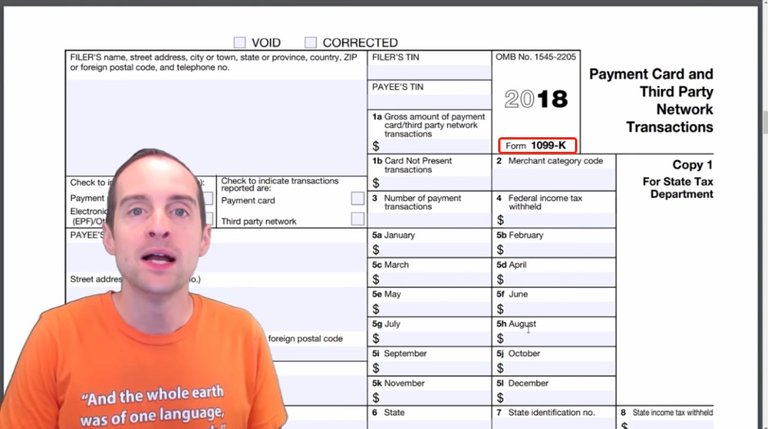

Now, if we've used a third-party network, it is their responsibility to send us a "1099-K" form when we've received over $20,000 in payments and over 200 transactions.

The purpose of this "1099-K" form is especially for online sellers like me using third-party networks, so the IRS can easily track our income.

This means PayPal sends me a "1099-K" for the total of my transactions made through most, but not all payment methods.

I also received one of these from Stripe.

I also got one from Coinbase, which provides additional complication.

If you're driving for Uber or working through some other services where you accept transactions directly on a credit card and you have over $20,000 in payments and over 200 transactions, you're very likely to get a "1099-K" form.

This form provides the gross number, that means the total. It doesn't include things like fees. It doesn't include things like refunds. When we put these in, we need to go in and enter all that stuff as expenses in Schedule C, which is what I'm in the process of doing now.

I enter the PayPal fees on Schedule C as an expense, I go in and enter the refunds as money given back in the income.

Now, where this gets confusing is checking exactly how we paid and clients that end up paying us or clients we have that we end up paying using a credit card, because when we use a credit card to pay as the purchaser or when we are paid with a credit card, we are not supposed to send a "1099-Miscellaneous" for that income.

I just learned that this year and this is very helpful for me because now I know when I pay an independent contractor through a third-party network like PayPal or Stripe I'm not responsible for reporting that income in terms of using a "1099-Miscellaneous" because that's on the payment processor to do that.

Now, the problem I've encountered is that I've had at least one client sending thousands of dollars of payments that was not aware of this.

What happened, the income has then been reported twice.

The income was reported within the "1099-K" PayPal gave me. I went in, looked at the reconciliation report and I can see all the transactions that client sent, which the client also reported on a "1099-Miscellaneous" are all then also reported to PayPal in the "1099-K."

That means the income was reported twice to the IRS. The same income was reported double.

Now, obviously, I am not expected to pay tax twice on the exact same income.

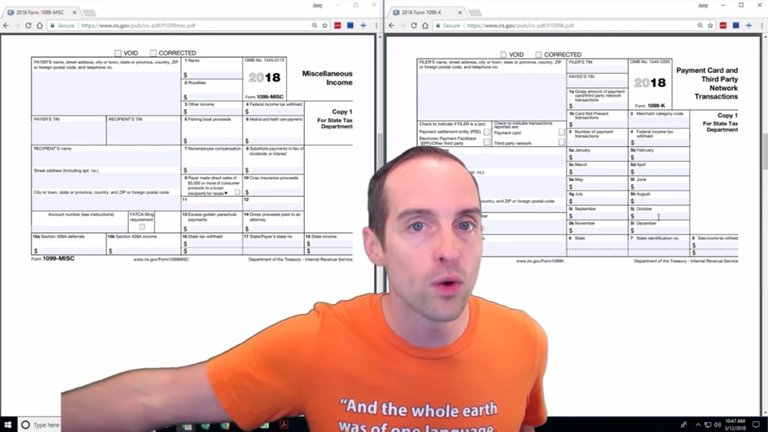

The limitation is that the IRS has automated systems set up that look for under-reporting or not reporting income. I've read some conflicting advice from Certified Public Accountants answering questions online about how to handle this.

Here's how I'm choosing to handle it.

