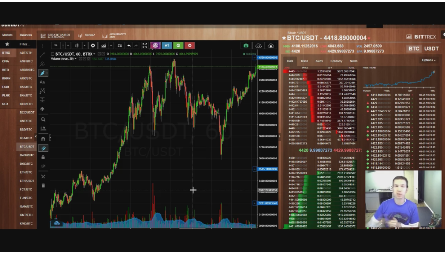

Watch Bitcoin at all time highs, whats gonna happen video on DTube

Hey everyone, its friday, Bitcoin is at all time highs, and might break out. Lets discuss: how to read the history of the chart, to help predict what might happen here, and how we can trade this. Also I keep receiving questions about growing a small account, using my Small Account Building trades.. So let me give you an example of one I have been trading the past few days, and how you can quickly double a small account in a few trades..

Thanks everyone for supporting my blog with your votes. Your continued comments and interest tells me I should keep these videos coming (whenever I get a break from the market)

Luc

Hi there, Luc!

If other people are interested in building small accounts, i can tell them my story.

I saw your videos and switched to position trading first. Secondly, you released the marketscanner and i saw that most of the alerts are coming from Hitbtc, so i got an account there and sent 0.1 btc and 3 eth there. (around 1000 $ 3 weeks ago)

I started watching for scanner and made some beautiful trades. I made from 1000$ about 5k in 3 weeks! That's just insane, i got less from position trading than i got there.

The most beautiful trades:

I caught massive sell on etherium classic, price went all down to 0.00081000, i saw this on scanner, revised market depth and placed an order of 0.1 btc at 0.00081100. I got order filled, so i just transfered them to bittrex and sold. It was x4 profit with high volume coin. (you can even check history on HITBTC, it was an august 15) (i have screenshots as well).

Another beautiful trade - I got in BET coin 5 times and received about 5 etherium of profits, with trading only about 1 eth every position. It's just insane, all you need to do - is watch for market scanner and wait, check coins and trade.

Last but not least, I made incredible arbitrage profit on DDF, it flashed on HITBTC and i checked that it's also tradable on cryptopia, i bought in, sent tokens there and made x5 profits as well.

Thank you for such an incredible chance!

I had a similar experience when I first opened the HitBTC account.. I just sent over $10,000 worth of BTC and figured I would give the exchange a try and see how the orders executed and if there were any bugs in their trading platform... but in a few weeks my account was at $15,000 without barely trying.. It's very easy to find those Small Account Building trades on HitBTC

I've checked HitBTC out before, but didn't see any way to be notified when a trade is executed. Since they don't integrate well with Coinigy, I'm hoping there's some way this is possible. Do you have a way to be notified when a buy goes off?

This takes an extra step, but yeah, I put all my orders as alerts in Coinigy.. and then when an alert goes off (a price point is hit) then I know that I excuted a HitBTC trade.. thats the only way I have found...

Makes perfect sense. Thanks Luc!

Just signed up for HitBTC now... but having problems with Coinigy. I can connect my account with the API, but I cannot enable trading? Do you know why? Do you need to be verified first by sending all of your docs to the company? Also, it looks like in order to trade in USD, you need to be qualified by verifying all of your personal info (which seems to be a major process).

Do you have any recommendations on this or how to make this easier? IS there an easier way? Thanks!

A while ago I asked this question to Coinigy support, this was the answer:

Trading on HitBTC isn't supported right now but we do support charting and balance tracking with your account.

Check this following link to see what exchanges we have integrated and to what extent they're integrated: https://www.coinigy.com/bitcoin-exchanges/

Thanks a lot Selsrog. I'll check that out! Appreciate the response.

Hey @quickfingersluc ... do you think Cryptopia is equally as good for finding good account builder coins/trades? I ask because Cryptopia works better with Coinigy than Hitbtc.

