[Image Source]

https://www.thirdway.org/memo/five-problems-with-universal-basic-income

Opening

Dr. Trost's "The Libertarian, Conservative Progressive, Communist (Not Socialist) Case for a Universal Basic Income" outlines a potential plan for a universal basic income. There are a few juicy details that resonate with me, but also a few pitfalls that could make the case for a UBI moot.

What I Liked

The caveats associated with the plan are well thought out:

The Politics

The Constitutional Amendment requirement checks a big box for me. Not only is this the only possible way for something of this kind to actually come to fruition, but it's also a safeguard – provided that a UBI is something that a majority of American's wish to have. If not, it could be amended and altered into a feral monstrosity.

The Mobility

Payments being tied to previous year's GDP was expected, and its effects would most certainly be seen. I really liked the emphasis on mobility as that is something that isn't spoken about very often. This definitely appeals to the hardcore libertarians in the sense that so much of individualism is the environment you choose to put yourself in, and many individuals are not able to do such a thing due to their income. The privatized schooling is a wonderful daydream as well. Not only would this give different geographies different specializations, but it would also give individuals greater freedom in choosing what and where they want to study. It follows that with such specialization, schooling would be (unmeasurably) better. In turn, this ammounts to a net benefit to society.

The Flat Tax

The idea of a flat tax has been food for my brain for a while, but a flat tax in itself is a huge change. Tossing the progressive tax rate aside is obviously exciting. As noted in the presentation, this would substantially cut down on preferential treatment by the government to corporations and certainly some individuals as well. The implications of such a tax are rather broad, though. A study from George Mason University estimated that the cost of compliance to the Federal Tax code is north of $350 billion (at least, according to a PragerU video I just watched). Thats a TON of money that could be put to work in our economy. However, getting rid of said tax code means that millions of people lose their jobs. This brings us to the second section of my reflection:

What I Did Not Like

The Flat Tax (Again)

"... means that millions of people lose their jobs." Tax accountants and tax attorneys now need to look elsewhere for work. Lobbyists, while useless, will need to put their legal brains to use somewhere else. This unemployment would most likely be negligible in comparison to the added $350B coming into the economy. Yet, the most vital shock to the economy would be the higher costs borne by corporations. If Milton Friedman is correct in that the sole social responsibility of firms is to maximize profits, it logically follows that the added costs of this flat tax (no more preferential treatment) would be passed on to consumers; we would ultimately bear the cost of the lack of such treatment.

The Economics

Unless I missed something, my concern with this entire idea is inflationary forces, but the overall economic consequences of a UBI are largely negative. We saw just a few years ago how devastating a stimulus can be. Prices were stuck low when the stimulus checks hit, and it really helped people for a few months. But, when the stimulus checks quit coming, prices were increasing, and real income ultimately fell victim to vicious inflation. Now, theres a reason it was called a stimulus: because it was a temporary thing. A Universal Basic Income wouldn't end though, so everything would be a-okay right? Well potentially yes, but realistically, no. Here's why I think that:

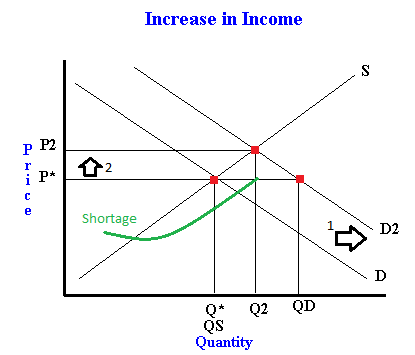

[Image source] https://www.freeeconhelp.com/2012/02/how-change-in-income-changes-demand-and.html#google_vignette

An increase in income ultimately drives up prices. This happens for a variety of reasons (Milton Friedman's 'increase profits' being one of them). These new (higher) prices come with a bit of dead weight for the economy, rendering it inefficient (it is already, but moreso under price increases). They also rise to a point that would render the basic dividend useless. If the point is to ease mobility and supply people with what they need, but the things they need become just as expensive as they were, relatively, then what has changed? Being tied to GDP doesn't change much either. The hope would be that new higher prices would see less sales and a lower GDP, but (via the graph above) thats not the case. And, if it were, those higher prices would stay where they are, and the UBI payment would be less the next year, putting us in a COVID stimulus situation. An argument could be made that the absence of a minimum wage could account for this, but a similar thing would happen. Wages would fall to compensate for the UBI, and real income would remain largely unchanged.

Closing

While a UBI is something that looks great on paper, I'm skeptical that something like this could truly have the intended effect.

Congratulations @dieselchugga! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 50 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: