The FinCEN Files: How Banks turn a Blind Eye to Mass Crimes while We The Sheeple Get Shafted

Introduction

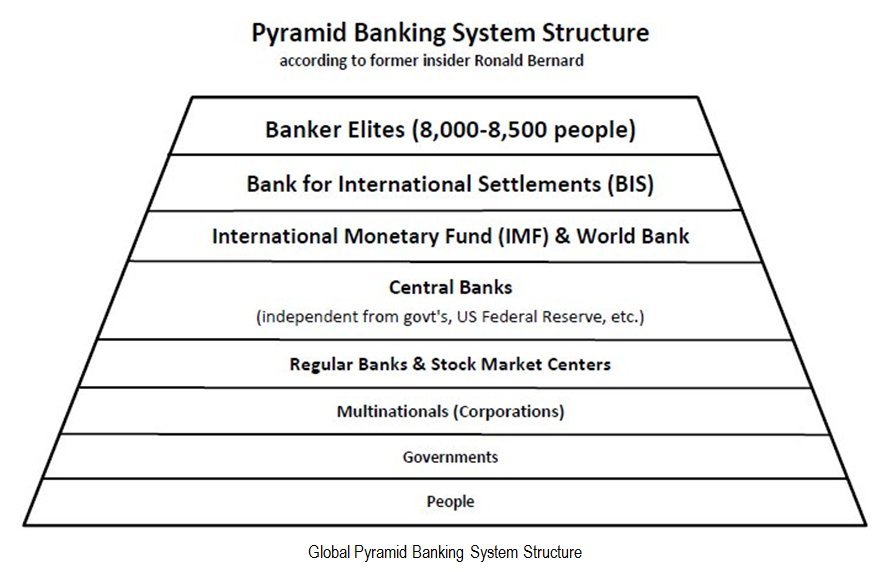

It's incredible what banks get away with. I've previously covered the pervasive extent to which banking institutions are really the ones running the show in a four-part exposé entitled The International Banking Cabal Exposed. In it, I outlined the structure of this banking cabal as follows:

Not only do these banking institutions get away with looting the masses through their counterfeiting of currencies, the manipulation of practically every market out there (equities, bonds, precious metals, oil, commodities, etc.), the bribery of politicians and gov't officials, corruption, bail-outs, bail-ins, and so forth, but they also facilitate criminal activity whilst constantly harassing us with never-ending and overbearing banking regulations, tax compliance mechanisms, and countless other annoyances. which makes banking with them an absolute nightmare.

The FinCEN Files

If you don't know what FinCEN is, it stands for Financial Crimes Enforcement Network; it's basically an agency of the U.S. Department of the Treasury that monitors and analyzes information about financial transactions in order to combat domestic and international money laundering, terrorist financing, and other financial crimes. At least, that is what they state they do.

A recent investigation by the ICIJ (International Consortium of Investigative Journalists) - an organization that has real journalists from all around the world - demonstrates how large banks are complicit in aiding and abetting criminal organizations (such as drug cartels), corrupt government officials, and other class acts to launder money through their banks while turning a blind eye to these activities.

They have even done so after numerous authorities and regulators have fined them, along with countless bank employee whistleblowers who reported on these suspicious activities. In fact, many of these whistleblowers were ostracized and told to shut up by their superiors.

Luckily, the ICIJ has done a remarkable job at compiling and exposing numerous instances of such criminal activities and related bank cover-ups.

Bank employees and required to file SARs (Suspicious Activity Reports) when they suspect wrong or illegal doings. Thousands of these are filed every single day by bank employees - yes, even the kind when you want to send grandma a few thousand dollars (you are likely to be flagged with a SAR for such egregious actions).

There are far too many instances to enumerate in this post, so I will leave the reader to explore them on the main page of their investigation. Or, you can read a summary article by ZeroHedge entitled Massive FinCEN Leak Exposes How Biggest Western Banks Finance Drug Cartels, Terrorists & Mobsters.

I will, however, highlight just a few instances that I find interesting:

- The first is a video - Watch: How banks move dirty money around the world:

The second is how US Treasury Department abandoned major money laundering case against Dubai gold company

The third is how HSBC moved vast sums of dirty money after paying record laundering fine

I highlighted the HSBC case too, as during the 2007-08 Financial Crisis, this bank became center stage during investigations with the DOJ (so-called Department of Justice) in the United States but got off scott-free because of the slimy bankster Mark Carney, former Governor General of the Bank of Canada and the Bank of England and head of the FSB (Financial Stability Board) at the time. In my post, I reference the amazing work of John Titus who exposes exactly how this smooth operator Carney and the FSB made HSBC a "Too Big to Jail" bank in the eyes of US Justice; here is his video called All the Plenary's Men to this effect:

The more things change, the more they stay the same...

God Bless,

In Peace & Liberty

Banks are crooked, you say? Hmmmm... gotta agree with ya there.

Yep I agree the banks are crook alright.

More than crooked.

Indeed.

On a related note, here is an SAR that was undoubtedly "overlooked":

via ZeroHedge - Hunter Biden Raised 'Counterintelligence And Extortion' Concerns, May Have Participated In Sex Trafficking: Senate Report

Awesome article. Congrats for helping people be conscious of our reality!

How many people listen to what we're saying?

What do you think about that?