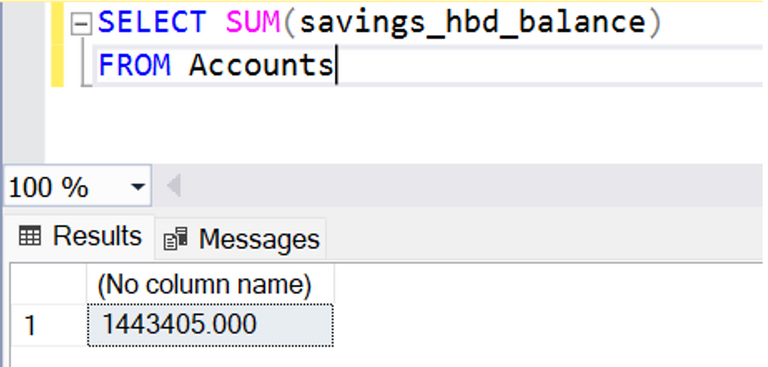

As it stand right now, after a few months of 10% APR for HBD in savings there is around 1.5M HBD parked there. At yearly level this is a yield (additional inflation) of 150k HBD and monthly around 12.5k HBD.

These are peanuts numbers. Almost non existing. HBD has its issues, especially with the low liquidity and not enough listings, but the option to give out yield for an almost stablecoin, is probably the number one use case.

As things stand I think bumping up HBD interest to 20% is a no brainer.

I would even go further and make it 30% for the next one year, like a promo period.... :)

Most of the top stablecoins on the defi apps have somewhere between 15% to 20% APR, for billions locked in liquidity.

We can argue is it a short term or long term thinking, but most likely it will push the amount of HBD in savings to 30M plus HBD unlike the 1.5M now. HBD in circulation is around 25M now. More usage, more liquidity, more adoption etc ...

The Hive community can provide 30M liquidity in stablecoin for sure.

The HBD interest is a parameter set by the witnesses and they can change if the majority agree without a hardfork. So witnesses ... it's your turn :)

Better case for this after increasing the supply cap above 10% in my view. As things stand we have not hit the cap due to high demand (the HIVE price has always increased, moving the cap away, which is a good thing), but we have gotten reasonably close. The proposed bump in the supply cap to 20% or 30% would make for a better environment to promote and have it more likely that increased demand for HBD translates into demand for HIVE rather than just hitting the cap.

We are almost there with HBD .... all we need is a little push ...

In the long term I think HBD can have a great impact in the ecosystem, so it should be taken seriously.

P.S. Thanks for the stableizer :)

I agree, I think there's no point in trying to increase demand until the system allows for significant expansion of supply without breaking peg. I also think that such an interest rate increase should be coupled with some kind of marketing effort to promote it to new participants, otherwise I'm not sure it will achieve much.

I second the marketing-effort.

I've got a bit of HBD, hence I'm biased and would love to see an increase in APR, but this would be much more fruitful if people within crypto/defi in general knew about HBD and the "30% APR promotion".

Maybe we could couple short-promotional/educational videos about HBD (how it works, maybe even a fun/animated comparison between HBD and other defi alternatives. This could show how easy and secure HBD is) with some ads & influencer-marketing. @lordbutterfly comes to my mind reg. (influencer)-marketing & ads.

Posted via inji.com

IMO even with higher APR + influencer marketing, Hive is not ready for the mass.

Look the retards give away seed phrase on ETH. I don't think we are on the tipping point.

HBD also has its dangers. I would like to see a crash first with lower HBD and lower Haircut before high Haircut and huge amounts. Could destroy tokenomics of hive.

We don't need to be ready for masses, we just need to get known more. We're home to one of the biggest crypto games) nearly on-par with Axie Infinity), made blockchain history by becoming a fork that's worth more than orig, etc. etc. and we're still ranked 183 on CMC.

Yes, there are flaws, but #Hive shouldn't be that far behind in the ranks or rather have poorer investors than the rest of crypto.

Posted via inji.com

that's true, but the core problem is the demand. There is no reason to hold millions in HP. That's been a problem since the start. You can delegate, but not really help other projects to play Venture capitalist or do something else with it.

The main reason is your power up and distributing the token to others. That's why other investors avoid hive a bit. That's why they avoid hive. Core problem is also, most are finance degends in crypto. Makes it even more difficult + high power up time.

IMO hive is not ready to moon shoot, but i can be for sure wrong.

There's no "reason" to hold millions in any of the top 100 cryptos that I can think of, other than that you think the value will go up. None of them have "real world" value commensurate with holding millions (some, like Hive, have PoS where you get access by holding, but no one needs millions worth of access).

HBD is better now then a year ago ... IMO it has a huge potential the lift up the overall ecosystem ... we should do whatever we can to improve it

Some thoughts about HBD that have been brewing lately from a friend wanting to get in;

He has a hard time doing it in one go, buying up HBD on bittrex is close to impossible at a good price and takes a long time of adjusting back and forth based on Bitcoin's movements. His other option is to do it in the inner market with Hive which is also just as volatile if not more than Bitcoin.

Converting Hive into HBD is also not an option due to the 5% fee, I understand the fee is there to avoid manipulation but maybe once we get a bigger supply and more listings we can consider removing the 5% fee altogether allowing bigger investors to purchase Hive on the big exchanges and quickly be able to convert it to HBD without a fee and only based on the 3.5 day median price it currently works as.

Raising the APR now without having these options ready won't make much sense, it'd be like offering people who are already hard to reach something awesome but even if they manage to find out about it need to go through hoops to get there. The only people that can possibly do this conveniently enough right now is bot operators or people with a lot of time on their hand to manually edit buy orders according to prices, having said that most serious private investors won't.

On top of all of that we need to find more usecases for HBD. I have some things in the works but can't say much yet as it'll be experimental to begin with, but I'd love a big HBD supply as much as the next guy.

We def. need a HBD/stablecoin pair. This would make it a lot easier for the average hiver to buy HBD instead of either having to do it manually or use scripts to trade (USDT => BTC => HBD)

Posted via inji.com

The liquidity is terrible ... I was trying to buy HBD in the past few days, and Bittrex was down.

We desperately need USD-HBD listing on a big exchange.

I even ranted a bit here :)

https://peakd.com/hbd/@dalz.shorts/if-we-are-serious-about-hbd-we-need-to-get-it-listed-on-more-big-exchanges-paid-listings-included

Forget Bittrex. Hive Engine is the place to do this, and liquidity is slowly increasing there.

Talk to them, get a quote, pitch funding to cover the cost on DHF. That's how this works. There's no one "in charge" who is supposed to do it.

If there isn't one single person in the community willing to make the effort (which can include getting paid personally by DHF too), then it won't happen.

Yes I can try that, but I supose others already have contacts at least with bittrex, binance and huobi, where hive is already listed and can ask for hbd listings ..... I might try to get in contact with kucoin and some others where hive is not listed at all, and ask for listing for both hive and hbd

First, we'd have to raise the cap on debt from 10%. But, higher interest could distort the Hive blockchain. Let's not forget that each HBD is backed by actual HIVE coin. Potentially, they'd be flooding the market with too much HIVE in the form of HBD. 10% to 12% should suffice. If you want Hive to grow, inflating the supply is counterproductive.

Increasing the debt limit would result in even higher, unhealthy inflation rates of HIVE, HIVE/STEEM had an actual inflation rate of 20% per year, because HBD is not backed by fiat but only HIVE. Many users think that the inflation rate of HIVE is only 8% but don't know that HIVE is also inflated for backing HBD.

The inflation rate is no problem. People are scared of it. With the growth rate presently taking place with @splinterlands, it is getting swallowed up.

With all that is starting to roll out, the next year will not see any difficulty have a growth rate sees a 50% growth rate in our active users.

