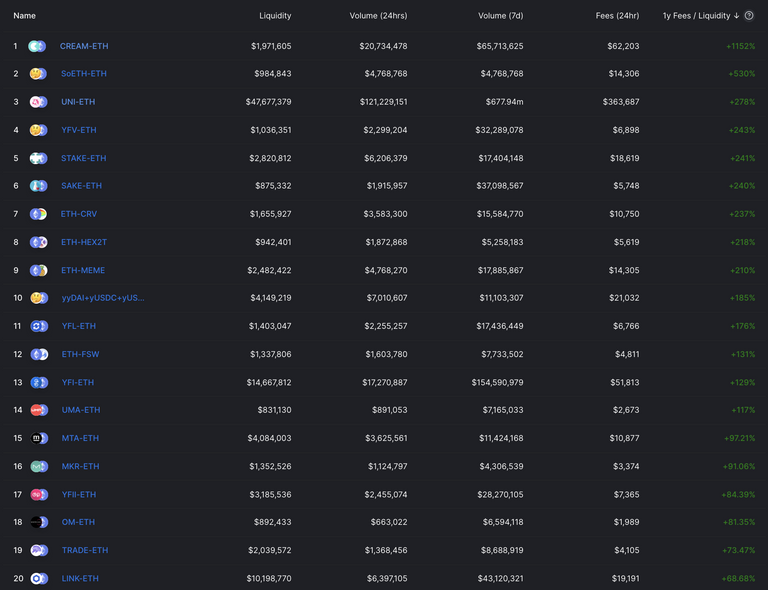

Who needs 100%+ APR with extreme liquidity, no lockup period & massive airdrops, when you can stake your HIVE for 12%-20% APR and 13 weeks power-down and with the pinky-promise to never "abuse" it via self-voting or circle-voting; or else...

PS: Sarcasm

PS2: Hive is not a DeFi protocol, but we can improve/better align investor incentives

PS2: Hive is not a DeFi protocol, but we can improve/better align investor incentives

->This is sounding better to me after some thought.

Regarding to your post; one can currently really get this kind of an APR from providing liquidity? * running over to defi *

Yep, it's prob. not sustainable to get 500% APR or even 100% over a long period of time, but it depends on the risk-factor. And I'd argue that locking up HIVE for 13 weeks is a risk factor as well.

It's easy:

We need to allow Hive users to be actual investors, not just bag holders.

Also ads.

That's for a start :)

Please, somebody get ad revenue up and running.

Investors will find successful projects and we are wasting our greatest selling point. A community of content creators. Generating monthly revenue to buy hive back from the markets adds instant buy pressure which will encourage others to join when they see how the token will be funded going forward.

The current business plan where all the money flows out of the system will turn away any serious investors but if we generated more demand for hive and external sources of revenue to increase the price it would be a lot more tempting to invest and hold the token.Apps will do this in the long term but we need solutions for right now.

Also 13 weeks is pointless and needs to be at most 4 weeks for powerdown.

A higher token price will lead to more interest, more users and more exposure which will in turn lead to even more buy pressure and a higher token price. At the moment we are in a negative circle and ad revenue is the best and fastest solution to start turning it into a positive cycle.

I mentioned getting ads setup on hive.blog a while back but blocktrades was not interested, though he did say someone else was free to set that up. The overall tone was that the work/costs were not worth the likely projected benefits...

Hasn't stopped LEO though.

Didn't stinc rake in thousands of dollars from add revenue? O yeah people on the top dismiss it for ideological reasons. If people don't want adds they can just use an add blocker or you can build a front-end where you can opt out.

All social media sites derive their market value by add placement. It's just that simple.

The path is clear, but not easy, at least if we want to make it great.

We need different time-frames & specific rewards for them. If I lock-up my HIVE longer, then I should also receive more rewards.

Not sure.

That one for sure.

That's not relevant for HIVE; but for apps/frontends.

Not really, this could be build into Hive as well. For a start: hive api could return which post should be displayed in a "promoted post" spot on trending. The algo for that is up for discussion but we already have "promoted post" functionality that no one uses.

The ultimate goal would be to have a decentralize ads system that takes payments from ad makers and sends the funds to users who display those ads in their posts.

Overall the ads system should be build into Hive so frontends just display the data provided by nodes. A build in ecosystem, where hive users pay other hive users for displaying their ads.

(About printing HBD). This is basically how DeFi started. Locking funds (so you don't have to sell them) to acquire stablecoins that can be used for further investments.

Ads should/could be part of the core protocol. On multiple levels.

First, the chain returns the feeds. Ads in the feed, as a sort of native ads, would then run on every frontend which doesn't run its feed through its own db (think for example for tags, if you want to show more than 7 days to make tags actually useful as meta data — but that could be enforced on license level: as long as the governance supports ads (the decentralized code) ads in feeds can not be removed unless there where the chain delivered feed doesn’t deliver the required feeds in said implementation).

Better even, the cost of ads is rather known. Most niches have a rather stable eCPM. Ads should be charged against HIVE (HBD), of course. Which ads valuable token utility. Albeit not volatility, which is what most drool over, but it is then an actual use case of our token.

Rev sharing would be the nec plus ultra, especially if combined with also a share going to both the DAO and the witnesses. But this would ad complexity and also load. Plus it would require heavy tracking, read: heavily cleansed view and click tracking. This obviously shouts abuse and would need the cleansing before rev sharing could be rolled out.

If we're talking about a protocol, then it makes sense to look into how this could be implemented on the blockchain level.

I initially thought you meant "Google Ads" or smth.

Aye, makes sense. Probably it would be best to make a centralized service like this as a proof of concept before work on protocol level. I need holidays :D

I know what you mean 😅

That sounds like a very good start...

These are all good starting points.

You know we can allow users to disable ads. We have the technology.

?

Let's finally change this stupid long power-down period!

It's a bit more complex, as a longer staking period is actually something we can play around with - i.e. higher rewards, but yeah. I agree that the default rate has to go.

How about instead of focussing 100% on the issues "at home" we acctualy reach out outside of hive and try to make colaborations and partnerships with other projects.

You are most likely right about some of the issues, long staking period, complicated staking rewards (curation), etc...

But I see zero effort of the top20 trying to promote this thing. Splitnerlands being the exception and some other new pojects poping up ....

Further I see no dev tools being build and open sourced, so more devs can easily build new apps .... how do one make web like peakd? Or like the new leo?

Collaborations are good but aren't going to scale; we need real changes and more focus on what Hive is doing exceptionally well: cheap decentralized storage as an example.

Not the task of top 20. Splinterlands is an app and we need more of those for a robust ecosystem. I'm working on something, but the fundamentals have to be adjusted and that's what I'm criticizing with this post.

That isn't a question good devs are going to ask; we've got pretty solid documentation and more than enough open-source projects that can be used as a starting-point.

The developer documentation on the hive.io is full with "steem" in it.

We havent found the time to change that yet.

Example?

I see. Yeah, need some more contributions on that, but it's basically the same.

For dapps that need to save logic on-chain; not for the end-consumer nor for dapps to save high file-size data, even though Hive supports binary data.

100% apr...sounds good! Do I hear Bitconneeeect!

In all seriousness, Those returns do not have anything to do with the staking model (or lack there of).

By that same reasoning we should adopt a piramid scheme model, or better yet let's turn hive into Bitcoin, we will be number one in marketcap in no time.

Some interesting thoughts on the posts mentioned.

I agree we should work on improving this.

I agree, that to be competitive in this space token projects need to consider increasing their inflation rate via staking interest.

Yeah, Hive needs to follow the trend of DeFi in my opinion. No or short power down period, wrapped HIVE and HBD, HIVE based liquidity pools and outreach and teach other netizens why they should be on HIVE in order to monetize their time online and get a stake in the social apps sector.

Oh yeah, and ad revenue. People have been suggesting this for years. We could use the ad revenue to reward the users bringing in the traffic to HIVE, as well as promote the great HIVE apps like http://Dcity.io and Splinterlands.

Definitely look at how great @leofinance has been doing lately!

Positive changes need to be made.

Sometimes I wonder, the improvements that are being done are only feel good factors and does not add much value fundamentally to the outside world to make hive more interesting.

This perfect post

The huge ROI comes down to a simple fact: the price of UNI is very high.

The incentive to buy uniswap is just influence on governance. Hive has a governance model.

So why aren't people buying hive instead of UNI? Not because of low ROI on staking. Speculation is the answer. Once people sell their returns on UNI tokens, price goes down, which takes ROI down, which makes eve more people sell, and the downward spiral will have no end.

Of course in the meantime, the right thing to do is farm and dump on UNI bagholders.

HIVE is safe.

I wouldn't recommend 'investing' in any of those DeFi 'projects', but I would recommend HIVE.

I know my money will be here a year from now, and a 12%-20% APR isn't half bad when seen in that light.

exactly! I don't know why people are complaining about this "low" APR. It's actually really good... (of course maybe not so much if one factors in the risk).

But HIVE is low risk - in comparison, anyway. 😁

Congratulations @therealwolf! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

i know shit about this, but do you think 100%+ APR is sustainable, and will stay like that for years?

As LP, you get fees in both currencies. So if you're holding ETH anyway, you can get ETH and another token as APR.

I'm comparing the incentives investors are attracted to; not the fundamentals of DeFi.

Seems like you haven't used DeFi, but you have an opinion on it? How about you try it first, instead of calling it "crapware", otherwise I'll close our conversation right here.