Few days ago, I made a post stating why I've been powering down. Afterwards, more thoughts on that matter arose, which I thought would deserve another post. So here it is.

NFA

What happened after the HIVE Airdrop

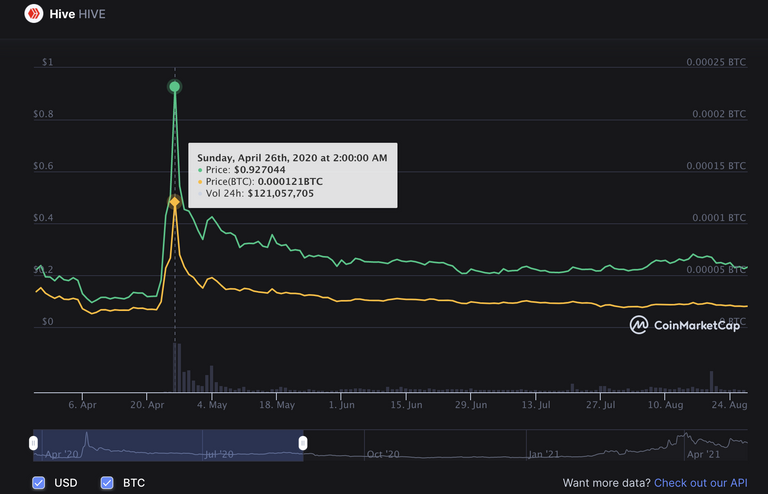

Shortly after HIVE was airdropped in March 2020 and it got listed on the first few exchanges (incl. Bittrex) the price was stable at around 2k sats or 20 cents.

A few weeks later, around early April, some stakeholders decided to dump their airdropped HIVE, which resulted in a drop to the 10 cents mark or 1k sats.

Then a few more weeks later, HIVE was listed in Huobi and the Koreans seemingly did what they do best: pumping prices to insane amounts. HIVE reached a dollar or based on CMC 92 cents / 12k sats.

This sadly didn't last long: peak lasted only a few hours. And then from ~50 cents back to 10cents of the next half a year.

Gains USD !== Gains BTC

You might have already realized it. Even though HIVE recently reached the 90 cents mark as well, the satoshi value was far lower. Around 2k sats, compared to 12k sats a year ago. (In case you don't know: 1 sat is the smallest unit of a bitcoin, 0.00000001 BTC)

So if you sold some HIVE for 1 BTC total in this years' run to 90 cents, you would have gotten 6 BTC for the same amount of HIVE last year. Imagine that person would have even put some in ETH, SOl, BNB, or DOGE. Yeah, massive gains. F********!

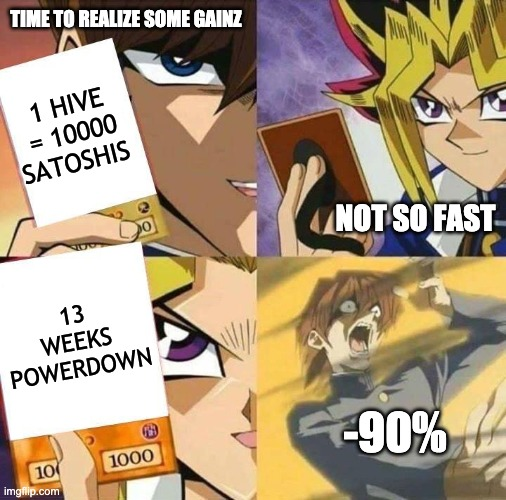

Now, if the difference was that much, one would have sold for sure some of their Hive last year, right?

Well yes, but my experience was as follows:

POWERUP

What does every active & loyal Hiver do?

Exactly: powering up.

So when HIVE reached 12k sats/~90 cents, I couldn't do anything besides watching - watching as the price went down.

Even if I'd started a powerdown just when the pump started, on the 23rd April 2020, I would have gotten 1/13th of my stake 7 days later (not counting possible 5 days of undelegation), on the 30th, when the price was back down to 40 cents. Next three months, prices were: 30 cents, 25 cents, 20 cents (2k sats).

Who benefitted the most?

Traders & people who keep their HIVE liquid on exchanges or their wallet.

Those who are active on HIVE and even powered up their stake previously to secure Steem and then Hive were passive bystanders. Maybe some of them had some spare liquid HIVE on the exchanges. I bet most didn't.

Why does this matter? Well, if I had sold - let's say - 50% of my HIVE (12k sats was a very, very solid number), I would have been able to buy right now up to 12 times (if kept as BTC) the same amount of HIVE than before, even more, when HIVE was at 500 sats or if sold for any other well-performing altcoin before - even ETH.

Again, why does this matter? It would have given HIVE stakeholders a major capital boost. The wealthier passionate HIVE stakeholders are, the higher & stable the price baseline becomes.

What's the lesson?

We can't predict pumps. At least I can't. STEEM has always performed somewhat as a latebloomer. If HIVE does it the same way (they do seem to correlate somewhat, even nowadays), HIVE could pump once again late.

What if it would pump to 12k sats or higher? With current BTC prices, that would be 5$. I'm obviously not talking about "dumping bags", mainly about "taking profits". Getting some fat on for the crypto winter or red sea.

The only way to truly benefit from those times, as long as power down takes 13 weeks, is to have a liquid position.

Longterm Solution: Reduce Powerdown

In my opinion, it should be the goal to let people participate/earn within the system without having to lock up funds for months.

Even if that means to lock certain rights (governance voting, etc.) under specific conditions. And if the concern is that fewer people will vote, then let me say this: powered-down stake won't/can't be used to vote either.

Hive on

PS: If you haven't - consider following me on https://twitter.com/NFTimo

Question. Would you sacrifice 10% of your stack when Hive was trading at 10k sats to power down instantly?

Reward long-term holders and punish short-term speculators. Instead of burning the 10%, what if that 10% went back to HP holders? So when Hive pumps, lots of people sacrifice 10% to cash out. The ones that stayed should be rewarded greater by the system. We don't need extra inflation for rewards, a simple exit tax.

The tax can be opt-in or opt-out. Users who want to sacrifice some security for more freedom can do so under the system.

A similar mechanism to Safe**** coins. Could be interesting.

That's a fantastic idea. It's not easy to hold HP during the bull market without clicking the power down button. It should be compensated.

Also a solid idea. Leave it to the Hive community to get creative and come up with solutions to the problems they face!

I have another idea, now that I think about it:

What if you could opt for an instant powerdown, but you must sacrifice 10% of the powerdown value to go back to the reward pool? Maybe the reward payouts for that particular block are a little bit higher as a result of the added hive made available for your posts.

I prefer back to holders. It creates more passive income for HP holders without extra inflation.

I have another idea, now that I think about it:

What if you could opt for an instant powerdown, but you must sacrifice 10% of the powerdown value to go back to the reward pool? Maybe the reward payouts for that particular block are a little bit higher as a result of the added hive made available for your posts.

Sounds reasonable to me ;)

Namaste 🙏

Yes!

It's rather long, a bit too long honestly. Pretty much if you lock up your hive you can count on never really getting it out which I feel causes some people to not power it up. 7 days would be the minimum but honestly I feel like 2 weeks would be the max.

You have other platforms now which only lock up funds for 3 or so days. I understand why hive needs to be at least 7. 13 weeks is a long flippin time.

I also feel like more people have a understanding of RC resource credits now due to Wax, Tron and other platforms that use this. It would make more sense to have a grudge right here on hive that shows how many RC you have and how to get more along with some better error messaging.

To be honest the entire Hive blockchain needs some better UI. What makes sense to a dev for sure does not make sense to someone new joining hive. It ends in frustration and them leaving. Our retention rates are literally horrible.

I can't edit it but looks like Gauge defaulted to Grudge

The long 13 week powerdown is ridiculous. The witnesses and big whales talked about reducing it months ago, but we're still where we are, stuck with 13 weeks. I think we all experienced the frustration of watching price go high, but can't do much to take profits because of the locked stake. This is not attractive to big investors, especially in a fast moving crypto market where liquidity is essential. I supported the 4 weeks powerdown because I find it balanced between security and having a descent liquidity.