I'm choosing to handle it when a client has double reported the income:

a) I tell the client to make sure it doesn't happen again next year and say, "Look, will you please not report this on a "1099-Miscellaneous" if you use a credit card to pay or send money to friends and family on PayPal. That way it won't get included in the "1099-K." Then, you can send a "1099-Miscellaneous" form."

So, a) it's up to me to educate whoever's paying on this tax law, and then b) I need to handle it this year without preferably reducing the income, because if I just start subtracting things from the "1099-K," then it looks like I'm under-reporting my income according to the automations the IRS has set up.

This is what I've read from one CPA and I read it from another seller on Amazon whose friend, he said, simply reduced his "1099-K" income to cut out all of the Amazon fees and payments like that, and then that triggered an audit.

We don't want to reduce the income reported. That way the IRS can see we've reported all of the income we got and what we want to do based on what I've seen is to add that in as an expense. Put that in in the relevant place to then essentially deduct that double payment.

So, what I've done for the client, the client who also paid with the "1099-Miscellaneous," I've reported the income both times in there.

In other words, I put the exact PayPal "1099-K" income, I put the exact "1099-Miscellaneous" income, and then all I do in my expenses is I add in a line, essentially an expense back to that client for the double payment, because the client only actually paid me once, and yet the same income is reported twice.

Therefore, I put in an expense back to that client to cancel out the double income reporting. Then, if there are questions it's easy for me to demonstrate in my "1099-K" this income was reported here and in my "1099-Miscellaneous" the client reported it there.

I was only actually paid once, so this is an expense that cancels out the double payment, which reflects the truth. The truth of one single payment sent for this amount without reducing the income reported to the IRS.

That was one CPA's suggestion for how to handle it. That's the one I agree with because after what I read and logical, you don't want to reduce the income reported to the IRS. You simply expense that back out.

Now, with PayPal, with some processors, this might be fairly straight forward. If you got a double payment you simply expense it out.

This gets more complicated using PayPal because PayPal does include some things on the "1099-K" and does not include other things.

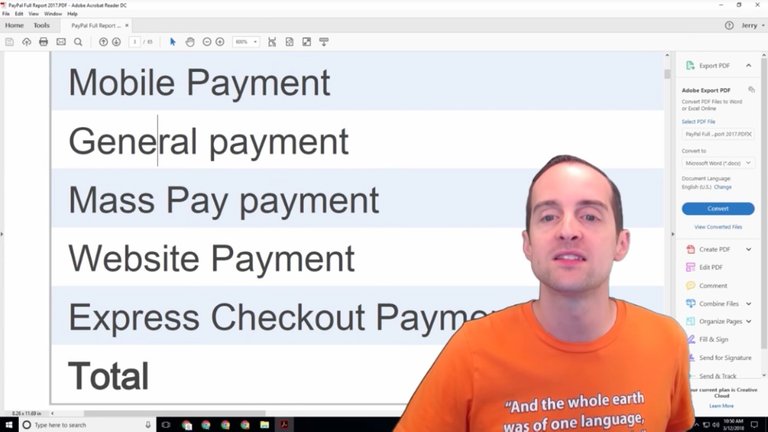

Based on my calculations, I am not asserting this as the absolute correct answer, but when I calculate the "Mass Pay payments," plus the "Website payments," plus the "Express Checkout payments," the number is within $20 or so of what PayPal reported on the "1099-K."

When I subtract out "General payments" and "Mobile payments" from the total, it appears, at least cross-checking the "General payments" with the "1099 reconciliation" report, that PayPal is not including "General payments" or "Mobile payments" in the "1099-K" total.

These apparently are cash equivalents. That means it's the same as if someone just made a check directly to my bank account or made a payment directly through some other service that doesn't count as a third-party reporting transaction.

Just having direct deposits and a bank account does not trigger a "1099-K," at least as far as I'm aware.

Therefore, when using PayPal we need to specify and help the people paying us to provide the correct method. Using a Website payment, Express Checkout, or Mass payment results in it being added as a "1099-K."

If we have clients or we are paying people who are determined to use the "1099-Miscellaneous" system or who just want to be paid with cash equivalents instead of credit cards, we can use send money to friends or family, or we can send mobile payments.

That said, PayPal asks that when we pay for goods and services we do it through a payment for goods and services because for PayPal's accounting, and for putting it on the "1099-K," it all does it automatically then.

However, if you have a client you know is sending a "1099-Miscellaneous" who refuses not to or who demands that they have to because of their accounting using a general or mobile payment can get around PayPal triggering a "1099-K." If you think that's not complicated enough, then we can get into the Coinbase "1099-K" reporting.

Coinbase sent me a "1099-K" for a hundred thousand plus dollars in 2017, which reflects the total amount of payments sent in to me.

What am I supposed to do with that?

Because some of those payments I literally sent say, $10,000 out to Bittrex, traded some, and then sent $9,000 back after having lost a $1,000, and then on the "1099-K," it just gets reported $9,000.

So, it looks like I just got $9,000 in.

The way I'm planning to handle this is to put it on cost of goods sold because the "1099-K" in from Coinbase reflects essentially sales that I've gotent in from somewhere else. If it cost me $10,000 to put it in there, and then I get back $9,000, then the income is the $9,000 with the gross sales and it cost me, cost of goods sold, $10,000 to get that $9,000 back in.

Now, this may not be the absolute best way to do it either, especially when it's capital gains. I'm not reporting any capital gains income this year on Coinbase.

Now, next year I will be reporting that where then I will want to separate that out and put that in as capital gains. This theoretically could be done through cost of goods sold too. I could simply put the total "1099-K" in, put all of the things that were cost of goods sold, and then simply report that income as capital gains on a different section.

So, it could theoretically all be done.

PayPal's reported this straight to my business as has Stripe, and Coinbase I believe has sent it directly through my business as well, and because I've got a bunch of payments that are for my business directly in that "1099-K" as well. Therefore, it seems the easiest thing I can do is use cost of goods sold to simply cut out the things in the "1099-K" that do not correctly apply, or to cut out the expenses I had relevant to generating that "1099-K."

Like I just said, if I sent $10,000 out and got $9,000 back out of that $10,000, it cost me $10,000 to essentially generate that $9,000 in sales, and then if I'm paying capital gains on it somewhere else I could put theoretically, let's say send out $1,000, and then I got back $10,000.

I could theoretically put $11,000 on the cost of goods sold on "Schedule C" for my business, then I go in in my personal income under capital gains and I put in the appropriate numbers in there, which then would be the capital gains of $10,000, and then I pay tax on that capital gains, instead of paying it as a part of my business income.

In that respect, I've essentially canceled out all of the income relevant to my business with cost of goods sold and put that in directly to capital gains while getting that "1099-K" form to my business.

What's challenging with the taxes is this is very much an artwork. We have a lot of choices as to how we can go about reporting things. While the IRS provides clear guidelines in some places for a lot of things, it's not precisely clear exactly what to do.

Different Certified Public Accountants provide different answers, and then the answers may vary by state as well depending on whether state taxes are involved or not. The IRS changes things from year to year too meaning one year it was appropriate to do it this way, the next year you have to change it.

Therefore, with the taxes, in my opinion, the key thing is to do our best in honestly reflecting our income, to report our income and our profit, especially for a business, in a way that's accurate. In other words, if we get audited and if we didn't put things in exactly the right spot, but the numbers come out correctly, then it's all good.

The place the IRS has a problem is when we've screwed around and under-reported, or failed to report our income, or done our accounting in such a way as to artificially reduce our tax burden.

I do my best to pay what is right.

Now, I want to pay the lowest tax possible and at the same time, I want to pay an amount that I feel good about. An amount that if there is an audit I feel good about.

I say, "Look, I know I did this to the best of my ability. I intended to pay every dollar of tax I was responsible for and I intended to do my best to minimize my responsibility just through, however I set things up. For example, to make sure I include all my advertising expenses."

Some business owners are not aware of all the things. I was not aware of some of the things you could deduct as an expense related to your business when I got started.

Using things like capital gains.

It's better to buy something and hold it for a year and sell it at the capital gains rate than it is to just buy it and trade it back and forth. You have to sell it at full income. Using that as the strategy to reduce income is totally legal and therefore you want to do that whenever possible.

For cryptocurrencies, for example, it's better to buy and hold something for a year, and then you can sell it at most likely a much lower tax rate. That is reducing your tax burden and tax liability through smart planning.

Therefore I try to use a combination of smart planning, accurate accounting, to report my income and also not to trigger any automated problems with the IRS, and so I can sleep at night.

When I get a letter from the IRS with questions, it's no problem. I got one letter because I had two businesses open and PayPal sent the income to one and I put the income on another. The IRS was confused. I sent a letter back saying I already paid that on this other business and they quickly verified that.

Then, I don't have to be afraid. I know if the IRS wants to see my full books, they can have everything, there's nothing to hide.

I hope this has been useful for you because I googled a bunch on this particular subject: 1099-K, 1099-Miscellaneous, double income reporting, Coinbase 1099-K.

I couldn't find a lot of good information about it.

I've produced this with the hope that this is good information and it's a helpful part of your research if you're doing your own taxes or trying to help someone else out with theirs.

Thank you very much for watching.

I love you.

You are awesome.

I hope this video has been helpful and the accompanying blog post with it has been helpful as well.

Thank you for reading this post which contains everything I said in the video! If you found this post helpful on Steem, would you please upvote it and follow me because you will then be able to see more posts like this in your home feed?

Love,

Jerry Banfield with edits by @gmichelbkk on the transcript from @deniskj

Shared on:

- Facebook page with 2,239,763 likes.

- YouTube channel with 230,829 subscribers.

- Twitter to 103,249 followers.

Our Most Important Votes on Steem are for Witness!

Would you please make a vote for jerrybanfield as a witness or set jerrybanfield as a proxy to handle all witness votes at https://steemit.com/~witnesses because we are funding projects to build Steem as explained here? Thank you to the 5000+ of us on Steem voting for me as a witness, the 2 million dollars worth of Steem Power assigned by followers trusting me to make all witness votes through setting me as proxy, and @followbtcnews for making these .gif images!

Or

Let's stay together?

- If you want to stay updated via email, will you sign up either to get new emails daily at http://jerry.tips/steemposts or join at http://jerry.tips/emaillist1017 to get an email once a week with highlights?

- If you would like to build a relationship with me online, would you please visit https://jerrybanfield.com/contact/ because I would like a chance to get to know you?

My video is at DLive

Thanks Jerry! Are there any projects that are getting funding to help people with taxes here on Steemit? Even if it is a basic tool that gathers data from your Steemit account history and displays it so we can see when we bought, at what price, when we transfered out etc.

@carface there are some data tools that pull transaction data (although I am personally not sure/ not able to verify how accurate the information is). You might find them through the tax/taxes tags.

Also, I released an open source e-book that includes a section dedicated to Steemit taxation with a basic couple of examples (I repeat basic!). I say "open source" because I engage in discussion in the comments and over time have added additional explanations based on the user feedback. It's a continuously growing/updating book and others are welcome to contribute. This is not an official "project" with outside funding.

That's a great idea!

@carface not that I know of yet and I will love to provide funding for one along with the other methods at https://busy.org/steemit/@jerrybanfield/10-ways-to-fund-a-steem-growth-project

jerry this does not cover it jerrybanfield transfer 4.001 SBD to deliberator Refund for missed bid

it was more than that

deliberator transfer 2.735 SBD to jerrybanfield https://steemit.com/blog/@deliberator/watching-from-afar-civilisation-google-false-flags-and-tv-no-thank-you-to-all-of-it

deliberator transfer 3.001 SBD to jerrybanfield https://steemit.com/steemit/@deliberator/steenit-from-the-investment-side-thoughts-and-general-musing

$5.735 not 4.01

I'm giving away steem to help people

This was a really helpful article and I appreciate it a lot because I also do ecommerce and taxes is getting extremely complicated. You never hear any of the so called "gurus" talking about the back end of working online, blogging, ecom, crypto, and all the drama with not screwing it all up. We want to have fun and enjoy our work, not panic because the information out there just isn't practical. I have friends who've spent thousands of dollars on very simple taxes they could have done themselves, simply because it's so overwhelming. And some of us (me) are not yet in the position to hire a full time accountant. Thanks for the tip and while I'm not sure how many people need information like this, I sure do.

Thank you Omi I was hesistant to share this here because I wondered how many people will need it and your comments helps me know even if not many people need the information, it might be very helpful to those that do!

@jerrybandfield This is precisely the type of "missing information" when it comes to all things online money making. There is a lot of focus on onboarding. For instance, when I got involved with eCommerce, the people I was learning from were focused on students taking action. I realize that is often what makes or breaks people (most quit early or never start.) But the second point of GREAT FAILURE is the hump. Most businesses go out of business in the first two years because of things like cashflow issues, taxes, legal issues, and overall administrative maintenance. So many entrepreneurs close their companies, go bankrupt, get sued, paypal holds their money, or the IRS makes their life hell.

I realize that it's everyone's own responsibility to realize they're in COMMERCE, but that's not what happens. Most people make a big wad of money and then it backfires and burns them.

Be it blogging, ecom, crypto, advertising, or whatever you do online that involves commerce, if you're doing it well, you're going to pay the piper right? So thank you for the tip and if you continue to make content that is on those topics, I'll be following it more closely.