I use Cryptopia too .. but I find alot more trades at HitBTC.. but yeah, its annoying to have to work around Coinigy

it seems you made huge profits from arbitrage twice, i didn't even consider to check that deep. There are many ways to trade and it can be overwhelming.

sometimes the opportunity for arbitaging coins is just a quick stint and by the time the transfer goes through, it may be too late. this is speaking from medium sized altcoins such as ltc or etc. there may be opportunities for other smaller altcoins, but not all can transfer from one exchange to another. but if you ask me, theres definitely some nice opportunities.

ETC wasn't arbitrage, it was a flash sell on hitbtc (3 times in every 15 mins in a row). I just knew that buy volume on hitbtc isn't enough to quickly get out of position, as i need bitcoins to trade, that's why i sent them to bittrex and sold immediately .

For low volume coins arbitrage works nice, but you need to be careful.

ahhhhhh, i didn't completely read the bottom of your post. man, that's some good work.

I have been trying for weeks to open an account with HitBTC but the confirmations emails dont work and the contact email bounces... :(

Perhaps you can try sending them an e-mail mentioning that u want to put in $XX,XXX sum of dollars. I heard someone did that with other exchanges and miraculously gained access.

try to reach them in twitter

Does hitbtc work great with coinigy?

Nope - you can only view charts on Coinigy. Have to do all your trading over on their website.

Hi @feleks, thanks for sharing. May I know which particular scanner are you using because there are several of them announced recently.

awesome

Smooth moves @feleks , I'd love to see your screen shots.

Also, what is wrong with this screenshot?

How can the price go up on a sell off. One red line down, followed by a red line up?

The candle is red when the price at the beginning of the interval is higher than the time at the end of the interval. So, for example, if it is a 1-hour chart (where each candle represents one hour) and there was a spike in price at 10:00, than it goes back down immediately after, it would be shown as a red candle, because the opening price for that hour is higher. You might be able to better understand what happened if you look at smaller resolution (but this could happen even on the 1-minute chart, for the same reason).

Hey @feleks That's awesome man! Quick question... when picking your trades on the scanner...are you adhering to quickfingerlucs cracking support rules, or just buying dips based on the scanner (common sense first of course)? I ask because it's not often that I see the scanner coincide with lucs general rules. Also... have you pretty much exclusivly used Hitbtc, or have you traded at all on Cryptopia (which also has a lot of obscure low cap coins). I ask because Cryptopia works a lot better with Coinigy, and seems to have a fair amount of activity on the scanner. I personally haven't done a single trade using the scanner, but your post has me looking to revisit. Thanks in advance for any other info you might care to share.

All Luc's videos are masterpieces. It's impossible not to love this guy, folks. He is the man. I'm also making awesome tradings using Luc's method. It is just a question of dedication in studying the charts and its bases. Thank you, Luc. You live in my heart and thoughts every day.

I'd love to see a video on timing of trades, meaning....you're placing all these trades. Then you go to sleep. What do you do at the end of the day? Everything with preset buys/sells? Or just let it ride and see how things look in the morning?

Also, maybe a video on how you keep track of all your buys/sells across all those different coins. If you take a nibble here and there and there and then a lot, and you sell on the way up....how do you figure out what your end results are?

After I buy anything, I immediately put in my sells for where I think it should go.. With Coinigy, I can leave my computer on and it will make an alert if I buy or sell anything while im not in my office. So I do often end up running back to the office to submit an order at night.. But it just depends if the trade is big or not.. Coinigy also sends you email alert, so even if your not at home you can see if anything has happened in your portfolio...

As far as adding up my day goes, (with the stock market, im usually totally in cash by the end of the shift so its easy to total) with cryptocurrency its difficult to try to accurately add everything up an see a running fiat total, so i just take a good guess each day of what I made and give myself a total, then once a week or so I do an accurate total for my entire portfolio..

Do you set up many orders before you go to bed to catch quick dips? I usually wake up to a ton of alarms where they have broken the base or quick dips but by the morning they have risen back to the bases. Any elaboration on your nighttime strategy would be appreciated. Thanks!

Hello luc, I think most people are confused with where it should go after purchase.Could you upload a new video about where to sell? Yeah , you said that anywhere we can get profit is a good place to sell,and nobody can predict the future,as sometimes even you, luc, sell it then it heading to the moon(that EOS example before). And also you teach us that combie Hot potato method with Position trading is Powerful.

Expect more knowledge about where to sell.

Thank you sincerely.

Hey Luc, thank you for your helpful videos, I created a steemit acc just to follow you.

Anyway, I was wondering if you could do a video or share your opinion about technical analysis. I know you are hardly using anything else than bases in your videos but I think many people tend to believe in "line drawing and predicting future" stuff.

I am not sure myself which parts of TA could be useful (RSI, MA,...) and which parts are complete bs.

It would be really nice to hear an opinion from a professional trader.

Best regards

Hey Luc and Cenox, first post here as well :)

I think Luc already gave some hints about what he thinks about traditional TA in a few videos, that he is not trying to predict, but instead reacting and evaluating the probabilities.

When I got into crypto I tried to learn some TA as well and it didn't feel right. All these methods are trying to predict the future based on past data, which is most of the time irrelevant in front of news or market makers movements. It did look convincing for a while, so many books and serious people trying to act all scientific talking about it, cool kids on twitter making charts and slack channels... But then you notice how these people are anything but scientists, their systems work until they don't for some reason. They will celebrate loudly when they have a winning prediction, and will forget quickly about all the wrong ones.

It's also clear that a lot of these people's main objective is to make money out of books, training seminars and paid telegram private channels.

I am really thankful to Luc for taking an opposite approach and taking the time to explain and demonstrate something that to me, makes much more sense: looking at the past, learn to read a chart, and thinking in probabilities before taking a position.

Still I would be curious as well to know if Luc thinks some part of TA are more or less useful, or if he has used some in the past and got over it for some reason. Some people are saying that TA is useful just to anticipate what other traders using it are thinking...

Congratulations @quickfingersluc! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPLuc! What brilliant vids!!! Been investing/speculating in the crypto space for about 5 months and your vids have given me the confidence to get started with some trading. My main worry is the security of the exchanges.

How do you try to mitigate the risk of loss? I think spreading across a few exchanges in case of hacking at one but it still feels quite insecure.

Do you worry that you might loose the money/coins you leave on the exchanges?

Thanks a bunch for the ongoing rocket fuel!

Unfortunately exchanges are always a risk, so like you I spread my money around on different exchanges. But here is how I think of it: we make stupid amounts of money off all the opportunity here in cryptos, so if it happens that we end up losing a little because of some exchange issues, thats not that big a deal, because we are so heavily rewarded thats its worth that minimal risk.

Luc what exchange to you suggest for beginner traders. Most people seem to start with Bittrex but do you have other suggestions or reasoning why that might not be ideal?

Hey Luc, for the most part my trades have been all going pretty smooth, but these two particularly the LGD trade kind of has me in a pickle.

You can see where I drew my base with LGD, and instead of the bounce fell another 40%, would you buy in more here? Or just wait it out until I get the bounce for the original trade?

With XRP as you can see I juuuuuust missed my sell by like 2% or something, do you think the base I was working off of is still good?

Maybe just some more patience is needed, but i feel with LGD i could be missing out if i dont buy more but this dive has me slightly nervous.

On both of those trades you had some great entries, very nice trading :) I would have taken those trades.. But yeah, that LGD looks suspect.. You should go look up the news, incase there is something that has effected the price.. There may have been some significant news, and news does trump all technicals. It would have to be pretty bad tho, because this chart is very respecting of every base i can see..

Thanks Luc! I was pretty excited myself about both entries lol. I've been searching Google for news on LGD but I can't find anything, no threads stood out in the popular forums that pulled up. Is there some trick to spotting news as it happens or do you just goto Google too? I did end up buying more and strengthening my position as it does have a history of respecting bases and at least if it bounces to my first buy I can get out unharmed.

With XRP I just missed my sell, would you lower the sell now or just be patient and keep it there, I mean it is Ripple and should get a bounce at some point.

Again thanks, I have been making plenty of other positive trades the past few weeks I would post them here but I do in slack instead don't need to clutter your thread up lol, just these two are ones that I have gotten in a little trouble with. Keep up the good work your the man!!

Yeah, thats why I usually sell some in levels.. I write orders to sell all coins near the base right after I get some coins, incase there is a reaction spike.. but as time goes by, like a few hours after my entry, then cancel that first sell order, because a reaction spike is less likely and I start to layer sells all the way back up to the base. Like you I have often missed my sell.. But after you miss it, its not the same odds any longer, its a toss up now.. it might turn back up and it might not.. The odds are no longer in your favor, its 50/50 now for XRP..

As far as LGD goes, its very hard to know what to do with that trade, I would be scratching my head? That looks like a news drop to me, because why would all the buyers disapear like that... I dont usually throw good money at a bad trade.. But you are right, that it has respected bases in the past.. Gah, its hard to know what to do.. There must be some news out there somewhere because it looks so ugly now.. Atleast make sure to take a break even, or small loss on the next bounce.. my rule is to always participate (sell some) on every bounce, when Im in a trade gone bad.. You have a real stumper here.. if I get some time today I might try to look up this coin for news for you.

i've put in a sizeable position for this trade too and now am stuck. i've done some reading and this is a coin for a strip club in Vegas. the pump up was due to media announcements + hosting an event for mayweather vs mcgreggor. Customers who wish to become VIP's have to purchase 5000 LGD coins. if you look through the history of the coin you'll notice single day large spikes, followed by an immediate crash, probably the coins being dumped by the club owner.

there is another event on the 9 of september, however i dont expect it to be as big as the mayweather event. probably wont have as much of a spike. meanwhile dont expect the coin to move any higher.

Ouch, so this coin is only used by a single strip club? Damn lol I wish i knew that before taking the trade. There's a huge boxing match coming up, I thought it was on the 16th, supposed to be two very legit fighters.....obviously nothing will get the hype that mayweather/mcgreggor got, hopefully I will be able to sell for break even.

they have a twitter follow it for updates https://twitter.com/legendarycoin?lang=en

lesson learnt. always read the story of the chart. preferably before you buy ;)

Thanks for the info, good to know I wasn't the only one who fell for that drop. Tried doing my own research when it happened and never got deep enough to make heads of tails of it, just praying for that spike lol

Thanks Luc, I appreciate the advice, I'm gonna watch it closely and see what happens.

in my stupid opinion, LGD is a club coin, i saw last few spike like a small one on wednesday 16.08.and another huge spike before weekends, and there are a few tweets on LGD offical some photos AFTER party. yeah, party is over I think someone still have some LGD are stripteaser who just received it. When people realize party is over, at least from thier official tweeter, there is no demand anymore, If i went to LGD club at weekends after enjoy that, i ll sell LGD which left on my hand. Nobody goes to club on Monday i think.and people will buy LGD when they need (buy some beer in that club,scan QR code to watch stripteaser dance)

Hope you will read this, that is my opinion and luc's method : Read the story behind the chart.

Thanks a lot

So would you say just wait it out till the next major event or possibly the weekend when people are hitting up the club?

https://motherboard.vice.com/en_us/article/qk7g8p/a-las-vegas-strip-club-is-making-it-rain-cryptocurrency

Im struggling with thinking is this actual "bad news" or just the way this coin behaves, I think it will spike again. There doesn't seem to be actual bad news per se. And if you read the article it looks like the club is going to keep using this coin. I think the real bad news here would be if they decided the experiment is up and no longer use this coin they created, but I don't think they'll do that. The real world purpose behind using the coin for people going to the club is to hide their spending habits......so my plan is to wait for the next spike (hopefully this weekend) or the next decent fight and then get out and probably will leave this one alone, unless we see clear trends of huge pumps right before a fight or something.

Just got out of XRP at break even

Hi Luc.

I'm a big fan of your videos.

Just got approved for the Steemit account and the main reason for me was to get in touch with you about the slack chat.... the link on your youtube video doesn't work anymore. Could you please let me know how to join the slack chat to be up to date with your material and trading strategies? I'm just starting with the trading and I know there is a lot space for a growth if I follow the right person / people.

Thank you in advance.

Im sorry I don't have an invite for you. I don't moderate that chartoom, and so I am not making those decisions about when to allow more people into the room. Just keep watching here and likely they will be giving out invites again soon.

Hi Luc, anyway to drop you a PM?

I would like to ask you a question.

Hello guys and Luc! I love all Luc's videos, but I don't know the technical basics, how to actually start trading coin. How to actually buy and sell coins (do I just exchange other coins for BTC back and forth, or should I use Tether (USDT)? When I make my first investment, should I buy BTC, ETH, LTC od USDT? Do I store my coins on coinbase (or other pockets), or send them to bittrex and connect my coingy with bittrex and make trades from there? Those are my only concerns. Thanks!

I purchace BTC on coinbase, then send them to the exchange of your choice. Plenty of videos on how to use bittrex.

thank you for your effort

cryptocurrencies are next to become common economy of all the nations...

Thanks Luc, my trades seem laughable in face of such opportunities. I should probably study charts more to find the good ones, and it will be worth the time more than trying to trade average ones.

Wow, those are some big percentages on BAS

Thank you! I have learned so much from your videos. I appreciate it so much!

You've been such a great help! Really appreciate you taking the time to make these videos. Please keep them coming! :)

Now following you on Steemit ! Thank you so much for sharing your videos.

I learn a lot with you. Keep feeding us :)

Luc Is the greatest, you give me so much confidence in trading, your the best and please post more of your stories

Gotta say Luc, I'm a fan. Whereabouts in Canada are you from?

Hello from England again and thanks for another great sharing video Luc, it all helps a little more each time. Cheer Paul

Hi Luc, thanks for the nice video, always a lot to learn from you!

I would be interested in your strategies to day-trade pumps; you mentioned that you buy on the first dip, but it would be nice to know better how do you do it, like: where do you buy? What percentages do you aim for?

Thanks luc for the videos. I don't understand something. Let's say I start to trade using a 2000$ worth of account. I saw that your eth trades are of small percentage e.g you buy for 230 and sell for 240. If you take into account 0.005 fee then you make 9 dollars per eth you buy. If I risk 10% of my account, I can buy one eth so I just make 9$ on a sucesfull trade that I might catch once a week? What am I missing? Should I leverage?

Hi Luc,

I've been following you since you started the original channel... I have kept mostly quiet and just reading and testing things out. I am crypto and trading mad right now, as I see it as a way of getting out of my debt and sh*t 9-5 job that is killing me mentally...

Anywho, I only have 0.07 BTC (~$300) at the moment to trade with. Not much I know. I hope to add to it soon... I keep using 10% for trades and get 10% returns which is tiny in terms of money (but decent as %). Shoud I split that $300 into 3 amounts..

I'm finding it difficult to find markets that are ready to break the base... I decided to create a simple tool. Just considering how to set the algorithm ... set it to alert when the price has dropped at least X% and is within X% of the 24hr low..?

Obviously you would need to manually check the graph but it would save setting alerts for each market and redoing them every so often.

Thoughts?

There are quite a few members who have worked on scanners, so you could try them out first and see if they give you the alerts you were hoping for.. there is also the slack chatroom that has a base breaking alert channel.

There was a slack room link posted in the comments for one of your videos, but it's no longer working. Do you know of an active slack channel that you could share? thanks.

Slack chatroom is down for security reasons, follow @tizzle for updates on when it will be back up

Appreciate the reply Luc! I had a nice trade today, not massive but I am happy with it! Take a look at my page to see the trade itself. I had so many questions and looked over your videos again and I had a eureka moment with the bases... I'm still learning though.

I think my plan is to make some good position trades but try to find coins that are account builders. If I can get my ~$300 into $1000 I would be over the moon.