Made similar or even higher gains to HIVEPOWER APY with 100% stablecoins recently which also got paid out liquid. The incentive model of Hive is outdated. Needs to be changed. But I'm not a c++ dev, so writing about it is as much as I can do.

Or just keep some Hive liquid to trade.

I couldn't agree more. 13 weeks is just too much. This actually scares investors away. Imagine yourself buying $200k Hive and powering it up. How do you get out when the market is up? Looks like a trap. I think it should be reduced to like 6weeks.

STEEM did it, yet we didn't see the "negative" effect on the price.

Price performance is the best marketing you can give in this space.

Yes the 13 week powerdown makes powering up during bull season an unthinkable commitment.

Posted Using LeoFinance Beta

So true

Posted Using LeoFinance Beta

The point of a lockup period in blockchain that uses staking as a security mechanism is to punish stakers that engage with the blockchain in non-value adding ways. A shorter lockup period is just conceding that you believe the coin has no intrinsic value and you would rather have as a pump-and-dump instrument that people can speculate on. It decreases the security of the coin so you can sell it faster.

The fact that everyone agrees with it in the comments disappoints me. It shows a clear lack of what the plebs call "diamond hands" and a fundamental misunderstanding of the purpose of cryptocurrencies. The perceived loss is well deserved. If you want a better cryptocurrency, earn it, build it. Needing speculators is a fancy way of saying "I don't believe in this cryptocurrency outside of it's ability to make me money by selling my bags to some schmuck".

The main point within this post was that loyal/active Hivers are usually powering up their HIVE, which renders them impossible to take advantage of any trading opportunity. Even curation rewards are 100% staked.

The pump to 10k sats, in the beginning, wasn't rational, rather artificial. If loyal Hivers were able to take advantage of it, profits would have gone a long, long way.

@klye is working on something that allows people to instantly powerdown.

Yeah I agree, @klye just started the airdrop the other day for the coin for the new revolutionary power down evading system. I hope thee two witnesses can get on the same page and work together, because from the sound of it Hive.Loans is here to stay, this post should be deescalated and topic about shortening the power downs, marked as closed for good @therealwolf!

The service I'm offering isn't viewed as the perfect solution by many and I respect that. It's incredibly stressful dealing with account ownership and keys to be honest, let alone custodial funds and having active customer facing wallets.

A lot of what is said on the powerdown issue has some serious merit. That is why Hive.Loans was created in fact.. While at a network level it doesn't require any modification so to say, the application and lending model itself were designed to entirely side step around the powerdown period length problem. If instant or 1 week powerdowns were ever implemented it would nullify the need for that aspect of the Hive.Loans platform, that is why it offers more financial vehicles than just the lending part. Gotta "future proof" things. :)

I feel anyone that wants to power down should pay some percentage of their hive, I believe power downs are to take gains, these percentages can always be burned

Posted Using LeoFinance Beta

Well said. Investors do not like illuiqid investments like users do not like downvotes.

There are definitely some intriguing points here, and this debate is one that should happen in a more definitive way. I do usually have some liquid HIVE in my exchange wallet to play with, but I still think 13 weeks is a bit excessive. And regardless of the staking/unstaking structure, I'm not sure how many newer and lower-level users are participating in the governance side of things... that's more of an onboarding issue. Thanks for bringing sharing these thoughts! I hope you get some moderately heavy aquatic creatures in the chat thread. :P

Posted Using LeoFinance Beta

I dislike Sun but his 4 week power down was only good decision he made, i am still powering up every chance i get and dont plan to take profit for at least another 5 years.

Posted Using LeoFinance Beta

The 13-week period is just too long. The 13-week power down time probably drives away more speculators than not.

If HIVE was an ETH-priced token, people might be more tolerable to such a lengthy period. But, what drives ETH price isn't entirely speculation.

I am holding this point of view

Two ways. At first I would say it is bad

Due to lack of experience but we see how it is done in steem and the outcome is unchanged.

At some points we will have to implement this change in the name of decentralization.

The same way powered hive did receive an inflationary percentage the system should do the same for that amount in the case of withdrawal.

I know it is possible and this action can prove to make us more decentralized.

Wait and see.