Posted Using LeoFinance Beta

I get that point but am more on the conservative side regarding inflation. Organic growth. If the Market Cap of HIVE keeps growing, we can print potentially billions of HBD as long as the debt ratio stays below 10%.

In the grand scheme of things 25M HBD supply is nothing. Also don't forget that the demand for HBD is a demand for HIVE. If there is a demand for HBD for 20% APR, say for 50M more HBD, where will that HBD come from?

The price of HBD should go up, that will cause HIVE to HBD conversions to meet the demand, basicly transfering demand to HIVE.

We can print billions of HBD if the market cap of HIVE allows it, i.e. the debt rate stays below 10%, organic growth. Problem is that HBD is only backed by HIVE not Fiat.

I agree that Hive to HBD conversions would lower the amount of liquid Hive in circulation.

However, isn't HBD interest merely "printed"? That would be my concern.

If, on the other hand, the HBD comes out of the reward pool or from the built-in inflation, there wouldn't be a net change. I ask out of ignorance. I don't know the source of the HBD paid in interest.

HBD interest is new HBD.

Say there is 30M HBD in savings with 20% APR, that is 6M HBD per year, 0.5M per month. 6M plus on 300M market cap (2%) or hopefully higher is not an issue .... plus you will remove HIVE in circulation, transferring value from HIVE to HBD, and if HIVE goes up, the mechanic can be deflatory instead of infatory.

I get you on the deflationary part. As the price of Hive goes up, converting from HBD to HIVE nets less HIVE.

Where I'm hung up is the part where HBD interest is new HBD. There's no assurance that people will convert HIVE to HBD. I suspect you mean that Hivers will want a guaranteed and easy 20% return rather than cling to HIVE that requires active work for unsteady returns. Thus, they would happily convert liquid HIVE. That does make sense.

Personally, I would slowly ratchet it up a percentage at a time to find the inflection point at which Hivers start converting their HIVE to HBD. It is likely lower than 20%.

A very good point. You hit the nail on the head. We need to keep thinking about growth rates. That is the key metric and something that few on Hive even mention.

Posted Using LeoFinance Beta

I'd support 20% interest.

Good point. I've been converting some HBD into Hive for the SPK airdrop but I really want to build a nice HBD savings stack in the future. It would be amazing if the interest was increased to 30% Even 20% is already great! I was expecting to see 12% or 15% soon so if it gets bumped to 20% that's already more than what I expected

Posted Using LeoFinance Beta

30% would be amazing! Heck, 20% would be amazing and I am still socking stuff away at 10%, so I wouldn't complain about any of it! Much better than the .1% you get at a bank!

Posted Using LeoFinance Beta

very good point

Congratulations @dalz.shorts! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 2750 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

i just left this comment on taskmasters post linking here but ill share what i had been thinking of...

say there was a "longer term" hbd super savings that you could hold your hbd and would pay out more than 10%, but it would be locked up longer, encouraging saving while also keeping the $ more secure. just something i had been thinking about

Posted Using LeoFinance Beta

there's no such thing as a money tree. Why 20 and not 40? Why not 500? Why not 50000000000000 %? At what % do things break?

Posted Using LeoFinance Beta

Probably somewhere more than 50% :)

Agreed .... but one of the main thing that is driving crypto are stablecoins .... BIG time ... it all started with Tether back in 2017 .... Tether was even accused of pumping BTC to 20k back then.

Now back to HBD .... when looking only at % we dont get the whole picture .... HBD has only 15M supply .... if we give out say 20% .... and more people want on board the only way HBD will come into circulation is from HIVE converted to HBD ... ergo demand transferring to HIVE .... as thing stand now with HIVE marketcap between 300M to 400M, we can print out 50M HBD with ease not be wary about it at all. 50M HBD to 300M HIVE market cap is only 16% .... this means we have a colateral od 6:1 at that rate ....

Long stroy short .... HBD supply is low, we can afford to bump the the HBD interest to make it grow .... this will most likely increase the price of HIVE in the process.