Hi investors,

Today on the menu:

- BTC market update

- MicroStrategy issues debt to buy more Bitcoin

- CRED Lending Postmortem

- History of Bitcoin UX and development

- The last word on China's influence on Bitcoin mining

DISCLAIMER: This content is not financial advice and only represents my personal opinions.

Always do your own research.

Bitcoin Market Update.

BTC is trading at $18,378 USD at the time of writing, we're -3.95% since last week and +153.40% YtD.

The market had a pullback, briefly breaking below 18k before recovering. My feeling is that we're going to keep consolidating right below 20k before breaking out sometime early 2021.

Once we break out of this cup and handle pattern, I believe price discovery will slice right through 20k, followed by a close retest of 20k before moving higher.

Why?

Well, as we've already established many times on this blog, Bitcoin is coming into 2021 with strong tail winds.

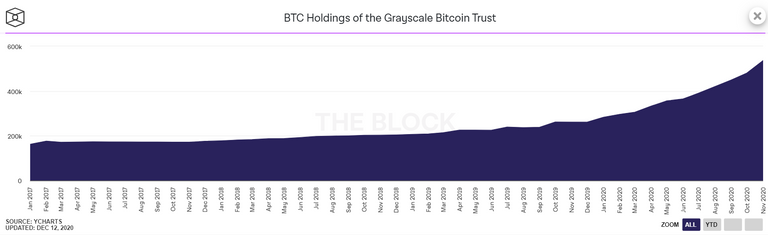

Institutional interest in Bitcoin is showing an early parabolic trend...

..and Bitcoin has arguably found product market fit as a bank account in cyber space (to paraphrase Microstrategy CEO Michael Saylor).

From that angle, business is booming.

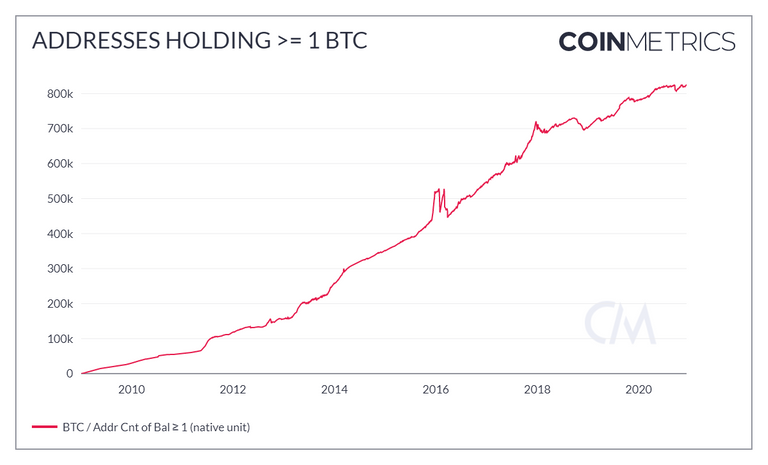

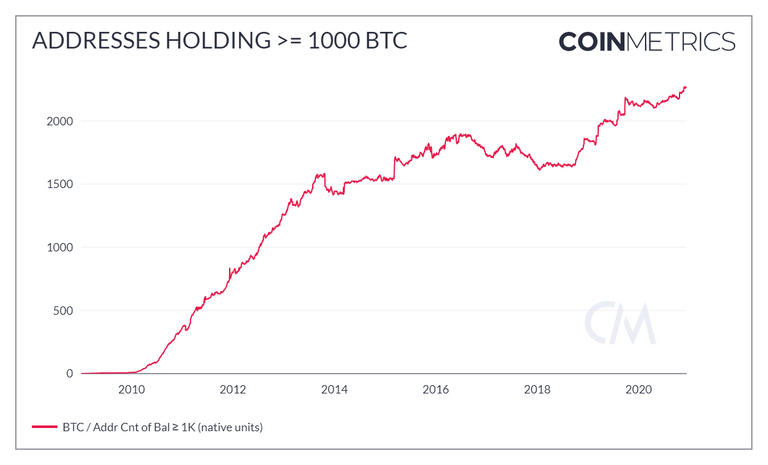

Blockchain data shows addresses containing over 1 and 1000 BTC at an ATH.

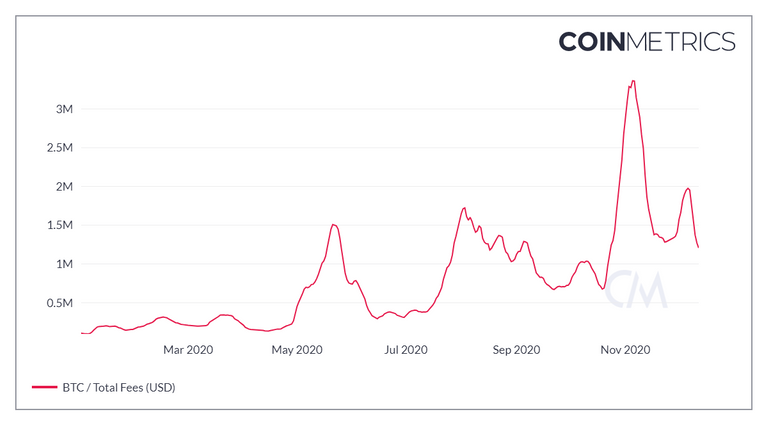

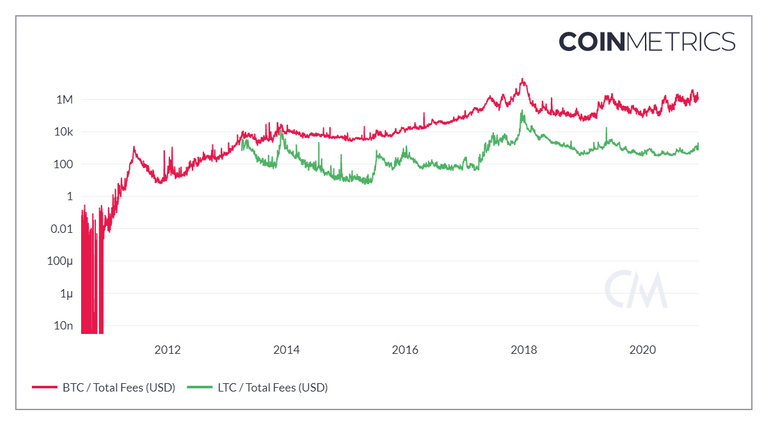

The Bitcoin network also maintain a very healthy level of fees which is critical as the block rewards diminishes.

I expect all these positive trends to continue in 2021 and the price to keep going up as more and more people chose Bitcoin to store value and participate in the upside of what could be another record breaking year.

Exciting times ahead.

Microstategy goes Macrostrategy.

Speaking of Michael Saylor, the CEO of MicroStrategy announced Friday that his company has completed its offering of senior convertible notes just five days after announcing the fund raise.

The company has been very transparent that it aims at using the proceed of the sales to buy more Bitcoin:

"MicroStrategy intends to invest the net proceeds from the sale of the notes in bitcoin in accordance with its Treasury Reserve Policy pending the identification of working capital needs and other general corporate purposes".

Some facts about the notes:

- Maturation date: December 15, 2025

- Yield: 0.750% (paid twice a year)

- Conversion rate: 2.5126 shares of $MSTR class A common stock per $1,000 principal of notes

- Notes are convertible into cash, shares of MicroStrategy’s class A common stock, or a combination of both at MicroStrategy’s election.

The speed at which these notes were gobbled up by the market is quite astonishing for a product with such a low yield (effectively negative in real term).

The sales speaks volume about the market's appetite for anything that yields over 0% in safe interest (MicroStrategy had close to no debt before the sales).

