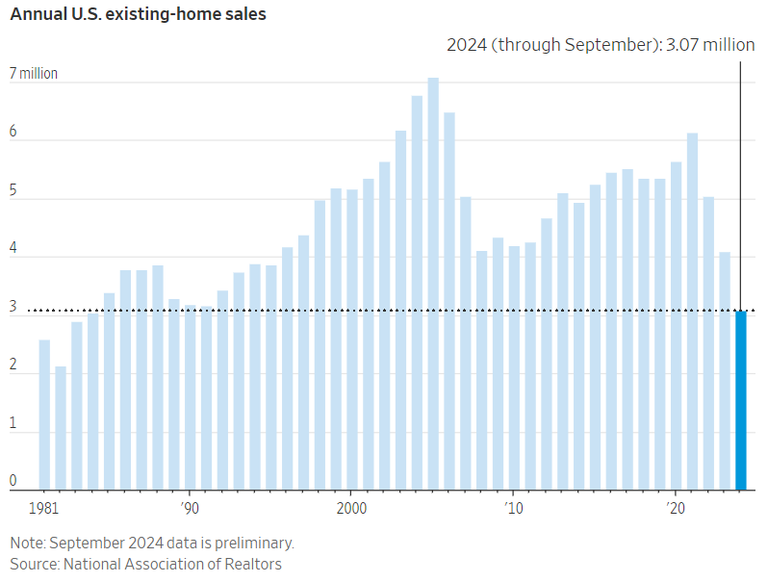

... 37 years ago. Here is the graph:

What is causing this?

Simple: many existing home owners re-mortgaged during the Covid era when mortgage rates were 2.5% or lower. Mortgage rates currently are about 7%.

If you have a 30 year mortgage at 2.5%, it makes no sense to move house and pay 7% on your new mortgage.

So people are staying put, paying their existing mortgage and waiting for mortgage rates to come down to covid era levels before they move.

But it's likely mortgage rates will never get as low as during the pandemic, which was a unique moment in time.

As a result, the US is looking at a 30 year slowdown in existing home sales. The only sales will be if people divorce or are deceased. Even getting a job in another part of the country won't trigger a sale, as it makes sense to rent the home out to cover the existing low mortgage plus a profit.

This has profound implications for the real estate industry, and related industries (home removals, home furnishings, and so on). All are likely to shrink and become a smaller part of the economy.

New house sales, where people sold their existing home to move to a new build, will also be impacted. This has consequences; the construction industry will also shrink.

And this is not a short-term trend. It's likely to go on for 25 years till the covid era mortgages end, at which point a new equibrium will form at a higher interest rate.