Direct costs: Direct costs are costs that can be directly traced to a specific product, service, or project. Examples of direct costs include raw materials, direct labor, and direct expenses such as shipping and handling costs. These costs are directly tied to the production of a good or service and are usually easy to identify and measure.

Indirect costs: Indirect costs, also known as overhead costs, are costs that cannot be directly traced to a specific product, service, or project. Examples of indirect costs include rent, utilities, insurance, and general and administrative expenses such as salaries for administrative staff. These costs are typically more difficult to allocate to a specific product or service and are usually spread across multiple products or services.

It is important to understand the difference between direct and indirect costs because they are used in different ways in financial planning and decision-making. Direct costs are used to calculate the cost of goods sold, while indirect costs are used to calculate the operating expenses of a business. By understanding the difference between direct and indirect costs, businesses can better understand the cost structure of their operations and make more informed decisions about pricing, production, and resource allocation.

Otherwise costs can be classified into several types:

Fixed costs: These are costs that do not change with the level of output, such as rent for a factory or salaries for employees.

Variable costs: These are costs that change with the level of output, such as raw materials and energy.

image source

Total costs: The sum of fixed costs and variable costs is called total costs.

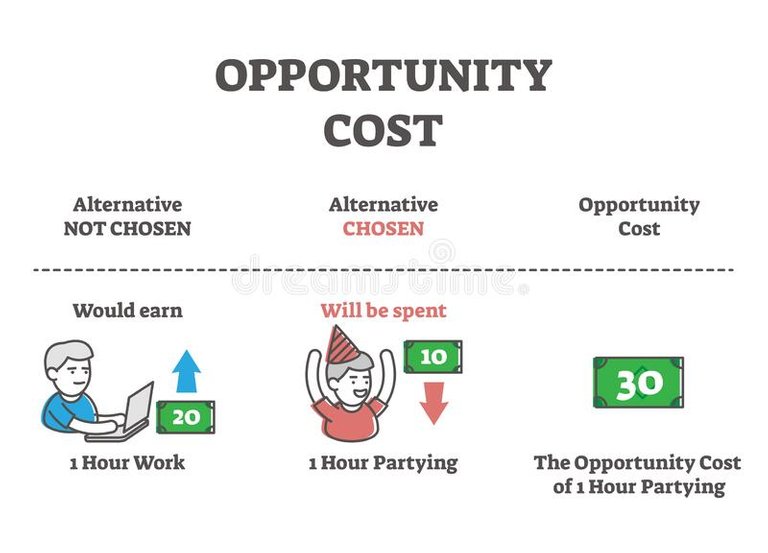

Opportunity costs: Opportunity cost refers to the benefits that must be given up in order to pursue a certain action or decision. It is the cost of the best alternative use of resources.

Marginal cost: The change in total cost resulting from producing one additional unit of output.

Understanding costs is important for individuals and businesses as it helps them make informed decisions about production and consumption, and allocate resources efficiently.