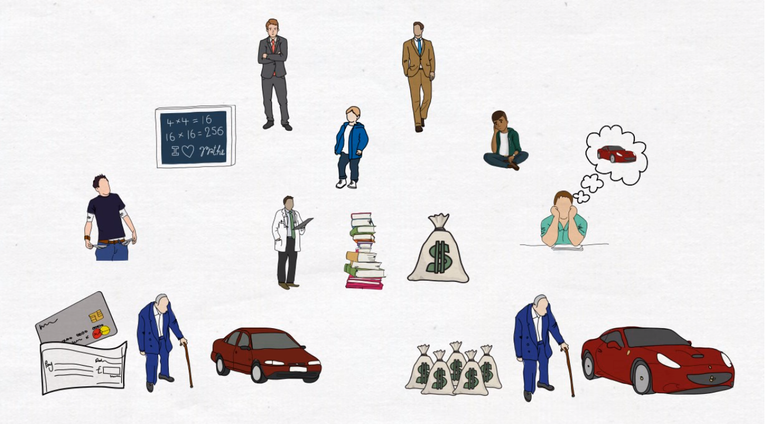

Yesterday, we discussed the first four principles that explain why the rich keep getting richer while the middle class and the poor typically stay the same.

So far, we have established that the rich just have a different mindset. Today, we have three more principles to discuss from the book: “Rich Dad, Poor Dad”.

The fifth principle from the book is: “The rich invent money.”

This means they seize new opportunities to make money. Remember that great opportunities are not seen with your eyes. They’re seen with your mind. The single most powerful asset you have is your mind and if trained well, it can create enormous wealth for you. Another important point from the book is: In the real world, it is not the smart who get ahead but the bold. This means that the bold, or risk takers, tend to make the most financial progress even if they're not as smart as others.

The sixth principle from the book says: “Work to learn. Don’t work for money.

This means that rich people work to learn and not for job security. If you want to get rich, you should acquire a little bit of knowledge about a lot of subjects. One of my favorite quotes is: “J.O.B. is an acronym for just over broke!” It means that focusing only on a job may prevent you from being too poor, but will also prevent you from becoming truly wealthy.

Image Source

Number 7 principle from the book is: “Overcoming obstacles.”

The primary difference between a rich person and a poor person is how they manage fear. Even if you have an excellent financial IQ, there are a few major obstacles that may hold you back from becoming rich. These obstacles are:

1. Fear: Some people are so afraid of losing that they lose.

2. Cynicism: It is like another word for self-doubt and for many, it’s a major obstacle.

3. Laziness: It is also a major obstacle that we all sometimes struggle with. What could happen is, when you get some results, you start to relax and reverse your progress. This happens a lot when losing weight. After getting weight loss results at the gym, they stop and try something more fun, eat more junk food, and end up with the same weight as before or even more obese. The same laziness that prevented you from going to the gym may hold you back from getting rich.

4. Bad Habits: They can have the same effect. Stop watching so much television and going out to drink on the weekends.

The final obstacle that everyone must face is:

5. Arrogance. -Robert Kiyosaki said: “Everytime I’ve been arrogant, I’ve lost money because I believed that what I didn’t know wasn’t important. Don’t let arrogance steal your money.

Now, let's look at the 10 steps to awaken your financial genius.

- Find a reason greater than reality. The power of spirit: Have a strong reason to pursue financial independence.

- Make daily choices. -Choose your daily activities wisely to invest in your mind and your goals.

- Choose your friends carefully. -Be careful who you choose to associate with.

- Master a formula then quickly move on to the next. Financial success is closely linked to how quickly you can learn new formulas for making money.

- Always pay yourself first to enhance your self-discipline. If you can’t control yourself, don’t try to get rich.

- Pay your brokers well. It’s hard to measure the power of good advice.

- Be an Indian giver. With the right deal, it is possible to get something from nothing. Try to make investments that offer you something for free, such as a piece of land.

- Use assets to buy luxuries. Don’t buy luxuries from loans. For example, I don’t buy a new phone for as long as mine is still working fine. When a new flashy model comes out, I just have a look to learn something about new technology. I also wrote a review of the iPhone X in the past even without buying one. Buying the most expensive phone with monthly payments (just because you want it or just because of arrogance) is such a bad idea but it is often done by people with poor self-control. - That’s why it is said that if you can’t control yourself, don’t try to get rich.

- Choose heroes by having heroes. By having a hero, someone to look up to whose values are aligned with yours, it becomes much easier to tap into your own genius. You don’t have to follow exactly your heroes’ steps. Just try to acquire their mindset and notice your common values by their actions. Then, practice good habits based on that mindset and those values in your daily life.

- Teach and you shall receive. When you need something, you want to give first and it will come back to you. Even professional trainers offer free sessions not only to promote their services but also to give value.

Image Source

By following these principles, one becomes more valuable not only in terms of financial status or net worth but also in terms of character.

I used to work mainly for money too and I have seen the grumpiness and boredom that result even with my colleagues. By working to learn and to be able to acquire assets, like Steem, I feel that everything is more exciting and rewarding.

Please upvote, resteem and follow me, thank you.

yes you are right dear because born in poorness is not bad but its wrong that you will die in poorness. i really like your post dear

That's right. It's about taking control of what's controllable.

Well taught out and informative post about being financially stable and rich. To truly become waelthy is to always think outside the box. And do thing differently from others .

Acquiring financial information is good but implementing those information is what leads to success. Great post

Well said. These principles are easy to understand but actually practicing them everyday is much harder and more important.

yeah it is a common problem in our country india.

rich people are getting more rich while poor are still poor.

helpful and an informative post sir.

It happens in many developing countries. I think it's the mindset of the majority that makes a country either rich or poor. A strong culture of financial literacy and business-mindedness is invaluable for a country to make progress.

yeah it's true.

i agree with you sir.

Excellent post, thanks for sharing

i listen this book aswell and i can really recommend anyone that thought about reading it :)

great informative post and Great philosophy.i appreciate your work and thinking keep it up...i will stay here sir for more learning,making and building my skills here love to see your post resteem it

Thank you.

Yep, thanks for reminding us the principles written in the book Rich Dad Poor Dad.

what I love the most is people getting cockey. Most people forget to be humble once they get successful. To be successful yet Humble is best 😊

These are great rules & steps that would be useful for the open minded ones...thanks alot

Great post.

Thanks for this Hiro

I read this book years ago. It was nice to have the highlights refreshed.

Cheers

Anj :D

The one I loved the most was "pay yourself first'. That really resonates with me and i try to implement in in my life.

I like what you say about being bold, keep in mind that being bold can also be very harmful for many people without the mindset you alluded too. I fear that greed will always ruin people's dream of financial freedom, but I still believe their is hope with the right mindset and learning. Thanks!

I'm a big fan of Robert Kiyosaki so I think I'm gonna enjoy reading your blog all the time. All this principles are to be followed religiously

Great advice

@hiroyamagashi good read here