Does Need Financial Intelligence In Managing Moeny?

Money Works For You or You Work For Money???

Financial Intelligence is Able To Make Money Productively

In practice (best practice), financial intelligence covers at least all aspects. First, how we make money in a productive way in the sense that we work to make money, and that is for sure everyone works to get money. But the thing is, is the way we do to get money productive? Is the time, mind and energy that we have used with the money generated has been the same (already balanced)?

For example: Complaints around us where most of the employees who work in certain companies or agencies are always thinking of getting a raise constantly. As a result of them constantly thinking about salary increases, work is not concentrated so the results are not effective. Furthermore, the output given to the company is also decreasing. In the end, the company's performance can decline which may have an impact and have implications for the inability of the company to pay the salaries of its employees well.

People who have financial intelligence, say an employee, he should have to understand that the source of income is derived from salaries, benefits and bonuses provided by the company where he works. So to be able to get more salary (income), like it or not it has to give a greater output to the company so that the performance of the company concerned also increases.

So in order to get money that is equivalent to the time, energy, and mind that is poured out, then do your work well and effectively, so as to be able to influence the improvement of the company's performance. That means you have worked optimally (working with high quality), not working with high quantity in the sense that your work duration (time) is more but the results are not quality.

If the quantity of your work is high, but the quality of your work is low, it cannot be said to be productive. So this is where we need financial intelligent so that with relatively little time we can work optimally, and the results are productive.

Then how is the right way to protect the money that has been obtained, regardless of whether it is obtained easily or is very difficult. Regarding this, can be said that very few formulations or ways to protect money, because of the basic principle (the key word) therre is on our as the owner of money. If someone is able to control and manage their financial management properly, then automatically the money is protected safely. Maybe most of us know how to make money productively, but not necessarily able to protect it from the things that make us wasteful in spending it. So the point is, it all depends on our principles and behavior as the owners of money. There are no specific formulations on this matter.

Although very few formulations about how to protect money. But, With financial intelligence that we have, of course, there are special ways to protect money, in the sense that we must protect the value of money.

As a simple example, if we currently have 10,000 Steem / SBD, where we can invest amount for Steem Power (SP), or we can also buy a plot of land for example. So if we still hold the money in cash, then it's not certain that in the next year we can buy a plot of land that currently costs 10,000 Steem / SBD. This is intended to protect the value of our money. The only step to protect it from the decline in value, we must exchange the money with other objects that can increase in value in next year.

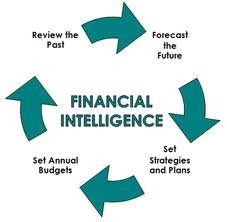

Furthermore, after we are able to protect the value of money from decline, the third step we must do is effectively manage the budget. After we are able to provide protection against the value of money, is the problem finished? Of course not yet. Budget management is also far more important so that our financial activities meet this third step to fulfill this third rule.

Therefore, we must be effective in managing the budget. In the sense that we must determine how much of our income is spent to finance consumptive, for example. Then how much of the income we get should we tube. Then we also have to pay attention to whether our consumptive financing is based on planning or just exhausted (following instinct) in the sense of unplanned consumptive costs.

Someone who has financial intelligence, then every satoshi or penny of money that he spends must be based on a need, and has been allocated and budgeted beforehand. All the money he spends is planned according to his priorities on his needs, and then every budget we have spend it, we have to do an evaluation so we know where the deviations, how much the deviation, and then we want to improve the activities of our financial. If you are able to manage your finances like that, I think your chances of financial freedom are enormous.

Wow ! Thats quite a good piece of investment advice, upvoted

thanks