What is a Stoploss?

A stoploss is an order that you place with your entry or after your entry so that you can limit your losses in any investment.

Basically, Stoploss is like insurance that will always save you from blowing up your capital.

Why you should put a Stoploss?

- If in a scenario you haven't put a stoploss and your investment goes down by 50%, your investment's price has to move 100% to come to your cost price.

- A 100% price move when the stock or crypto is already falling is extremely difficult to recover.

- So it would be better to cut the losses short and take an opportunity somewhere else.

So where should you place a stop loss so that you don't get stopped frequently?

- You have to put a stoploss where it is not obvious.

For eg., A normal trader would put a stoploss at the nearest swing loss but you should put a stoploss between the second swing and the nearest swing. (Refer to the image below) - This will help to avoid stoploss hunting which is very common these days.

- One thing to note is we have to modify our target to match our stoploss.

Dynamic Resistance

- While Using moving Average we can use Moving Averages as our Stoploss.

- In the above image as we can see it is respecting 50 EMA.

- We will put our Stoploss at 200 EMA so that we don't get stopped.

- As you can see in the image if we would have put our stoploss at 50 EMA our Stoploss would have been hit and then the rally began.

- So our stoploss at 200 EMA saved us from this.

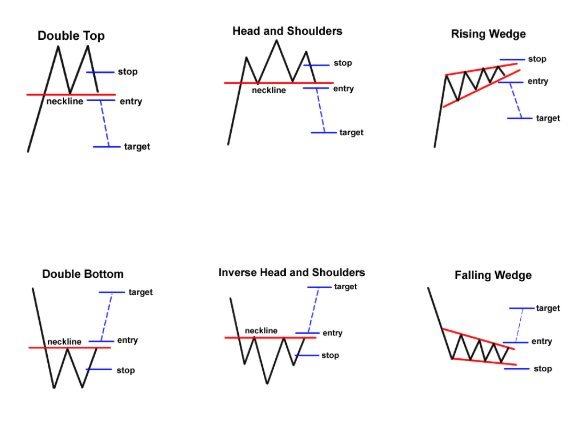

Pattern Stoploss

- We have been told to put stop loss in the right shoulder while following the inverse head & shoulders Pattern (See Image Above)

- In the above image we can see how big Players has eaten the stop losses for the swift move.

- So we should have put our stoploss between right shoulder and head.

- As there is no logic to wait for the price to come till head and bear a bigger loss and cut our losses earlier but away from market makers.

GOODLUCK TRADING!!!

I hope this helps. If this article is useful, share this in your circle, and/or sign up with my affiliate links on the below exchanges:

FTX: https://ftx.com/#a=35800747

Binance: https://accounts.binance.com/en/register?ref=HW9JOWRK

Posted Using LeoFinance Beta

Congratulations @aretailtrader! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 50 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz: