Hi investors,

Today we're talking about Bitcoin leading the charge in crypto and I am sharing my thoughts about "blockchain" voting.

Let's dive in!

Bitcoin.

BTC is trading at $15,673 USD at the time of writing, we're up +13.97% since last week and +114.33% YtD.

This week's price action seems propelled by considerable uncertainty around the US Elections which have yet to yield a winner and to guarantee a peaceful passing of power.

While the world is watching the quagmire that US policy has become, Bitcoin has been on the proverbial rocket-ship, inching ever closer to its historical ATH of nearly 20k.

Source: https://bitcoinwisdom.io/markets/bitfinex/btcusd

But 2020 Bitcoin market is a very different beast from what it was in 2017.

The 2017 spike was the result of an immature market infrastructure. Propelled by frenzied retail investors eager to get rich quick in the ICO craze, Bitcoin then was mainly in demand as a bridge currency to gamble on tokens or acquire ETH to participate in ICOs.

The market structure was also very different. Liquidity was fragmented across dozens of venues (some extremely shady) and spot markets were the only way to get a slice of the action.

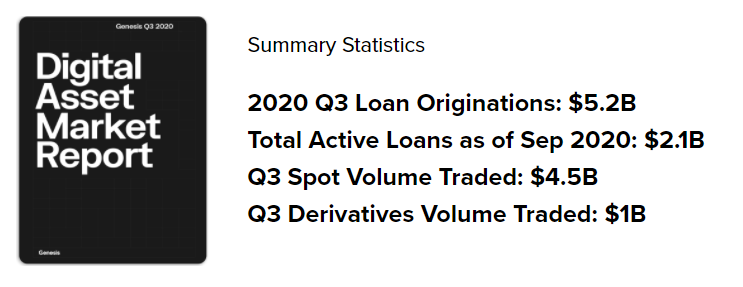

Today's Bitcoin markets are much more sophisticated. Derivatives products like options, perpetual swaps and futures contract have become popular ways for investors to get exposure without moving spot. Beside, lending venues like Genesis are gaining immense traction and offer investment rails to much bigger players.

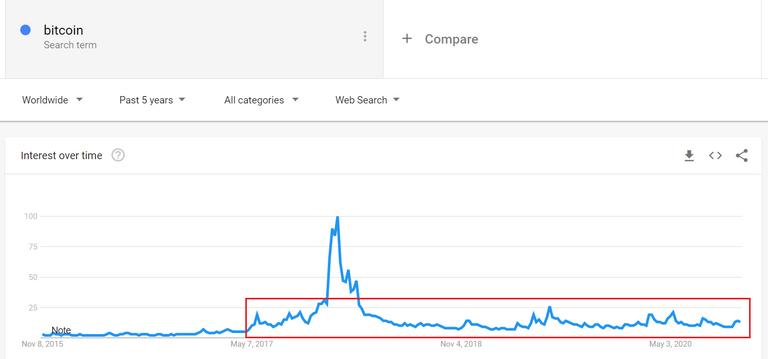

Last but not least. Google trend data suggests that, unlike 2017, this bull run is not led by retail (at least not yet).

Instead, it's likely that institutions (and corporations!) have waken up to the incredible risk-reward asymmetry offered by a BTC trade.

Smart corporate money has already been betting on BTC as a reserve asset, so far to handsome results.

Source: https://bitcointreasuries.org/

On the institutional side, investment products like Grayscale's GBTC have attracted large amounts of liquidity, 84% of which is reported coming from institutional investors.

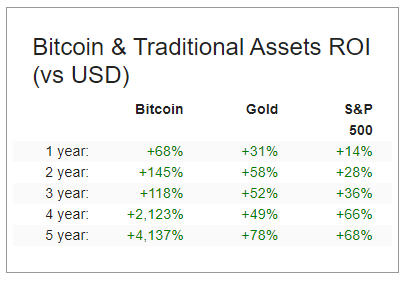

So far, the smart money got it right, the Bitcoin of 2020 has done nothing but deliver.

Up over 100% YtD, BTC has been one of, if not the best performing macro asset of the year.

Source: https://casebitcoin.com/

For the first time since its inception in late 2008, Bitcoin is trading in a receding global economy and showing incredible performance in the face of uncertainty.

This is not a bug.

Born on the heels of the financial crisis of 2008, Bitcoin was designed from the start as a risk-resilient, scarce asset in a world of financial excess and fiat currency debasement (which is the world we live in right now).

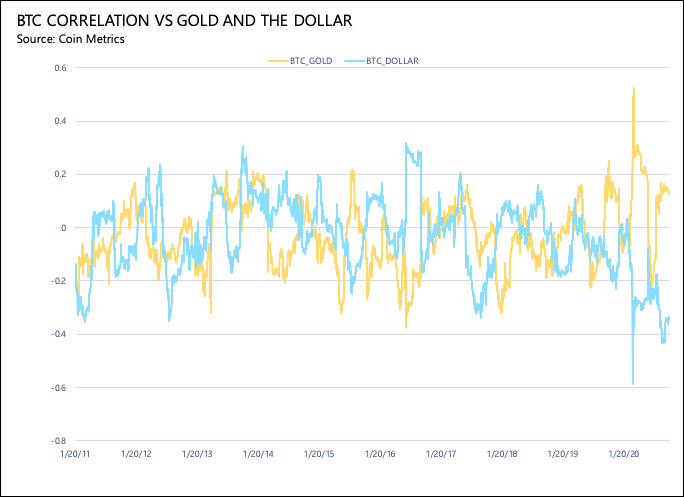

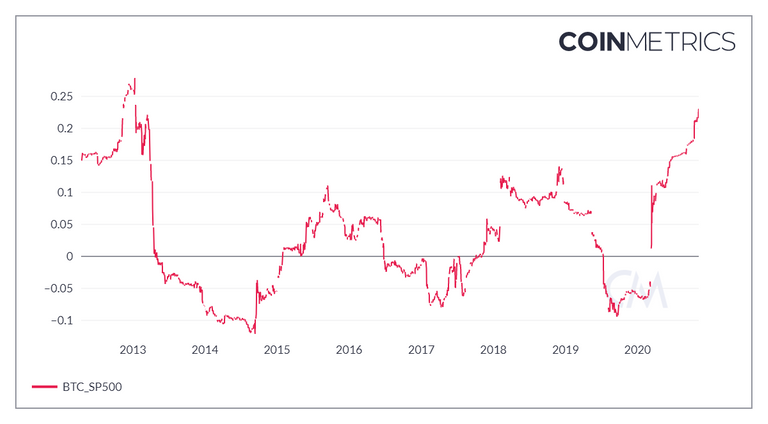

Over 10 years later, BTC is living up to the digital gold narrative, growing increasingly positively correlated to gold and the S&P500 and negatively correlated to the USD.

This is not surprising.

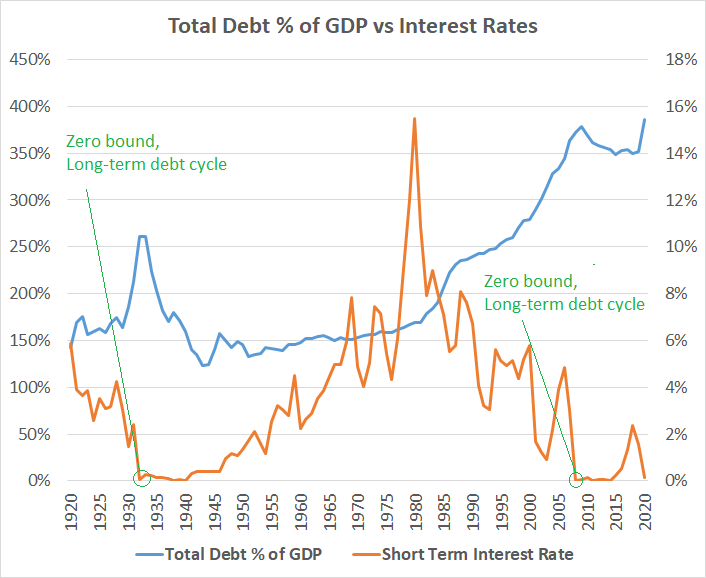

The hunt for yield is on and the 60/40 portfolio looks in bad shape. US bond yields are pathetically low, probably negative in real terms and the S&P500 looks like a crowded trade, propelled by a handful of tech giants with very expensive P/E ratios.

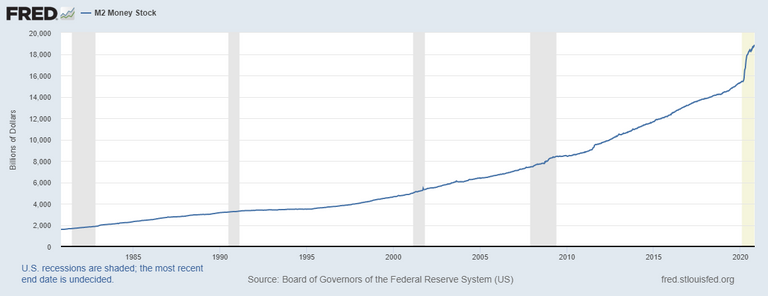

Meanwhile, a debasing US dollar is proving yet again to be the worst of possible stores of value. With recession on the horizon, FED rates at all time lows and tons of debt, the devaluation of the USD seems now likely going forward.

Source: https://www.lynalden.com/money-printing/

In such environment, a Bitcoin trade has never looked better.

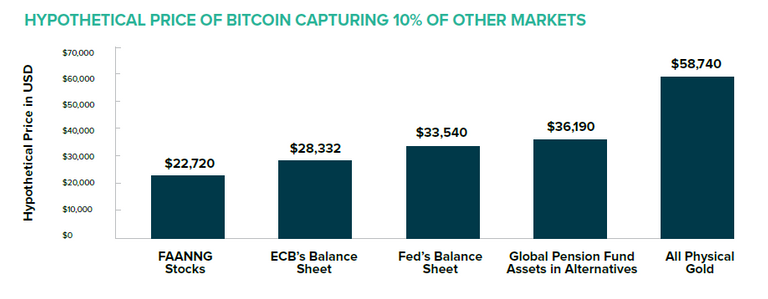

Bitcoin is an aspirational store of value, gold for the digital era. Unlike real gold though, Bitcoin's supply is algorithmically capped to 21M units, auditable at all time, highly portable and can be settled instantly over the Internet.

Bitcoin's simple, elegant monetary policy is easy for anyone to grasp and its addressable market intuitive enough to size.

Source: https://grayscale.co/financial-advisors-toolkit/

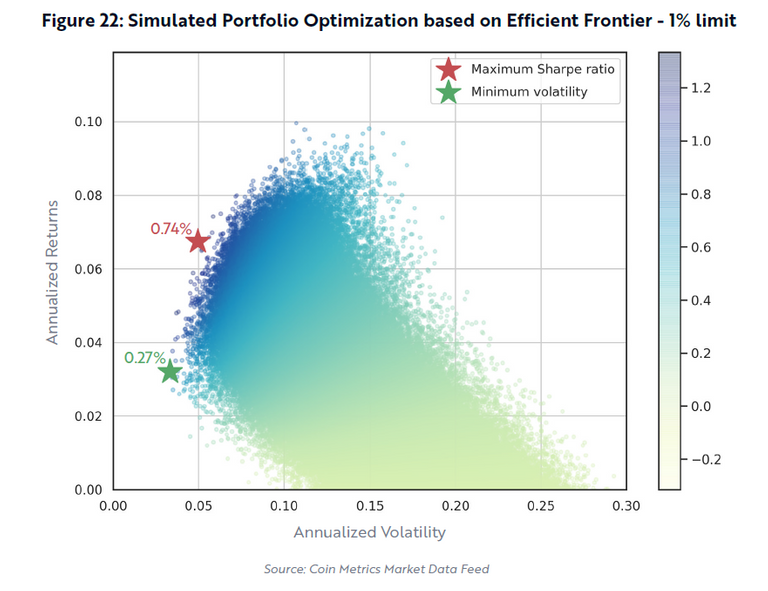

The risk-reward asymmetry looks good so that even a small 1% allocation can safely and noticeably improve the performance of a portfolio.

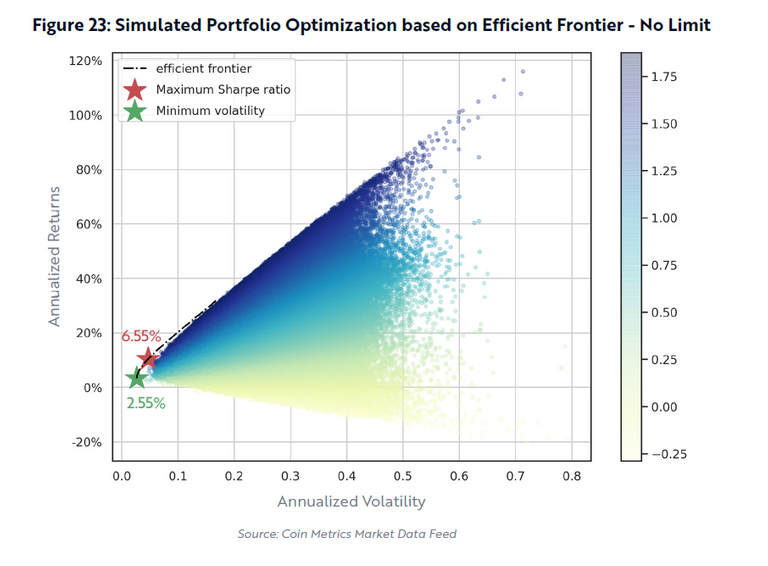

Removing the 1% allocation limit, returns start to look asymmetric, particularly under high volatility.

Demographic changes also play in favor of the asset.

The concept of digital property is a no brainer for digital natives who grew up trading digital swords on World of Warcraft and paying real bucks for skins and in-game items.

As millennials (and later GenZ) mature in their career and start seeking to optimize their wealth into portfolios, understanding Bitcoin as an asset class will become a must. It will not be an option for wealth managers to not have an informed opinion about the asset.

That being said, there is a time to get in and a time for staying on the side-line. The current market looks extended and pumped by fears surrounding the political situation in the US. A pullback followed by a dollar-cost averaging strategy is always the best way to dip your toes or continue accumulating.

Speaking about the elections there's been some grumbling about 'blockchain voting' recently on Twitter.

Blockchain Voting.

To be clear and concise.

"Blockchain" voting is a bad idea.

Here's why.

- First, a blockchain-based voting system would require voters to hold on and secure a set of private keys to be able to vote (think: a life-long password). Losing your keys would prevent you from being able to prove your voter ID, and thus to vote. This is bad.

- Second, non-privacy-preserving public blockchains (like Bitcoin or Ethereum) are transparent by nature. This mean that anyone could audit the blockchain and see for whom you voted... this is bad.

- On the other hand, privacy-preserving public blockchains pose the problem of auditability. i.e how can you guarantee that someone only voted once? Well you can't... this is bad

- Furthermore, using a permissioned blockchain (say where all the nodes are in the hands of the government) would basically reintroduce the problem of trust... and defeat the purpose of having a blockchain in the first place.

- Finally, blockchain being basically just a database structure, you're left with the issue of "garbage in, garbage out", it doesn't matter if your vote is stored on-chain, the problem is data input quality and secure identification, not storage.

So you see, blockchain voting is not a panacea and there's probably a better analog way to speed up voting while preventing fraud.

To be clear, I doubt that there's much fraud (if not any) going on right now during the US election. At the very least, I completely reject the idea that there is organized nation-wide fraud going on in the country.

I think this whole blockchain voting affair is a reflection of the frustration and impatience US voters are experiencing right now and some magical thinking derived from a profound misunderstanding of what blockchains actually are (i.e. very slow and expensive databases.).

By the way, it seems like my prediction of a tight Trump victory might not prove very successful.

But time will tell.

Worth your time:

See you next weekend for more market insights.

Until then,

🦊

Bitcoin breaking its 2020 ATH so far has started to bring a lot of people out of the midst, but I think we're due for a pull back soon there are loads of investors who feel its time to take profits and have been HODLing for ages. I also think there's going to be some fud coming through as is ALWAYS the case, you cant have success without haters

I'm honestly quite bummed about the price rally, I've been silently stacking sats and I never feel I have enough and this is just making it that much harder, lol yes I am greedy

Posted Using LeoFinance Beta

Not sure I agree with your analysis here mate, I think the 2020 market has been driven by patient, mostly non-retail investors (see google trends and hold time on Coinmetrics). Larger players are unlikely to take profit at x2 when the risk reward is looking so juicy and retail is still mostly on the sideline.

Smart money needs dumb money to make serious money.

But yeah there'll be a pullback from here, Bitcoin will take the stairs up as always :)

I am with you, never feel I have quite enough haha

That’s an interesting sentiment you have there my reasoning is based on each month as lock downs continue people need liquidity abd if there’s a big retail holding people are going to look to liquidate especially if the economy doesn’t pick up soon

Lol absolutely the stairs, I actually need to start focusing on setting new buy orders and pick up any pull backs I’m scared the cheap BTC under 20k won’t be with us for very long and I’ll get very little Sats for my shitty South African rands

yep, very much a buy the dip sort of market for the next 3 years imo

I hope you're right, I need more dips, my fiat isn't getting me enough satoshis anymore, the South African rand is tanking lol

Congratulations @f0x-society! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

@tipu curate

Upvoted 👌 (Mana: 0/10) Liquid rewards.