:)

Fond of reading poems? Visit my blog and get some dose of it, just click the link given:

https://poetrygallery650854510.wordpress.com/ and my Facebook page

https://www.facebook.com/aTherapeuticArt/

Nice post bro......

Fond of reading poems? Visit my blog and get some dose of it, just click the link given:

https://poetrygallery650854510.wordpress.com/ and my Facebook page

https://www.facebook.com/aTherapeuticArt/

Very good post @jerrybanfield

I’m new to everything. A lot here, appreciate very much. Enjoying myself so far , crypto diff to research for me.

I think your article is excellent! Clearly and precisely you managed to describe the incidence between the two forms. I congratulate you for your altruistic sense of reporting possible solutions, and especially the ability to induce third parties not to repeat their mistakes in using a wrong form, without first verifying the operation.

I was, for more than 25 years, an officer of the national tax collection agency, and I remembered my years as an auditor, so having read your article brought back beautiful memories of what my activity as an auditor was.

Thank you for that remembrance!

thanks

nice

Such a wonderful project. You are doing a great work. This project is really great. I like it, no no i love it.

Its always good to know that someone is trying hard to make Steemit a better & beautiful place.

I will upvote & resteem this post.

Fond of reading poems? Visit my blog and get some dose of it, just click the link given:

https://poetrygallery650854510.wordpress.com/ and my Facebook page

https://www.facebook.com/aTherapeuticArt/

This is a very vital information from you.. It is very useful

agreed, thank you for this post.

Good Post

Hey Jerry, what's wrong with the bidbot? it seems to have gone awol with 6 of my dollars, will it stop by again later after missing me last time? just asking, so I do not have to ask in the future, cheers.

I've said this before on my previous blog when Steemit started dropping two months ago,

"Mentally, its always sad to see your account value or net worth dropping on paper; This is just a paper-loss, and doesn't MEAN ANYTHING, unless you panic sell with everyone. "

So Steemians,

PLEASE HODL!

give upvote

https://steemit.com/dmania/@zoeyvalliant/super-harmony-zg1hbmlh-czplf

Using PayPal might even be safer than giving your credit card number (or bank account information) directly to the website you're buying from; you can keep that information in one place – at PayPal – instead of spreading it around everywhere you shop 😁 very useful in these days...I use it everytime I get the chance.

Share your problems with @astro-science.

Hi everyone, I m @astro-science. I deal with #vedic astrology. I will help you to solve your domestic problems, family problems, mental stress and all other problems in life including your future prediction.

Try me once to judge my astrology and than #believe.

Send me your details (Zodic sign, Date of Birth, Time, Place of birth and country) You can also send your palm.

#Male:. Right Palm

#Female: Left Palm

#Fees

Send 0.5 SBD/STEEM with #memo :

STM6XggVip46Enzc1bMTq7mPRjs6LzXgHqw4YX2YaiEJK9GtLsQAG

Get result within 24 hrs of sending details.

https://steemit.com/astrology/@lachitsarmah/share-your-problems-with-astro-science-4daae4519012f

Wonderful news and important for all

Thanks for sharing☺

@upvote and @resteem done

Nice projects & thanks information, upvote and reseteem this post 🍻

maravillosa idea Dios quiera, te deseo éxito

ufffffffff you are the BOooooooooooooooos

Thank you so much. This was very helpful. It's always a challenge every year for me to do my taxes. I use TurboTax for many years now.

Thanks again!

Thanks, you have informed detail. It will be thw better cobtribution for the the readers. Mee too.

Hello ! Thanks @jerrybanfield for this article! Very good post!

Thank you Jerry. @hashclub is your big fan. We already vote you witness. We always get valuable information from you. Love the project you shown here.......Thanks once again.

Nice sharing and illustrating mate

sir,,i love you,,i love steemit

Congratulations @jerrybanfield!

Your post was mentioned in the Steemit Hit Parade in the following category:

Sure man, added you as witness :)

What a long article...i wish have to read it....

VOTE and FOLLOW me please

Thanks for the informative post. I needed this info. Steem on!!

nice

your writing is helpful, many people are discussing the basics without telling the basic details

nice

Very helpful bro

good idea.

coinbase working with paypal?!

That's great great post. Basicly it stands on two view namely using third party and non 3rd one. Advantage and disadvantage always be on the point view of user. Great post

Wow Joss

This guy always is quite helpful and presents innovative ideas

Thank you for subscribing me. I wish you good luck and best regards.

Follow @merlin7

nice post