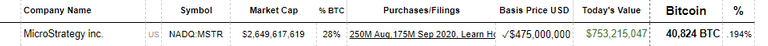

It's also likely that some investors are attracted to gaining upside exposure to MicroStrategy equity ($MSTR) and indirectly to Bitcoin itself since MicroStrategy has 90% of its treasury in BTC (currently valued at around $750 million USD) .

Another round of BTC purchase from MicroStrategy will push the company's exposure to the asset at over a billion USD... which is wild.

The stock market responded quite negatively to the news though. CitiGroup even downgraded $MSTR to a "sell" which sent the stock tumbling into a pullback after a very strong second half of 2020.

I personally don't think the downgrade will have lasting consequences for the stock. MicroStrategy is a solid business with low levels of debt and its large exposure to Bitcoin makes it the closest thing to a de facto Bitcoin ETF.

Fore more on this piece of news I recommend listening to the latest installment of What Bitcoin Did:

Looking Back at CRED Lending Bankrupcy.

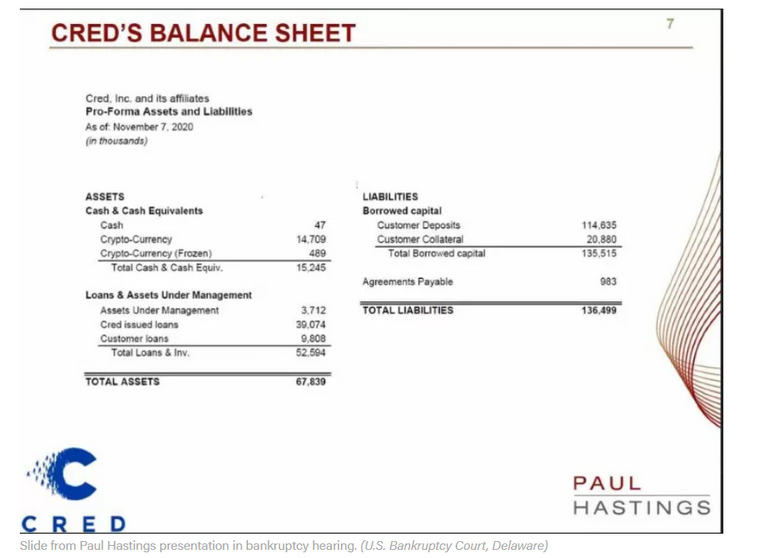

CoinDesk published a good article which covered the demise of crypto lending platform CRED. The firm filed for bankruptcy about a month ago after over 50% of their assets went missing from its balance sheet.

The biggest take-away for me was that in order to generate yield for depositors, CRED had to take incredible amounts of risk including a microloan program in China that charged 40% interest to its clients.

I personally don't think getting 8% yield on your Bitcoin justify getting exposed to this amount of risk, plus indirectly participating in what looks like a loansharking operation.

As far as I can tell the platform is currently dormant pending going through bankruptcy and their Twitter account is down.

Good riddance CRED.

Top 20 Market Cap Coin Discussion.

Hasu (independent crypto analyst) and Su Zhu (CEO/CIO at 3 Arrows Capital) are discussing the first 20 crypto assets on CoinGecko on their shared podcast Uncommon Core.

Both are veteran investors and community members and this is a rich conversation filled with measured and reasoned opinions on the biggest projects in crypto.

For example, I really liked Su Zhu idea of a reverse Lindy effect that can negatively affect blockchain tech platforms that don't meet their tech goals.

Whereas Lindy effect tends to strengthen "money" cryptos like Bitcoin (the longer they exist, the stronger they get), it damages "tech" cryptos which don't achieve their adoption goals (I would put XRP in this category).

Another thing that struck me listening to this podcast is how durable crypto networks can be. Litecoin for example is arguably a coin that doesn't need to exist. It was born out of a meme (Silver to Bitcoin's Gold), has weaker security than BTC and generates a ridiculously small amount of fees compared to Bitcoin. Yet Litecoin has been chugging along almost as long as Bitcoin has.

