May 25 was momentous for Splinterlands, with the team releasing the sale of Validator Nodes and selling the first 2000 (the "presale" tranche) within 11 minutes. Sales have since slowed down, given the next phase ("Tranche 1") sees the price of nodes increase to $3000, and as of this writing there are still a little over 2600 of the 3000 node licenses available from Tranche 1. Check out the team's official post for more details on the Tranches and the pricing in each one.

I was lucky to be able to buy a few licenses in the presale phase, and they are my most prized assets in this game. Not only am I interested in the potential financial rewards, but I am extremely excited about the ability to play a role in helping the game become more scalable, secure, and decentralized, which is fundamentally what these nodes will do.

I had 2 questions in mind today that I wanted to analyze:

- Is it still worth buying a Validator Node at the current prices (Tranche 1) given current asset prices; i.e. what's the APR?

- How quickly will nodes continue to sell & what would prices do to node sales?

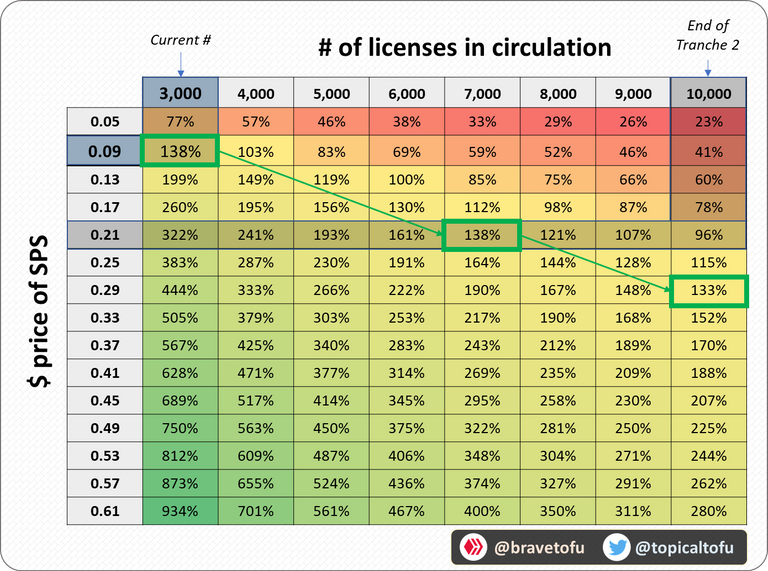

I did a sensitivity analysis below which looks at the estimated APR (annual percentage return, i.e. yield vs. what you pay) looking at 2 variables: the price of $SPS and the # of licenses in circulation. Some notes and assumptions first:

- The rewards for operating a node are 3,375,000 SPS / month + 20,000 vouchers / day split equally across operational node licenses

- The table below does not include the rewards for nodes voted as top validators (those earn extra rewards)

- Given the rewards are both in SPS and Vouchers, I'm assuming a constant ratio between the price of SPS and Vouchers of 0.075:1 (which is the current ratio). This certainly will vary so keep that in mind (if the ratio of voucher to SPS price is higher, then the APRs in the table will increase, while the reverse would mean it would be lower)

- The table assumes all circulating licenses are actually operating (running) the node and therefore receiving rewards

- An APR implies a specific spend, and for this analysis I assumed Tranche 1 (i.e. $3000); APRs will go down for those buying in Tranche 2, and are higher for those who bought in the presale

- The APR is based on receiving rewards, which has obviously not started yet, so really this begins once we start getting rewards!

Here's the analysis:

Today the price of SPS is about $0.09 and we have sold 2.3k licenses, so we're on the top left of the table. Assuming SPS stays at the current price and Vouchers remain at $1.2, we are looking at an APR of 138%. As you can see if we move towards the right but the asset prices don't increase, that causes a decrease in the APR because the same number of rewards are shared amongst more license holders. This is fundamentally why node licenses will stall until there is some appreciation in price.

If you look at other places on the table where there are similar APRs to what we have today (130-140%) you can begin to predict where license sales will be as a function of the token price, assuming actors/investors are behaving with the same needs (i.e. looking for the same APR - this will be true for any institutional buyer, though probably not for retail investors).

In conclusion, I would expect that for us to sell out of Tranche 1 (5k total licenses) we would need to see an SPS price of about $0.17-0.21, and to sell out of Tranche 2 (10k total) we would need the SPS price to be around $0.30.

Hope you enjoyed this analysis. Do let me know what you think, whether you believe nodes are a good investment, and if there's anything you think I missed.

Excellent analysis. I particularly enjoy the thoroughness with which you identify and acknowledge those underlying assumptions.

Thanks Matt, really appreciate your comment.

Thanks for sharing! - @mango-juice

REALLY LIKED YOUR ANALYSIS!

@bravetofu great thoughts! very helpful analysis of the data.

I got a license as well - excited to be a part of this phase of @splinterlands journey!

!PIZZA

!HBITS

!ALIVE

Success! You mined .9 HBIT & the user you replied to received .1 HBIT on your behalf. mine | wallet | market | tools | discord | community | <>< daily

@bravetofu! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @iviaxpow3r. (1/10)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want.

Top-notch content as usual. Sharing this on https://twitter.com/PraetoriaDigest.

Thanks!

Para mi es una buena inversión a largo plazo

PIZZA Holders sent $PIZZA tips in this post's comments:

@iviaxpow3r(1/5) tipped @bravetofu (x1)

You can now send $PIZZA tips in Discord via tip.cc!

Thanks for the analysis, I would love if you can add the left column to see how the prices behave for pre-sale buyers (luckily I bought one)