Posted Using LeoFinance Beta

Agreed, I would like to see the power down phase reduced as well. Otherwise keeping some full liquid Hive handy is a way to go, although, I still just power everything up lol

Cant we do some kinda of vote on this which isn't based on your stake?

Those memes 😁 especially the Cat - yes in a word 13 weeks is far too long, this is the challenge with such a powerdown time and crypto as we all know being inherently volatile.

A shorter time frame would help to a point, the thing is, like you mention, people who believe in Hive powerup at every opportunity to support good content.

Therefore the answer completely eludes us, maybe keep liquid Hive or ... carry on for the time being powering up

Short term solution : Reduce powerdown to 5 weeks

Posted Using LeoFinance Beta

Your recollection of what triggered the initial dump to 10 cents is not accurate. It wasn't "some stakeholders" that decided to dump a few weeks after the airdrop. The crash happened when Upbit distributed their portion of the airdrop to the traders on that exchange. I wouldn't consider people who live by speculating on exchanges as stakeholders (in the strict sense of the word).

Semantics aside, your point that having funds locked is beneficial to speculators in detriment of vested holders is on the mark. It's quite obvious, people buying the coin on exchanges are guaranteed not to lose by virtue of the vested stakeholders dumping on them.

Correct, that's what I meant. But thanks for writing it up in detail!

Excatly!

On the other hand HP holders can earn from the vesting and curation rewards so the advantage flips to them on that front so the issue is not cut and dry. The real question is where does it all balance out.

Are you preferring that they don't buy?

Of course not, I was just stating the obvious. If we think about it, it's actually an advantage for everyone to have that guarantee (speculators can hold the coin for longer periods on exchanges without the fear that they will lose because the stakeholders start selling).

Having a large proportion of the total supply on exchanges means that HP holders get higher vesting and curation rewards. That has its drawbacks as well...the risk of an exchange hack would hit the network in a bad way (for example).

4-week power down would be nice.

Would you be able to initiate a proposal based voting- FOR and AGAINST, similar to what @thecryptodrive did last time. I believe it was very close. If there is high demand for 4-week power down, this may convince the dev team to include such change?

@blocktrades thoughts?

I'm generally opposed to the idea, but we can always see where other people stand. I'll code it in if that's what the stakeholders want. But I don't want to try to fit into this HF, I'm already dealing with a couple of longstanding bugs that we've found in the code base that I want to get fixed.

I get your point, but I prefer the payment system as it is right now. I get that it doesn't allow for investment but you can also gather hbd payouts too.

But then again, I'm new here so...yeah.

Posted Using LeoFinance Beta

That last statement is a lot more true than a lot of people would probably admit. I keep a couple hundred hive liquid, mainly for the power up days, but you might be on to something there.

I have a hypothetical idea here. What if you have to "season" your HP before it can be used for governance? Much in the same way you need to keep your cash locked up in a savings account for 6 months or more when looking to buy a house, what if that 13 time period were applied to the front side of staking? When you stake your HP, you need to keep it staked for 13 weeks before it is usable for governance functions. Sure, it'll slow things down for minnows who are looking to power up their standings, but perhaps we can find additional ways to help them out via expanded delegations and other community support.

As long as the rules are known in advance and you make your own choices, the 13-weeks power-down system is fair. You could very well keep larger part of your HIVE liquid, too.

Of course, which I'm doing now, but it's still valid to argue that 13 weeks powerdown is contra-productive. I doubt outside people are inclined to participate within the system if it's either no stake or 13 weeks powerdown - especially compared to ever-increasing competition outside of Hive; DeFi alone has enough lucrative possibility with higher/similar APY without 13 weeks lockup.

Yep! oh except for whales - they should be locked up for years. haha

Anyone else remember how steem started off at 104 weeks powerdown? Lol

I remember. Throwback :)

Just an idea I just had. Feel free to criticize and destroy it.

What can be done using the current system:

BUT:

It is just an idea...

I think @klye is doing something like this, but centralized risk is not desirable.

I agree with this and will be making things as "headless" as possible coming up here in the near future. It's stressful holding keys and funds and not something I necessarily encourage anyone delve into. But for proof of concepts to test the market and skirt around the powerdown roadblock before I've had enough time to assemble a decentralized trustless version.. :D