To me, this speaks to the resilience of crypto networks and to a sort of "Marlboro effect" where people in crypto tend to be very emotionally attached to projects they've invested in early into their crypto journey.

Bitcoin UX and Development.

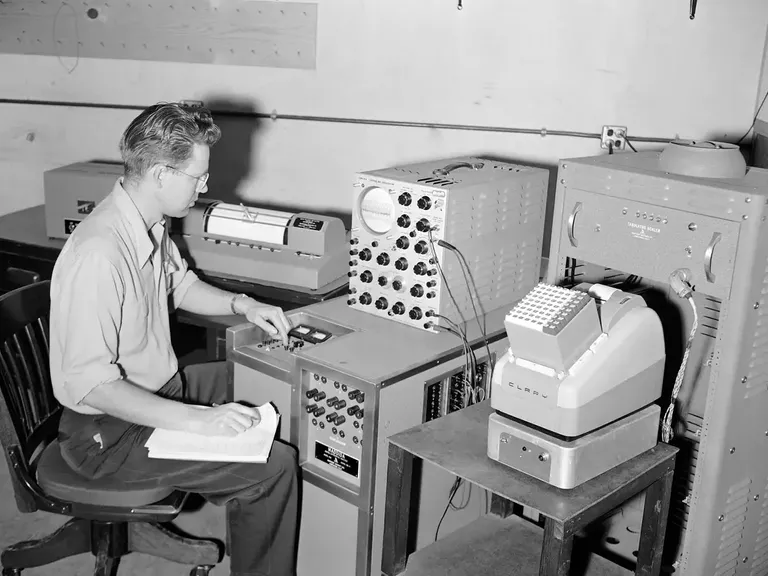

Gigi who is a senior Engineer at Swan Bitcoin has a good article on the evolution of Bitcoin UX and how, similarly to what happened to the Internet, engineering will slowly abstract the complexity away until Bitcoin users stop realizing they're using Bitcoin.

You can see early signs of that democratization today. Bitcoin QR codes are ubiquitous and great companies like CASA or Strike are working to make self-custody and Lightning payments easy to use.

Bitcoin development itself is a complex beast which this article makes a good job of breaking down.

If you have interest in how the sausage is made, 0xB10C, a German anonymous Bitcoin developer has put together this handy flow chart which tracks the history of Bitcoin.

Finally, I'd like to attract your attention to this fascinating Coin Telegraph article about the messy history of early Bitcoin development and the rise of Gavin Andersen as a Bitcoin Core developer.

Interview with an Asian Bitcoin Miner.

Last but not least, Nic Carter did a great podcast with Mustafa Yilham, VP of global business development at Bixin which is an early Asia-based Bitcoin miner.

On the podcast Mustafa debunks a number of theories regarding whether the latest Bitcoin rally was caused by withdrawal issues at OkEx and Huobi (it wasn't), if the drop in hashrate was caused by monsoon-related seasonal migration of hashpower in China (it was) and whether China CONTROLS Bitcoin (it doesn't, nodes do).

All in all a great listen which airs out the room of much conspiracy theories regarding the role of China in Bitcoin mining.

For the record, Mustafa also underlines the fact that miners are fundamentally businessmen that go where power is cheapest (which happens to be China at the moment). He describes them as philosophically aligned with Bitcoin and not the Chinese communist party. He also predicts that, as the price of Bitcoin goes up, we might see the distribution of hash power re-equilibrates towards other countries, including the US where electricity price is competitive and alternatives energy sources like flares are available.

See you next weekend for more market insights.

Until then,

🦁

Congratulations @f0x-society! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Great summary!

Posted Using LeoFinance Beta

Thanks for the kind words :)

Thanks for the follow @deanliu and welcome back ;)