Massive thanks for your videos and time man. You don't know how much I appreciate it. Seriously, turned me from extremely fed up to seeing a way out (one day) of a crappy day job.

Thank you for sharing. One question... when you make those building account trades do you sell all your bought coins at once on estimated gain or do you do as with position trading, like 75% at estimated gain and rest for higher?

I do sometimes keep some of those smaller illiquid coins for the future, depending on which they are.. But yeah I keep some.. I generally keep a little of everything that I work on, as long as its all from profits it doesnt hurt to grow your holdings in your portfolio with free coins..

Luc what's your process when a panic is happening? How do you figure out why the panic is happening and how do you use that information to determine your entries (and ultimately predict how deep the panic is falling)?

You need to watch m other videos.. I explain all the details to my entries...

Would anyone be interested in starting a Slack group for this type of trading? Seems like that platform is better suited for group discussions and sharing screenshots of our trades.

Already exists. Check back in the comments of Luc's recent posts for the links.

Hi Luc, I really appreciate all the effort you have put into helping us all.

Do you know what determines which bid will be bought first? I ask because I am curious how something like DENT/ETH on HitBTC works? The price is sitting at .000003 and the next possible option to bid is either .000002 or .000004 and at the .000002 mark in the order book, there is 23218545.20 worth of orders, with obviously may people all crammed into one spot.

Is it fist come first serve, smaller orders first, exact orders first then the next closest....?

I have always avoided anything that looked like that, but I see the volume is higher than I would expect for such a low priced coin (105. ETH).

I wish it was first come first serve.. But in the stockmarket it is random.. I have often been the first one bidding at a price point and still didnt get a fill first.. and then I have often added my bid to a huge bunch of orders and then got my shares seconds later, before everyone else.. totally random... So I would expect that it works the same for coins..

On that note, In the order book today I noticed that someone had a bot or script of some sort to put his sell order on the front of line so to speak. Every time I moved my order down it kept jumping in front of mine. Do you know what that was, where I can get one and what else they can do? I would really love to get something to place a sell order for me, right after I a purchase goes through, so I could set it up when a good opportunity shows up right before the end of the day. Stop limit will not work if the price has not dropped far enough and sometimes don't work anyway. I don't even know if that would work, I have noticed that in Coinigy the order often doesn't process until I hit refresh.

BTW a few days ago you posted about a scanner in slack, but the owner of that slack account canceled the invite because someone was spamming through that link. Are there any other scanners out there you could recommend? I have never used one and would like to experiment a bit.

Thanks again for your comments and videos!

It went past 4600. can you tell us what is your strategy at this point? are you planning to sell some now and then buy back when it drops? Thanks!

nope.. its not a big enough of a percentage for me to sell.. if it runs to $5,000 and then struggles, then I may sell a little.. if it blows right past $5,000 and retests it from above, I might still keep holding.. As I said in previous videos, anywhere in profit is a good place to sell.. The most difficult part of trading is knowing where to buy (safe circles) then after that, figuring out how much profit you want to take is just a great problem to have :)

Best teacher!

quickfingersluc! You have a sweet gig. Seriously. I am hoping to be able to grow to where I can trade full time. Thanks for posting your stuff and being inspiring.

Oh my, do I ever.. Was a super fun day today.. Stock market was giving me awesome trades and then around noon time BTC and ETH started heading up again, so my coin portfolio balance just keeps growing.. I cannot convey how great trading can be once you get it... I wish I could help more people to understand the basics, because there is soo much opportunity in the markets..

NEO dropped significantly! Good time to buy??? Thoughts?

I would have to say, this is one of the easiest charts to read.. obviously the base is $30ish.. and so I would start buying any decent panic below that.. Im hoping for a panic to 26 or lower, but well see what we get ..

Hey Luc, I noticed the same chart but I have my bases outline below... are they not bases too? NEO/BTC.

Your bases are correct, but you have to start to wonder about the strength of that 85 base after all that consolidation.. Let me explain:

on the 23rd it gave a solid bounce from 85 to 105ish.. thats really strong, and makes for a good base.. it would be very surprising to everyone if that support did not hold in a future retest.. Then on the 27th it retested and held, and caused a bounce from 85 to 96ish.. (smaller bounce, less conviction)... then the next day it restested 85s again and bounced to 90s (smaller bounce, less conviction) then for the next day or two it played around 85s... So after all that weakening, who is surprised that it cracked below 85?? Like, who was not expecting that?? it was getting weaker and weaker..

Well, there will always be a few novice players that get surprised and that will maybe cause a little panic, and it did .. all the way to 65s but then it bounced only to 80s again and not to its 85 base, and that does not surprise me, because that 85 base was pretty well played out..

I just gave you a long rant/explaination to help you to see why it may not return to the 85s : because for most big players, they could see that 85 was about to crack and therefore they were not caught in trades, they didnt have to panic, most of the crowd was not surprised by that crack.

So in situations like this do you wait for a newer more well defined base to jump in, or do you just want to see a larger dive before jumping in? Or do you kind of fall back to using the last stronger base at 76? As you can see if you did use 76 it did get the bounce back.

I only take trades off a strong base.. I need all my trades to have a high high success rate

Absolutely excellent reply, this has cleared a lot up for me tremendously. So if a base appears to be weakening from being retested multiple times and the bounce gets weaker, it may not return to that base if it cracks it. In that case, do we go to the base before that (assuming that base has a strong bounce)?

Thanks so much man, I keep rewatching videos for any info I missed.

Luc I understand where you're going with the 85 base becoming weaker and weaker on the chart but this heavy panic was gamechanging news related I didn't exactly happen organically. Does this impact your buy in.. or you think whales will scoop up these low 70's regardless of the news?

Thanks

News trumps technicals... If you every find a coin with game changing news, (an example would be fraud, or some one hacked there system and took coins) then I wouldn't touch it no matter how great the bases are.

@quickfingersluc you have taught me something new

This was such a great explaination and makes so much sense. I was literally thinking about this on several charts and couldn't explain what I thought was going on... but you can literally see the support weakening before your eyes. You nailed it. Thank you.

How many trades on average can a trader expect per day/week? I know this varies greatly based on many factors... greatly. However, with the types of deep bases that you are perfect at trading off of, it seems that these types of trades don't happen all that often. I'm continually marking charts daily, but very few bases crack regulary. Perhaps I need to get into HitBTC or Liqui? I'm on Poloniex, Bittrex, and Bitfinex now. Do you have any thoughts on this topic?

I'm just trying to figure out the best way to allocate my funds for position trading vs. day trading vs. long-term investments (e.g. Bitcoin) and what reasonable expectations are in terms of gains (not necessarily the percentage of gains, but number of times you can gain via a base cracking). My goals are to account build, but ALSO make large profits through larger swings.

Would love your thoughts on this and THANKS AGAIN, really love your stuff.

If you set alerts below bases, on all the coins you like, then you will find your alerts go off, quite often. Just set those alerts at places that you would buy, not at base cracks, but lower.. and then you can also use the scanners to take small account building trades for fun, with small amounts of money, just to keep yourself active all day.. That helps with patience while you wait for the bigger position trades.

Thank you Luc - really so very appreciated.

Bro have you noticed BCC after a long quiteness it spikes up for 2 days to all time high.. i guess i myt b wrong bt i think its spike up soon again to another high and come back down... what do u think abt this ?

BCC or BCH has too many players for it to follow that type of pattern.. Even tho I don't like BCH much, and have sold all my free coins, (i have no position) it does have enough of an argument to be a great trading vehicle. It does respect its bases and can be traded quite easily.

Regardless of what your personal views are regarding BCH, I would buy any good panic below a base.. The current base is around $525 usdt

Friday is my new favourite video of the week day ;-).

Luc how do u still feel about bas? its looking pretty weak today with btc and eth going up. I bought some at 44 and 38